Most Resin Prices Flat or Lower

Prices of three of the four commodity resins appear to be trending flat-to-down; ditto for three of the four “commodity” engineering resins.

Prices of three of the four commodity resins appear to be trending flat-to-down; ditto for three of the four “commodity” engineering resins. PVC and ABS are the exceptions, due to good domestic demand for both and other global factors working in their favor. While prices of both PE and PP jumped up in the first quarter, a reversal in feedstock prices, generally lackluster demand, and some improvements in supplier inventories now are pushing prices in the other direction. Polystyrene prices have already dropped, driven by similar factors. Ditto for PC and nylons 6 and 66. This is the overall outlook of purchasing consultants at Resin Technology, Inc. (RTi), Fort Worth, Texas and CEO Michael Greenberg of the The Plastics Exchange in Chicago.

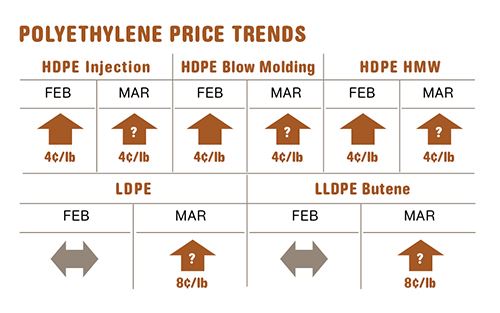

HDPE PRICES UP, LL/LDPE FLAT

Polyethylene price moves in February were split, with HPDE injection and blow molding grades going up 4¢/lb while LDPE and LLDPE saw no change after implementation of the January 5¢/lb across-the-board increase. Suppliers were seeking new increases of 4¢ for HDPE and 8¢ for LL/LDPE, effective March 1, though implementation is doubtful because demand is lackluster and monomer prices were on the way down, according to Mike Burns, v.p. of PE at RTi.

The move to hike HDPE prices was attributed by suppliers to increased demand and low inventories. Yet, their inventories actually have been building since January. Moreover, the tightness in PE supply appears to be more directly linked to prebuying late last year in anticipation of price hikes and export demand.

The spot PE market was relatively soft into March, with prices very close to prime material tabs. Domestic demand was not expected to rally significantly in the second quarter. Also, ethylene monomer spot prices were dropping, from a high of 68¢/lb in late January to 62.75¢ in the first week of March, with a further price slide expected by Greenberg of The Plastics Exchange. He and Burns agree that, with the exception of one large ethylene cracker scheduled for a maintenance shutdown last month, ethylene supply/demand should be quite well balanced.

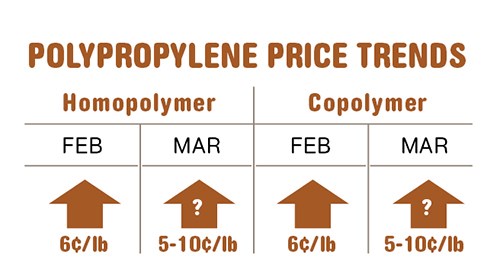

PP PRICES UP, BUT NOT FOR LONG

Polypropylene contract prices moved up 6¢/lb in February, following propylene monomer contract prices penny for penny. This came after PP prices surged by 16¢ in January, following the monomer’s 15¢/lb increase plus a 1¢ surcharge. But a downward trend appeared imminent, as at least one propylene contract price nomination in early March posted a 6¢ reduction.

Scott Newell, RTi’s director of client services for PP, foresaw a drop in monomer and PP prices in March of 5¢ to 10¢/lb, with potential to keep going even lower. “There are some scheduled cracker outages in April, though it’s hard to say how much, if any, impact they may have on PP prices.”

But with most maintenance turnarounds completed and monomer supply becoming much more available, Newell says monomer tabs are expected to move downward from May through the fall. Newell projected PP prices to follow suit as early as April, remaining flat to lower.

Newell says February demand was very weak as there was a clear response from the industry to the sudden, whopping increases. Where possible, contract buyers cancelled orders or postponed them, and very possibly turned to the spot market where feasible. Spot PP trading was quite active with heavy discounting taking place right through the end of February, according to Greenberg.

Considering that suppliers’ inventories were low right into February and that there was little prebuying activity in late 2012, one could assume that processors’ inventories have been tight as well.

While some rebound in demand is likely, Newell says he does not expect much more growth this year over that of the last two years—around 1%. Exports are also not expected to bounce back until domestic PP prices drop. PP plant capacity utilization is expected to drop lower this year.

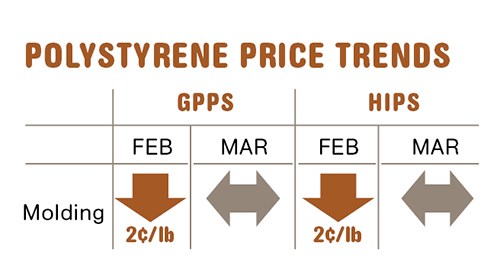

PS PRICES DOWN

Polystyrene prices fell 2¢/lb across the board in February, leaving only a penny in place from the January hike. Both moves—up and down—were attributed to benzene price swings, according to Mark Kallman, RTi’s director client services for engineering resins, PS, and PVC.

Benzene prices dropped again in March and were expected to drop even further this month, as world oil prices continue their downward slide. PS prices are likely to be flat if not slightly lower this month. Despite dropping benzene prices, scheduled styrene monomer plant turnarounds were expected to make supply a bit snug, according to Kallman. A seasonal uptick in the lackluster demand for PS is expected through the second quarter.

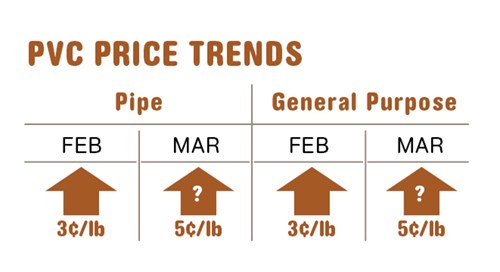

PVC PRICES UP

PVC prices rose 3¢/lb in February. Suppliers seemed to have the momentum to push through all of their 5¢ March hike. Kallman says price moves are being driven by planned and uplanned shutdowns, strong exports, and tight supplier inventories.

Suppliers issued a 3¢ increase for Apr. 1. Kallman ventures that PVC resin prices are more likely to remain flat this month. He notes that there was some increase in domestic demand in January and February in advance of the increases. After March and April, demand is expected to really kick in. The supply/demand balance could also improve if exports weaken, which could result if oil prices continue to drop.

ABS PRICES UP

ABS prices moved up 4¢/lb by the end of February. Implementation of January increases was supported by rising prices of offshore ABS, particularly from the Far East, which had been very competitive. Their move was attributed to cost increases from feedstocks, especially benzene.

Meanwhile, suppliers had issued price increases of 4¢ to 6¢/lb for March 1, which were expected to be felt this month, but perhaps not in their entirety. RTi’s Kallman thinks the increases will be closer to the 1-3¢ range, as prices of most key feedstocks were dropping. The one exception was butadiene, which moved up 7¢ in March to 84¢/lb. Kallman points out, however, that this is still well below the high of $1.50 last year.

Domestic ABS demand was reasonable in the first quarter, supported primarily by automotive. Kallman projects some increased demand in this quarter from pipe and fittings as well.

PC PRICES FLAT TO DOWN

Polycarbonate prices were largely flat or lower due to competitive activity, and suppliers failed to implement their January price hikes of 11¢ to 12¢/lb. But new price hikes for the second quarter were forming, with one supplier asking for 14¢/lb, effective March 1.

“I expect suppliers will have some success in raising prices,” says Kallman from RTi. He thinks suppliers may be able to implement about one-third of their new hikes, because propylene and benzene prices dropped in March and were expected to fall farther this month.

Domestic automotive demand for PC has been good and improvements are anticipated in the construction sector in the coming months, although not expected to reach the highs of 2007. Poor demand in Europe and slow growth in Asia, evidenced by production cutbacks (including SABIC shutting down for 10 weeks), has started to cut into U.S. PC exports.

NYLON PRICES FLAT

Nylon 6 and 66 prices held even through the first quarter. In the case of nylon 6, where suppliers have sought 7¢ to 10¢/lb price hikes since late 2012, prices didn’t budge, due to domestic and import competition, as well as low caprolactam prices.

With benzene prices dropping, the chances of implementing a price hike are even lower, according to RTi’s Kallman. BASF and DSM issued a 5¢ hike on low-viscosity nylon 6 resins, effective March 11. The move was attributed to increased costs of feedstocks. In fact, benzene prices were at a record high in January, but have since fallen over 10%. The low-viscosity resins are used primarily in lower-priced extrusion applications with the narrowest profit margins, notes Kallman.

Domestic demand for nylon 6 has been relatively good in fibers and some injection molding applications. Significant new nylon 6 fiber capacity in Asia has cut into domestic exports.

Meanwhile, low butadiene prices helped keep nylon 66 prices relatively stable, despite spikes in propylene monomer and benzene early in the year. Prices backpedaled in the last two months for propylene and benzene, and the March increase in butadiene is not significant enough to cut into suppliers’ margins. If butadiene prices move up again, suppliers could well hike nylon prices before the end of this quarter. But if benzene prices are low, that would be difficult, cautions Kallman.

Demand for nylon 66 has been steadily good, particularly in automotive, and an increase is expected from the electrical sector as the construction season gets under way.

Related Content

Commodity Resin Prices Flat to Lower

Major price correction looms for PP, and lower prices are projected for PE, PS, PVC and PET.

Read MoreFirst Quarter Looks Mostly Flat for Resin Prices

Temporary upward blips don't indicate any sustained movement in the near term.

Read MoreDelivering Increased Benefits to Greenhouse Films

Baystar's Borstar technology is helping customers deliver better, more reliable production methods to greenhouse agriculture.

Read MorePolyethylene Fundamentals – Part 4: Failed HDPE Case Study

Injection molders of small fuel tanks learned the hard way that a very small difference in density — 0.6% — could make a large difference in PE stress-crack resistance.

Read MoreRead Next

See Recyclers Close the Loop on Trade Show Production Scrap at NPE2024

A collaboration between show organizer PLASTICS, recycler CPR and size reduction experts WEIMA and Conair recovered and recycled all production scrap at NPE2024.

Read MoreBeyond Prototypes: 8 Ways the Plastics Industry Is Using 3D Printing

Plastics processors are finding applications for 3D printing around the plant and across the supply chain. Here are 8 examples to look for at NPE2024.

Read More