Packaging Outlook Shifts with New Data

With a large portion of the industry having released its data for the first quarter, capital expenditures for the industry reported contracting growth.

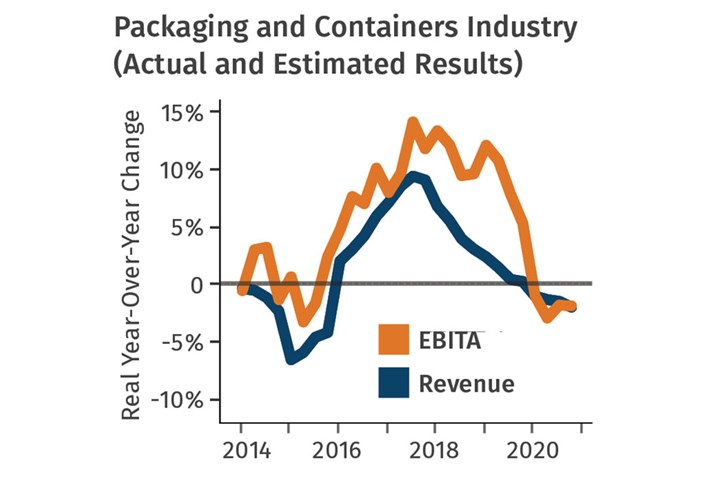

In February, Gardner forecasted a slowing growth outlook for the packaging and container industry based on actual financial results from the third quarter of 2018 along with Wall Street’s consensus projections. At that time, capital expenditures had grown strongly over the trailing 12 months while earnings before interest, depreciation and amortization (EBITDA) were growing at nearly 15% and projected to grow even more quickly through the fourth quarter of 2019. The 2019 outlook for the industry at that time looked very promising.

With a large portion of the industry now having released its data for the first quarter of 2019 as of the time of writing, capital expenditures for the industry — which grew during 2018 at double-digit rates — reported decelerating growth during the first quarter of the year. Between 2013 and 2017, the industry had booked an outsized portion of capital expenditures during the fourth quarter of each calendar year. 2018 not only saw the industry break this pattern, but fourth quarter 2018 capital expenditures were approximately 7% below the level recorded during the fourth quarter of the previous year.

The extended outlook for the packaging and containers market through 2020 has not significantly changed since Gardner’s last report. Earnings and revenue through 2020 are still projected to experience slowing growth. However, the latest projections for revenues and earnings now contain estimates through the third quarter of 2021. According to these more distant projections, expectations are for less than 1% industry growth before accounting for inflation, which could easily result in contracting real revenues and earnings in 2021.

About the Author

Michael Guckes is chief economist and director of analytics for Gardner Intelligence, a division of Gardner Business Media, Cincinnati. He has performed economic analysis, modeling, and forecasting work for more than 20 years among a wide range of industries. He received his BA in political science and economics from Kenyon College and his MBA from Ohio State University. Contact: (513) 527-8800; mguckes@gardnerweb.com. Learn more about the plastics processing Index at gardnerintelligence.com.

Related Content

-

PHA Compound Molded into “World’s First” Biodegradable Bottle Closures

Beyond Plastic and partners have created a certified biodegradable PHA compound that can be injection molded into 38-mm closures in a sub 6-second cycle from a multicavity hot runner tool.

-

Multilayer Solutions to Challenges in Blow Molding with PCR

For extrusion blow molders, challenges of price and availability of postconsumer recycled resins can be addressed with a variety of multilayer technologies, which also offer solutions to issues with color, processability, mechanical properties and chemical migration in PCR materials.

-

‘Monomaterial’ Trend in Packaging and Beyond Will Only Thrive

In terms of sustainability measures, monomaterial structures are already making good headway and will evolve even further.

.jpg;width=70;height=70;mode=crop)