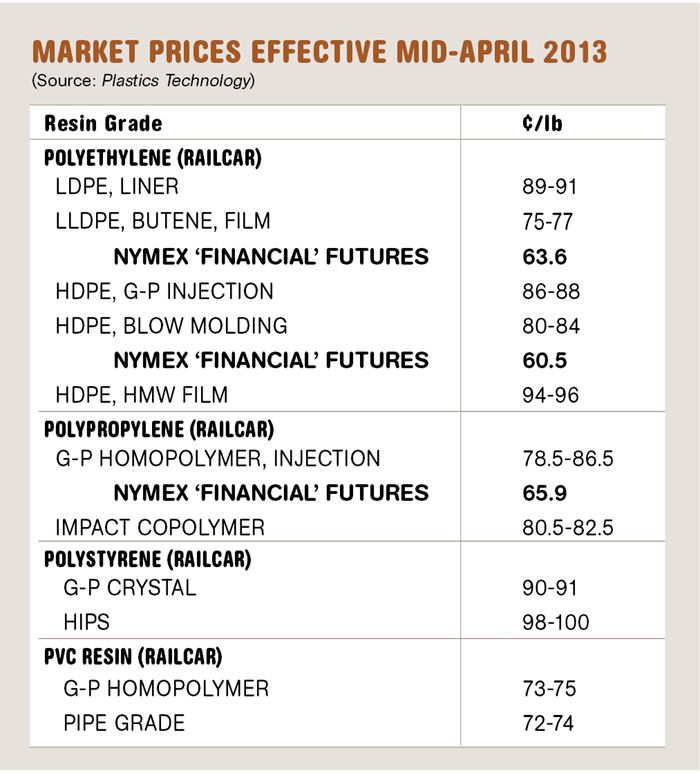

PE, PVC Prices Up; PP, PS Softening

Polyethylene and PVC prices moved up, while PP and PS prices were headed down by the end of the first quarter and into April.

Polyethylene and PVC prices moved up, while PP and PS prices were headed down by the end of the first quarter and into April. Lower feedstock costs, lackluster domestic demand (except for PVC), relatively good resin availability, and potential for good export opportunities for PE and PVC are expected to contribute to flat-to-lower pricing through this quarter. This is the outlook offered by purchasing consultants at Resin Technology, Inc. (RTi), Fort Worth, Texas, and CEO Michael Greenberg of Chicago-based The Plastics Exchange.

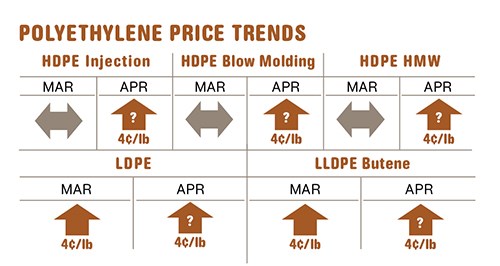

PE PRICES UP

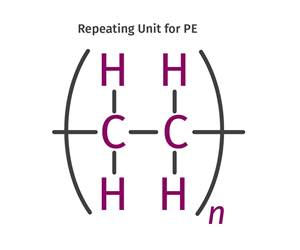

Polyethylene prices moved up in the last two months by 4¢/lb, starting with HDPE injection and blow molding grades and spreading to all other grades by the end of March, bringing the

total increase for PE for the year to 9¢/lb. Suppliers aim to implement a new 4¢/lb price hike this month.

Mike Burns, v.p. for PE at RTi, and Greenberg of The Plastics Exchange agree that most key indicators support a flat market. The exception is supplier inventory levels: Suppliers claim that

inventories are tight, but no one is having problems finding resin—other than HDPE non-film grades, which are still a bit tight. PE suppliers have throttled back on production to around 85% capacity utilization, while processors have been working off their inventories for the last couple of months.

A buying spree is likely in this quarter, says Burns, but only to meet current demand as processors’ inventories dwindle. He ventures that over the next six months, processors can expect to get back 2-4¢/lb from the first-quarter increases. If suppliers succeed in pushing through their new 4¢ increase now, processors can expect to get even more back in the next six months.

Greenberg points out that ethylene prices came under pressure as several crackers returned to full operational status, and spot prices dropped by several cents. Ethylene for March delivery

traded down to 61.25¢/lb and April was no higher. He also reports that PE spot prices edged 5¢ higher as spot supplies dwindled in late March. Generic prime material was available throughout the month, but in limited quantities.

Demand remains unenthusiastic and even well-priced resin was hard to move, he notes. “Exports to Latin America are flowing but there is only sporadic spot demand from Asia. However, fully integrated North American PE producers continue to enjoy a long-term feedstock cost advantage and can export profitably at will to maintain high operating rates and offset resin surpluses as they develop,” Greenberg explains. Burns points out that suppliers’ cost to make PE pellets is 30¢/lb, while market prices are more than twice that cost.

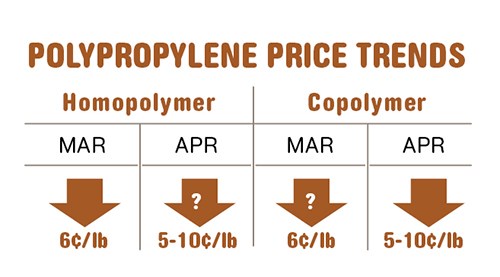

PP PRICES DROP

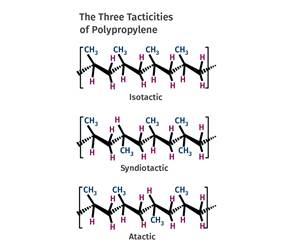

Polypropylene prices dropped 6¢/lb in March, in step with propylene monomer. Moreover, monomer nominations for April indicated a more sizable drop was on the way, with PP prices to follow. RTi’s director of client services for PP, Scott Newell, predicted last month that monomer and polymer prices would drop 8-10¢/lb and perhaps more.

Signaling this trend were spot PP prices continuing to trade lower after March PP contracts dropped 6¢/lb, according to Greenberg. He notes that spot prices for generic, prime commodity-grade PP slid all through March, trading typically at an 8-10¢ premium over spot polymer-grade propylene monomer. Atypical generic prime grades, the kind that accumulate

from cancelled contract orders, sold at sharp discounts near spot monomer costs, right along with offgrade PP resins.

At the end of March, Greenberg observes, “PP market sentiment remained negative. Material was plentifully available and spot prices continued lower. After PP rose 21¢/lb during January/February, processors were disappointed with the modest 6¢/lb decrease for March contracts. They responded with minimal contract orders, and with their sights set on the weak

propylene monomer market, they waited confidently for lower prices ahead.”

Adds Newell, “There was definitely a response from processors to the high PP prices early in the first quarter, and demand slumped.” He believes there may be some pent-up demand from processors with depleted inventories, as well as something of a rebound in end-use demand

this month, although the degree of such a rebound is uncertain. Demand pick-up typically associated with seasonal markets like construction, gardening, and outdoor recreation equipment is difficult to predict in the shadow of higher prices.

Another effect of high PP prices, says Newell, is that “we have been completely priced out of exports. Polypropylene exports are the lowest we have seen in recent years."

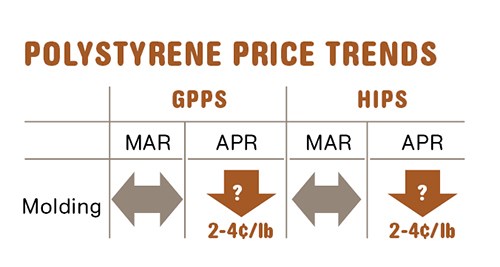

PS COULD GO LOWER

Polystyrene prices remained flat in March after a 2¢/lb drop in February, which left a 1¢/lb net increase since January. However, a significant drop in benzene prices last month was expected to result in PS prices dropping 2-4¢/lb in the April/May time frame, according to Mark Kallman, RTi’s director of client services for engineering resins, PS, and PVC.

The likely potential for lower ethylene prices also points to lower prices ahead, despite the expected increase in seasonal demand for recreational PS products.

PVC PRICES UP

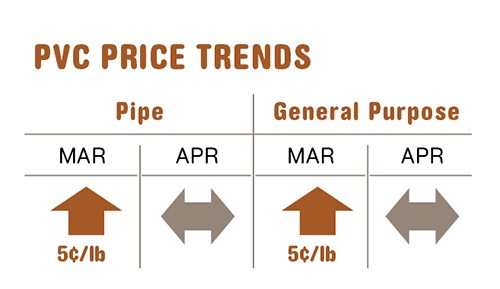

PVC prices moved up 5¢/lb in March. An attempt to get another 3¢/lb in April was not supported. Slight downward pressure in the May/June time frame is likely, due to lower ethylene costs, says Kallman.

Domestic demand is not bad: Despite cold weather in the Northeast, housing starts are up. Kallman notes that suppliers have slashed PVC prices for exports significantly in order to regain business. “Exports in February were down 18% over February 2012, due to higher prices,” he explains.

Depending on how much export business is generated, downward pressure on domestic PVC prices could surface, as the delta in export vs. domestic PVC pricing is significant.

Related Content

Fundamentals of Polyethylene – Part 5: Metallocenes

How the development of new catalysts—notably metallocenes—paved the way for the development of material grades never before possible.

Read MoreFirst Quarter Looks Mostly Flat for Resin Prices

Temporary upward blips don't indicate any sustained movement in the near term.

Read MoreThe Fundamentals of Polyethylene – Part 2: Density and Molecular Weight

PE properties can be adjusted either by changing the molecular weight or by altering the density. While this increases the possible combinations of properties, it also requires that the specification for the material be precise.

Read MoreFundamentals of Polyethylene – Part 6: PE Performance

Don’t assume you know everything there is to know about PE because it’s been around so long. Here is yet another example of how the performance of PE is influenced by molecular weight and density.

Read MoreRead Next

See Recyclers Close the Loop on Trade Show Production Scrap at NPE2024

A collaboration between show organizer PLASTICS, recycler CPR and size reduction experts WEIMA and Conair recovered and recycled all production scrap at NPE2024.

Read MoreLead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read MoreFor PLASTICS' CEO Seaholm, NPE to Shine Light on Sustainability Successes

With advocacy, communication and sustainability as three main pillars, Seaholm leads a trade association to NPE that ‘is more active today than we have ever been.’

Read More