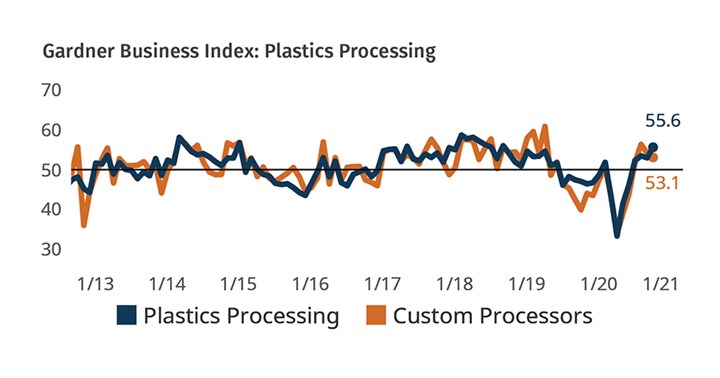

Plastics Processing Index Hits Two-Year High

Five of six business components show expanding October activity as index hits 55.6.

The Gardner Business Index (GBI) for plastics processing closed October with a two-year-high reading of 55.6. Five of the six components of the Index reported expanding conditions (above 50), with only export activity contracting (below 50). The Index, which is calculated based on monthly surveys of Plastics Technology subscribers, moved higher thanks to a fourth consecutive month of expanding new orders and production activity. Strength from these areas likely contributed to the year’s first expansionary backlog reading and a third month of expanding employment activity. As the Index moves into the final months of the year, concerns remain around the ability of shippers to maintain the sufficient flow of goods so as not to stymie production.

Gardner’s Custom Processors Index indicated continued expansion but decelerated slightly to 53.1 due to a greater contraction in export orders and slowing expansion of new orders and production. Custom processors also reported slower supplier deliveries during the month, which may have partially influenced the lower production activity. The disruption of supply chains as the world battles the spread of COVID-19 has been one of the unique challenges for all manufacturers in 2020. COVID’s impact has affected both the demand for goods and the ability of firms to supply those products in particularly high demand.

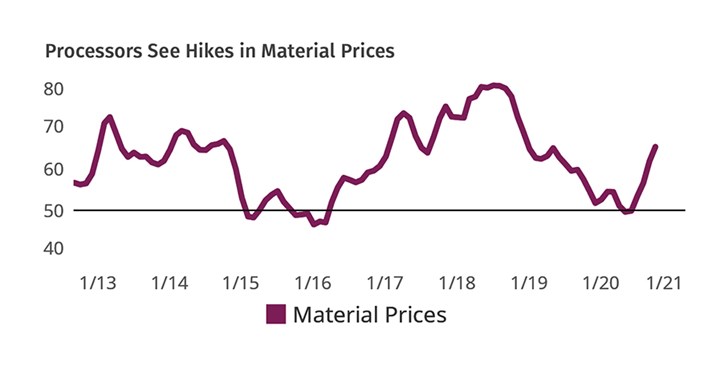

Constraints along the plastics manufacturing supply chain have manifested themselves not only in the form of slowing deliveries but also in rising input prices. Gardner’s tracking of material prices shows that beginning in July a swelling proportion of plastics processors began experiencing rising material prices. The latest plastics prices index was the highest since the end of 2018.

FIG 2 The proportion of plastics processors reporting increasing material prices has grown quickly during the second half of 2020. This may in part be due to the disruption that the coronavirus has caused to supply chains.

Editor’s Note: The Plastics Processing Business Index is unique in its ability to measure business conditions specific to plastics processors on a monthly basis. The challenges facing manufacturers today require leaders to have good data in order to make effective forward-looking decisions. It is particularly important at this time for our readers to complete the survey sent to them each month. Your participation will enable the best and most accurate reporting of the true impact that COVID-19 is having on the plastics industry.

If you are a North American plastics processor and would like to participate in this research, click here to begin the process by subscribing free to Plastics Technology magazine.

About the Author: Michael Guckes is chief economist and director of analytics for Gardner Intelligence, a division of Gardner Business Media, Cincinnati. He has performed economic analysis, modeling, and forecasting work for more than 20 years among a wide range of industries. He received his BA in political science and economics from Kenyon College and his MBA from Ohio State University. Contact: (513) 527-8800; mguckes@gardnerweb.com.

Related Content

Plastics Processing Business Index Contracts Further

All components dip as index hits low point of 2023.

Read MorePlastics Processing Continued Contraction in April

Despite some index components accelerating and others leveling off, April spelled contraction for overall plastics processing activity.

Read MorePlastics Processing Activity Contraction Continues in August

Four months of consecutive contraction overall.

Read MorePlastics Processing Contraction Continues

Contraction dominated the GBI index for overall plastics processing activity and almost all components, collectively suggesting a slowdown.

Read MoreRead Next

For PLASTICS' CEO Seaholm, NPE to Shine Light on Sustainability Successes

With advocacy, communication and sustainability as three main pillars, Seaholm leads a trade association to NPE that ‘is more active today than we have ever been.’

Read MoreSee Recyclers Close the Loop on Trade Show Production Scrap at NPE2024

A collaboration between show organizer PLASTICS, recycler CPR and size reduction experts WEIMA and Conair recovered and recycled all production scrap at NPE2024.

Read MoreMaking the Circular Economy a Reality

Driven by brand owner demands and new worldwide legislation, the entire supply chain is working toward the shift to circularity, with some evidence the circular economy has already begun.

Read More

.jpg;width=70;height=70;mode=crop)