Plastics That Conduct Heat

Helping electronics, lighting, and car engines keep cool are some new roles for hermoplastics that are formulated to replace metal or ceramic.

Heat sinks and other heat-removal applications are among the last areas where thermoplastics—inherent thermal insulators—have yet to replace metals. Until fairly recently, that is. Modifying plastics to improve their thermal conductivity is a burgeoning area of opportunity for a handful of compounders. They have taken up the challenge of using plastics to solve problems of heat build-up in electronics, appliances, lighting, automotive, and industrial products.

Among the pioneers, whose heat-conductive compounds have gone commercial in just the last couple of years, are PolyOne Corp., Cool Polymers, LNP Engineering Plastics, RTP Co., and Ticona Corp. GE Plastics, DuPont, and A. Schulman have development programs under way. And last month, PolyOne entered into a joint-development agreement with Cool Polymers in order to utilize the latter’s capabilities in tool design, thermal-management testing, and injection molding of prototype applications.

Thermally conductive compounds are generally not considered to be direct drop-in replacements for metals. Instead, they open up a broad range of new opportunities for “thermal management” applications. Parts molded out of this new generation of materials can replace metals and ceramics in some applications, and non-conductive plastics in others. Uses include custom-molded heat sinks on circuit boards, as well as tubing for heat exchangers in appliances, lighting, telecommunication devices, business machines, and industrial equipment used in corrosive environments. Heat sinks often involve plastic overmolded on a metal heat pipe. Lighting applications also include reflectors, laser-diode encapsulation, and fluorescent ballasts. Automotive headlamp reflectors are in development.

In temperature sensors like thermistors, thermally conductive plastic encapsulation can help improve the response of the temperature sensor itself. Thermally conductive compounds are also used to encapsulate small motors and motor bobbins. A diesel fuel pump uses a thermally conductive plastic to help keep fuel flowing in sub-freezing temperatures.

More exotic applications may include radiant floor-heating systems, where a thermally conductive film placed between coils could allow water to be run at lower temperatures. Another possibility is molding all-plastic car radiators around contours of the bumper instead of the traditional square box.

Cool new materials

The heat-transfer requirements of ever-smaller and more power-hungry electronics have opened the door for this new generation of cooling materials. Whereas unfilled thermoplastics have a thermal conductivity of around 0.2 W/mK (Watts/meter-°Kelvin), most thermally conductive plastic compounds typically have 10 to 50 times higher conductivity (1-10 W/mK). One firm, Cool Polymers, offers products with 100 to 500 times the conductivity of a base polymer (10-100 W/mK).

Traditionally, aluminum has been the prime material for controlling higher heat fluxes in electronics. Thermal conductivity of extrusion-grade aluminum alloys is near 150 W/mK. Some die-cast metal alloys (magnesium or aluminum) are in the 50-100 W/mK range.

However, it can be argued that metals’ high thermal conductivity cannot be effectively utilized if they conduct heat to the surface of a product faster than air-flow convection can remove heat from the surface. According to Jim Miller, product manager at Cool Polymers, “Heat transfer in many applications is convection-limited (that is, design-dependent), not conduction-limited (material-dependent).”

His company has demonstrated the concept in certain applications where thermally conductive plastics provide heat transfer equivalent to aluminum and copper designs.

Adds Mark Kaptur, LNP product marketing manager, “Where conductivity is the limiting factor, metal is the preferred material. But there are many applications where convection is the limiting factor, and then thermally conductive plastics are a better fit.”

Also, thermally conductive plastics typically boast lower coefficients of thermal expansion (CTE) than aluminum and can thereby reduce stresses due to differential expansion, since the plastics more closely match the CTE of silicon or ceramics that they contact. Conductive plastics also weigh 40% less than aluminum; they offer design freedom for molded-in functionality and parts consolidation; and they can eliminate costly post-machining operations.

Many technological advances utilizing microelectronics would have been impossible without thermally conductive plastics, according to Miller of Cool Polymers. “This ability to control heat build-up, yet also provide lightweight, flexible, and low-cost applications will make these plastics one of the most important technological developments for decades to come.”

Infrared photography from Cool Polymers demonstrates why many components made of plastics overheat and fail. Spot heat sources were applied to the center of flat molded panels—one made with a standard PP and one made of a CoolPoly thermally conductive PP compound. The latter conducts heat away from the center hot spot, generating a more isothermic profile that varies no more than 4° C throughout the panel. But the standard PP panel shows a 24° C temperature difference between its hottest and coolest points.

High initial cost is currently the biggest obstacle to wider acceptance of thermally conductive compounds. A key factor is the high-priced fillers used to achieve good heat conduction, which result in these compounds costing at the very least two and a half times as much as metal or ceramic materials they might replace. Many thermally conductive compounds sell in the $25-$45/lb range, though some with lower conductivity cost as little as $4 to $6/lb.

Suppliers say the technology is currently best suited to high-volume production (e.g., 10,000 parts/month) in order to realize the design and fabrication advantages of injection molding. Cool Polymers’ Miller says cost savings of up to 30% have been achieved in replacing a metal design. However, he notes that part size can make a critical difference. “For a small part, the majority of the cost is in the injection molding process, while for larger parts, material is the big factor. Because of their higher upfront costs, thermally conductive plastics have an advantage for smaller units—up to 1-lb.”

Active ingredients

Among the most commonly used heat-conductive additives are graphite carbon fibers and ceramics such as aluminum nitride and boron nitride. Graphite fibers conduct electricity as well as heat, which suits them to applications where RFI shielding is required, such as hand-held communication devices. By contrast, the ceramic additives are electrically insulative. They are suited to applications that come into contact with electrical leads. Virtually all the suppliers of thermally conductive compounds offer both electrically conductive and insulative types. Thermally conductive compounds are usually formulated with crystalline engineering resins due to their high heat resistance and lower melt viscosities, but amorphous resins can also be used. Cool Polymers, for instance, has developed a thermally conductive polysulfone compound. In general, conductive compounds have higher stiffness and strength, but lower impact properties than unfilled or glass-reinforced resins. For example, a glass-reinforced nylon 66 has a notched Izod impact of around 1.7-1.8 ft-lb/in., while a thermally conductive, electrically insulative nylon 66 has a notched Izod of 1.0 ft-lb/in.

The most thermally conductive additives are specialty graphite fibers made from petroleum pitch. They have conductivity values of 500-1000 W/mK. By comparison, structural-grade carbon fibers based on polyacrylonitrile (PAN) have conductivities less than 10 W/mK. Thermal conductivity of electrically insulative ceramic fillers are 60-80 W/mK for boron nitride and 300 W/mK for aluminum nitride powders. According to Sam Johnson, industry manager for BP’s Carbon Fiber Industrial Composites, most commercial uses of pitch graphite fibers require conductivity in the range of 500 W/mK. This typically requires high fiber loadings (up to 70%). Even at such high loadings, Johnson says fairly long flow paths are possible with crystalline plastics like LCP and PPS, owing to their excellent interfacial compatibility with graphite fibers. Johnson adds, “You don’t need to cool the mold because these fibers are very thermally conductive. As a result, the compounds cycle quickly.”

BP is currently the sole North American maker of pitch-based graphite fibers. Conoco aims to become a second source when it starts up production of specialty pitch fibers at a new plant in Ponca City, Okla., early next year. Although BP’s ThermalGraph pitch-based fibers sell for around $25/lb, BP has developed a low-cost process that will reduce prices by at least 25%, Johnson says. BP expects to begin using the new process early next year.

Also pricey are the ceramic fillers. Aluminum nitride sells for around $20/lb, while boron nitride averages around $50/lb. Juyoung Kim, technical development manager at Advanced Refractory Technologies, says compounds with aluminum nitride flow much better than those containing boron nitride due to the former filler’s rounder particle shape versus the latter’s platelet shape. “As a result, you can easily get loadings as high as 60% by volume of aluminum nitride, compared with up to 20% by volume for boron nitride,” Kim claims. His firm is the only U.S. supplier of aluminum nitride. A new version in development, called Maxtherm, will permit higher loadings and greater thermal conductivity, Kim says. It will be ready for market later this year.

Advanced Ceramics Corp. is working on new surface treatments that allow boron nitride (BN) to be loaded at high enough levels and maintain good moldability, says marketing director Don Lelonis. Efforts are also in progress to modify the BN particle shape and size to optimize thermal conductivity. (The only other U.S. supplier of boron nitride is Saint-Gobain Advanced Ceramics, formerly called Carborundum Corp.)

Graphite fibers and ceramic fillers both can be abrasive to processing equipment. Molders can compensate by using low-compression screws and avoiding small gates and check rings. In general, minimize shear, Johnson advises.

Adds LNP’s Kaptur, “The biggest difference in processing these compounds is that they cool very rapidly in the injection mold because they transfer heat very quickly. So once they stop flowing, they won’t start flowing again. This is a consideration in mold design, such as where you put vents and gates.”

Polymer range expands

Initial work on heat-conducting thermoplastics has focused on highly heat-resistant resins like LCP, PPS, PEEK, and polysulfone. PolyOne is also testing new compounds based on polyetherimide (GE’s Ultem). Suppliers are now expanding their range to include medium-temperature resins like ABS, PBT, polycarbonate, and nylon, as well as lower-temperature commodity plastics like PP and PS. Even TP elastomers are getting the thermal-conductivity treatment.

Says Cool Polymers’ Miller, “In the mid-temperature engineering resins group, we have aimed at applications for heat sinks in smaller stepper-motors for a broad range of industrial equipment. In the commodity resins area, we see potential for PP-based compounds and possibly PS in non-electronic applications such as food-related consumer heating and cooling products.”

Cool Polymers’ CoolPoly line today includes compounds of LCP, nylon 66, PC/ABS, and PPS. They offer thermal conductivities up to 60 W/mK, depending on resin type. Elastomeric TPO compounds are in development. The company offers to custom formulate thermally conductive grades of any engineering or commodity thermoplastic.

LNP’s Konduit line includes PPS, PP, and nylon 6 and 66 grades. These resins are compounded with carbon, ceramic, or metallic fillers and small amounts of glass reinforcements, if needed. A lower-cost product group uses ceramic or metal additives to provide thermal conductivity up to 2 W/mK. A high-performance product group uses a specialty carbon fiber to achieve 10 W/mK. LNP can offer customized Konduit products in any crystalline thermoplastic.

PolyOne’s Therma-Tech line includes compounds of LCP, PPS, and PPA (BP’s Amodel) with thermal conductivities up to 10-12 W/mK. Newer additions include a TPV (flexible crosslinked TPO).

RTP’s Thermoplastic Conductive Compound (TCC) line can be custom formulated in PPS, LCP, PPA, PC, nylon 66, PP, PE, and TPEs (olefinic or styrenic). Conductivities range up to 18 W/mK. Unlike most suppliers, RTP offers conductive compounds for both injection molding and extrusion. An example of the latter is a PP compound used for tubing to convey paints and adhesives that must be kept at a constant temperature.

Ticona offers four Fortron PPS grades with thermal conductivities up to 3.0 W/mK in electrically insulative or conductive versions.

Packing more powerful microelectronics into ever smaller spaces would not be possible without heat sinks and heat spreaders molded from new thermally conductive thermoplastic compounds.

Related Content

The Fantasy and Reality of Raw Material Shelf Life: Part 1

Is a two-year-old hygroscopic resin kept in its original packaging still useful? Let’s try to answer that question and clear up some misconceptions.

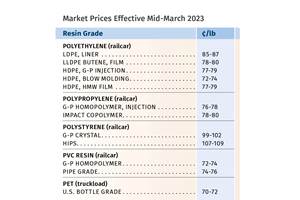

Read MorePrices of Volume Resins Generally Flat or Lower

Exceptions in early March were PP and PS, which moved up solely due to feedstock constraints, along with slight upward movement in PVC and PET.

Read MoreScaling Up Sustainable Solutions for Fiber Reinforced Composite Materials

Oak Ridge National Laboratory's Sustainable Manufacturing Technologies Group helps industrial partners tackle the sustainability challenges presented by fiber-reinforced composite materials.

Read MoreTracing the History of Polymeric Materials, Part 26: High-Performance Thermoplastics

The majority of the polymers that today we rely on for outstanding performance — such as polysulfone, polyethersulfone, polyphenylsulfone and PPS — were introduced in the period between 1965 and 1985. Here’s how they entered your toolbox of engineering of materials.

Read MoreRead Next

People 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read MoreFor PLASTICS' CEO Seaholm, NPE to Shine Light on Sustainability Successes

With advocacy, communication and sustainability as three main pillars, Seaholm leads a trade association to NPE that ‘is more active today than we have ever been.’

Read MoreBeyond Prototypes: 8 Ways the Plastics Industry Is Using 3D Printing

Plastics processors are finding applications for 3D printing around the plant and across the supply chain. Here are 8 examples to look for at NPE2024.

Read More