PP Bucks Trend to Flat or Lower Prices

Lower feedstock costs, slowed demand in early first quarter are likely to keep most prices stable.

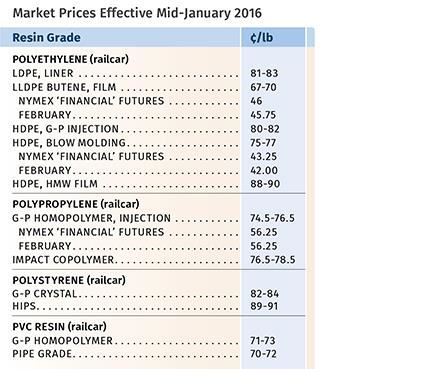

At the start of 2016, prices for PE, PS, and PVC generally appeared to be flat, and possibly softening, driven by slower demand and falling feedstock prices. This was true even for PE and PVC, whose suppliers aimed to implement price hikes. The exception was PP, where new margin increases are more likely to get implemented, if not all at once.

These are among the views of purchasing consultants at Resin Technology, Inc. (RTi) of Fort Worth, Tex., CEO Michael Greenberg of The Plastics Exchange in Chicago, and Houston-based PetroChemWire.

WILL LOWER PE PRICES HOLD OFF IMPORTS?

Polyethylene prices were flat though December and were expected to remain flat, if not move lower, last month and/or this month. That did not stop suppliers from rolling over their seven-month-old announcement of a 5¢/lb increase into the new year.

Says Mike Burns, RTi’s v.p. of client services for PE, “There is nothing to support any type of price increase. Moreover, imported film and bags with lower competitive prices have started to surface in North American markets.” He ventured that PE suppliers may have to respond by lowering prices to avoid a flood of these imported finished products. Burns noted that in the first week of January, bags from China coming into the U.S. were going for 75¢/lb while domestically produced bags were at 82¢/lb. He said this will become an urgent issue if the difference widens beyond 10¢/lb.

The Plastics Exchange’s Greenberg reported at year’s end that “2015 saw PE contract prices decrease 13¢/lb, while spot prices dropped 15-19 ¢/lb. This left market liquidity up to distributors and resellers to sell off their uncommitted stocks before year-end. Although most spot PE prices slid 2-3¢/lb in December, suppliers managed to hold contract prices steady.”

Also at year’s end, PetroChemWire reported industry chatter that a busy cracker turnaround schedule for PE suppliers in early 2016 would lend support to price increases, but that the near-term upside risk was limited. This year’s cracker turnaround activity is about 30% more than last year and takes place between February and May, according to Burns.

PP PRICES STILL GOING UP

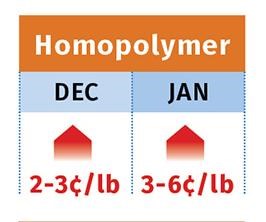

Polypropylene prices moved up another 1-3¢/lb in both November and December, so fourth-quarter increases totaled as much as 8.5¢/lb. Meanwhile, PP suppliers had issued margin increases of 6¢/lb above any propylene monomer increase, effective Jan. 1. PetroChemWire reported that one supplier had nominated a 7¢/lb contract increase specific to PP impact copolymer.

RTi’s v.p. of PP markets Scott Newell ventures that suppliers could likely implement the entire increase within first quarter, but not all at once. He noted that January propylene monomer contracts were expected to be flat if not down. Greenberg reports that the limited year-end spot monomer activity was a bit lower and contract prices were expected to roll over. Both sources noted that the past year was as one of tight PP supplies—the result of growing demand and production constraints—but it ended with supplier resin inventories having increased. Says Newell, “Inventories grew due to soft demand. There were some good offers in the secondary markets.” He adds that this softer demand could be a market response to suppliers’ margin expansion increases.

This year will also prove a very tight one for PP, as evidenced by new contracts for some processors carrying higher tabs to ensure they receive the volume they require, according to Newell. PetroChemWire reported that supply would remain tight in the first quarter due to maintenance outages and continued strong demand, but relatively weak international PP markets could drive an influx of imported resin and finished goods.

Newell noted that the domestic PP price is carrying a big premium over the rest of the world—nearly 25¢/lb over Chinese PP prices. “This spread is growing as domestic suppliers continue to implement profit-margin increases, and this could result in demand destruction over time for the domestic PP market.” He ventures that such demand destruction could come in the form of imported resin or PP finished goods and transition from PP to other resins.

PS PRICES FLAT

Polystyrene prices remained flat in the last two months of 2015 and were expected to mirror that trend this month. PetroChemWire reported at year’s end that PS spot prices were also mostly flat, though some offgrade activity was seen at prices that were up to 1¢/lb lower.

Aside from this being a slow season for PS, there was downward pressure from all key feedstocks, notes Mark Kallman, RTi’s v.p. of client services for engineering resins, PS, and PVC. Benzene prices dropped 28¢ to $2.12/gal, while late-settling ethylene contracts in December were expected to drop 2-3¢/lb. January contract butadiene prices, which impact HIPS prices, also dropped 2¢/lb. Kallman ventures that the March-April time frame could signal upward pressure on PS prices, depending on impact of ethylene cracker turnarounds and demand levels as we enter the stronger spring season for PS in recreational products and construction markets.

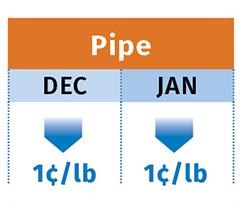

PVC PRICES FLAT FOR NOW

PVC prices dropped 1-2¢/lb in the last couple of months and were expected to be flat this month. Even so, suppliers announced January price increases of 2-3¢/lb, with one supplier floating a second such increase for this month as well.

“There is no reason for an increase this month,” says RTi’s Kallman, citing the drop in ethylene contract prices, which reduces the cost of PVC production, coupled with a slow season in PVC markets. At the same time, he sees these proposed increases lingering into the next two months as suppliers seek an opportunity to implement them. Upward pricing pressure could eventually result from cracker-maintenance supply constraints and an uptick in demand for the spring season.

Related Content

Prices of PE, PP, PS, PVC Drop

Generally, a bottoming-out appears to be the projected pricing trajectory.

Read MoreFundamentals of Polyethylene – Part 5: Metallocenes

How the development of new catalysts—notably metallocenes—paved the way for the development of material grades never before possible.

Read MoreThe Fundamentals of Polyethylene – Part 2: Density and Molecular Weight

PE properties can be adjusted either by changing the molecular weight or by altering the density. While this increases the possible combinations of properties, it also requires that the specification for the material be precise.

Read MoreFundamentals of Polyethylene – Part 3: Field Failures

Polyethylene parts can fail when an inappropriate density is selected. Let’s look at some examples and examine what happened and why.

Read MoreRead Next

See Recyclers Close the Loop on Trade Show Production Scrap at NPE2024

A collaboration between show organizer PLASTICS, recycler CPR and size reduction experts WEIMA and Conair recovered and recycled all production scrap at NPE2024.

Read MoreMaking the Circular Economy a Reality

Driven by brand owner demands and new worldwide legislation, the entire supply chain is working toward the shift to circularity, with some evidence the circular economy has already begun.

Read MoreFor PLASTICS' CEO Seaholm, NPE to Shine Light on Sustainability Successes

With advocacy, communication and sustainability as three main pillars, Seaholm leads a trade association to NPE that ‘is more active today than we have ever been.’

Read More