PP, PS, PVC Prices Up, But Not for Long

Resin Buying Strategies

A soft landing is expected for the four commodity thermoplastics as the year comes to an end.

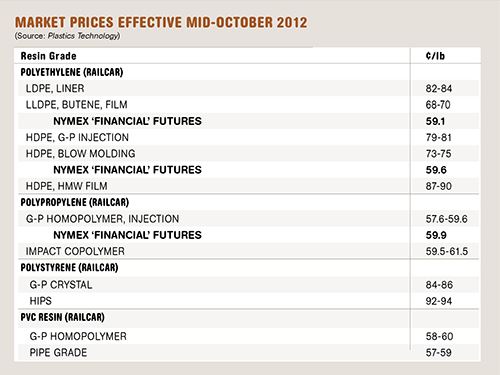

A soft landing is expected for the four commodity thermoplastics as the year comes to an end. This despite price increases that went through in October for PP, PS, and PVC. Prices for PE also had a chance of rising, but not by as much as suppliers sought. Lackluster domestic demand, falling feedstock prices, and weak export markets weighed on buyers and sellers of all four resins. While supply tightness also characterized all four up until October, availability of PE and PP showed some improvement. This was first indicated by spot market prices, particularly for PE, according to CEO Michael Greenberg of Chicago-based The Plastics Exchange. He and purchasing consultants at Resin Technology. Inc. (RTi), Fort Worth, Texas, generally project weak prices for all four resins through year’s end.

PE PRICES LOOK STABLE

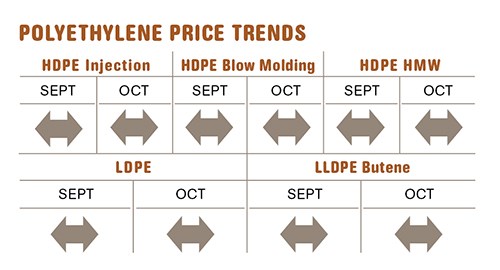

Polyethylene contract prices appeared to have a good chance of remaining stable for the rest of the year, although suppliers issued increases of 3-5¢/lb for Oct. 1. There are currently no market factors that would support an increase, says Mike Burns, v.p. of PE at RTi. Greenberg reported that the PE spot market was easing at the end of September, with prices dropping from 0.5¢ to 2¢/lb, depending on grade. By mid-October, average PE spot prices had slid by another penny or so—this despite higher contact price nominations.

Although resin producers’ inventories remain tight by usual standards, there were signs of improvement in October. Greenberg reported that weak exports freed up a wide range of PE resins offered by Houston traders, though HDPE injection grades remained snug.

PP PRICES UP A BIT

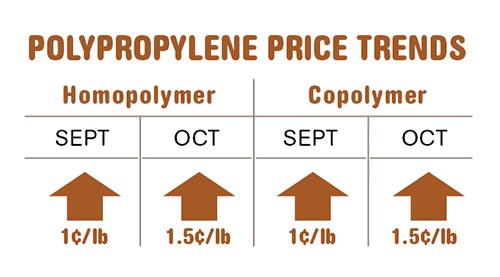

Polypropylene contract prices were poised to move up 1.5¢/lb in October, matching the increase in propylene monomer contracts for that month, which settled at 53¢/lb. As was the case in September, when both resin and monomer moved up a penny, there was an unsupported attempt by a few PP suppliers to get an additional 1¢/lb margin increase above the change in monomer cost.

Material availability eased across the board, including railcar offers from suppliers, warehoused material from national resellers, and bagged resin from Houston traders, Greenberg reports. He adds that slowed exports contributed to improved supplies.

Scott Newell, director of client services for PP at RTi, says demand in September was down almost 200 million/lb but so was resin output, with operating rates dropping to around 84-85% , primarily due to production issues. Demand for October was also expected to be down, including exports. “We’ve had the lowest PP prices globally since June, but this has not resulted in an uptick in exports, partly due to weak global economies and falling PP prices overseas.” Newell projects that by end of the year, PP operating rates will be up to 88-89%. “The market is still tight, and it won’t take that much for operating rates to rise to 92-94% if there is export demand, to gain back some of the material replacement that took place when PP prices were very high.” For that reason, suppliers are expected to be more competitive in 2013, and will aim to decouple PP pricing from that of monomer.

PS PRICES STRONGER

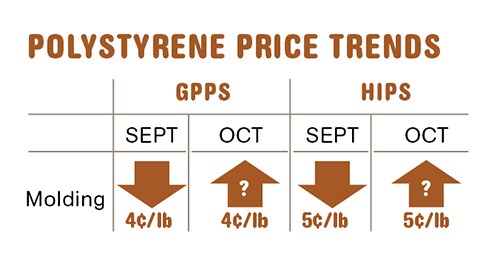

Polystyrene prices ranged from flat to higher in October, after falling in September by 4¢ for GPPS and 5¢/lb for HIPS. The amounts of the increases appear to vary broadly depending on the pricing formula in a buyer’s contract, according to Stacy Shelly, RTi’s director of business development for engineering resins, PS, and ABS. Nonetheless, he says November and December prices are likely to trend flat-todown, in step with projections for key feedstocks and continued weak demand.

Supplies of both styrene monomer and PS remained tight last month, but “real” demand remained weak, down 4-5% year-to-date. Despite reports that American Styrenics would continue to operate under force majeure through mid-November, other monomer disruptions have been resolved. Still, PS plant operating rates have been reduced by suppliers in this quarter to keep supplies tight and margin gains in place. Shelly expects year-end deals on spot domestic resin to be tough to come by.

Spot monomer prices declined slightly in October and restarted capacity was expected to improve domestic material availability. While ethylene prices were moving from flat to down, benzene spot pricing rose more than 20¢/gal above contract tabs by mid-October, driven by supply tightness. Shelly expected that to ease by November.

PVC PRICES UP FOR NOW

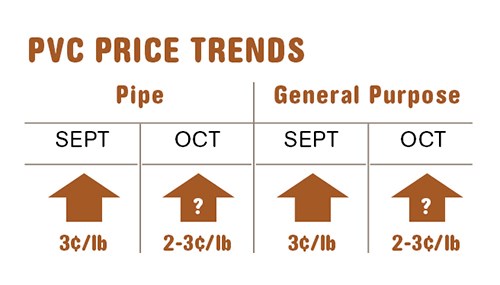

PVC prices moved up 3¢/lb in September. Moreover, suppliers boosted their initial increases of 3¢/lb for Oct. 1 to 5¢/lb. The more aggressive pricing stance was attributed to tighter supplies by the end of August. These were spurred by very strong export demand, good domestic demand in July and August, and short-term production shutdowns resulting from hurricane Isaac. But, the market took a turn downward in September, one that is likely to last through the fourth quarter, according to Mark Kallman, director of client services for engineering resins and PVC at RTi.

“The month-to-month numbers for September versus August, showed demand falling off—4% domestically and 11% for exports—and October appeared to be following suit. Domestic demand typically slows down in the fourth quarter anyway, and the effects of a slump in overseas economies is evident with the drop in export sales,” says Kallman. Third-quarter numbers show that exports were up 19% from the second quarter, whereas domestic demand was flat.

But prices were still expected to rise a bit by the end of last month. Kallman notes that three suppliers have planned maintenance turnarounds in October and November. He ventures that PVC prices will move up by 2-3¢/lb out of the 5¢ sought by suppliers.

Related Content

Commodity Resin Prices Flat to Lower

Major price correction looms for PP, and lower prices are projected for PE, PS, PVC and PET.

Read MoreThe Fundamentals of Polyethylene – Part 1: The Basics

You would think we’d know all there is to know about a material that was commercialized 80 years ago. Not so for polyethylene. Let’s start by brushing up on the basics.

Read MoreFundamentals of Polyethylene – Part 3: Field Failures

Polyethylene parts can fail when an inappropriate density is selected. Let’s look at some examples and examine what happened and why.

Read MorePrices Up for PE, PP, PS, Flat for PVC, PET

Trajectory is generally flat-to-down for all commodity resins.

Read MoreRead Next

Lead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read MoreBeyond Prototypes: 8 Ways the Plastics Industry Is Using 3D Printing

Plastics processors are finding applications for 3D printing around the plant and across the supply chain. Here are 8 examples to look for at NPE2024.

Read MoreMaking the Circular Economy a Reality

Driven by brand owner demands and new worldwide legislation, the entire supply chain is working toward the shift to circularity, with some evidence the circular economy has already begun.

Read More