Price Relief Continues in Commodity Resins

Resin Buying Strategies

Further price erosion is projected for at least this month, particularly in the case of polyolefins and polystyrene.

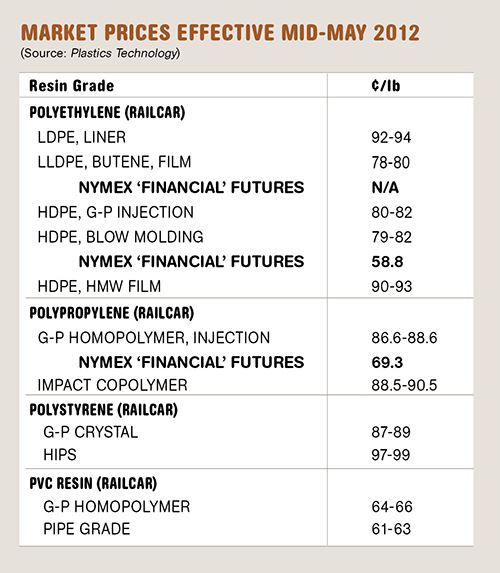

Prices of the four commodity thermoplastics were flat or lower last month. Key driving factors include rapidly declining feedstock prices, lackluster domestic demand, sluggish exports, and suppliers’ mounting resin inventories. Further price erosion is projected for at least this month, particularly in the case of polyolefins and polystyrene, according to consultants from Resin Technology Inc. (RTi), Fort Worth, Tex. , and CEO Michael Greenberg of The Plastics Exchange in Chicago.

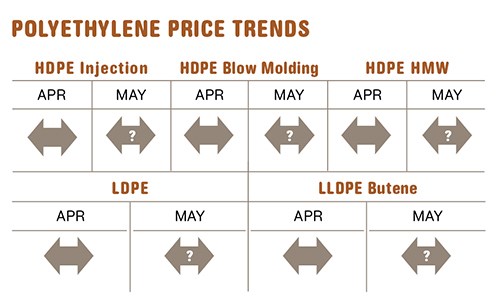

PE PRICES SLIPPING

Contract polyethylene prices were flat in April, following increases totaling 6¢/lb between February and March. However, price reductions of 4¢ to 6¢ were expected to be in place by the end of last month, according to both Mike Burns, v.p. of PE at RTi, and Greenberg of The Plastics Exchange. Further price drops were projected for June.

These developments were in step with lower PE spot prices, which dropped a total of 6¢/lb within a 30-day period, according to Greenberg. As key contributing factors he cites the lowest domestic demand in two years combined with the lowest export activity since January 2009.

In addition, PE plants were still operating at over 90% of capacity during April, with suppliers’ inventories accumulating 700 million lb so far this year, according to Greenberg.

Last, but not least, ethylene monomer prices have been dropping rapidly as planned maintenance outages came to a close last month, and further price reductions were expected. Spot ethylene prices for May delivery dropped from a high of 75¢/lb to 54.25¢/lb. Ethylene for third-quarter delivery last traded at around 51.5¢, with fourth-quarter material another 2-3¢ lower, according to Greenberg.

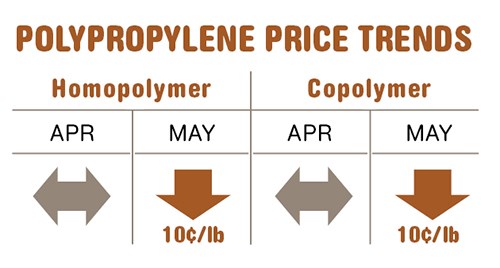

PP PRICES BOTTOMING OUT

Contract prices for both polypropylene resin and propylene monomer were flat in April, though spot PP continued to sell at heavy discounts. Both monomer prices and PP contract prices dropped by 10¢/lb in May.

A bit more price erosion is likely this month, after which prices will have bottomed out, according to Scott Newell, director of client services for PP at RTi.

PP demand in both March and April were very poor, with suppliers’ inventories continuing to grow by around 50 million lb. Says Newell, “This has been a weak market but we expect to see some rebound, most likely starting this month.” He also noted that planned cracker outages would come to completion by the end of May, so that monomer availability is expected to improve.

Greenberg of The Plastics Exchange sees the current PP market as oversupplied. He points out that even though monomer contract prices dropped by a dime to 67.5¢/lb, followed by PP contract prices, spot prices for both monomer and resin remained at a sharp discount to contract prices through mid-May.

For example, spot monomer at mid-month traded in the low 50¢/lb range and spot PP was in the upper 60s. Another significant price reduction in both monomer and resin is likely this month, with the forward market flattening out after that, according to Greenberg.

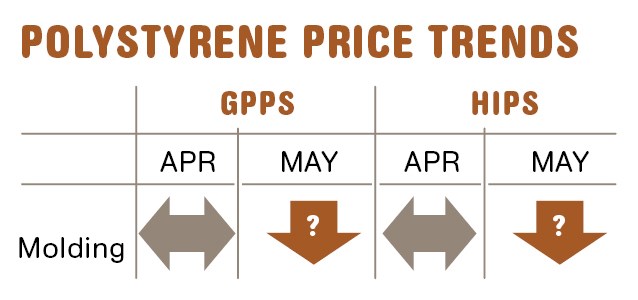

PS PRICES MOVING SOUTH

Polystyrene prices peaked in early April and stayed there through last month. Price hikes for May 1 of 2¢/lb issued by Styrolution and Total and 4¢/lb by Americas Styrenics appeared to have no momentum by mid-month, as feedstock prices slumped. Based on this movement and weak demand, GPPS and HIPS prices are projected to drop this month.

Spot benzene prices fell by more than 10¢/gal, spot ethylene prices dropped 25%. Both spot and contract styrene monomer prices remained relatively flat from February through May, despite weak demand. Spot feedstock prices were dropping, however, and are likely to continue that trajectory, which will ultimately bring down the cost of the monomer, according to Stacy Shelly, RTi’s director of business development for engineering resins, PS, and PVC.

Meanwhile, the average settlement for May butadiene contracts dropped 7¢/lb from April to $1.48/lb. Spot butadiene pricing has declined for six consecutive weeks.

Ditto for global butadiene prices, as demand is weak and inventories are ample. Shelly sees further reductions, noting: “The HIPS premium over GPPS should then begin to narrow.”

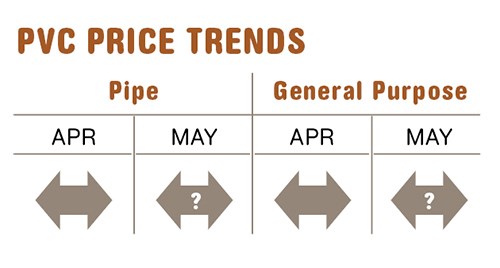

PVC PRICES FLAT TO DOWN

PVC resin prices were flat through April, as ethylene contract prices settled lower by 0.5¢/lb, and a further decline was expected for May by Mark Kallman, RTi director of client services for engineering resins and PVC.

PVC resin demand in 2012 has been steady, with domestic demand up and exports down. Domestic demand in January and February was spurred by the unusually warm winter and then flattened out by April.

Meanwhile, resin production rates, which had been throttled back to the low-to-mid 70% range earlier in the year, were moving back up.

April production rates were in the upper 80s, and suppliers’ inventories were building, according to Kallman. PVC pricing for now is expected to be flat to lower.

Related Content

Delivering Increased Benefits to Greenhouse Films

Baystar's Borstar technology is helping customers deliver better, more reliable production methods to greenhouse agriculture.

Read MorePolyethylene Fundamentals – Part 4: Failed HDPE Case Study

Injection molders of small fuel tanks learned the hard way that a very small difference in density — 0.6% — could make a large difference in PE stress-crack resistance.

Read MoreFundamentals of Polyethylene – Part 5: Metallocenes

How the development of new catalysts—notably metallocenes—paved the way for the development of material grades never before possible.

Read MoreThe Fundamentals of Polyethylene – Part 2: Density and Molecular Weight

PE properties can be adjusted either by changing the molecular weight or by altering the density. While this increases the possible combinations of properties, it also requires that the specification for the material be precise.

Read MoreRead Next

People 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read MoreSee Recyclers Close the Loop on Trade Show Production Scrap at NPE2024

A collaboration between show organizer PLASTICS, recycler CPR and size reduction experts WEIMA and Conair recovered and recycled all production scrap at NPE2024.

Read More