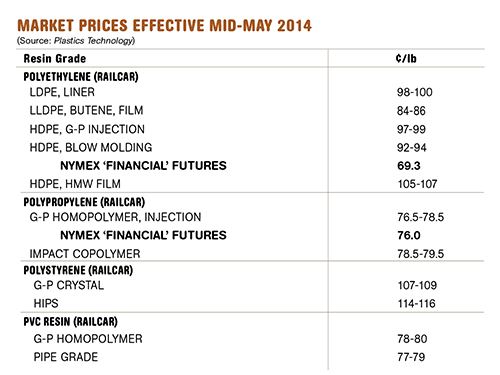

Price Trend Still Flat to Lower

Prices for three of four commodity resin trending down. PE relatively stable.

Prices of three (PP, PS, PVC) of the four major commodity thermoplastics are trending downward while PE prices may remain relatively stable. Driving factors include lower feedstock costs, planned and unplanned shutdowns that constrained supply, and overall lackluster demand due in part to weather-related issues. These are some of the observations cited by resin purchasing consultants at Resin Technology, Inc. (RTi), Fort Worth, Texas, and CEO Michael Greenberg of The Plastics Exchange in Chicago.

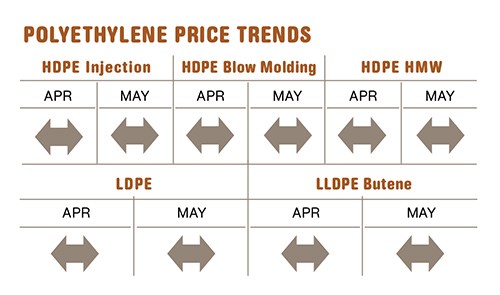

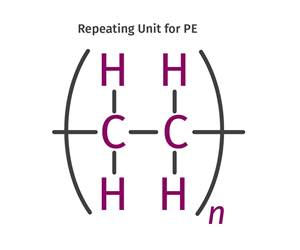

PE PRICES FLAT

Polyethylene contract prices remained flat through April and were on the same path early last month. This was despite price hikes of 3-6¢/lb left on the table for April-May by some suppliers.

By press time, still abstaining from announcing price increases were ExxonMobil and Nova Chemicals. Meanwhile LyondellBasell split its 6¢ hike for April 1 into 3¢ effective June 1 and another 3¢ for July 1. The Plastics Exchange’s Greenberg reported in early May that spot PE prices were holding steady, though some suppliers eased up a bit on their asking prices. He ventured that a small decrease in PE contract prices might make more sense, though he noted that production issues could temper such movement.

Mike Burns, v.p. for PE at RTi, noted that planned and short-term unplanned PE production shutdowns made a price decrease unlikely. “There is not enough resin out there for processors to be able to negotiate lower pricing,” he said. Particularly tight are injection molding grade HDPE, HMW-HDPE, and butene-LLDPE. One HDPE injection molder told Burns that this was the first time in nearly 10 years that he has worried about getting material. Burns pointed out that PE resin availability is now tight globally and prices are starting to inch up. By the same token, he noted that PE suppliers appear to recognize that processors cannot continue to pass on further increases to end users, so this relative price stability could continue.

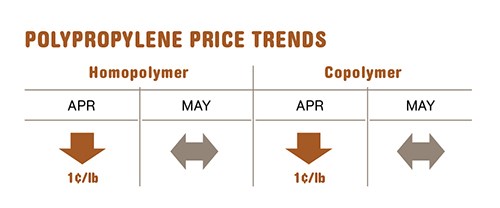

PP PRICES DROP

Polypropylene prices dropped by another 1¢/lb in April, after the March 1st 1.5¢/lb price cut, all in step with monomer movements. Another 1-2¢/lb reduction was possible for May contracts, according to both Greenberg and Scott Newell, RTi’s director of client services for PP.

The PP resin and propylene monomer markets are currently relatively well balanced, which explains the lower price volatility. Greenberg reported an uptick in spot PP trading, with offgrade prices easing up a tad, though generic prime prices held firm. RTi’s Newell conceded that the rebound in demand he expected in April did not materialize. “The first four months of the year place PP demand in negative territory.” But he said PP suppliers have indicated a rise in May orders. Newell ventured that processors were able to make their pre-buying inventories last about a month longer due to a colder Spring, but they will need to restock soon.

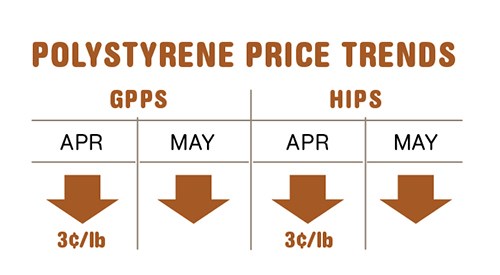

PS PRICES DOWN, TOO

Polystyrene prices dropped 3¢/lb in April, and were poised to fall perhaps another 2¢/lb last month, according to Mark Kallman, RTi’s v.p. of client services for engineering resins, PS, and PVC.

Driving this movement are benzene prices that fell by another 23¢/gal to $4.57 last month, after dropping a total of 29¢ in March/April. Lower ethylene contract prices, down 4¢/lb in March, added a downward push, though April ethylene contracts moved back up 1.5¢ to 47¢/lb. That was driven by planned cracker maintenance turnarounds. Kallman said, “We did not see the seasonal burst in demand you typically get for construction and recreational products in April and into May, but demand is improving.” Although styrene monomer is tight, PS availability is reasonably balanced.

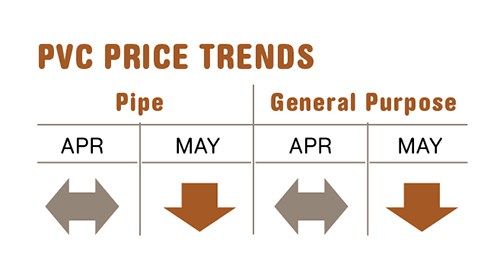

PVC PRICES FLAT TO DOWN

PVC prices were stable in April. Demand was more sluggish than originally expected, while production issues resulted in snugger supplies and lower exports. RTi’s Kallman noted that PVC processors could not capitalize on the lower ethylene contract prices to negotiate lower contract tabs. May was projected to be flat-to-down, and this month should see a further easing of prices, according to Kallman.

Still, demand is expected to rebound as the construction season picks up, albeit later than usual. Exports are also expected to be on the upswing.

Related Content

Recycled Material Prices Show Stability Heading into 2023

After summer's steep drop, most prices leveled off in the second half.

Read MorePrices of PE, PP, PS, PVC Drop

Generally, a bottoming-out appears to be the projected pricing trajectory.

Read MoreCommodity Resin Prices Flat to Lower

Major price correction looms for PP, and lower prices are projected for PE, PS, PVC and PET.

Read MoreThe Fundamentals of Polyethylene – Part 2: Density and Molecular Weight

PE properties can be adjusted either by changing the molecular weight or by altering the density. While this increases the possible combinations of properties, it also requires that the specification for the material be precise.

Read MoreRead Next

See Recyclers Close the Loop on Trade Show Production Scrap at NPE2024

A collaboration between show organizer PLASTICS, recycler CPR and size reduction experts WEIMA and Conair recovered and recycled all production scrap at NPE2024.

Read MoreLead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read More