Prices Flat for PE; Down for PP, PS, PVC; Up for PET

Prices for both polyolefins and PS seemed to be bottoming out as production rates were lowered.

A halt in the pricing plunge for PE, PP, and PS appeared to be shaping up going into November, owing primarily to suppliers reducing their swollen inventories by throttling back production rates and, in the case of PE, multiplying attractive offers for exports and the domestic spot market. Still, first-quarter 2023 looks to be a buyer’s market for all five major commodity resins.

These are the views of purchasing consultants from Resin Technology, Inc. (RTi), senior analysts from Houston-based PetroChemWire (PCW), CEO Michael Greenberg of The Plastics Exchange, and Scott Newell, executive v.p. of polyolefins at distributor/compounder Spartan Polymers.

PE Prices Flatten

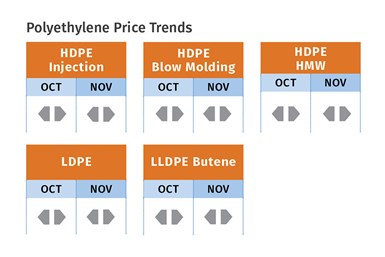

Polyethylene prices for October appeared to hold even and were expected to be generally flat for the last two months of the year, according to David Barry, PCW’s associate director for PE, PP, and PS; Robin Chesshier, RTi’s v.p. of PE, PS, and nylon 6 markets; and The Plastic Exchange’s Michael Greenberg. Reporting on one longtime market watcher’s projections, Barry noted, “Don’t expect any big price swings for several months.” Meanwhile, suppliers notified customers they were postponing their increases of 5-7¢/lb from October to November, though these sources saw this move as mainly an effort to halt any further decline.

Contract prices fell a total of about 11¢/lb in the third quarter, with more dramatic price drops in the spot market. As October approached, spot prices began to stabilize. Going into November, Greenberg put it this way: “Spot PE price were holding firm for three weeks in a row. Even as PE spot levels have seemingly found a floor, buyers continue to enjoy good availability for most grades near these yearly lows.” He did note that some more niche grades, such as injection molding LDPE, EVA, POE and rotomolding resins had been in tighter supply, and have good underlying demand if better supplies surface.

Major contributing factors to the improved PE market balance were that after several years of high production rates, PE suppliers throttled back plant utilization rates to the low 70s percentile, in addition to offering lower-priced exports and spot material to bring down their high inventories.

Both PCW’s Barry and RTi’s Chesshier ventured that this relative stability might well be shaken up within the first quarter, due to the substantial new capacity being brought on stream by Shell and Baystar, the new 50/50 joint venture between Borealis and Total Energies. Combined production will represent a 10% increase in annual domestic capacity. Noting that early 2023 will remain a buyer’s market, Chesshier said that suppliers will face further challenges from lower global demand. As Barry put it, “The export packaging pipeline was viewed as a likely bottleneck for producer export sales in the coming months. Prices in Asia were softening as well-stocked Chinese producers lowered offers to stimulate demand and Southeast Asian markets followed the softer trend.”

PP Prices Drop Sharply

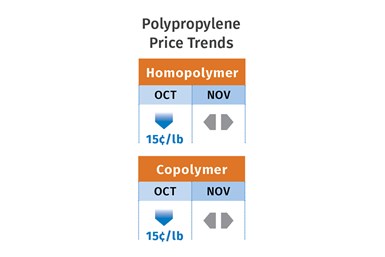

Polypropylene prices in October were on the way down by double-digits, as propylene monomer contracts were expected to settle 9¢/lb to 11¢/lb lower, along with an expected margin contraction of 4¢/lb to 5¢/lb, according to PCW’s Barry, Spartan Polymers’ Newell, and The Plastic Exchange’s Greenberg. The market was characterized as very well supplied, amid continued lackluster demand, despite suppliers throttling back plant operating rates to a low of 70%

For the November-December timeframe, these sources noted signs that prices were bottoming out, with flat to slightly lower pricing expected. “I think we haves some visibility of a bottom forming with a little bit of further drop,” said Newell. Barry saw potential for further price reduction in the fourth quarter, noting that demand in the global PP market was down and China was becoming a regular exporter of PP, the latest competitor for U.S. suppliers.

At the same time, he ventured that it was possible that November-December propylene monomer prices would not drop any further. He did not anticipate any further margin contraction, though he said that could play a factor in 2023 PP price negotiations behind the scenes.

While suppliers have throttled back production, these sources say there is a lot of material to be had and that heavily discounted spot deals were on the table. There was also substantial new capacity coming on stream, with ExxonMobil starting up its new plant and Heartland Polymers readying its PDH and PP units. Greenberg confirmed that some PP suppliers were offering deeply discounted railcars for higher volume orders as they aimed for better positioning in first-quarter 2023. He reported that there was good ongoing demand for packaged truckloads from processors that had drawn down their stocks and now required more material, and from others waiting for late railcars to arrive.

PS Prices Down

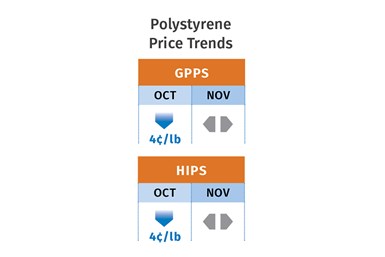

Polystyrene prices in October looked to be heading down by 4¢/lb, bringing the total three-month drop in prices to 40-43¢/lb, and they could bottom out for the last two months of the year, according to both PCW’s Barry and RTi’s Chesshier. Both noted that demand was down but that suppliers had stayed on top of things by lowering production rates.

While an uptick in benzene contract prices of about 40¢/gal was expected in November, these sources predicted that PS suppliers might opt to give up some margin due to high volumes of imported PS. According to PCW’s Barry, one resin distributor described the price gap between imported and domestic resin as “unsustainably large.”

RTi’s Chesshier ventured that PS tabs could remain flat this month but may rise if benzene prices move up again. Meanwhile, the implied styrene cost based on a 30/70 formula of spot ethylene/benzene fell by nearly 2¢/lb to 36.2¢/lb going into November. Implied styrene costs have been hovering in the mid-30s since late August, according to Barry.

PVC Tabs Continue Sharp Decline

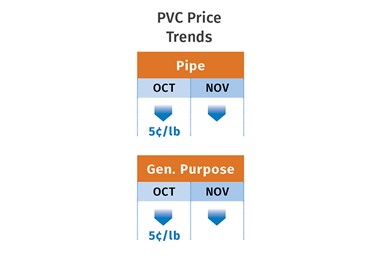

PVC prices in October were expected to drop another 5¢/lb following a cumulative drop of 15¢/lb in the previous three months. Moreover, similar decreases were expected for the last two months of 2022, which would bring the total decline in the second half of this year to 30¢/lb, according to Mark Kallman, RTi’s v.p. of PVC and engineering resins and PCW senior editor Donna Todd.

The latter reported that PVC prices are forecasted to be flat in January, followed by a 2¢/lb drop in February and flat again in March, for a total decrease of 32¢/lb over nine months.

Both sources noted that falling PVC export prices have continued the downward pressure on domestic prices, along with increasing supplier inventories. However, Kallman reported that suppliers have exported a substantial volume of PVC and that Formosa had planned a shutdown of its Louisiana plant through November, which would perhaps result in a more balanced market. He noted that with the exception of wire and cable—the “most resilient market sector”—PVC demand is off in nearly all categories.

PET Prices Up, Then Down

PET prices in October were on the way up by 3¢/lb to 4¢/lb based on an upward blip in feedstock costs, but were expected to drop again on the order of 1-2¢/lb in November-December. This would follow a decline of about 23¢/lb between July and September, according to RTi’s Kallman.

Kallman characterized domestic demand as slower and the market as well supplied, with attractively priced exports continuing to arrive at a steady pace.

Related Content

Fundamentals of Polyethylene – Part 6: PE Performance

Don’t assume you know everything there is to know about PE because it’s been around so long. Here is yet another example of how the performance of PE is influenced by molecular weight and density.

Read MorePrices for All Volume Resins Head Down at End of 2023

Flat-to-downward trajectory for at least this month.

Read MoreCommodity Resin Prices Flat to Lower

Major price correction looms for PP, and lower prices are projected for PE, PS, PVC and PET.

Read MoreThe Fundamentals of Polyethylene – Part 1: The Basics

You would think we’d know all there is to know about a material that was commercialized 80 years ago. Not so for polyethylene. Let’s start by brushing up on the basics.

Read MoreRead Next

Lead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read MorePeople 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read MoreMaking the Circular Economy a Reality

Driven by brand owner demands and new worldwide legislation, the entire supply chain is working toward the shift to circularity, with some evidence the circular economy has already begun.

Read More