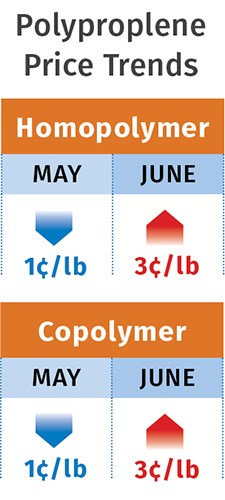

Prices of Commodity & Engineering Thermoplastics Trend Flat to Lower

Prices of PP, PS drop as PE, PVC are flat or softening. Ditto for ABS, PC, and nylon 6 and 66.

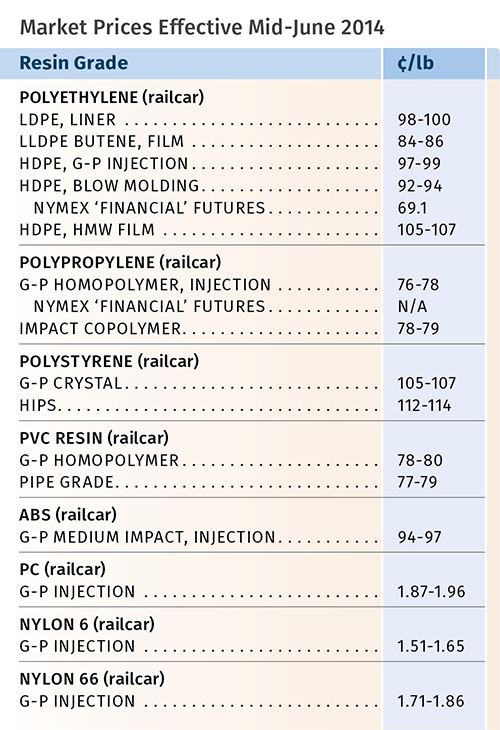

Lower feedstock costs, improved availability of both feedstocks and resins with the conclusion of plant shutdowns (planned or not), along with a general improvement in demand, has brought about some price relief. In the case of PE and PS, prices moved down again; and while PE and PVC remained flat, there were indications that lower prices could be in the offing as well. At midyear, prices for ABS, PC, and nylons 6 and 66 were also largely stable, with downward pressure from falling feedstock costs.

These are the views of purchasing consultants at Resin Technology, Inc. (RTi), Fort Worth, Texas, and CEO Michael Greenberg of The Plastics Exchange, Chicago. Addressing polyolefins, Greenberg points out that this year’s price increases for both PE and PP, totaling 4ȼ/lb so far, appear relatively “benign” compared with the double-digit increases seen in the first quarter of the last few years. He and other industry sources expected PP prices to drop a bit farther last month.

PE PRICES FLAT

Polyethylene contract prices remained flat for the third month in May. The same was generally projected for last month and possibly into this one, according to Mike Burns, RTi’s v.p. for PE.

Prices in August may be pushed in either direction, and the main driver to watch will be supplier inventories. One unpredictable factor is hurricane season, which can draw down inventories and tighten resin markets, resulting in upward pricing pressure, Burns notes.

Greenberg reported at the end of May that spot HDPE prices moved down by a half-cent as availability improved, so that HDPE prices are now only slightly higher than LD/LLDPE. In contrast, snug availability for PE film grades accompanied an increase in LDPE spot prices by 2.5ȼ/lb while LLDPE moved up 1ȼ/lb. Overall, spot prices have stayed firm, near prime levels due to material snugness.

In general, strong demand and tight availability characterized the PE market through most of the second quarter, according to Burns. He expects resin availability to improve for all grades as most scheduled and unscheduled plant outages have been resolved. A slight build in supplier inventories added two days’ worth above the three-year average of 32 days’ inventory. Burns notes that actions by major film suppliers to increase prices of their products by an average of 4% above resin cost increases in June to cover other rising costs (fuel, shipping and freight) are a positive indicator of market demand, at least in the film market.

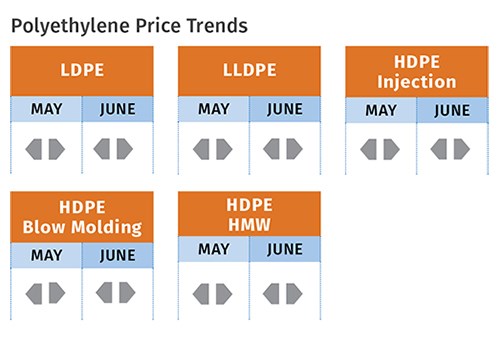

PP PRICES DROP

Polypropylene contract prices fell by a half-cent in May, in keeping with the monomer’s movement. This brought the total drop in prices to 3ȼ/lb since March. Additional relief was expected last month.

While June monomer contract offers were 0.5-1.0ȼ/lb lower, a decline in spot monomer prices approaching 5ȼ/lb indicated a bigger drop was in the offing, according to both Greenberg and Scott Newell, RTI’s director of client services for PP. He forecasted a drop in June monomer and PP prices of 2ȼ/lb or more.

Greenberg reported in late May that several large groups of PP railcars appeared on the spot market and he ventured that this may be an indication that actual contract orders are falling short of those forecasted. “Processors in general seem to have scoffed at the half-cent decrease afforded by May contracts and appear to be waiting for cheaper prices ahead,” he reported.

A relatively modest improvement in PP demand was seen in April and May, and there were forecasts for a stronger rebound last month, according to Newell. “Processors’ inventories have dwindled and we expect the consumer markets to pick up,” he said.

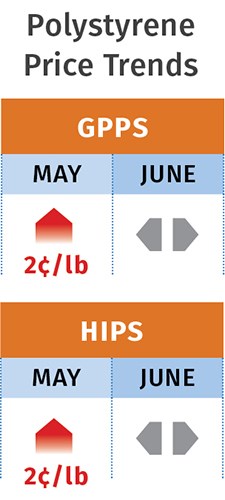

PS PRICES DROP AGAIN

Polystyrene prices dropped for the second consecutive month in May, another 2ȼ decline shaving off a total of 5ȼ from the 11ȼ/lb gained by suppliers in first quarter. Moreover, flat-to-lower pricing was anticipated for last month and into this one by Mark Kallman, RTI’s v.p. of client services for engineering resins, PS, and PVC.

Driving this price relief is the continuation of lower benzene prices as higher operating rates from domestic refineries are turning out more product and exports are coming in. June contract benzene prices dropped by another 9ȼ/gal to $4.48. Add to that continued flat-to-lower ethylene contract prices and more of the same projected ahead. Meanwhile, domestic demand is on its seasonal uptick in recreational products and construction, though how much the latter improves remains to be seen, says Kallman.

PVC PRICES FLAT, BUT NOT FOR LONG

PVC prices remained stable for the second consecutive month in May, with price relief considered possible last month. RTi’s Kallman foresaw prices dropping last month and into this one by 1-3ȼ/lb, helping to shave off some of the 9ȼ/lb gained by suppliers in the first quarter.

A major driver toward price relief is improved availability of both ethylene and vinyl chloride monomers as well as lower ethylene prices. Sluggish domestic demand appeared to improve by midyear, and improved demand for exports was also expected within in June-July.

ABS PRICES FLAT

ABS prices were largely flat through the second quarter and may face downward pressure ahead, according to RTi’s Kallman. The two key drivers are falling prices of key feedstocks (acrylonitrile, styrene, butadiene) and ABS imports from Taiwan and South Korea.

PC PRICES FLAT FOR NOW

Polycarbonate prices were relatively flat through the second quarter, and suppliers implemented increases of only a couple of cents at some accounts versus the 7-8ȼ/lb they originally sought. The continued drop in benzene and propylene monomer costs could translate into some third-quarter price relief, ventures Kallman.

Demand has been steady for PC in automotive and is now picking up in the construction sector. There has been a glut of material globally and domestic availability has been plentiful. However, Styron’s recent announcement that it would exit the commodity PC business leaves only two major players—Bayer and SABIC. Styron will continue to market its higher-value PC compounds and blends, which are toll-produced by PolyOne.

NYLON PRICES FLAT-TO-DOWN

Nylon 66 prices were largely flat through the second quarter and some price easing is possible as costs of key feedstocks—benzene, propylene, and butadiene—have trended lower, according to RTI’s Kallman. Competitive pricing among suppliers continued through the first half of the year. Demand has continued to be strong in automotive and has improved in the construction sector as well.

Nylon 6 prices are projected to be flat-to-down as benzene and ammonia prices have dropped. Suppliers reportedly implemented a few cents out of their 10ȼ/lb March price hike, but not across the board, says Kallman. Meanwhile, demand has been steady to strong in automotive and packaging film and is showing improvement in fibers.

Related Content

Prices of All Five Commodity Plastics On the Way Up

Despite earlier anticipated rollover in prices for most of the volume commodity resins, prices were generally on the way up for all going into the third month of first quarter.

Read MoreFundamentals of Polyethylene – Part 5: Metallocenes

How the development of new catalysts—notably metallocenes—paved the way for the development of material grades never before possible.

Read MoreThe Fundamentals of Polyethylene – Part 2: Density and Molecular Weight

PE properties can be adjusted either by changing the molecular weight or by altering the density. While this increases the possible combinations of properties, it also requires that the specification for the material be precise.

Read MorePrices Up for All Volume Resins

First quarter was ending up with upward pricing, primarily due to higher feedstock costs and not supply/demand fundamentals.

Read MoreRead Next

People 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read MoreLead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read More