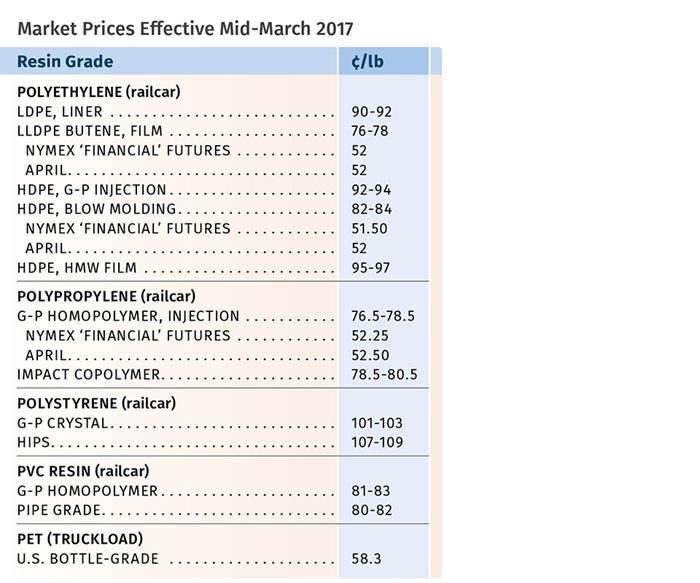

Prices Up for All Commodity Resins, Including ABS, PC, Nylons 6, 66

Reversal of some factors driving prices up could change the trajectory in the second or third quarter.

Considering the various factors that contribute to upward pricing of individual resins, it is highly unusual to see all commodity resin prices move up at the same time, and in relatively hefty proportions. But as the first quarter neared its end, that was the case for PE, PP, PS, PVC, PET, ABS, PC, and nylons 6 and 66. Chief factors included higher global prices of hydrocarbons and key feedstocks, which were also affected by planned and unplanned outages that resulted in snug supplies. By early March, there appeared to be potential for at least a bottoming out of prices, if not an eventual reversal in the coming months for at least some of these resins. Indicators included a decline in spot prices of several key feedstocks and a return of more adequate supplies. At the same time, prices could hold firm for some resins, as the early second quarter typically signals the start of strong seasonal demand.

These are the views of purchasing consultants from Resin Technology, Inc. (RTi), Fort Worth, Texas, CEO Michael Greenberg of Plastics Exchange, The in Chicago, and Houston-based PetroChemWire (PCW).

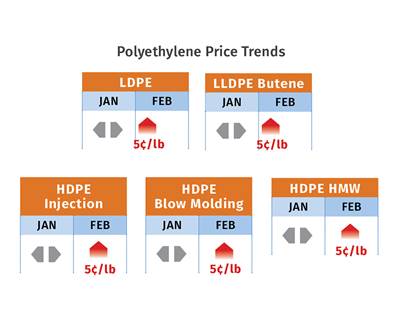

PE PRICES UP FOR NOW

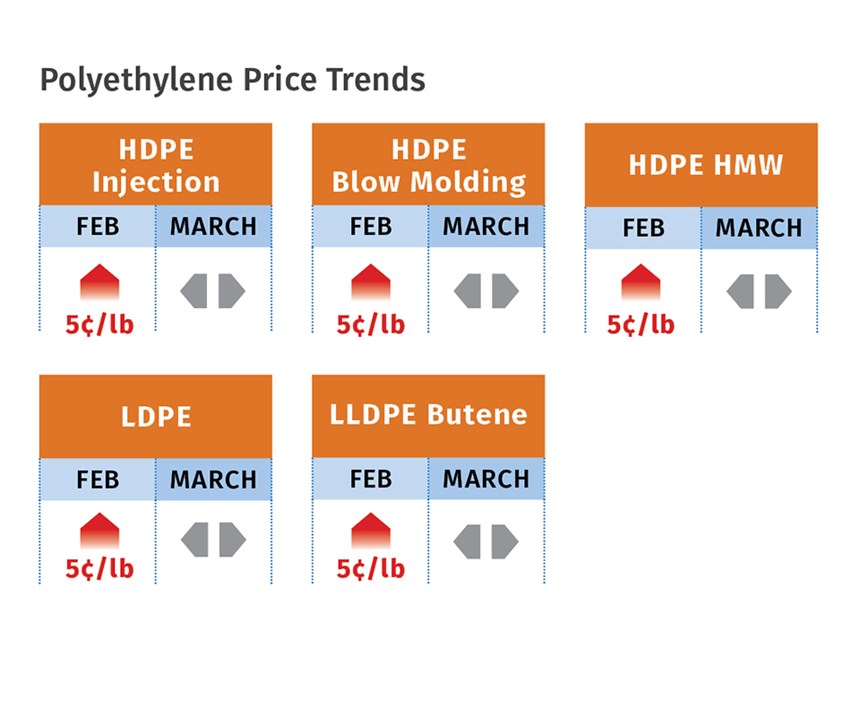

Polyethylene prices, as had been largely expected, moved up the full 5¢/lb sought by suppliers in February. Suppliers issued a 6¢/lb increase for March, but its chances of implementation were not as clear cut. According to Mike Burns, RTi’s v.p. of client services for PE, there were no legitimate drivers behind this second increase. The Plastics Exchange’s Greenberg concurred.

For one thing, all the planned and unplanned shutdowns of ethylene crackers were resolved by early last month and spot ethylene prices were on the decline. Moreover, crude oil prices still hovered at $52/barrel. In addition, the tight PE market that took place as a result of high export activity in December, coupled with a 80-million-lb supplier inventory drawdown in January, is expected to be reversed. Industry sources agree that first-quarter demand is likely to be less than average—partly a seasonal factor and also due to January prebuying. Burns ventured that supplier inventories would slowly recover—most likely by the end of this month and into May.

Burns explained a key point about the current domestic price level: With the 5¢/lb increase in place, North American commodity resin prices averaged 7-10¢/lb higher than in Southeast Asia. All major film processors were “comfortably” passing through the 5¢/lb increase in early March. But if the 6¢/lb increase were to go through, that would bring the spread to 13-16¢/lb, which would open the door for finished PE imports (e.g., bags). He added that Asian PE prices are going down and their inventories are in good shape.

PCW reported in early March that PE spot prices were mostly higher, with limited export activity, though high volumes sold earlier in the year were still moving to the ports. Following heavy domestic buying in January and February, there was some talk that domestic sales could cool off in March. Similarly, Greenberg reported at the end of February, “Incremental domestic demand has been lacking, as major processors seem to be well served with direct availability. While suppliers are out looking for orders, nobody is willing to really dump on price.” Greenberg also noted that the absence of plentiful material, along with very high margins and lackluster demand, point to reduced operating rates.

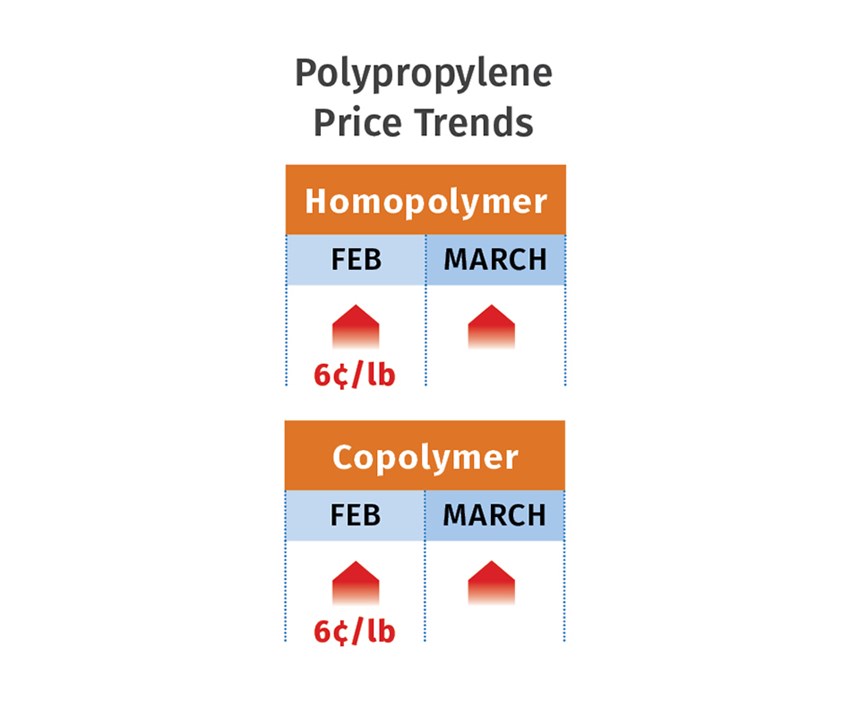

PP PRICES HIGHER

Polypropylene prices moved up 6¢/lb in February, in step with propylene monomer contracts, and driven by several planned and unplanned outages. By the end of that month, spot monomer prices were rallying upward by as much as 5¢/lb, according to PCW, Greenberg, and Scott Newell, RTi’s v.p. of PP markets. “Processors are still knee-deep from the 16.5¢/lb contract-price increase during

January/February; but rather than getting some hopeful relief in March (which we never thought would happen), the market is poised for yet another increase ahead,” reported Greenberg.

Newell ventured in early March that it was too early to say how things would shake out. He noted that March monomer and PP contracts could increase by another 4-5¢/lb but that things could turn around as well.

“Monomer has been short and overpriced but the market is in the process of trying to rebalance, and we could see that happen in April.”

PP domestic demand in February was slow, with processors buying as needed. This was due not only to the price increases, but also to a lot of prebuying at the end of 2016, most of which shipped in January, which thus appeared to be a strong demand month. “Once prices make their correction, demand will improve,” noted Newell. Both Newell and PCW noted the opportunity for imports of attractively-priced PP pellets from Latin America and the Middle East.

Still, prices are not at the high levels seen last year. PCW reported in early March that PP spot prices were up 1-2¢/lb with limited availability. Domestic demand was expected to slow in March, based on forecasts that monomer and PP contract prices will approach their peaks.

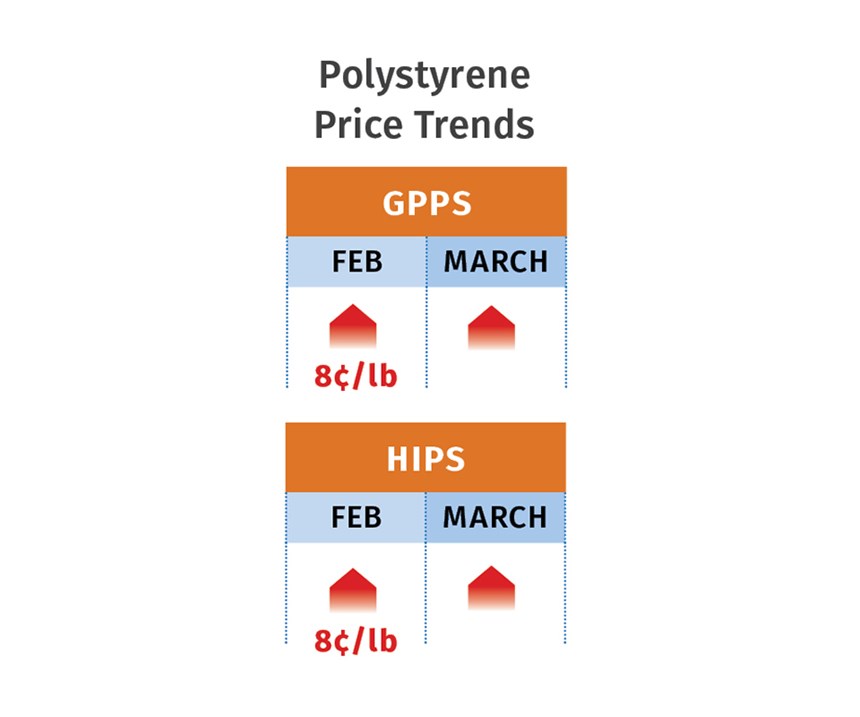

PS PRICES MAY BE TURNING AROUND

Polystyrene prices moved up 8¢/lb in February, following the 5¢/lb January hike, driven by continued price increases in benzene contracts and styrene monomer. Both PCW and Mark Kallman, RTi’s v.p. of client services for engineering resins, PS, and PVC, confirmed that PS suppliers issued March price increases of 6-12¢/lb.

Kallman noted that these new price hikes are not justified by feedstock costs. For one thing, March benzene contracts were offered at $3.26/gal. “Although it’s only 7¢/gal lower, it’s enough to say we may be turning the corner,” Kallman said. Similarly, while February styrene monomer spot prices jumped up by 20¢/lb, they were already trending downward in the first week of March. Monomer price increases were driven by globally tight supply due to both planned and unplanned outages.

Kallman ventured that PS suppliers’ push for the March increases would likely be hampered to some extent by lower benzene and styrene monomer prices. He added that demand for PS has been steady, though somewhat diminished due to the price hikes. Still, processors will need to buy as they enter the traditionally busy second quarter.

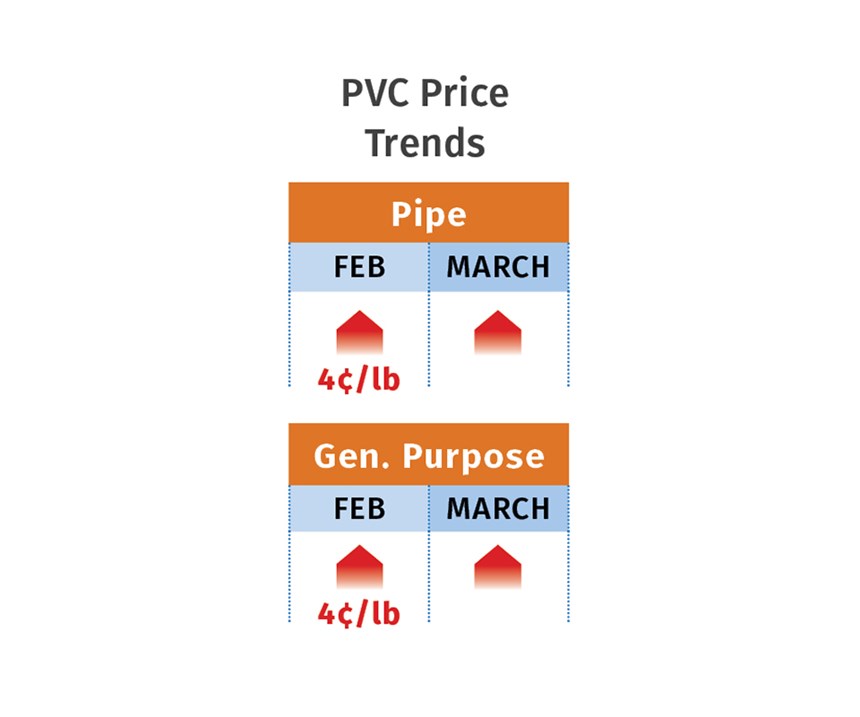

PVC PRICES COULD STABILIZE

PVC prices moved up the full 4¢/lb sought by suppliers in February. Moreover, suppliers came out with a 3¢/lb increase for March, and there was another “reinforcing” 3¢/lb increase for April from a couple of suppliers, according to RTi’s Kallman.

One driver for the already imple- mented increase was the February ethylene contract settlement, up 2.5¢/lb. However, spot ethylene prices began to significantly decrease in early March. Kallman ventured that PVC prices for March were likely to roll over due to the falling ethylene prices.

“Whether prices move up further will be largely dependent on supply-demand balance,” said Kallman. This includes both domestic demand as we approach the busier construction season, as well as exports due to PVC production outages in China.

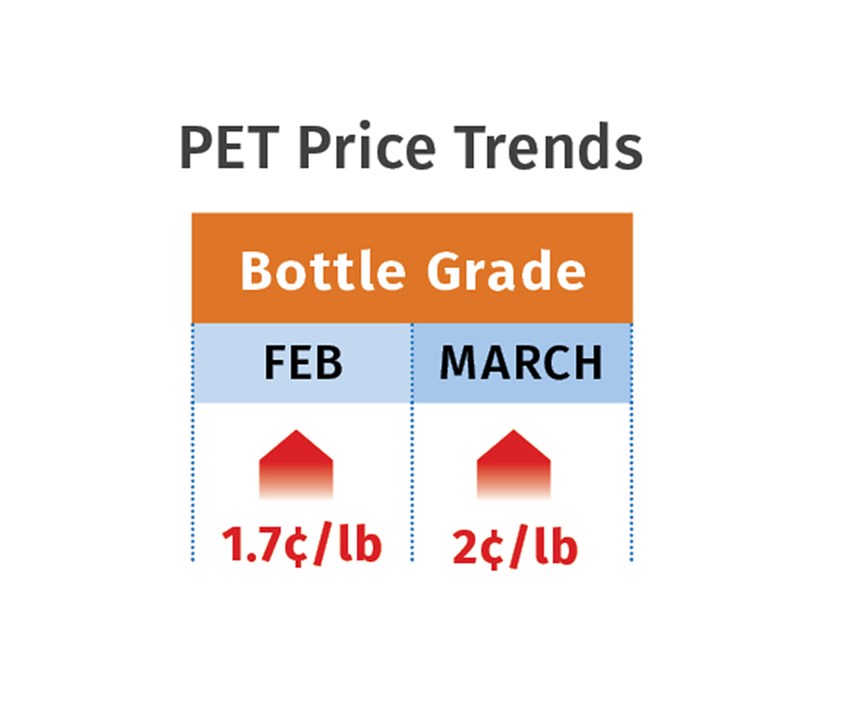

PET PRICES PUSHED BY FEEDSTOCKS

Domestic bottle-grade prime PET prices in February averaged 58.3¢/lb, up 2¢/lb from January, based on PCW’s Daily PET Report. That price represents PET on a delivered Chicago basis. On March 3, the price was 58¢/lb.

In February, imported prime PET averaged 53.3¢/lb, up 0.85¢ from January (on a delivered duty-paid U.S. port basis). The price on March 3 was 53.5¢/lb.

Prices rose primarily due to higher costs for feedstocks such as PTA, MEG, and PX, driven by higher hydrocarbon prices and strong demand for intermediates, according to Xavier Cronin, senior editor for this PCW report. The average cost of feed- stocks in February was 56.4¢/lb, 2-3¢/lb higher than January. Broken down, costs were: PX, 45.75¢/lb, PTA, 45.44¢/lb, and MEG, 49.76¢/lb.

ABS PRICES BREAK OUT

ABS prices, which generally held flat through the end of 2016, were expected to rise 10-17¢/lb by the end of first quarter, according to RTI’s Kallman. Most of the activity took place in February, when suppliers sought increases of 5-12¢/lb, with yet a new round of 5-12¢/lb hikes announced in March.

The March increases were likely to be softened to some degree by decreasing spot prices of feedstocks as well as lower ABS prices overseas, according to Kallman. He saw March as signaling the bottoming out of prices of acrylonitrile, butadiene, and styrene.

PC PRICES RISE—TEMPORARILY

PC prices, generally flat through the fourth quarter of 2016, were on the way up in this first quarter, with suppliers seeking increases of 9¢/lb in February and 16¢/lb in March, driven by feedstock price increases and tight supplies, according to RTI’s Kallman. He ventured that by the end of first quarter, PC prices would be 5-10¢/lb higher. Kallman expected PC prices would see a reversal in the third quarter after a decline in second-quarter feedstock prices.

NYLON 6, 66 PRICES UP

Nylon 6 prices moved up 4-8¢/lb in January and 10-12¢/lb in February, driven by price increases in benzene and caprolactam, according to RTi’s Kallman. He predicted that nylon 6 prices in the second quarter could start to fall once feedstock prices drop. First-quarter demand is characterized as pretty decent, driven by automotive and film markets.

Kallman expected nylon 66 prices to be higher by the end of

the first quarter, up 7¢/lb for compounds and 14¢/lb for virgin resins. Contributing factors were a globally tight market for all key feedstocks— benzene, propylene, butadiene—with higher prices resulting from planned and unplanned outages. Prices were expected to simmer down as feedstock prices decline. Demand is pretty strong,supported largely by automotive and increased demand for trucks and SUVs.

Related Content

Medical Manufacturer Innovates with Additive Manufacturing and Extrusion Technology Hubs

Spectrum Plastics Group offers customers two technology hubs — one for extrusion, the other for additive manufacturing — to help bring ground-breaking products to market faster.

Read MoreMedical Tubing: Use Simulation to Troubleshoot, Optimize Processing & Dies

Extrusion simulations can be useful in anticipating issues and running “what-if” scenarios to size extruders and design dies for extrusion projects. It should be used at early stages of any project to avoid trial and error and remaking tooling.

Read MoreMedical Molder, Moldmaker Embraces Continuous Improvement

True to the adjective in its name, Dynamic Group has been characterized by constant change, activity and progress over its nearly five decades as a medical molder and moldmaker.

Read MoreCustom Molder Pivots When States Squelch Thriving Single-Use Bottle Business

Currier Plastics had a major stake in small hotel amenity bottles until state legislators banned them. Here’s how Currier adapted to that challenge.

Read MoreRead Next

Beyond Prototypes: 8 Ways the Plastics Industry Is Using 3D Printing

Plastics processors are finding applications for 3D printing around the plant and across the supply chain. Here are 8 examples to look for at NPE2024.

Read MoreMaking the Circular Economy a Reality

Driven by brand owner demands and new worldwide legislation, the entire supply chain is working toward the shift to circularity, with some evidence the circular economy has already begun.

Read More