Processing Index Dips on Slowing Backlogs & New Orders

Processors reports slower expansion in new orders, production, and backlogs.

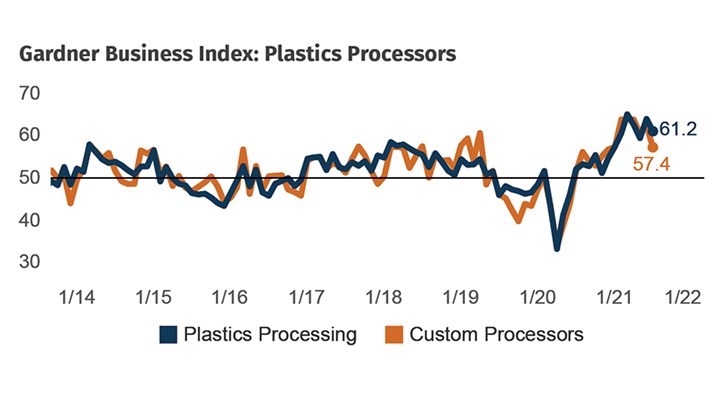

The Gardner Business Index (GBI) for plastics processing ended July at 61.2. The latest overall result is consistent with recent months and is only four points below the all-time high in March. The Index is based on survey responses of subscribers to Plastics Technology magazine.

The latest Index reading was influenced by rising export orders and supplier deliveries. The month also witnessed declining readings in new orders, production, backlogs and employment. These declining readings indicated slowing expansion as they remained above 50—signaling no change”—and should not be confused with a contraction in business activity.

FIG 1 While several measures of business activity reported lower month-to-month readings, only export activity contracted. Falling readings that remain about 50 indicate only a slowing pace of expansion.

FIG 1 While several measures of business activity reported lower month-to-month readings, only export activity contracted. Falling readings that remain about 50 indicate only a slowing pace of expansion.For custom processors, export activity contracted, and production activity was unchanged from June. While the July reading for new orders exceeded that of production, backlog activity slowed sharply with a nine-point decline. Despite their recent declines, the latest backlog and new orders readings remain comparable to those during the peak of the 2017-2018 expansion.

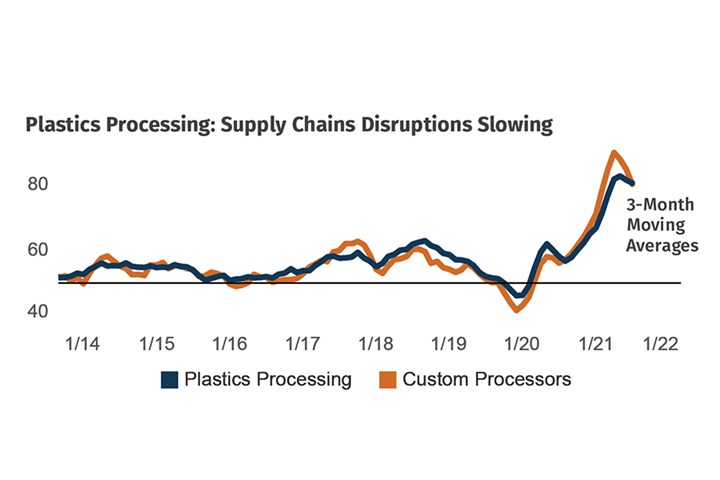

In more encouraging news, July marked the third consecutive month of slowing expansion in supplier deliveries, implying that order-to-fulfillment times are stabilizing for a growing proportion of surveyed custom processors after 18-months of near continuous disruption.

FIG 2 Slowing expansion in supplier deliveries reported by all processors may signal a peak in supply-chain difficulties after nearly 18 months of worsening disruption.

EDITOR’S NOTE: Finding reliable and relevant data to help guide your business is always important, but especially so during challenging economic times. For this reason, the GBI Plastics Processing and Custom Processing Indices serve as a great tool for making data-driven decisions. Thank you to everyone who has previously completed GBI surveys. Your participation helped increased response counts by 15% in 2020, making the GBI better than ever because of your involvement. Thank you for your time and efforts and for trusting us to provide you with the latest industry and business insights both in the past and in the future.

If you are a North American plastics processor and would like to participate in this research, click here to begin the process by subscribing free to Plastics Technology magazine.

ABOUT THE AUTHOR: Michael Guckes is chief economist and director of analytics for Gardner Intelligence, a division of Gardner Business Media, Cincinnati. He has performed economic analysis, modeling, and forecasting work for more than 20 years among a wide range of industries. He received his BA in political science and economics from Kenyon College and his MBA from Ohio State University. Contact: (513) 527-8800; mguckes@gardnerweb.com.

Related Content

-

Plastics Processing Contraction Continues

Contraction dominated the GBI index for overall plastics processing activity and almost all components, collectively suggesting a slowdown.

-

Plastics Processing Activity Contraction Continues in August

Four months of consecutive contraction overall.

-

Plastics Processing Continued Contraction in April

Despite some index components accelerating and others leveling off, April spelled contraction for overall plastics processing activity.

.jpg;width=70;height=70;mode=crop)