Processors End 2020 on a High Note

December’s Plastics Processing Index clocked in near 55, in line with the best readings since early 2019.

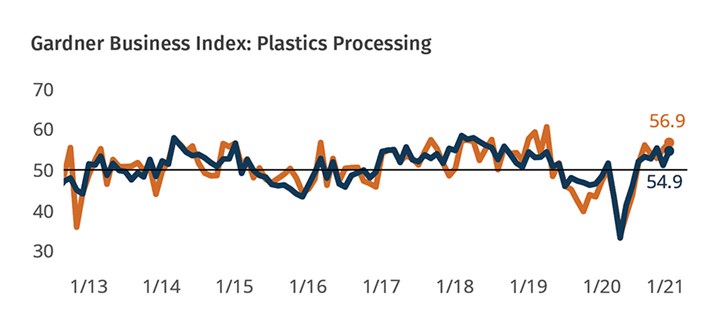

The Gardner Business Index (GBI) for Plastics Processing jumped more than three points in December to close at 54.9. Extending the Index’s expansionary path for a sixth consecutive month, December’s results saw new orders, employment and backlog activity all transition from contractionary to expansionary levels, with each crossing above the 50 mark. The monthly survey is conducted of subscribers of Plastics Technology magazine.

FIG 1 The Plastics Processing Index rose modestly during December as new orders, employment and backlog activity all reported expanding activity. Excluding the impact of congested supply chains on the Index would have resulted in a still encouraging 52.2 reading.

The index for custom processors, in particular, registered 56.9, a 20-month high. New orders and employment activity both expanded while production activity registered decelerating growth for a third month running.

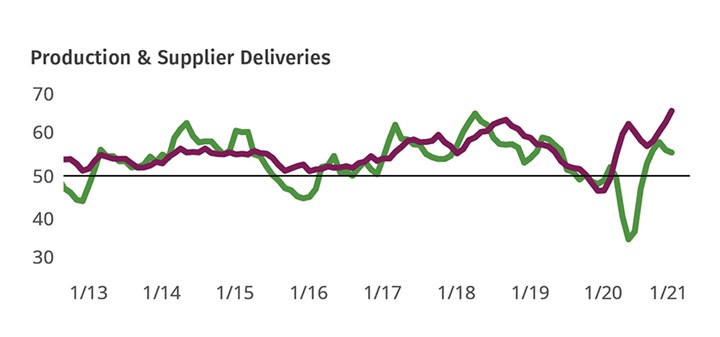

A large majority of survey participants across the entire plastics space reported lengthening order-to-fulfillment times, driving supplier deliveries to new heights and signaling that the worst of the industry’s supply-chain challenges may not yet be behind it. The present congestion of supply chains may explain why production activity appears to be struggling to keep pace with new orders and, hence, why backlog activity has neared a two-year high. Moving into 2021, it appears that plastics manufacturers’ top priority will remain strengthening their supply chains.

FIG 2 The supplier delivery reading set an all-time high in December after falling just shy of the record in November. Holiday packages and Coronavirus vaccine-distribution efforts competed for limited space on trucks and planes. This is likely the cause for recent months of restrained production growth and

swelling backlogs

Editor’s Note: The Plastics Processing Business Index is unique in its ability to measure business conditions specific to plastics processors on a monthly basis. The challenges facing manufacturers today require leaders to have good data in order to make effective forward-looking decisions. It is particularly important at this time for our readers to complete the survey sent to them each month. Your participation will enable the best and most accurate reporting of the true impact that COVID-19 is having on the plastics industry.

If you are a North American plastics processor and would like to participate in this research, click here to begin the process by subscribing free to Plastics Technology magazine.

About the Author: Michael Guckes is chief economist and director of analytics for Gardner Intelligence, a division of Gardner Business Media, Cincinnati. He has performed economic analysis, modeling, and forecasting work for more than 20 years among a wide range of industries. He received his BA in political science and economics from Kenyon College and his MBA from Ohio State University. Contact: (513) 527-8800; mguckes@gardnerweb.com.

Related Content

-

Plastics Processing Activity Contracted in July

Plastics processing GBI contracted for the third month in a row.

-

Processing Activity Dips in May

Plastics processing took a downturn in May, the first appreciable dip since November 2023.

-

Plastics Index Shows Fourth Consecutive Monthly Gain

December reading hints at slowing contraction as plastics industry outlook improves

.jpg;width=70;height=70;mode=crop)