Processors Taking Pragmatic Approach to Industry 4.0

Recent survey reveals that processors evaluate any new technology—including Industry 4.0—by its contribution to improving operations and shop-floor productivity.

The Industry 4.0 agenda for plastics processors is a pragmatic one that encompasses closing performance gaps in shop-floor productivity, making operational improvements, upgrading existing machinery, and acquiring new machinery when needed. These companies are most focused on how “smart,” connected operations across their shop floors can improve product quality, reduce costs and deliver customer orders on time. To them, Industry 4.0 is another term for planning for the future in the most practical way possible with proven technologies they trust.

These insights on Industry 4.0 come from a February 2019 survey of 150 North American manufacturers—the majority of which are in the plastics industry—conducted by Decision Analyst in collaboration with IQMS, a division of Dassault Systèmes. The survey’s results provide a timely glimpse into plastics processors’ top investment strategies, greatest barriers to growth, the areas of most and least technology investment, and where Industry 4.0 fits into these companies’ plans today.

While all plastics processors interviewed are well aware of the most-hyped Industry 4.0 technologies—including Industrial Internet of Things (IIoT), among others—the results show they evaluate any new technology by its contribution to improving operations and shop-floor productivity. Among all manufacturing companies surveyed, those in plastics processing are by far the most practical when it comes to evaluating, piloting and putting new technologies into production.

Growth Guides Industry 4.0 Investments

For many manufacturers, 2018 was a year of record revenue and profit gains, with plastics manufacturers leading the way. Among those plastics processors growing 10% a year or more, several trends have emerged:

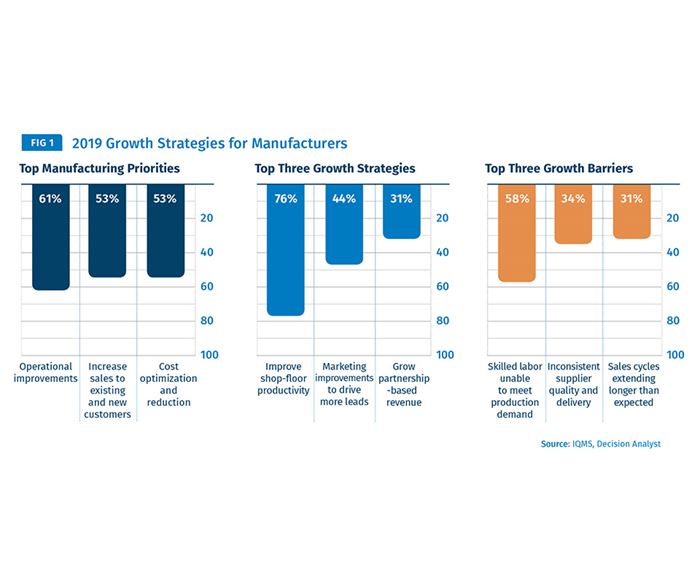

• They are investing in machinery upgrades, next-generation machines, real-time monitoring, and manufacturing execution systems (MES) to achieve greater speed, scale, and visibility and to stay competitive by continuously improving shop-floor productivity (see Fig. 1).

• They excel at orchestrating their enterprise resource planning (ERP), MES, and quality-management system (QMS) solutions to achieve continuous improvement and production goals.

• They have one or more production shifts running autonomously today and share a goal of achieving lights-out manufacturing.

• They prioritize shop-floor productivity above any other growth strategy by a wide margin.

• They have developed a unique series of process and production skills that enable them to translate their machinery and plant investments into greater production-run flexibility and quality.

• They are translating machinery upgrades and new machine purchases into bringing new products to market faster than their competitors.

• They capitalize on their technology and operational strengths to capture more revenue from existing customers while winning new ones.

Improve Shop-Floor Productivity:

This is the top goal a majority of plastics processors are working to achieve in 2019, and they’re relying on a broad base of Industry 4.0 technologies and techniques to get there. Among all manufacturers surveyed (Fig. 2), 76% prioritize improving shop-floor productivity as their most valuable growth strategy, ranking it 1.4 times more important than marketing improvements to drive more leads (44%) or growing partnership-based revenue (31%). These companies have identified three reasons for focusing on improvements in operations and shop-floor productivity: They want to offer short-notice production runs to their customers, improve product quality, and meet on-time delivery dates consistently.

Modernize Machinery:

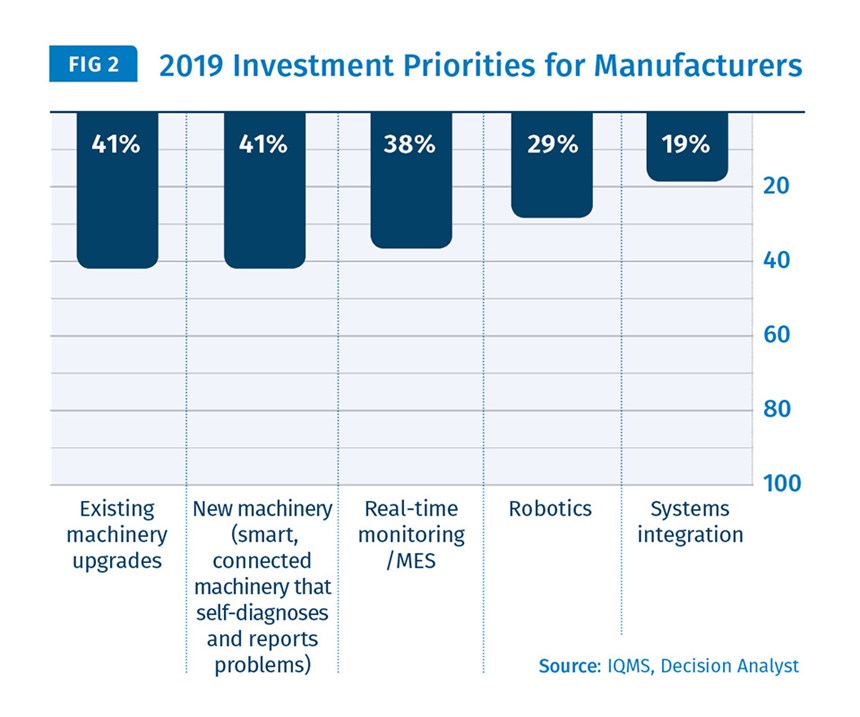

Plastics processors’ greatest investment priorities for 2019 are upgrading existing machinery and acquiring new smart, connected machines to drive greater shop-floor productivity. Overall, 73% of survey respondents have fully depreciated their equipment, and a majority of companies plan to reinvest their 2018 profits into modernizing their machinery. Among all manufacturers, 41% are updating their existing machines while an additional 41% are investing in new smart, connected machinery that self-diagnoses and reports problems.

At the same time, 29% of all manufacturers are investing in robotics to alleviate the skilled labor shortages that leave them unable to meet production demand. Notably, 42% of the fastest growing manufacturing firms are actively piloting and introducing robotics to meet existing production forecasts and take on new customers.

Improve Product & Service Quality:

Investing in improvements to product and service quality fuels growth, keeps customers for life, and leads all technology spending in 2019. All manufacturers surveyed are most focused on how they can excel as suppliers in 2019.

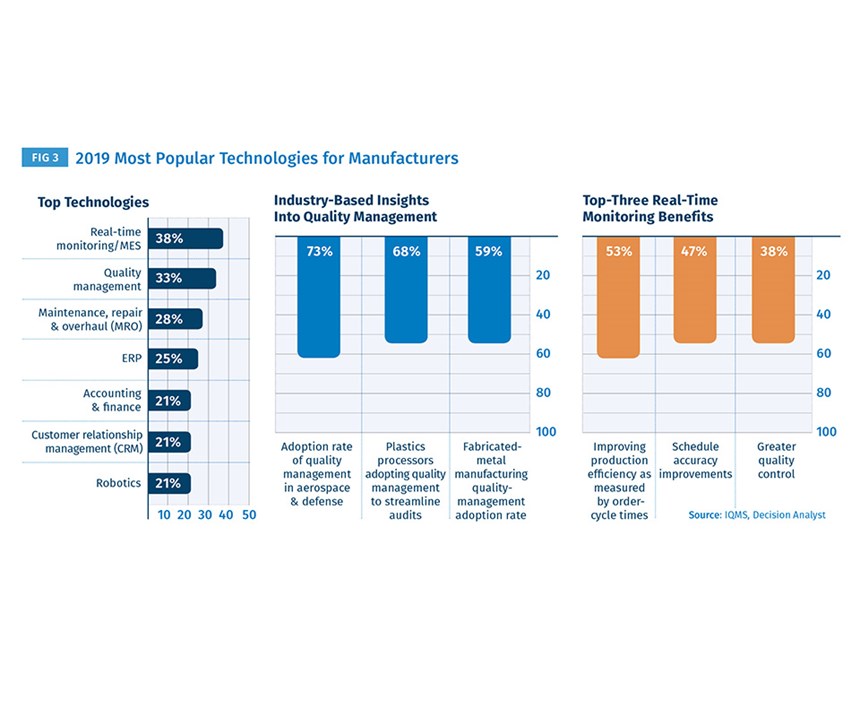

In particular, plastics processors are aiming to achieve lights-out manufacturing for the cost and time-to-market advantages it can provide to their customers. This is a key factor driving their adoption of real-time monitoring and MES systems as they seek to build the data, insight and knowledge foundation needed to transition to one or more lights-out manufacturing shifts.

For the fastest-growing plastics processors, product quality is how they evaluate their own success in getting value from Industry 4.0. These top-performing companies rely on quality management and real-time monitoring to reduce scrap rates, increase yield rates by machine, and improve on-time delivery performance. More broadly, 68% of all plastics processors are adopting quality management to streamline audits. Figure 3 compares the most popular technologies manufacturers are investing in this year.

Mitigate Top Growth Barriers:

Plastics processors are investing in overcoming the two top barriers to growth. Among these plastics processors, 68% percent report that that they do not have enough skilled labor to meet production demand, constraining their ability to meet their full growth potential. As noted earlier, some companies are augmenting staff with robotics. Others are implementing initiatives to attract skilled workers, which will be discussed in the next section.

The second growth barrier is the inconsistency of supplier quality and delivery performance, a challenge reported by 34% of manufacturers. The fastest-growing manufacturers are investing more than their peers in QMS software to improve inconsistent supplier quality.

Additionally, 31% of manufacturers are seeing sales cycles take longer than expected, which is driving the demand to put more information in the hands of sales and support teams via ERP, MES and QMS software.

Find and Attract Skilled Workers:

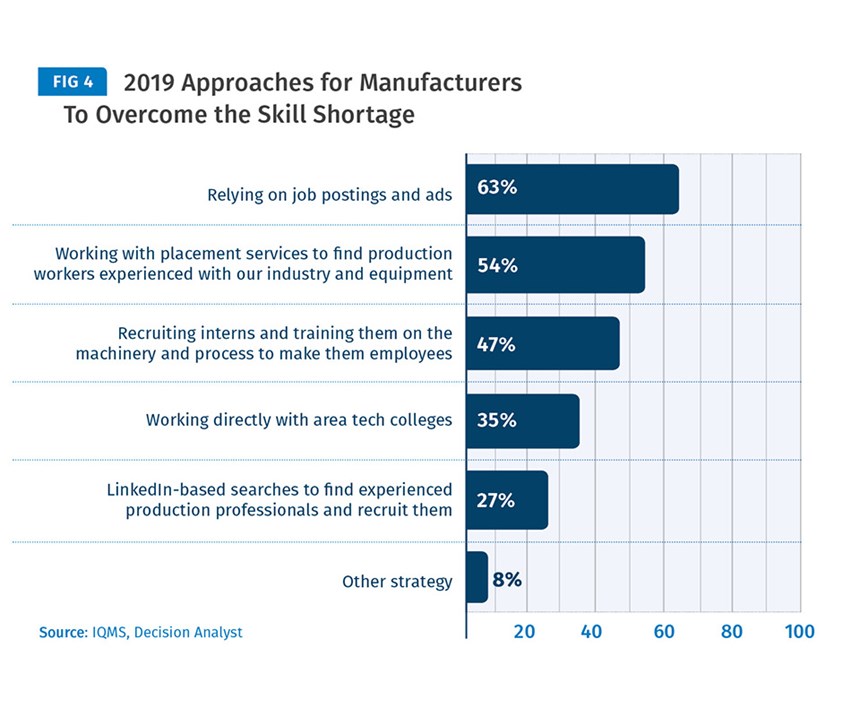

Plastics processors are among the manufacturers taking the greatest number of multifaceted approaches to finding skilled workers. Quickly moving beyond job postings and ads, these companies are working with placement services as well as recruiting interns (Fig. 4). Many manufacturers also find that paying incentives for job applicants is a successful approach to finding skilled workers. Among the least effective tactics is using LinkedIn for finding production associates.

The CEO of a plastics processor remarked that a multi-faceted strategy is the only way to keep the pipeline of new employees full enough to meet production schedules. His company offers a series of incentives ranging from $2500 to $5000 to employees who recommend a new hire that passes a drug screen and reaches their 90-day review.

In short, the most successful and fastest-growing plastics processors in 2019 will be able to take on short-notice production runs, fulfill customer and regulatory audits, and improve shop-floor productivity, with revenue being the guiding goal. Their growth this year and in the future will be most attributable to a pragmatic focus on getting results from their Industry 4.0 strategies.

Those plastics manufacturers who excel at balancing Industry 4.0 investments are also taking an early lead in capturing greater upsells and cross-sells from their existing customer base. Manufacturers’ funding priorities point to a concerted strategy of making every aspect of a shop floor—from the machinery to supplier quality levels to delivery accuracy—all contribute to customer satisfaction and loyalty.

ABOUT THE AUTHOR Louis Columbus is a principal at IQMS, part of the Dassault Systèmes portfolio. Professional experience includes marketing, product management, sales and industry analyst roles in the enterprise software and IT industries. Contact: louis.columbus@3ds.com; iqms.com

Related Content

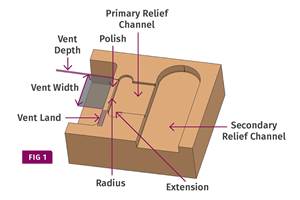

Back to Basics on Mold Venting (Part 2: Shape, Dimensions, Details)

Here’s how to get the most out of your stationary mold vents.

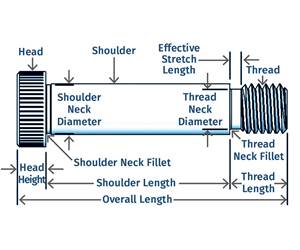

Read MoreWhy Shoulder Bolts Are Too Important to Ignore (Part 1)

These humble but essential fasteners used in injection molds are known by various names and used for a number of purposes.

Read MoreInjection Molding: Focus on these Seven Areas to Set a Preventive Maintenance Schedule

Performing fundamental maintenance inspections frequently assures press longevity and process stability. Here’s a checklist to help you stay on top of seven key systems.

Read MoreWhere and How to Vent Injection Molds: Part 3

Questioning several “rules of thumb” about venting injection molds.

Read MoreRead Next

People 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read MoreFor PLASTICS' CEO Seaholm, NPE to Shine Light on Sustainability Successes

With advocacy, communication and sustainability as three main pillars, Seaholm leads a trade association to NPE that ‘is more active today than we have ever been.’

Read MoreMaking the Circular Economy a Reality

Driven by brand owner demands and new worldwide legislation, the entire supply chain is working toward the shift to circularity, with some evidence the circular economy has already begun.

Read More