Resin Prices Are on the Way Up

Higher prices are projected for PE, PP, PS, and PVC in this first quarter, driven by tighter availability and/or higher costs of feedstocks.

Higher prices are projected for PE, PP, PS, and PVC in this first quarter, driven by tighter availability and/or higher costs of feedstocks. Ditto for commodity engineering resins—ABS, nylons 6 and 66, and PC. That’s the consensus outlook of purchasing consultants at Resin Technology, Inc. (RTi), Fort Worth, Texas, CEO Michael Greenberg of The Plastics Exchange in Chicago, and consultants at IHS Chemical, Englewood, Colo.

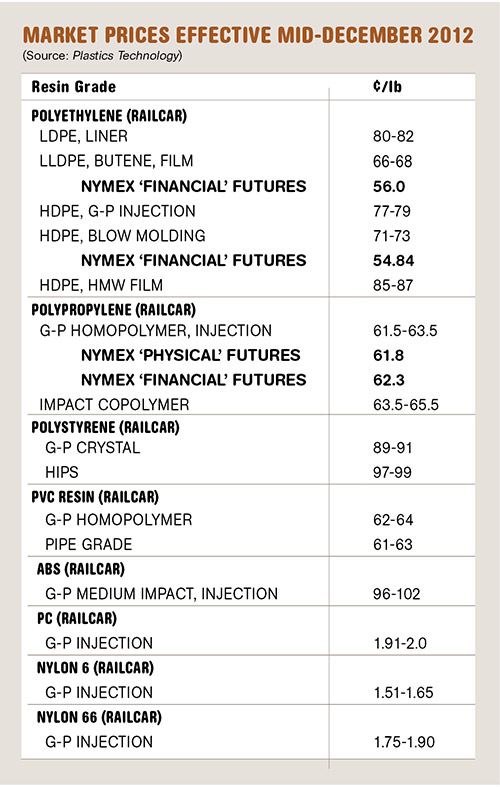

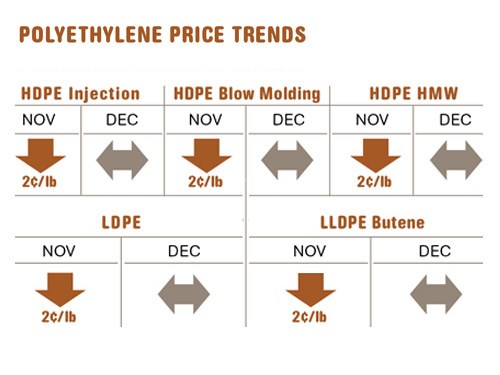

PE PRICES DOWN, BUT NOT FOR LONG

Polyethylene contract prices dropped by 2¢/lb in November, following discounted spot prices due to a decline in both demand and monomer costs. Suppliers failed for the third time to push through their October 5¢/lb increase, but a “new” 5¢/lb hike was posted for Jan. 1.

Throughout 2012, PE prices fell a total of 5¢/lb. The scenario changed somewhat in December, as spot ethylene monomer prices rose following several unplanned cracker outages. Ethylene for December delivery traded at up to 53¢/lb, a gain of about 2¢, according to Greenberg. “January was priced at a slight premium and from there prices began to slide, eventually reaching a discount of 4¢/lb,” he said. According to Mike Burns, RTi’s v.p. for PE, the cost to produce ethylene is the lowest it has been in at least five to six years.

Both Greenberg and Burns reported that there were lots of orders for prime and off-spec PE in November and early December. Says Burns, “I believe PE prices have now bottomed out. This big inventory pull will make for even tighter inventories, which will serve to support firmer prices.” He ventured that PE prices could remain flat through December and January, but he does not see any further price decline, based on inventory levels. Both sources see higher prices coming this quarter.

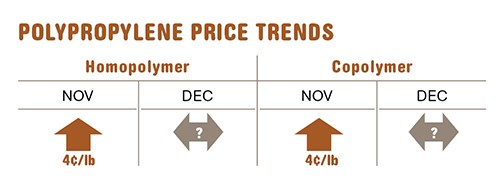

PP PRICES UP

Polypropylene contract prices moved up 4¢/lb in November, in step with monomer. By mid-December, PP prices appeared to be flat, although monomer contracts had yet to be settled, but spot propylene monomer prices were rising. “Best-case scenario for processors is that propylene contracts will settle flat at November levels,” noted Scott Newell, director of client services for PP at RTi. Both he and Greenberg saw potential for a tightening of monomer supplies due to planned cracker shutdowns in the first and second quarters, which could put upward pressure on resin prices. At the same time, industry projections suggest that overall demand may remain flat through this quarter.

According to Newell, a big push for wider profit margins by PP suppliers has proved successful, to the tune of 1¢/lb on average. Some buyers got the increase in December, and many others will feel it this month, depending on contract terms. Some suppliers aim to decouple PP pricing from monomer price fluctuations in order to improve margins. Other suppliers may have given up on that approach and have instead taken the position that while monomer-based pricing can continue, PP resin will be priced higher depending on other factors.

Operating rates for PP in 2012 averaged between 88% and 89%. Overall PP demand for 2012 was expected to be up between 1% and 1.5%, with export demand down by 20% and domestic demand up about 2.5%.

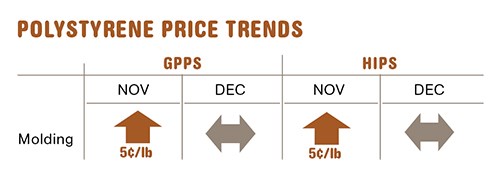

PS PRICES FLAT FOR NOW

Polystyrene prices were flat last month after moving up an average of 5¢/lb in November. December benzene contracts settled flat, and November ethylene contract prices dropped 2¢/lb, according to Mark Kallman, RTi’s director of client services for engineering resins, PS, and PVC.

Nevertheless, domestic PS prices have been at all-time-high, and some industry sources expect them to remain there. That may attract more imports with competitive pricing.

In a recent IHS Chemical industry webinar, consultants noted that benzene prices hasve risen steadily in the last four years, reaching an all-time-high of $4.93/gal in December, and they expect this will continue. RTi’s Kallman concurs but does not see benzene prices rising much in this quarter. The consultants also noted that benzene imports to North America now account for 20% of supply and will only grow, as domestic supply remains constrained. That, in turn, will put pressure on PS prices. They also projected that the volatility in ethylene prices of the last few years will abate due to new ethane capacity.

Domestic demand for PS has been dropping since 2010, attributed to declining demand in packaging due to bans on PS packaging here and abroad. Experts at IHS say global PS operating rates are down to around 70% as a result. They expect Chinese demand for PS in electronics and appliances to drive the cost of PS from now on.

RTI’s Kallman and IHS consultants estimate a 2% drop in domestic demand in 2012. They project a slow first half for 2013, with possible growth in the latter half of 0.5-1.0%.

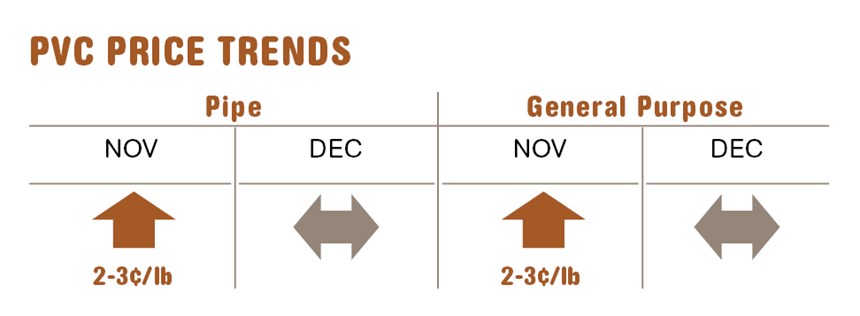

PVC PRICES ARE UP

PVC prices rose 2-3¢/lb by the end of November and were flat last month. However, Georgia Gulf initiated a 3¢ hike for Jan. 1, and the other two major suppliers were expected to follow suit. In addition to a couple of unplanned ethylene cracker shutdowns in December, there are planned maintenance turnarounds in the first quarter that could tighten ethylene supply enough to help support suppliers’ aim to increase prices, says Kallman from RTI.

Both Kallman and IHS consultants note that after the dramatic downturn in PVC demand since 2004, there was improvement between 2011 and 2012. This was particularly true in June to November of 2012, which saw an 8.4% increase in domestic demand. Demand growth for 2012 was expected to round out to around 5%. These sources project demand growth of about 3% in 2013. Higher prices are expected at least for the first quarter. IHS experts’ longer-range forecast is for domestic PVC prices be higher over the next 4-5 years and lower in Europe.

ABS PRICES DOWN BUT TURNING AROUND

ABS prices dropped another 2-4¢/lb by the end of November and flattened out in December. The total drop in prices from April to the end of 2012 was around 22-24¢/lb, estimates RTI’s Kallman.

However, suppliers have issued price hikes of 4-5¢/lb for Jan. 1, spurred by rising feedstock costs—primarily benzene but also acrylonitrile, ammonia, and propylene. Kallman ventures that suppliers will push hard to implement at least part of their increases, but he warns that they need to be watchful of very competitive ABS imports from the Far East.

Domestic ABS demand was lackluster last year and remains weak globally, so 2012 consumption was expected to be lower than 2011’s. Along with higher feedstock costs, this has resulted in very thin margins for ABS suppliers.

NYLON PRICES FLAT TO HIGHER

Nylon 6 and 66 prices in the fourth quarter were relatively flat, due to higher benzene prices, after price erosion in the third quarter of 5-10%. Nylon 6 suppliers came out with contract-price nominations 7-10¢ higher in November/December, and some degree of implementation was likely this month. Higher benzene prices are the key factor cited. Since benzene is of lesser content in nylon 66, no price hikes have surfaced thus far.

Domestic demand for nylon 66 and nylon 6 has been very good, due primarily to the automotive market and in part to housing and carpeting. A similar scenario is expected for 2013, depending on the strength of these sectors. However, exports have fallen due to slowed global economic conditions, so supplies of material are quite ample, which may remain the case this year. Expect flat-to-upwards pricing in first quarter, says RTI’s Kallman.

PC PRICES UP?

Polycarbonate prices remained relatively flat through the fourth quarter owing to high benzene prices and relatively good domestic demand. Following a failed price-hike attempt early in the fourth quarter, suppliers have issued new price increases in the 11-12¢/lb range, effective Jan. 1. The move is attributed to higher feedstock costs, primarily benzene.

Domestic demand remained good last year, primarily in automotive and to a lesser degree in construction. PC exports were also pretty healthy, according to Kallman. He estimated total demand growth of 6-7%% in 2012, but expected to see a decline this year due to competition from new global capacity that will result in lower U.S. exports. Prices could move up in the first quarter if demand in automotive holds up and construction also improves, says Kallman.

Related Content

The Fundamentals of Polyethylene – Part 2: Density and Molecular Weight

PE properties can be adjusted either by changing the molecular weight or by altering the density. While this increases the possible combinations of properties, it also requires that the specification for the material be precise.

Read MorePrices of All Five Commodity Plastics On the Way Up

Despite earlier anticipated rollover in prices for most of the volume commodity resins, prices were generally on the way up for all going into the third month of first quarter.

Read MoreImproving Twin-Screw Compounding of Reinforced Polyolefins

Compounders face a number of processing challenges when incorporating a high loading of low-bulk-density mineral filler into polyolefins. Here are some possible solutions.

Read MorePrices for All Volume Resins Head Down at End of 2023

Flat-to-downward trajectory for at least this month.

Read MoreRead Next

For PLASTICS' CEO Seaholm, NPE to Shine Light on Sustainability Successes

With advocacy, communication and sustainability as three main pillars, Seaholm leads a trade association to NPE that ‘is more active today than we have ever been.’

Read MorePeople 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read MoreLead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read More