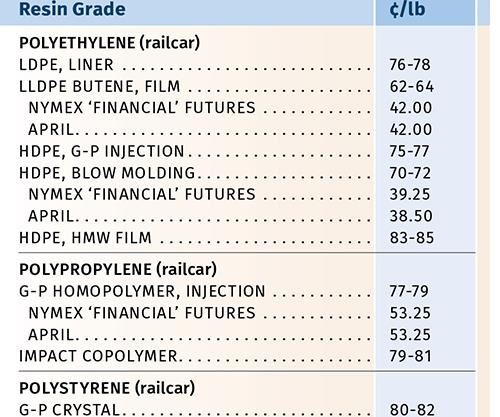

Resin Prices Drop Again—Except for PP

First quarter saw further price erosion, even for high-volume engineering resins, but PP was the exception.

Prices of nearly all large-volume commodity resins dropped through much of the first quarter, driven by lower energy and feedstock costs and generally limp demand. But polypropylene prices actually went up, though a flat pricing trend is expected for the second quarter. As for the rest of the major-volume resins, prices are generally expected to be flat or slightly higher. Expected firming of feedstock prices and anticipated increases in demand are contributing factors.

Those are the overall views of purchasing consultants from Resin Technology, Inc. (RTi), Fort Worth, Texas, CEO Michael Greenberg of The Plastics Exchange in Chicago, and Houston-based PetroChemWire.

PE PRICES BOTTOM OUT

Polyethylene prices in February dropped 2¢/lb (though one supplier went down 3¢), following a 3¢ decrease in January. After a seven-month downtrend, which saw PE contract prices drop a total of 15¢/lb, the market “seems to be consolidating and could be heading into a period of transition,” according to The Plastics Exchange’s Greenberg.

Meanwhile, PE suppliers issued a 5¢/lb increase for Mar. 1. Greenberg saw this as their attempt to stop the slide and eventually prop up prices, adding that such a reversal in price trajectory is likely to take a couple of months. Mike Burns, RTi’s v.p. of client services for PE, concedes that PE prices may have bottomed out. He notes that several ethylene cracker turnarounds over the next five or six months will limit availability globally. Also, prices in Asia have gone up 2-3¢/lb, and more could be in the offing as the region expects improved demand along with ethylene availability constraints.

The price reversal appears to have already started in the domestic spot market, and PE suppliers raised export prices 2-3¢/lb in concert with the Asian price hikes. PetroChemWire confirmed these trends and that February domestic sales appeared healthier than in January, with customers holding low inventory and hedging against the possibility of March increases.

RTi’s Burns pointed out that crude-oil prices will continue to be the lead driver for PE pricing, and ventured that with $30/bbl oil prices and the new PE price reductions, the PE market would stabilize between March and May. “Oil prices need to be near $40/bbl for a 5¢/lb PE price increase to have potential,” Burns noted. He suggests that processors of prime material would do best to consider end-of-month resin shipments (to avoid first-of-the-month price increases), and off-grade buyers ought to consider buying earlier in the month, as spot-resin availability typically lessens as the month progresses.

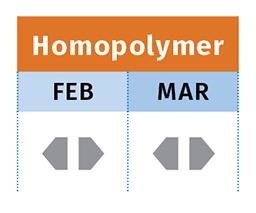

PP PRICE FLAT

Polypropylene prices appeared to have generally rolled over in February, after increasing 2.5¢/lb in January—nearly half of the split 6¢/lb increase sought by PP suppliers. February propylene monomer contract prices dropped by 1.5¢ to 30¢/lb. PP suppliers held onto that cost reduction to increase their margins, explains Scott Newell, RTi’s v.p. of PP markets.

Greenberg from The Plastics Exchange notes that the price variation across accounts has continued into this year, but he believes that several processors paid another 2¢/lb in February, and the rest are likely to follow suit. He reported in late February that prices of offgrade material, which had been discounted, were firming up by at least a penny.

RTi’s Newell expects to see relatively flat pricing for PP over the next few months. “There may be a bit of upward or downward movement, but nothing on the order of 5-10¢/lb.” He also believes that PP suppliers will find it difficult to implement any further margin expansion and may even “give back some of it.” Key drivers include imports of lower-priced PP resin and finished goods, since U.S. PP prices have been well above those of the rest of the world. He believes that domestic processors are taking a serious look at buying some imports as a way of pushing back against higher domestic prices.

PetroChemWire reported that by the end of February, the PP market was less tight than in the fourth quarter of 2015, attributing this to both increased resin imports and weaker consumption in most market sectors. “Automotive compounding continued to have robust demand, although there have been concerns raised over slowing auto sales. There were isolated reports of aggressive spot discounting as PP suppliers sought to shed inventory at the end of February.”

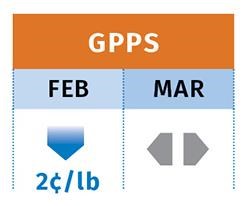

PS PRICES DROP

Polystyrene prices dropped 2¢/lb for GPPS and 3¢ for HIPS in February after four months of flat pricing. Key drivers, according to Mark Kallman, RTi’s v.p. of client services for engineering resins, PS, and PVC, included February benzene contract prices dropping 27¢ to $1.85/gal, and continued price declines for butadiene. Although March benzene contracts appeared to have settled another 8¢/gal lower, at $1.77/gal, spot prices were moving up.

Styrene monomer spot prices were also rising due to strong export demand, prompted by monomer outages overseas. Kallman predicted that March PS prices would be flat to slightly lower—by 0.5¢/lb. However, with some of these drivers reversing themselves, coupled with the beginning of the strongest seasonal demand for PS in the second quarter, April PS prices could see upward movement of 1-3¢/lb. PetroChemWire reported that there was talk in the prime market that PS prices could begin to rise in the second quarter. PS prime market prices last increased in April 2015.

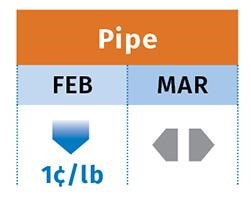

PVC PRICES FLAT TO UP

PVC prices dropped on average 1¢/lb between December and February. PVC suppliers had announced February and March increases of 2-3¢/lb each; by the end of February these had become a 5¢ hike for Mar. 1. RTi’s Kallman saw potential for modest increases of 1-2¢/lb in February and March.

This modest upward potential is attributed by Kallman to February contract ethylene prices moving up 1¢/lb and expectations of March contracts settling a bit higher as well, owing to cracker turnarounds. Kallman also cited higher PVC export prices, as a result of overseas prices moving up. Overall, prices are likely to firm up through second quarter unless demand from the construction market is lower than anticipated.

ABS PRICES DROP

ABS prices dropped 2-4% through much of the first quarter, following a price decline of 5-10% in fourth-quarter 2015. Key drivers were significant declines in benzene and butadiene prices caused by oversupply for the latter in Asia, according to Kallman from RTi. Cheaper ABS Asian imports also contributed.

However, market prices are expected to flatten out this month, as benzene prices may be moving up and Asian ABS import prices are higher. Kallman ventures that ABS suppliers will move to increase prices in the May-June period. He notes that the resin oversupply in Asia will keep the domestic market amply supplied, while demand is expected to be steady, coming from both automotive and appliances.

PC PRICES LOWER

Polycarbonate prices saw a 2-4% decline through the first quarter, driven by lower benzene prices combined with ample domestic resin supply and lower-priced imports.

RTi’s Kallman sees good potential for a reversal of these trends by the end of the second quarter, as PC suppliers will look to increase prices based on expected higher benzene tabs and potential for increased demand from the construction sector, in addition to continued good demand from automotive.

NYLON PRICES DOWN

Nylon 6 prices dropped 2-4% through the first quarter, following a 4-7% decline in the early fourth quarter, owing to the resin’s correlation to benzene and its price swings, as well as domestic oversupply of caprolactam, according to RTi’s Kallman. As pricing for benzene is expected to move higher, some upward pressure on nylon 6 was expected, with suppliers likely to issue a price increase within the month. “April will be the transition month for nylons and other engineering resins,” said Kallman, noting that how demand shapes up will be a key factor.

Nylon 66 prices, which had dropped 5% in the fourth quarter, continued to erode by 1-3%, and possibly more, through much of the first quarter. Said Kallman, “Suppliers enjoyed lower benzene and butadiene prices, passing the lower base-resin prices on to compounders.” He added that processors are seeking lower prices in nylon 66 compounds, too. He expected nylon 66 resin prices would flatten or increase modestly in the second quarter, driven by good demand in automotive and construction sectors. He characterized the domestic market as amply supplied, while there was oversupply in both Asia and Europe.

Related Content

Polyethylene Fundamentals – Part 4: Failed HDPE Case Study

Injection molders of small fuel tanks learned the hard way that a very small difference in density — 0.6% — could make a large difference in PE stress-crack resistance.

Read MoreThe Fundamentals of Polyethylene – Part 1: The Basics

You would think we’d know all there is to know about a material that was commercialized 80 years ago. Not so for polyethylene. Let’s start by brushing up on the basics.

Read MoreFirst Quarter Looks Mostly Flat for Resin Prices

Temporary upward blips don't indicate any sustained movement in the near term.

Read MoreCommodity Resin Prices Flat to Lower

Major price correction looms for PP, and lower prices are projected for PE, PS, PVC and PET.

Read MoreRead Next

Beyond Prototypes: 8 Ways the Plastics Industry Is Using 3D Printing

Plastics processors are finding applications for 3D printing around the plant and across the supply chain. Here are 8 examples to look for at NPE2024.

Read MoreSee Recyclers Close the Loop on Trade Show Production Scrap at NPE2024

A collaboration between show organizer PLASTICS, recycler CPR and size reduction experts WEIMA and Conair recovered and recycled all production scrap at NPE2024.

Read MorePeople 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read More