Resin Prices Go Up, Down and Sideways

Tight resin inventories and upward pressure from feedstocks were two factors pushing prices of PE, PP, and PVC higher last month.

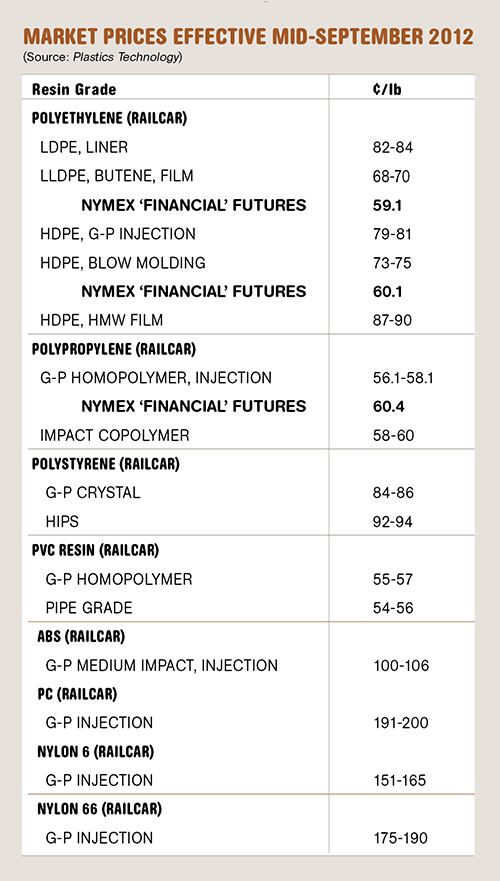

Tight resin inventories and upward pressure from feedstocks were two factors pushing prices of PE, PP, and PVC higher last month. At the same time, soft to slack domestic demand, declining exports, ample supplies (in most cases), and lower feedstock prices contributed to lower prices of PS and popular engineering resins such as ABS, nylon, and PC. That’s the overall picture, according to Michael Greenberg, CEO of The Plastics Exchange in Chicago and purchasing consultants at Resin Technology, Inc. (RTi), Fort Worth, Texas.

PE PRICES UP FOR NOW

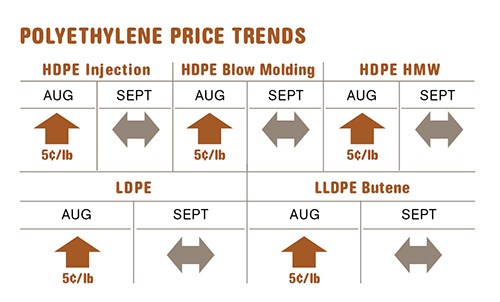

Polyethylene contract prices moved up a total of 5¢/lb in August and early September. Increases of 5-6¢/lb were also announced for Sept. 1. PE prices gave back a penny gained during the first week of September; Greenberg saw this as an indication that contract prices would remain steady last month, though he expected suppliers to try again for an increase in October.

Implementation of the August price increase was based primarily on low PE inventories in June and July, as processors who had drawn their inventories down to nothing restocked heavily. That was coupled with a rebound in exports, according to Mike Burns, v.p. of PE at RTi. Ethylene supply disruptions that resulted from Hurricane Isaac were a mere bump in the road for the PE market. “Ethylene is tighter now as a result of those disruptions, but as the crackers continue to run more normally, ethylene price pressure is expected to ease up,” said Burns. Spot ethylene prices in the second week of September were at 60¢/lb. August contract prices moved up 4¢ to 46¢/lb. The normal 10-12¢/lb premium of contract prices over spot tabs has been reversed, and the spread is now 15-16¢/lb.

Greenberg noted that spot PE is still hard to get and “well-priced domestic offers move fairly quickly,” but exports had slowed due to limited PE availability and higher prices. RTi’s Burns foresaw flat domestic PE demand and relatively stable prices through this month, due to the big restocking that took place. Processors are now expected to buy as needed.

PP PRICES FLAT OR HIGHER

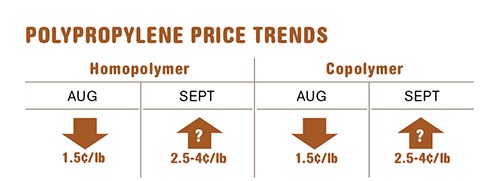

Polypropylene contract prices dropped by 1.5¢/lb in August, but were likely to move higher in September, following propylene monomer prices penny for penny. Increases of 2.5¢ to 4¢/lb in monomer contract prices were on the table for September. Some PP suppliers were already aiming for an additional 1-2¢/lb.

Scott Newell, director of client services for PP at RTi, expected last month’s PP prices to remain flat or rise at the low end of the monomer price nominations. He noted that monomer is relatively well balanced, though planned cracker outages in September and October could tighten up supply a bit. Greenberg ventured that monomer and PP prices could move up as much as 4¢/lb. “Upstream resin inventories remain tight and material in the reseller market has dwindled. Well-priced off-grade cars are selling fairly quickly, and the market is still starved for generic prime,” Greenberg observed.

He also noted that higher prices were inhibiting exports. Newell agreed that exports are currently soft, but he believes PP prices have come down enough that there is potential for exports to rebound. On the other hand, PP supply is tight. Suppliers’ inventories are down to 30-31 days vs. 40-41 days back in May.

PP domestic demand in June and July was about 10.5% above the January-May average, as prices dropped and processors stocked up significantly. Newell projected demand to fall below average in September and October. “Real demand overall is unimpressive —somewhat steady, but most companies say they are under forecast.” Newell sees 2012 ending up similar to 2011, with a very small increase in demand, if any.

PS PRICES HEADING DOWN

By the end of last month, polystyrene prices were slumping by 4¢/lb for GPPS and 5¢/lb for HIPS—pretty much the same amount they had risen in August. Both moves were driven by feedstock prices. “Although supplies of both styrene monomer and PS are tighter, real demand remains weak, so the market should be back in balance,” said Stacy Shelly, RTi’s director of business development for engineering resins, PS, and ABS.

On Sept. 1, Styrolution lifted the force majeure on its North American styrenic business that resulted from a fire at its Sarnia, Ont., plant, although PS allocations remained in effect until the end of the month. Plants of Total and Americas Styrenics that had been slightly affected by Hurricane Isaac were back on stream. Ditto for styrene monomer supply along the Mississippi. Monomer spot prices were flat. September benzene contract prices dropped 9% or 40¢/gal to $4.20/gal, offsetting the 4¢/lb increase in August ethylene contracts. September ethylene contracts held potential for another increase of 2¢/lb. Butadiene prices were flat. Contracts settled at a weighted average of 84¢/lb, the lowest in over a year.

“This could be a bottom for U.S. PS,” said RTi’s Shelly. “However, domestic demand does not appear to be picking up.” In the absence of unplanned shocks, soft demand and lower feedstock prices could lead to lower PS prices in the fourth quarter, he ventures.

PVC PRICES RISING

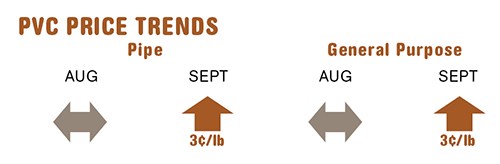

PVC prices were expected to move up 3¢/lb by the end of last month. Implementation of another 3¢/lb increase, slated for Oct. 1, was questionable, according to Mark Kallman, director of client services for engineering resins and PVC at RTi.

The first price hike was driven by a combination of the August 4¢/lb ethylene contract price increase, strong export activity in July and August, and steady domestic demand that kept the market in balance, according to Kallman. He noted that the potential for a 2¢ increase in September ethylene contracts will hinge on downstream demand and how well crackers are running, which in mid-September looked to be relatively smooth.

Kallman suggests processors take a buy-as-needed approach. He said suppliers’ inventories were increasing, despite their claims to the contrary.

ABS PRICES DROP FURTHER

ABS prices have continued to drop since the second quarter, and by September were 20¢/lb lower than in April. Prices were expected to remain flat or slightly lower last month as key feedstock prices continued to fall, according to RTi’s Shelly.

Shelly sees similar scenarios for ABS and PS prices: Barring unanticipated events, further erosion in ABS prices can be expected through the fourth quarter. Driving this trend is continued lackluster demand, which he expects will not finish this year ahead of 2011, along with lower feedstock prices.

September benzene contract prices dropped 9%, butadiene prices held at a low 84¢/lb, and styrene monomer prices were also relatively flat.

NYLON PRICES DOWN

Prices of both nylon 6 and 66 dropped in the third quarter, particularly in June and July, and flattened out in August. RTi’s Kallman estimates that nylon 6 tabs dropped 5-10% while nylon 66 tabs fell around 5%. He expected relative stability for both resins in September and October, partly because September benzene contracts dropped 9%, and partly because of slackening demand. Nylon 6 demand in both fiber and automotive markets appears to be relatively steady. But exports of caprolactam feedstock have fallen off and prices are one-third lower than a year ago.

For nylon 66, domestic demand has been pretty healthy, particularly in the automotive sector. But again, exports are off significantly because of the slump in the global economy and Asian automotive markets in particular.

For both nylons, there is a wild card of sorts in what happens to benzene prices. They already dropped by 9% in September and most analysts don’t forsee any major bounce upward in the near future. This is also the case for all other key nylon feedstocks. However, spot benzene prices in Europe and other regions have been inching upwards because of tight benzene supply, so there is some possibility of higher domestic benzene contract tabs if the tightness abroad gets more intense. That in turn might push up nylon prices.

PC PRICES DROP

Polycarbonate prices fell through the third quarter, after having gained around 10¢/lb in the second quarter. There were many price concessions, depending on the market, primarily in June and July, with August prices flattening out, according to RTi’s Kallman. The August halt to the decline was linked directly to an August hike in benzene contract prices of 7%. However, September benzene contract prices settled 9% lower.

Meanwhile, there were some nominations of higher PC contract prices in September, but they were expected to affect only the lower end of the market, if at all. Kallman says PC domestic demand in automotive has been better than abroad. There are some planned maintenance shutdowns of U.S. plants but they are not expected to tighten supply.

Related Content

Fundamentals of Polyethylene – Part 6: PE Performance

Don’t assume you know everything there is to know about PE because it’s been around so long. Here is yet another example of how the performance of PE is influenced by molecular weight and density.

Read MoreCommodity Resin Prices Flat to Lower

Major price correction looms for PP, and lower prices are projected for PE, PS, PVC and PET.

Read MoreRecycled Material Prices Show Stability Heading into 2023

After summer's steep drop, most prices leveled off in the second half.

Read MorePrices of PE, PP, PS, PVC Drop

Generally, a bottoming-out appears to be the projected pricing trajectory.

Read MoreRead Next

Lead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read MorePeople 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read MoreBeyond Prototypes: 8 Ways the Plastics Industry Is Using 3D Printing

Plastics processors are finding applications for 3D printing around the plant and across the supply chain. Here are 8 examples to look for at NPE2024.

Read More