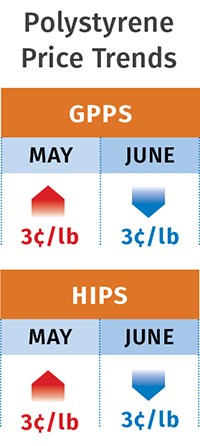

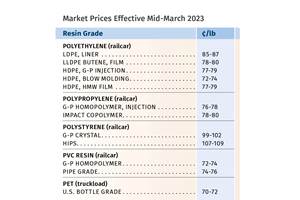

Resin Prices Relatively Flat for Now

Prices are up for some commodity and engineering resins, but the trajectory for the third quarter is generally flat.

There were no major price surges for either the four commodity resins or the most common engineering resins in the second quarter. That was due to a global cost advantage in lower feedstock costs and overall growing domestic industry demand—despite the clearly evident profit-margin expansions by suppliers of some of these resins. These are the views of purchasing consultants at Resin Technology, Inc. (RTi), Fort Worth, Texas, and CEO Michael Greenberg of The Plastics Exchange in Chicago.

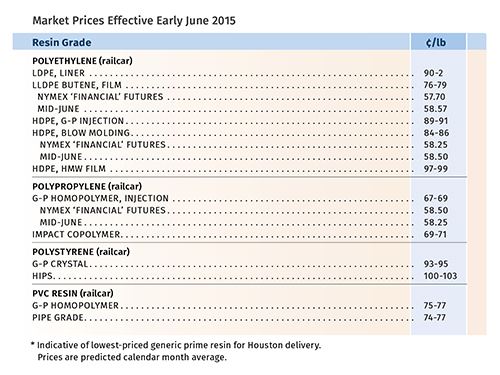

PE PRICES FLAT

Polyethylene prices went up 5¢/lb in May as expected, bolstered by strong exports and good domestic demand, and suppliers issued a second 5¢/lb price hike for July. It’s “iffy” as to whether that hike will arrive on time, ventures Mike Burns, RTi’s v.p. of client services for RTi.

Greenberg reports there was a significant amount of PE trading in the spot market at the end of May, but with firm pricing as suppliers implemented that month’s contract price increase and the new hike was announced. Still, he saw some weakness emerging as export demand softened: “While PE producers successfully liquidated significant inventories over the past few months, overall availability is adequate and all commodity grades are accessible in the spot market—it’s just a matter of price.”

Burns cites some key factors contributing to the likely delay of this latest price increase, including a drop in exports to Southeast Asia and China last month, as PE supplies there improved and prices dropped. Supply constraints in those regions are reversing, though they continue in Europe, which is not a major export market for North American PE suppliers.

On the domestic front, Burns also cites limited availability of off-grade butene LLDPE and some HDPE injection molding grades.

Overall, unless there is some major surge in oil prices, July’s announced PE price increase is likely to dawdle into the next couple of months. Key factors that will affect its standing include oil prices, good packaging demand in the fall, the summer hurricane season, and any other potential disruption, according to Burns.

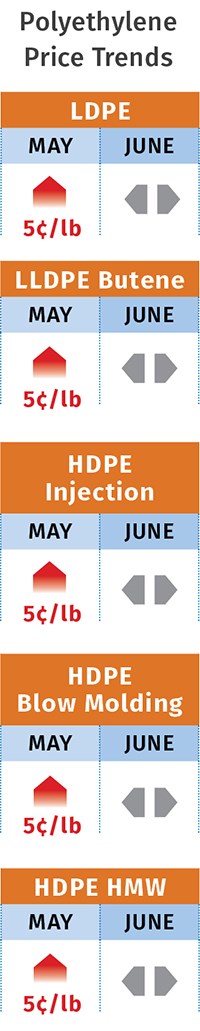

PP PRICES DOWN

Following a 1¢/lb decrease in propylene monomer contract tabs, PP prices dropped by 1¢ for some processors in May, while others saw no change, all depending on when suppliers’ realized their intended margin expansion. Says Scott Newell, RTi’s director of client services for PP, “There’s no one-size-fits-all anymore.”

June monomer contract prices were expected to settle 1-2¢ lower, with PP prices to follow, but likely not by as much. “There is an ongoing effort by suppliers to further expand their PP margins, and as PP prices have declined, we have heard few complaints from contract buyers so far, but we imagine their ambivalence will eventually be tested,” notes Greenburg. Both sources concede that though PP prices have been declining since the late fourth quarter, suppliers’ margins have grown about 5¢/lb fatter because the decline in PP prices has not been as large as their feedstock cost savings.

Meanwhile, the domestic PP market appears to be on an upswing. Though still tightly balanced, most everyone is getting the material they need, according to Newell. He says demand has grown at a 4.4% rate through April compared with the overall average of 2014. And, for the first time in the last several years, he says this growth “appears to have some meat on it” and spans all key markets from consumer goods, film, and fiber to automotive.

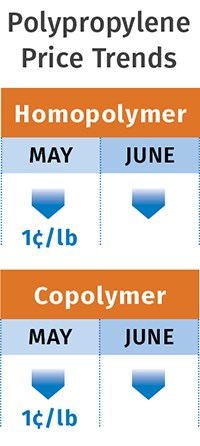

PS PRICES REVERSE COURSE

Polystyrene prices moved up 3¢/lb in May following April’s 5¢/lb price increase, but a reversal was underway last month. June benzene contract prices fell by a whopping 59¢/gal. As a result, at least one PS supplier offered a contract reduction of 3¢/lb for June.

Mark Kallman, RTi’s v.p. of client services for engineering resins, PS, and PVC, expects the decrease to be implemented, since suppliers will still walk away with some margin expansion. Essentially, this PS price reduction amount does not cover the benzene price drop. Benzene spot prices did rally upward a bit after the contract settlement—undercutting the decrease by about half, so July benzene contracts are expected to settle higher. But Kallman says benzene prices are very unlikely to go above the May levels, as supply and demand are pretty well balanced. The seasonal demand for PS is pretty good overall, though it was a bit lower in May.

PVC PRICES FLAT

PVC prices remained flat in April and May and were expected to continue that way last month, despite suppliers’ announced price hikes of 3¢/lb for June 1 and another 3¢ for July 1.

There was a modest increase in May ethylene contract prices of 0.25¢/lb, and prices of chlorine were moving up, due seasonal demand for water treatment. But RTi’s Kallman notes that PVC resin availability is plentiful, exports are down, and demand is good as the construction season picked up speed after a slow start, though it is still not expected to be as strong as originally projected. Moreover, he sees increasing pressure for price reductions from processors and predicts that prices will trend downward this month.

ABS PRICES FLAT

ABS prices have remained flat after bottoming out in April, following a cumulative 10% decline since late 2014. A price increase of 4¢/lb for June 1 was on the table, but the precipitous drop in the June benzene contract settlement was expected to undercut it.

Says Kallman, “If July benzene prices go back up to May levels or higher, you can expect ABS suppliers to try again,” Meanwhile, he notes that domestic demand continues to be good, with some modest growth expected this year. But he also notes that Asian ABS imports continue to be a factor for domestic suppliers aiming to tighten prices. In fact, imports in March 2015 were the strongest of any month in a five-year span.

PC PRICES FLAT-TO-DOWN

Polycarbonate prices were largely flat through the second quarter, following a 2-8% decline in the first quarter until benzene prices bottomed out. There were attempted price increases throughout the second quarter that fell by the wayside, according to Kallman. He foresees PC prices trending flat to possibly downward, noting that the domestic market is well balanced, with feedstock prices well below 2014 levels. Lower-priced imports are still a contributing factor, as global overcapacity has yet to be sufficiently curtailed.

NYLON 6 PRICES UP; NYLON 66 FLAT

Nylon 6 prices moved up by as much as 7¢/lb in April and May for processors on negotiated contracts. This came after a cumulative decline of 5-10% since third-quarter 2014. Suppliers issued another 5¢/lb increase for June 1, but it doesn’t have much of a chance, due to the benzene price decline, according to Kallman.

Nylon 66 prices remained primarily flat, with a bit of downslide in some cases, through the second quarter, after dropping a few percent during the first quarter, according to Kallman. A mid-April declaration of force-majeure by Invista prompted one supplier to issue a 15¢/lb price hike, but the Invista production disruption did not affect resin availability, notes Kallman. He sees a flat trend in prices continuing, even though domestic demand is a bit above 2014.

Related Content

First Quarter Looks Mostly Flat for Resin Prices

Temporary upward blips don't indicate any sustained movement in the near term.

Read MorePrices of PP, PET Drop; PE, PS and PVC to Follow

Going into fourth quarter, prices of the five commodity resins were heading downward, barring supply interruptions.

Read MorePrices of Volume Resins Generally Flat or Lower

Exceptions in early March were PP and PS, which moved up solely due to feedstock constraints, along with slight upward movement in PVC and PET.

Read MoreCommodity Resin Prices Flat to Lower

Major price correction looms for PP, and lower prices are projected for PE, PS, PVC and PET.

Read MoreRead Next

Lead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read MoreSee Recyclers Close the Loop on Trade Show Production Scrap at NPE2024

A collaboration between show organizer PLASTICS, recycler CPR and size reduction experts WEIMA and Conair recovered and recycled all production scrap at NPE2024.

Read MoreMaking the Circular Economy a Reality

Driven by brand owner demands and new worldwide legislation, the entire supply chain is working toward the shift to circularity, with some evidence the circular economy has already begun.

Read More