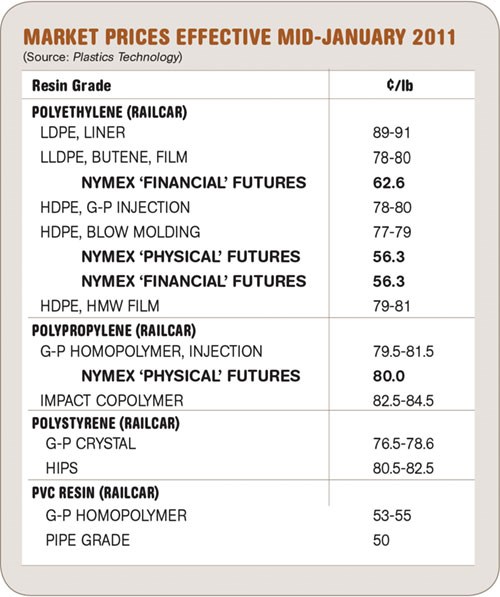

Sticker Shock: PP Prices Soar By 17¢/lb

Other commodity materials flat to down.

Monomer supply problems ignited a startling run-up in polypropylene prices last month, even though demand was slack. Polystyrene prices were also trending upward, though polyethylene and PVC were on a flat to downward path. But there are plenty of wild cards on the table. Keep an eye out for unplanned outages of monomer and feedstock plants and revival of domestic and export demand, say resin purchasing consultants at Resin Technology, Inc. (RTi) in Fort Worth, Texas.

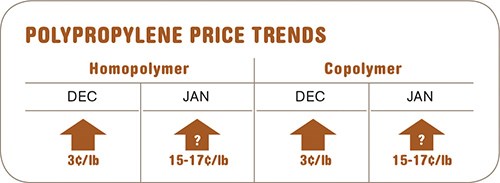

PP PRICES THROUGH THE ROOF

Polypropylene prices were heading for a shocking 17¢/lb increase last month, in step with 17¢/lb higher January contract settlements for propylene monomer, which leaped to 77.5¢/lb. A couple of PP suppliers were even asking for a 19¢ hike but are considered highly unlikely to get it.

This dizzying upswing is linked directly to feedstock shortages due to several planned and unplanned outages at refineries and steam crackers. It certainly wasn’t demand-driven. PP plant operating rates were in the mid-to-upper 80s percentage range from October and through December. PP sales came to a standstill in mid-December and supplier inventory levels actually increased. Sales are likely to be suppressed by the massive impending price hike.

Outlook & Suggested Action Strategies

30-60 Day: Buy as needed. After the January surge, PP prices may sit tight in February and even pull back a bit. A further price “correction” could come in March, if the demand slump continues. Expect PP suppliers to quickly throttle back plant operating rates.

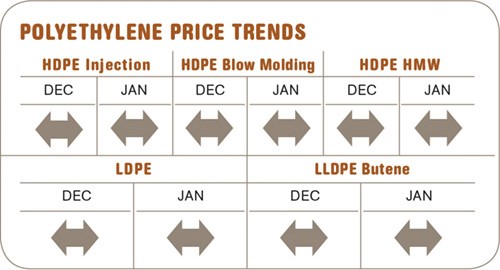

PE PRICES FLAT FOR NOW

Polyethylene prices were flat last month, despite suppliers’ attempts to a push through their delayed December 5¢ increase and January 6¢ hike. Nymex HDPE futures were also down 2.7¢/lb from last month. One reason is that ethylene monomer spot prices dropped to 41-42¢/lb in mid-January from 46¢ in mid-December and 52¢ in November. Both monomer and polymer supplies are ample. Sluggish domestic and export demand for PE continued into last month.

Outlook & Suggested Action Strategies

30-60 Days: Polyethylene pricing for the initial part of the first quarter is expected to be mainly cost-driven and appears to be trending downward. Buy as needed. Unplanned monomer and polymer outages could change things quickly.

Also, exports and inventory levels may come more into balance with demand by late in the quarter; particularly if China comes back into the market buying heavily and crude oil prices remain high.

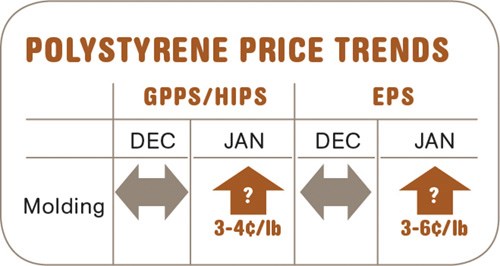

PS PRICES UP TO FLAT

Polystyrene prices were expected to move up last month although not by the full 6¢/lb sought by suppliers. That increase included the removal of a 2¢ TVA from December plus the January 4¢ hike. A 3-4¢ actual increase was more likely, due to higher feedstock costs.

January benzene contract prices moved up 56¢/gal to $3.84, driven by high oil prices and refinery outages. Moreover, styrene monomer contract prices for January were poised to rise 4-5¢ to 66-68¢/lb. Ditto for butadiene prices, with December contracts up 2-3¢ to 87¢/lb, driven by strong global demand. January contract proposals for butadiene were 5-6¢ higher, and prices could pass $1/lb before the end of March.

December PS plant operating rates moved up to 82% from the high 70s, and demand was up due to prebuying for restocking inventories after November production outages.

Supplier inventories were expected to drop lower than the 19-day mark in December for GPPS and HIPs but move up from the 24-day mark for EPS.

Outlook & Suggested Action Strategies

30-60 Day: January prices were on the way up and HIPS prices were anticipated to remain at a higher-than-normal premium over GPPS. January resin prices look like the peak for the quarter. Flat to downward pricing is likely for this month.

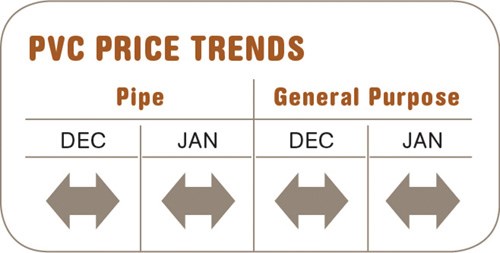

PVC PRICES FLAT TO DOWN

PVC prices in January were flat for a second month, despite suppliers’ issuing a 3¢/lb price hike for Jan. 1. By December, domestic and export demand had dropped by more than 5% and by 10%, respectively, while plant operating rates fell more than 9% by year’s end. This has brought some attractive spot-price deals.

The trend to flat-to-lower PVC prices in the first quarter follows falling prices for ethylene monomer, whose supplies have become ample, as well as more PVC hitting the market from the start-up of Shintech’s capacity expansion last quarter. What’s more, Formosa will be starting up a capacity expansion before March’s end for a net addition of 240 million lb/yr.

Outlook & Suggested Action Strategies

30-60 Day: Buy as needed, since prices could go lower this month. Some planned plant shutdowns will limit the oversupply situation, but supplier inventories will grow as domestic and export demand declines further though this quarter. Expect further opportunities for price reduction, barring any significant production outages of raw materials or PVC resin.

Related Content

Improving Twin-Screw Compounding of Reinforced Polyolefins

Compounders face a number of processing challenges when incorporating a high loading of low-bulk-density mineral filler into polyolefins. Here are some possible solutions.

Read MoreCommodity Resin Prices Flat to Lower

Major price correction looms for PP, and lower prices are projected for PE, PS, PVC and PET.

Read MorePolyethylene Fundamentals – Part 4: Failed HDPE Case Study

Injection molders of small fuel tanks learned the hard way that a very small difference in density — 0.6% — could make a large difference in PE stress-crack resistance.

Read MoreNew Facility Refreshes Post-Consumer PP by Washing Out Additives, Contaminants

PureCycle prepares to scale up its novel solvent recycling approach as new facility nears completion.

Read MoreRead Next

People 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read MoreFor PLASTICS' CEO Seaholm, NPE to Shine Light on Sustainability Successes

With advocacy, communication and sustainability as three main pillars, Seaholm leads a trade association to NPE that ‘is more active today than we have ever been.’

Read MoreLead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read More