Natural Gas Boom: What Will It Mean for Plastics Processors?

Plentiful shale gas promises to keep domestic polyolefin production costs among the lowest in the world. Whether (and when) you will see savings is debatable.

Plentiful shale gas promises to keep domestic polyolefin production costs among the

lowest in the world. What that will mean for resin prices is an open question. To shine some light on whether processors of PE, PP, and possibly other plastics are likely to see direct benefits of shale gas development in terms of lower or at least more stable resin pricing—and when—we turned to expert researchers and consultants at Texas-based IHS Chemical, Houston and Resin Technology, Inc., Fort Worth, Texas. We also asked two major polyolefin suppliers to comment on how resin prices may be affected, but they did not reply.

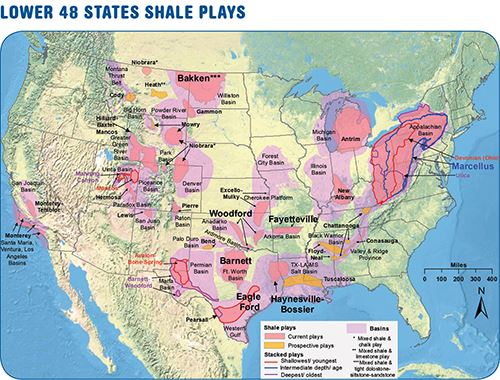

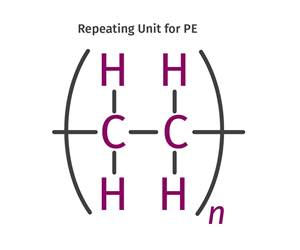

It was just a little over five years ago that natural gas prices were so high that some chemical manufacturers were shutting down U.S. operations. Now, U.S prices are only a fraction of those in other countries—the result of new ability to access natural gas trapped in shale formations via technologies such as hydraulic fracturing (“fracking”) and horizontal drilling. Natural gas, which is about one-third the cost of crude oil, contains large amounts of ethane, which is processed to make ethylene monomer, considered the workhorse of petrochemical building blocks, particularly for making PE, ethylene dichloride used in PVC, and styrene monomer for PS and other styrenic resins.

UNIQUE NORTH AMERICAN ADVANTAGE

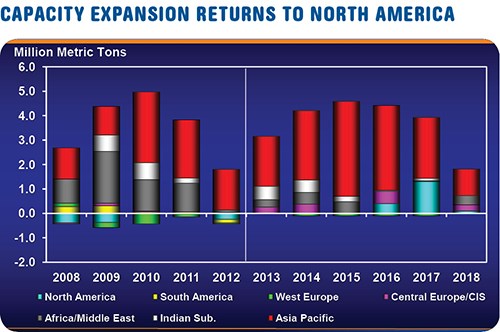

A recent IHS study, IHS Chemical 2014 World Ethylene Analysis, analyzes global ethylene markets for 2008 to 2023. It concludes that while abundant North American shale energy resources are driving low-cost ethylene production and a competitive resurgence for the continent’s producers of ethylene and its derivatives, producers in the Middle East are facing the opposite and unfamiliar challenge of ethane supply limitations. “The U.S. ethylene industry and the ethylene industry in the Middle East have essentially traded places in terms of supply outlook in the past few years. There is a tremendous amount of U.S. capital investment under way, with units starting up beginning in 2017,” stated Steve Lewandowski, IHS director of olefins research and an author of the study.

Lewandowski pointed out that “once blessed with abundant supplies of cheap ethane, Middle East producers invested heavily in capacity additions, but this market shift, a lack of readily available ethane supplies, has effectively put a stop to new, low-cost ethane-based ethylene capacity and shifted investments to ethylene-based on LPG (liquefied petroleum gas) and naphtha feedstocks.”

This past July, Dr. Joseph Ertl, head of Germany’s plastics industry trade body, known as the WVK, noted that thanks to cheap shale gas, the U.S. has emerged as “a very serious competitor in manufacturing terms and [is] developing into a global hub for petrochemicals.If cheap gas, low-cost energy and low-cost petrochemical raw materials substantially improve the [local] conditions in the U.S., they will tend to worsen conditions in all the other economic areas.”

Natural gas prices in the U.S. have been hovering between $3.30 and $3.40 per million Btu, down from a high of $12 before the last recession and a fraction of the cost in Asia and Europe. This price differential is key to domestic energy companies, who are willing to spend billions to build export facilities—or convert them from their previous import status—to ship liquefied natural gas (LNG) in tankers for sale overseas. Many in the petrochemicals industry believe that exports of natural gas will be beneficial and part of the transformation that promises to increase the nation’s weight in the global economy and to bring jobs back to the U.S.

But some are against increased natural gas exports. One is Dow Chemical CEO Andrew Liveris, who sees it as a threat to the U.S. manufacturing renaissance now in its infancy, and who has spoken out in the New York Times and on cable news channels. Of course, there is also the factor of his own company’s bottom line. As one of the biggest private consumers of natural gas in the country, Dow and other chemical companies are currently paying much less than foreign competitors for this feedstock.

There are currently about 15 proposed LNG terminal projects—each of which can cost $7 billion or more—seeking regulatory approval, and if all of them got the green light, they could export over one-third of domestically consumed natural gas. Add to that a projected future increase of natural gas consumed by vehicles and industry, and an export boom would surely push up prices. However, few industry experts believe that most of these terminals will be approved, noting that only a handful of the companies applying are likely to muster sufficient financing to build the facilities. The Obama Administration has so far granted permits to three terminal projects and indications are that just a handful more will be approved over the next several years to avoid risking the spike in natural gas prices feared by the likes of Dow’s CEO.

IHS projects that U.S. natural gas will continue to be attractively priced for export over the next 10 years. The ability to export LNG makes it easier and safer to transport the gas and will mean that natural gas globally will have a price advantage over oil.

Liveris’ overall argument is that energy, like defense and food, requires special care to protect the national interest. He thinks exporting natural gas is fine, but not at the price of importing it back in the form of finished goods made with our cheap gas.

These evolving issues have prompted industry events like the Global Plastics Summit, held Nov. 4-6 in Chicago, organized by IHS and the Society of the Plastics Industry (SPI). The summit’s aim: to address how the plastics industry chain, from production and processing to distribution, and other related industry sectors will be affected by this dynamic situation, in which growing exports are on the horizon for the U.S., Europe is under severe competitive pressure, and China is leveraging coal-based olefin production to strengthen its position.

AN OVERALL BRIGHT OUTLOOK

A recent and widely applauded study from IHS with SPI support—America’s New Energy Future: The Unconventional Oil and Gas Revolution and the Economy –Vol. 3: A Manufacturing Renaissance—reported that the economic and employment contributions from U.S. unconventional oil and gas production are now being felt throughout the U.S. economy. For example, 2012 showed an increase in disposable income of an average of $1200 per U.S. household as savings from energy costs were passed along to consumers in the form of lower costs for energy and all other goods and services. IHS projects this figure to grow to just over $2000 in 2015 and reach more than $3500 in 2025.

IHS also predicts that the U.S. trade position will continue to improve, owing to the significant reduction in energy imports and increased global competitiveness of U.S. energy-intensive industries.

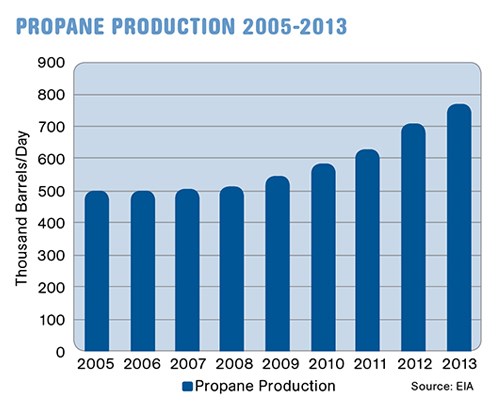

For the plastics industry, the abundance of natural gas sources from shale and the resulting increase in production of ethane and propane are “set to be a real game-changer,” stated SPI president and CEO William Carteaux.

At the release of this study, Mark Wegenka, IHS managing director of chemical consulting and a contributing author, noted, “The availability of a long-term supply of low-cost feedstock derived from unconventional sources is revitalizing the petrochemicals industry in North America. We’ve witnessed a complete turnaround. Not only is the industry competitive again, but it’s attracting significant domestic and foreign investment and adding capacity that’s resulting in more high-quality U.S. jobs that pay well.”

The report asserts that polyolefins and the vinyls chain, including PVC, are two of the nine value chains on which U.S. chemical investment will be largely focused. In the petrochemicals sector, ethylene and propylene are two of the four segments that will be further impacted by unconventional oil and gas development. Major capacity expansions have been announced for ethylene, which would approach nearly 20 billion lb of new capacity in the 2016-2018 time frame. Additional propylene supplies could approach 9 billion lb in roughly the same period.

Capacity expansions for PE have also been announced, and the same is expected for PP in the near future. Various industry experts, including some at IHS, venture that these new resin supplies could very well translate into business expansions for U.S. plastics processors.

The discussion below draws on the outlook for PE and PP from IHS director of polyolefins Joel Morales, RTi’s v.p. of PE Mike Burns, and RTi director of client services for PP Scott Newell. Commenting on PVC are Mark Kallman, RTi’s director of client services for engineering resins, PVC, and PS; and Ana Gamboa-Torres, associate director of chlor-alkali, vinyls, and inorganics at IHS.

MIXED VIEWS ON PE PRICE TRENDS

What will be the impact of all this on PE prices and how soon? Morales from IHS says that a significant portion of planned new PE capacity will have to find markets outside of the Americas and be offered at more competitive prices. “Our view is that in such a scenario, North American plastics processors are more likely to benefit from a more competitive global market.”

Morales and RTi’s Burns concur that the 2013-2015 time span is extremely favorable for PE suppliers due to tight inventories and lower ethylene costs, while the landscape for most plastics processors will be characterized by higher resin prices.

Morales foresees that by the end of 2015, some of the new PE capacity will start to come on stream, but the majority will arrive in 2016 and 2017, totaling nearly 16 billion lb. The expansions include all three PE types, although planned volumes for LLDPE and HDPE are higher, as their demand is growing at a faster pace.

Why will exports be a more significant factor? In 2013, only 5% of PE production left North and South America, and net exports from North America have matched up well with net imports to South America, explains Morales. But by 2018, domestic PE suppliers will need to export about 14% of production outside the Americas. Simply put, the expansions in North America far exceed the region’s ability to absorb the additional pounds, so more product will need to be exported outside the Americas at lower prices.

Says Morales, “Profitability for PE suppliers right now is very high and the new ethane/ethylene investments and PE capacity will result in more competitive prices for domestic plastics processors and converters, as they will be able to ‘repatriate’ their business in North America and produce more end-products here. The current level of profitability for PE suppliers cannot be sustained when they are investing so much, and they will need to export material and at competitive prices. We expect a reduction in profit margin for the PE suppliers, but it will still be good business.”

RTI’s Burns does not see as rosy a scenario for processors. He cites this past September as a lesson in point, when PE prices moved up 5¢/lb. The cost to make a pound of ethylene has been lower this year than in any other recent year—starting out in January at 10¢/lb when spot ethylene prices stood at around 60¢/lb, and 10.5¢ by mid-September, with spot prices dropping to near 45¢/lb. Not only was there a healthy profit in ethylene monomer—and most PE producers are integrated back to monomer—but its price dropped 15¢/lb while the polymer price went up by a similar amount—14-16¢/lb by the end of September, making for very healthy profit margins in PE production, as well. That’s a double hit for back-integrated PE producers.

Burns ventures that if the cost to make PE becomes even lower than it is already, it will not influence PE pricing. He says one factor is that the cost to make a PE pellet from petroleum rather than natural gas will continue to dictate the price floor for PE. Second, suppliers’ PE inventory levels, which have become the driving factor behind prices this year, will continue to play that role.

“The real impact of shale gas development,” says Burns, “is that the U.S. is becoming the cheapest guy on the block, and PE suppliers will create excess product, which they will sell to exports and domestically at the price of PE made by oil.” In order for domestic plastics processors to see lower PE prices, Burns maintains that resin suppliers would have to reduce their profit margins (noted also by Morales), but also that the price of oil would have to drop to below $70/barrel.

ROSIER PP PRICING OUTLOOK?

Newell from RTi sees some advantages for PP pricing down the road. He points out that shale gas is “wet” gas,” which means that it contains liquids—primarily ethane but also propane and butanes. "So far, most of the shale-gas advantage has been in ethylene and its derivatives. But shale gas is also producing a lot of propane," Newell points out. Within the last five years, propane production from shale gas has skyrocketed. "This will ultimately do good things for propylene and its derivatives."

According to Newell, “Steam crackers making ethylene are using a lot more ethane from shale gas versus other feeds. But when using ethane in ethylene steam crackers, yields of propylene decrease significantly. In fact, these low yields have been the key reason why U.S. propylene monomer and PP resin prices have become the highest cost in the world and is also the reason for the significant price volatility we’ve had.”

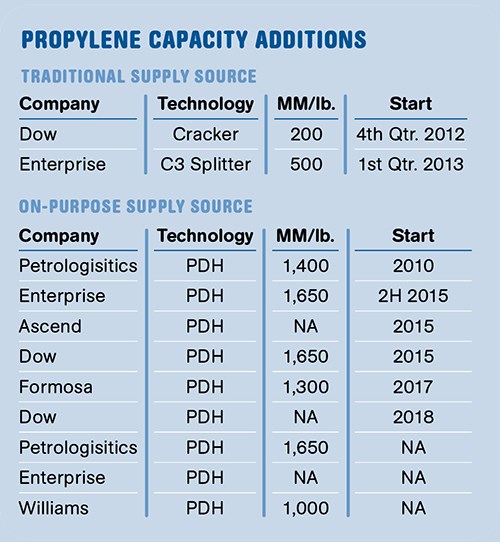

But there may be a silver lining. A turnaround of this situation for propylene and PP is under way and is attributed to significant investments in propane dehydrogenation (PDH) technology that is coming out of shale gas development. PDH is a method of making propylene from propane. Plans to build nine PDH units have been announced, although they are in various planning stages and not all may come to fruition, explains Newell.

Three of these PDH units are scheduled to start up in the second half of 2015. “That’s when you can expect to see shale gas development having a positive impact for propylene,” says Newell. “The reason is that the PDH units will alleviate the propylene constraint in natural gas and will go a long way towards reducing price volatility of the monomer and bring prices down to a more competitive level globally.”

Still, Newell maintains that the propylene advantage for shale gas will not be as high as that for ethylene. The key reason is that propane prices tend to align with oil prices, whereas ethane is aligned with natural gas prices. “Ethane has very few demand streams. It goes either to natural gas or to ethylene production. In contrast, propylene has many demand streams. It is also much easier to transport and can be exported to regional markets.”

Nonetheless, Newell expects that PP prices ultimately will be impacted advantageously by shale gas development, although perhaps not penny-for-penny with the monomer price. “There is one major issue right now,” Newell adds. “So far, all the new capacity announcements based on PDH are for propylene monomer and there have not been any for PP capacity expansions, though I believe there are discussions under way.”

Morales says IHS anticipates that there will be PP capacity expansion announcements within the next six months. However, the amount of that new PP capacity will be small enough that it will not require exports to be effectively utilized.

Says Morales, “The bad news for PP processors and converters is that they will not see as low prices rom global competition as are expected in PE. But the good news is that more abundant and lower-cost propylene will remove the peaks and valleys of PP pricing. Another piece of good news for PP is that inter-material competition with PE will be lessened as PP price volatility is reduced.”

Adds Newell, “I think for PP, the positives outweigh the negatives, overall. I think there is light at the end of this tunnel but we may not see it until late 2015 or 2016. Profit-margin expansion for suppliers is okay as long as we can reduce the high degree of price volatility and get to prices that are more competitive globally.”

MIXED PICTURE FOR PVC

RTI’s Kallman and IHS’s Gamboa-Torres foresee that PVC could well be impacted by plentiful, low-cost ethylene from shale gas and tight oil, which could make for lower cash cost of PVC production. They also note that PVC, like PE, has export opportunities, depending on overseas prices.

Says Gamboa-Torres, “Price volatility for PVC depends more on supply/demand fundamentals. We don’t see shale gas translating directly into lower PVC prices. They will still be dictated by supply and demand.”

Kallman’s opinion is that PVC was more closely connected to feedstock cost than PE, but with the growth in exports since 2009 the link to contract ethylene prices has weakened as the supply/demand balance has taken a larger role. PVC processors may see some lesser volatility in supply or demand from exports.

Related Content

Prices for All Volume Resins Head Down at End of 2023

Flat-to-downward trajectory for at least this month.

Read MoreThe Fundamentals of Polyethylene – Part 2: Density and Molecular Weight

PE properties can be adjusted either by changing the molecular weight or by altering the density. While this increases the possible combinations of properties, it also requires that the specification for the material be precise.

Read MoreImproving Twin-Screw Compounding of Reinforced Polyolefins

Compounders face a number of processing challenges when incorporating a high loading of low-bulk-density mineral filler into polyolefins. Here are some possible solutions.

Read MorePrices Up for PE, PP, PS, Flat for PVC, PET

Trajectory is generally flat-to-down for all commodity resins.

Read MoreRead Next

See Recyclers Close the Loop on Trade Show Production Scrap at NPE2024

A collaboration between show organizer PLASTICS, recycler CPR and size reduction experts WEIMA and Conair recovered and recycled all production scrap at NPE2024.

Read MoreFor PLASTICS' CEO Seaholm, NPE to Shine Light on Sustainability Successes

With advocacy, communication and sustainability as three main pillars, Seaholm leads a trade association to NPE that ‘is more active today than we have ever been.’

Read More