Thermoplastic Polyesters: It's Time to Know Them Better

There’s more to TP polyesters than you think. You may know PET, PBT, and PETG—but what about PCT, PCTG, PCTA, and PTT? If you’re not sure what they are, how their properties compare, and who sells them, we have the answers—and lots of new developments to report.

Ask a molder or extruder of engineering resins to name a thermoplastic polyester, and most would probably come up with PET or PBT or maybe PETG. Most likely, a smaller number would be aware that there are at least three more members of the terephthalate polyester family that are commercially available, plus another one waiting in the wings. An even smaller minority of processors would know where these “hidden” members of the resin family fit in terms of cost/performance or where they can be obtained.

Given their long track record in electrical, automotive, medical, and appliance parts as well as premium packaging (not to mention commodity packaging, which is beyond the scope of this article), what accounts for the fuzzy picture of polyesters in the marketplace today?

The lack of focus partly arises because TP polyesters encompass seven homopolymer and copolyester types, all based on ester chemistry and a terephthalic acid (TPA) backbone (see table). The different varieties share excellent chemical resistance and electrical properties, good dimensional stability and (if reinforced) high toughness-stiffness balance. Several have high clarity. But in varying degrees they are sometimes subject to poor thermal properties, appearance deficits, and susceptibility to moisture pick-up that makes drying a critical issue.

A second source of confusion arises from the marketing policies of some suppliers in recent years. Some deliberately avoid identifying specific types of polyesters and copolyesters. What’s more, in different end-use markets, the same resin from the same supplier may go by entirely different trade names.

A third source of uncertainty stems from recent shifts in the polyester supply line-up. Virtually every supplier in the past year has divested or acquired a polyester product line or initiated a major restructuring of their polyester operations. While these moves are intended to lay the foundation for a stronger long-term supply base in polyesters, the immediate effect is to heighten uncertainty about just who supplies what.

Further blurring the view is a key characteristic of polyesters themselves—their efficiency in accepting glass and mineral reinforcements, pigments, and other polymers. Around 90% of polyester is compounded with fillers, reinforcements, and other additives. This blurs distinctions between different base resin properties. Yet compounding is also responsible for new developments in flame-retardant and FDA-acceptable PBTs and a proliferation of alloys that combine polyesters with one another and with polycarbonate, ABS, and ASA.

Three factors make this an opportune time to clarify the status of TP polyesters in today’s market. One is the numerous shifts in supply. Another is marketing efforts by competing resin producers to replace polyesters with other resins in target applications. Last but not least is a number of new technical developments: Polyester suppliers are responding to this competition with novel resins and alloys, including hydrolysis-resistant PBT grades that enhance performance in electrical devices (e.g., connectors) under extreme conditions. Other options improve the decorative capabilities of PBT and engineering-grade PET. And PTT, a novel polyester, has recently been launched.

A versatile chemistry

Polyesters puzzle many would-be users because of their diversity. Workhorse homopolymers obtain their varied properties by combining TPA with different diols: PET and PBT are made from ethylene glycol (EG) and butanediol, respectively.

North American PBT suppliers include GE Advanced Materials, Ticona, and DuPont (which use domestically made resin), BASF (domestic and imported resin), and Bayer (which uses imported resin). DuPont, Ticona, BASF, and Bayer also supply reinforced PET compounds. Although there is a long list of independent polyester compounders, few of them say they are active in product development today.

A separate group of copolyesters combine TPA, EG, and a secondary diol, cyclohexanedimethanol, or CHDM. CHDM is made by Eastman Specialty Chemicals and Korea’s SK Chemicals. It is at least four times more costly than the diols used in PET and PBT, so CHDM-based copolyesters command sizeable price premiums.

The glycol-modified copolyesters are PETG (less than 50% of the diol content is CHDM) and PCTG (more than 50% of the diol content is CHDM). PCT, a homopolymer of TPA and 100% CHDM diol, offers elevated heat resistance. Eastman recently sold the PCT family to DuPont Engineering Polymers. DuPont also has rights to some reinforced compounds of PCTA, an isophthalic acid-modified PCT.

In recent years, Eastman has used only the generic labels “polyester” and “copolyester” to describe all its different materials. Since until recently Eastman was the only producer of PCT, PCTG, PETG, and PCTA, its generic labeling may have somewhat obscured perception of the variety of copolyesters and their individual attributes.

Electronic uses in flux

Demand for polyester resins and compounds in North America in 2003 was 600 million lb/yr, according to a recent study issued by SRI Consulting, in Menlo Park, Calif. Joel Levy, author of the report, breaks down the polyester market at 60% PBT (alloys included), 16% PET, and 22% copolyesters (of which PETG makes up 80%). Domestic demand is expected to grow at 5% to 6%/yr over the next few years. Much of the polyester—especially PBT—molding activity is migrating to the Asia-Pacific region, which is where a large share of recent capacity expansion is occurring.

More than 50% of demand for PBT and filled or reinforced PET is in molded electrical connectors, switches, and relays for automobiles and, to a lesser extent, printed circuit boards. This market is in transition as new forces drive up temperature requirements—notably miniaturization, increased crowding of automotive components under the hood, and newer lead-free soldering methods.

One response by polyester suppliers is a major push to upgrade connector materials so they are not made obsolete and replaced by competing resins. Equally important are efforts to exploit new technologies that drive polyesters into entirely new applications. DuPont recently purchased from Eastman the technology and marketing rights to reinforced Thermx PCT and reinforced PET, as well as PCTA compounds. DuPont views PCT as broadening its overall engineered thermoplastics palette for electrical devices.

David Glasscock, DuPont’s high-temperature materials manager for the Americas, says PCT gives DuPont a crystalline polyester with short-term thermal-stress performance bridging the gap between PET and liquid-crystal polymers (LCP). This is evident in the HDT for a 30% glass-reinforced PCT, which is 262 C/504 F at 264 psi. That is an advantage in the performance zone between PET (224 C HDT) and LCP (288 C).

PCT’s heat resistance suits it for electrical devices requiring infrared-reflow and surface-mount soldering, both involving elevated operating temperatures. Tyco Electronics in Greensboro, N.C., has adopted a 33%-glass PCT (Thermx CGT33) to replace PBT in an automobile power-seat connector that was converted to IR soldering.

PCT compounds reportedly also provide outstanding electrical properties, and good arc-tracking resistance relative to competing materials. Arc-track resistance opens opportunities in relays and switches for two fast-proliferating automotive applications—hybrid-electric and 42V vehicles. DuPont is working on new PCT grades and alloys to exploit this potential.

Another response to changes in the automotive connectors market is the launch of hydrolysis-resistant PBTs by BASF, Ticona, Bayer, DuPont and others. These compounds modify both the polymer and additives to increase resistance to degradation under elevated temperature and humidity. Mitchell Lee, BASF’s polyesters product manager, views these compounds as critical to PBT’s continued success in automotive connectors, since higher moisture resistance translates into improved warp- and heat resistance. They allow those making connectors to meet global standards without redesign and retooling of existing connectors for a different polymer. BASF is working to reduce the cost premium for hydrolysis-resistant PBT.

Ticona recently added impact-modified, glass/mineral-reinforced, and alloy grades of hydrolysis-resistant Celanex PBT. One of them, Celanex 3425 HRT with 40% glass offers toughness along with exceptional ability to bond to epoxy adhesives.

Bayer Polymers has recently emphasized PBT grades offering isotropic shrinkage for high-density plug connectors, whose dimensional tolerances are critical, and for higher stress-crack resistance in distribution terminal housings.

Starting next Jan. 1, Bayer will restructure its polymer and chemical businesses into two companies. That move will sever ties between its Pocan PBT business, which will go to the new Lanxess Corp., and its Makro blend PC/PBT alloys, inherited by the new Bayer MaterialScience AG.

LNP Engineered Plastics, previously a minor factor in PBT, is seeking a larger role in electronics markets. LNP aims to apply its proprietary technologies to producing PBT electrical compounds with high flow, non-halogen FR, and isotropic shrinkage.

Moving beyond connectors

DuPont has improved the aesthetic quality of its reinforced PET and PBT lines. Its new Shine-e Rynite PET grades enhance part appearance in terms of gloss and color hold. One grade achieves Class A appearance in exterior car panels when painted on-line with metal parts in E-coat ovens. Another re portedly im parts excellent gloss and color to un paint ed non-automotive parts like oven door handles.

DuPont also has introduced complementary reinforced and unreinforced Crastin PBT grades to address a handicap in the potentially large market for automotive headlight bezels. Existing PBT/PET alloys fail to create flawless mirror surfaces when vacuum metalized, making a preliminary coating necessary. That extra coating step threatens the cost-competitiveness of PBT/PET bezels versus thermosets and metals.

New Crastin CE2548 is an all-PBT compound formulated to give the desired mirror-like surface for direct metalizing of bezels. A proprietary reinforcement package is said to achieve flawless reflective surfaces without a coating. Richard Mayo, DuPont’s PBT global marketing manager, says the compound is being used on some U.S. vehicles like the Lincoln Navigator. Meanwhile, Crastin CE2055 is a new unreinforced PBT with flow properties that offer gloss and reflectivity superior to any reinforced PBT. This allows the direct metalizing of bezels requiring a high-luster surface. The grade is also said to permit lightweighting and is used in Europe.

DuPont has found a new application area for food-contact grades of Thermx PCT, namely industrial and commercial bakeware that can withstand oven temperatures of 350 F.

GE Advanced Materials also recently introduced a new PBT/PET blend for lightweight headlamp bezels. Valox EH7020HF is an improved version of the 20% mineral-reinforced EH7020 grade currently used in headlamps. The new version boasts improved flow to allow for thinner walls.

BASF has now integrated the former Honeywell reinforced PET compounds with its Ultradur PBT line. BASF’s Lee calls the reclaimed bottle-grade resin used in Petra PET compounds “pristine, predictable, and still cost-effective” despite recent run-ups in price. Ticona has introduced a low-melting-point (297 F) Celanex PBT binder for PET nonwovens in automotive headliners and hood and trunk liners. The all-polyester system is fully recyclable, unlike current liners made of cotton fiber with a phenolic binder. The all-polyester liners also reduce weight and improve heat and sound insulation, Ticona claims.

Another recent launch by Ticona is a family of medical-grade PBTs. One wear-resistant version is used in declutch tubes for an IV-therapy syringe, replacing five metal components.

To reduce the cost of PBT compounds, which currently sell for around $1.50/lb, A. Schulman has come out with a PBT/PET blend that uses at least 25% post-consumer PET. Schuladur PCR delivers properties and processability equal to virgin PBT at up to 20% lower cost, claims Jim Oakley, product manager for engineering materials. They are offered unreinforced and with 10% to 40% glass. Oakley says they are being adopted for auto windshield wipers, grille-opening retainers, window-lift motors, door handles, and connectors.

Action in alloys

There’s also plenty of activity in polyester alloys for automotive and other non-connector applications. BASF introduced Ultradur S 4090 PBT/ PET/ASA tri-alloys with 15% and 30% glass for exterior automotive parts and other outdoor electronic enclosures. ASA enhances the weatherability and dimensional stability, while polyester ingredients fine-tune cost-performance.

GE Advanced Materials is emphasizing new alloy developments. Its alloy slate, once primarily Xenoy PC/PBT, now includes Cytra PBT/ABS and Xylex PC/copolyester. The latter draw on various copolyesters to boost PC’s resistance to weather, chemicals, stains, and sterilization while retaining its toughness and clarity. “This tailored properties envelope is gaining market traction,” says Tim O’Brien, general manager for crystalline products, citing Xylex inroads in spas, pools, dog collars, sunglass lenses, and cosmetic items.

GE’s Xenoy PC/PBT is making a “dramatic comeback” in auto bumper fascias, where it has been challenged by lower cost TPO and foam systems, adds O’Brien. He credits a trend to thinner bumper cross-sections. Xenoy’s use is also growing in pigmented, unpainted vertical body panels as well as kayaks and backpack hardware.

Copolyesters expand reach

The sale of some polyester and copolyester businesses to DuPont has not halted product development at Eastman. One of its latest moves in copolyesters is the launch of its “Glass Polymer,” which replicates the look and feel of glass in thick-walled bottles for cosmetics and personal-care products. These PCTA materials include Eastar AN001, tailored for injection and stretch-blow molding, and AN004 for injection molding. AN004 is also said to reduce cycle times in thin-wall injection molded mascara tubes.

Why PCTA? Lower-cost PET crystallizes so quickly in wall sections thicker than 3 mm that hazing results. Acid modification in PCTA delays crystallization and retains outstanding clarity in thick-walled bottles while also providing the rigid feel of glass. Eastman is bringing out a new copolyester for extrusion blow molded bottles and parts. PETG has long been extrusion blow molded into relatively small, simple bottles such as refrigerator containers. The unidentified new copolyester, called EBO62, offers toughness, clarity, and melt strength exceeding PETG’s, opening the way for polyesters to penetrate tougher, thicker, and larger extrusion blown parts.

PETG is making new inroads in laboratory flasks and thermoformed medical packaging. Eastman recently added the Provista family dedicated to profiles for channels, signage, and medical and packaging tubes. Provista MP001 products use a branching agent and a broader molecular weight distribution to raise melt strength and reduce melt fracture at high throughputs, but the trade-off is lower toughness.

Eastman is also introducing branched PETGs for medical profiles. MP002 retains the processing advantages of MP001 together with higher toughness than workhorse PETG 6763.

Also new from Eastman is DN010, an injection moldable PCTG with high clarity (92% light transmission) and toughness suited to replacing acrylic. Higher toughness reduces breakage and permits snap-fit designs. Another new PCTG for injection molding is MN005 for clear medical devices and packaging. It has double the normal flow rate while minimizing trade-offs in impact strength and elongation.

SK Chemicals produces CHDM and copolyesters in Korea and is a major supplier to the Asia-Pacific region, where PETG is replacing PVC in sheet for displays, household-chemical bottles, and other applications. SK’s U.S. subsidiary has cautiously entered the market here with Skygreen PETG for film, sheet, and injection molding, which it supplies only to select U.S. customers. The head of one major domestic packaging firm says the quality is comparable to Eastman’s PETG, unlike some other overseas PETG materials. (All materials sold as PETG are not equal, as some foreign producers allegedly skimp on the CHDM level.) SK is also weighing the introduction of PCTG.

“We are taking a differentiated approach and do not plan to compete on price,” says Yoon Hong, business development manager at SK Chemicals America. She says SK’s processes for making CHDM and copolyesters differ from Eastman’s and yield subtle property differences.

A new polyester star?

Polytrimethylene terephthalate (PTT), discovered in 1941 and made by Shell Chemical through condensation of TPA and 1,3 propanediol, is only now being offered as a commercial resin for injection molding and extrusion. A catalyst breakthrough by Shell reduced PDO cost 10-fold to about $1/lb, making PTT at last a cost-effective alternative to PET and PBT.

Shell’s priority markets for Corterra PTT is in carpet face and textile fibers, where it offers outstanding resilience, stain-resistance, and color vibrancy. PTT carpet is already commercial in Korea. But also high on Shell’s agenda for PTT is use in engineered plastics. A higher molecular-weight version is now available for sampling in compounds and alloys.

Shell Chemical has a 36-million-lb/yr batch-process PTT resin plant in Pt. Pleasant, W.Va., but a 190-million-lb plant is due to start up in Montreal late this year. The plant is owned by a Shell venture called PTT Poly Canada, a partnership with a state-owned company in Quebec. It will use a new continuous melt process to make PTT. Shell Chemical will market the product.

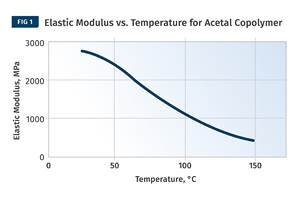

PTT is a fast-crystallizing, 1.35-g/cc resin that can be injection molded, extruded, and blow molded. It is more easily processable and less prone to moisture pick-up than PET, while its mechanical properties are between those of PET and PBT. Adding 30% glass to PTT results in properties equal or slightly superior to those of similarly reinforced PBT (see graph). According to Shell LP’s senior sales executive Joe LeGrand, non-fiber PTT is likely to be used almost entirely in compounds and alloys with PC, PBT, or PET.

Kailash Dangayach, a senior researcher at Shell, says PTT creates smooth, lustrous surfaces with mirror-like replication of mold detail. The polymer is more warp-resistant than other polyesters and accepts pigments more easily than PBT—so much so that 50% lower pigment loadings are expected to provide equal brightness, he says.

Potential PTT uses being investigated include large exterior panels for cars and agricultural, recreational, or off-road vehicles; appliance and industrial housings; and large, flat building and decorative panels. PTT can also be extruded into biaxially oriented films: A Korean film maker uses a PTT/PET blend to replace PVC in shrink film for industrial bundling of bottles.

Compounders RTP, Lati USA, and Albis are testing the ability of PTT to achieve UL 94V-0 in thin sections with non-halogen FR additives while retaining other critical properties for electrical coil bobbins, connectors, and housings. Until now, these goals have been difficult to achieve with PBT, so nylon 6 and 66 have been favored for these applications.

RTP and partner Epcos GmbH, an electrical device maker in Munich, Germany, have developed non-halogen, V-0 PTT compounds that deliver good electricals, 22,000-psi flexural modulus, and 410 F HDT at 264 psi. “The products are a technical success,” declares Paul Killian, RTP product manager, but he says sales have been disappointing. Killian suggests that the high cost and slow acceptance of non-halogenated flame retardants in the U.S. have thwarted wider adoption of PTT. RTP’s 4700 series of PTT compounds also includes halogenated FR, glass-reinforced, lubricated, and carbon-fiber (conductive and antistatic) compounds.

| Composition of TPA-Based Polysters | ||

| Type & Class | Composition | Attributes |

| Homopolymers PET PBT PTT PCT |

TPA + EG TPA + 1.4-butanediol TPA + 1.3-propanediol TPA + CHDM |

Superior stiffness, HDT Easier to process, better warp-resistance than PET Good dimensional stabiity, excellent surface properties Better heat resistance than other polesters |

| Copolyesters PETG PCTG PCTA |

TPA + EG (greater than 50%) + CHDM TPA + CHDM (greater than 50%) + EG TPA + CHDM + IPA |

Glass-like clarity, high stiffness Excellent clarity, better impact and elongation than polycarbonate Higher HDT and elongation than PETG; easier processing and drying; high clarity, neutral color |

| Key: TPA = Terephthalic Acid EG = Ethylene Glycol CHDM = Cyclohexanedimethanol IPA = Isophthalic Acid |

||

Related Content

The Effects of Time on Polymers

Last month we briefly discussed the influence of temperature on the mechanical properties of polymers and reviewed some of the structural considerations that govern these effects.

Read MorePart 3: The World of Molding Thermosets

Thermosets were the prevalent material in the early history of plastics, but were soon overtaken by thermoplastics in injection molding applications.

Read MorePolymer Science for Those Who Work With Plastic — Part 1: The Repeat Unit

What are the basic building blocks of plastics and how do they affect the processing of that material and its potential applications in the real world? Meet the repeat unit.

Read MorePrices for PE, PS, PVC, PET Trending Flat; PP to Drop

Despite price increase nominations going into second quarter, it appeared there was potential for generally flat pricing with the exception of a major downward correction for PP.

Read MoreRead Next

Beyond Prototypes: 8 Ways the Plastics Industry Is Using 3D Printing

Plastics processors are finding applications for 3D printing around the plant and across the supply chain. Here are 8 examples to look for at NPE2024.

Read MoreLead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read More