Your Business Pricing Update - November 2008

Prices Roll Downhill

All commodity resin prices are down and still falling, thanks to weak global demand and soft feedstock prices.

All commodity resin prices are down and still falling, thanks to weak global demand and soft feedstock prices. Processors now can get resin cheaper—if they have a reason (and the cash) to buy it.

PE PRICES DOWN

Polyethylene prices dropped 7¢/lb, as expected, in September. Further price drops are thought to be a strong possibility. However, the London Metal Exchange (LME) North American short-term futures contract for blown film LLDPE in November was 76¢/lb, down just a penny from October’s level.

Contributing factors: The current scenario points to further decline in prices for PE. Mike Burns, global business director for PE at resin purchasing consultant Resin Technology, Inc. (RTI), Fort Worth, Texas, would not be surprised to see PE prices down a total of 18¢/lb in the first quarter of 2009.

Ethylene supply is long, all feedstock prices have been dropping, and there are no more exports to Asia—but still some to South America. Domestic demand is down, with buyers ordering only as needed for the short term because they don’t know what will happen to the economy. Scarce credit is also a real hurdle, notes Burns. Demand for PE through the second quarter and into the third was estimated to have dipped 4% from 2007, which ended down 4% to 6% from 2006. As if things weren’t bad enough, industry sources expect the global slowdown to prompt a return of low-priced finished PE products (e.g., bags) from China on the U.S. market.

In September, suppliers’ inventories were at the highest levels ever, according to Burns. “Although temporary shutdowns during that month’s hurricanes smoothed things out a bit, it was not enough to prevent inventory build-up,” he said.

Ethane, precursor to ethylene monomer, dropped to 48¢/lb, the lowest in two years. Spot ethylene prices were around 40¢/lb—with some bids as low as the 30¢ range—down from 65¢/lb. Contract ethylene prices dived 11.5¢ in August/September to 63¢/lb from 74.5¢ in July. Burns foresees another 7¢ to 10¢/lb drop in ethylene contracts for October.

PP PRICES DROP

After falling 2¢/lb in August, PP prices tumbled another 17¢ to 20¢ in September. Further price slumps are possible. Meanwhile, the LME North American short-term futures contract for November in g-p injection-grade homopolymer sold at 59¢/lb, down from October’s 68¢.

Contributing factors: Propylene monomer contract prices settled 20¢/lb lower in September, according to some industry indexes, although other evidence suggests a dip ranging from 15¢ to 18¢. October contract prices could go much lower—anywhere from 5¢ to 15¢/lb, judging from spot prices, which have tumbled to near 40¢/lb as monomer inventories pile up, according to Scott Newell, director of client services at RTI.

Domestic PP demand is moribund. Customers are wary of buying material, exports are off, and PP inventory levels are building at suppliers. “The market is in terrible shape,” says RTI’s Newell. Industry statistics show demand for PP in 2008 to be down 7% by the third quarter, but Newell says, year-to-year totals were probably down 8% to 10% in mid-October.

PVC SLUMPS

Processors and resin producers seem agreed that August contract prices will finally settle unchanged or down a penny; September will be flat or down 1¢ to 2¢; and October will be down 4¢/lb. It should add up to a 6¢ decline for the months of August to October.

Contributing factors: As global feedstock prices tumbled, contract ethylene monomer settled down 11.5¢/lb in August-September. Spot ethylene is under 40¢. Resin demand has further weakened, especially for pipe.

PS GIVES BACK 5¢

At least two PS resin producers alerted customers in October to a price drop of 5¢ across the board. An attempt was initially made to lower HIPS only 3¢, but ultimately both came down 5¢. The spread between HIPS and crystal reportedly widened to 6¢ to 7¢, indicating that some GPPS may be down more than 5¢.

Contributing factors: Spot benzene in mid October plummeted to $2.50 to $2.60/gal vs. contract benzene at $4.24. One reason is that PS packaging has lost some market share to coated paper products during the recent period of soaring prices. HIPS is still affected by extremely tight supplies of butadiene rubber. Lanxess’ and Firestone’s Texas plants shut down after hurricane flooding in September, though Lanxess was expected to be back up by late October.

PET STILL FALLING

PET prices dropped another 4¢/lb in October, after a 5¢ decline in August to September. Says a major PET supplier, “Expect prices to soften at least 8¢/lb by the end of the year.”

Contributing factors: Prices of key raw materials like paraxylene and ethylene glycol have fallen. Domestic demand for PET could end up flat to slightly negative by year’s end—a far cry from the 5% to 6% growth projected in early 2008. PET beverage bottle markets are down 20% to 25%.

Still, PET resin tabs are unlikely to follow feedstock price drops penny for penny as they did earlier. While the fourth quarter is a traditionally a slow time, supply is also poised to be tighter than usual due to planned shutdowns. Among those is the permanent closure of Invista Polymer and Resins’s 300-million-lb/yr PET plant in Greer, S.C., and Wellman’s polyester bottle and fiber resin plants in Palmetto, S.C., each with an annual capacity of 452 million lb/yr. Moreover, DAK Americas shut its 440-million-lb/yr bottle resin plant in Cape Fear, N.C., for October maintenance, while Eastman was planning to shut down its Columbia, S.C., plant for an extended period in the fourth quarter in order to debottleneck and expand the plant from 700 million lb to 1.05 billion lb/yr. Total PET resin capacity to be shut down is about 2.344 billion lb/yr, according to Platts’ Petrochemical News.

DSM Doubles Capacity For Nylon 46

Royal DSM N.V. in the Netherlands has completed a second polymerization plant for its Stanyl nylon 46. That doubles the capacity for this resin, which is made only by DSM and supplied here by DSM Engineering Plastics, Evansville, Ind.

Related Content

Prices Up for PE, PP, PS, Flat for PVC, PET

Trajectory is generally flat-to-down for all commodity resins.

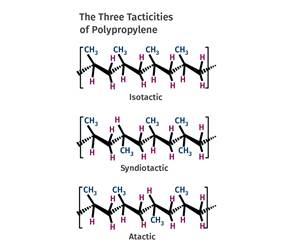

Read MoreFungi Makes Meal of Polypropylene

University of Sydney researchers identify two strains of fungi that can biodegrade hard to recycle plastics like PP.

Read MoreThe Fundamentals of Polyethylene – Part 1: The Basics

You would think we’d know all there is to know about a material that was commercialized 80 years ago. Not so for polyethylene. Let’s start by brushing up on the basics.

Read MoreFundamentals of Polyethylene – Part 5: Metallocenes

How the development of new catalysts—notably metallocenes—paved the way for the development of material grades never before possible.

Read MoreRead Next

See Recyclers Close the Loop on Trade Show Production Scrap at NPE2024

A collaboration between show organizer PLASTICS, recycler CPR and size reduction experts WEIMA and Conair recovered and recycled all production scrap at NPE2024.

Read MoreLead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read More