Generally Flat-to-Down for Prices of Volume Resins

PP, PVC are the exception with prices on ‘short-term’ upward trajectory.

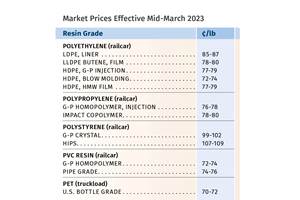

Second quarter appears to be heading to a close with prices of nearly all commodity volume resins flat, if not down. PVC suppliers were attempting to implement an increase last month to regain a lost one, and late-settling May propylene monomer contracts resulted in PP prices moving up, though that trajectory was expected to be short-lived.

This trend of largely flat prices is expected to continue into third quarter. Disrupters would include storm-related production outages, price spikes for crude oil, and how the tariffs shakes out.

Take a look of how our industry colleagues with pricing expertise view things for each of the major commodity volume resins. They’re purchasing consultants from Resin Technology, Inc. (RTi), Fort Worth, Texas; senior editors from Houston-based PetroChemWire (PCW); and CEO Michael Greenberg of the Plastics Exchange in Chicago.

▪ PE: Prices were flat in May, having increased by 3¢/lb in late April. Suppliers appeared to be postponing their May 3¢/lb price increase as they struggled to justify the earlier increase, according to Mike Burns, RTi’s v.p. of PE markets

In fact the outlook for June and July was for flat-to-lower prices according to both Burns and PCW senior editor David Barry. “Barring storm-related disruptions or some major global event, we could see more downward pricing impact through third quarter,” said Barry.

Burns emphasized that every single price driver was pointing to a flat-to-downward market, ranging from oversupply to lower global feedstock prices. He noted that oil price surges would be the only driver to reverse this trajectory and largely expected price increase attempts to dissolve along with good chance of seeing the April 3¢ increases shaved off.

The Plastic Exchange’s Greenberg reported it this way: “With additional new capacity slated to come online, some buyers are already hoping for that increase to be peeled back in June, but producers will do their best to hold it and defend their progress.”

He characterized the spot market going into June as plentifully supplied, reporting that after the April increase, buyers had been accessing the spot market for nicely priced deals and finding them. Spot PE prices were reported as having dropped 1¢/lb, except LDPE film and LLDPE injection grades which were flat.

▪ PP: Prices increased by 4.5¢/lb in May, in step with the late settlement of propylene monomer contract prices which settled at 40¢/lb. Projections for June and July were generally for flat pricing, with potential of slight movement down or up, according to both Scott Newell, RTi’s v.p. of PP markets and PCW’s David Barry.

Both Newell and Barry characterize the market as well supplied, owing to slower domestic and export sales, which were offset by some planned and unplanned production outages.

Newell and Barry also ventured that propylene monomer supplies should be in good shape as maintenance season was coming to an end. “The outlook is good for monomer supply and prices could slip back down, but even at 40¢/lb, the monomer’s price is historically low,” Newell said. Greenberg reported that spot monomer prices had eased by end of May, and the market sentiment had become “less frothy”, adding that spot PP prices dropped by 1¢/lb as an indication.

All three sources do not expect prices of PP, which will continue to follow the monomer, to rally back up to the high levels of years past (from Oct. 2018 to April 2019, PP prices dropped by nearly 25¢/lb). This, in particular, will be true if domestic PP demand continues to be weak in all major market sectors. “This has switched from a seller’s market for the last three years to a buyer’s market,” Newell said. Through April, domestic PP demand was at -1.2%, with total demand at +.8% due to exports.

▪ PS: Prices remained flat in May, were expected to rollover again in June, with a downward slide possible in July, after moving up 2¢/lb in March and 2-4¢/lb depending on contract terms in April, according to both PCW’s David Barry and Robin Chesshier, RTi’s v.p. of PE, PS and nylon 6 markets. “July has more potential for some price relief as buyers felt that a 4¢/lb price increase was too much,” Chesshier said. “I think they will become more aggressive to get off at least the 2¢/lb that suppliers attributed to flooding conditions in the Midwest.”

Chesshier noted that by end of April, supply was up 2% while demand was up only 1%, and exports for both monomer and PS were down by 17%. Both she and Barry characterized PS seasonal demand as lackluster, noting that it’s not where it should be traditionally, with plants operating at 72% capacity utilization in April, after an unprecedented sub-70% mark in the first quarter. According to Barry, the implied styrene cost based on a 30/70 formula of spot ethylene/benzene prices was up slightly at 26.1¢/lb as falling ethylene partly offset the benzene uptick.

▪ PVC: Prices dropped 2¢/lb in April, essentially nixing suppliers’ February increase. They were flat in May, but new 2¢/lb hikes, effective June 1, had emerged, according to both Mark Kallman, RTi’s v.p. of PVC and engineering resins, and PCW senior editor Donna Todd. “There are a lot of balls in the air of what could drive the success of the new 2¢/lb increase,” Kallman said. He cited lower feedstock prices contrasted by the potential for further increased demand following a slowed construction season along with one major supplier’s planned June maintenance shutdown, which could tighten supply.

PCW’s Todd noted that some buyers contended that the June price hike will not go through—at least fully. “While producers were talking about high resin demand and tight supply, buyers said that domestic demand has not been that hot so far this year and it was not all due to bad weather in the nation’s heartland, either. PVC said that if demand domestically and offshore was as strong as producers contend they would have been able to achieve more price increases this year.” Moreover, suppliers have not shared profit margins with resin buyers resulting from the 8.75¢/lb decrease in ethylene contract prices through April, with more expected, based on trending spot prices.

▪ PET: Prices dropped 1¢/lb at the start of June from mid-May levels, with imported PET available in the high 50¢/lb range delivered within 300 miles of ports on the West Coast, East Coast and in the Midwest. Domestically produced PET was 1-4¢/lb higher (60-63¢/lb range) for railcar business tied to monthly contracts using raw material costs as the pricing basis.

A surplus of PET imports and globally lower prices for raw material paraxylene were the major reasons for lower PET prices through much of second quarter, according to PCW Senior Editor Xavier Cronin. He noted that market sources expect domestic prices to stagnate at current levels through June and possibly into July, despite increasing demand for PET from bottle makers with the arrival of the high-consumption summer season for single-use beverages. “This, again, is the result of supply outpacing demand and lower prices for ‘raws’,” Cronin noted.

▪ ABS: Prices remained flat through most of second quarter in step with first quarter and this month was likely to follow, according to RTi’s Kallman. Key drivers include domestic demand that has been flat-to-down from all key market sectors and the imports factor. Prices in May, stood at very competitive levels due to the escalation of the trade war. “Countries like Taiwan and Korea are looking to cut down production rates as their margins are very low. Spot ABS import prices are already quite low…overall recovery of the domestic ABS market will be based on resolution of the trade war”, Kallman explained.

▪ PC: Prices were flat through much of second quarter, following suppliers’ concessions of 8-10¢/lb in first quarter contract settlements, according to RTi’s Kallman. He ventured that this trajectory would continue, despite some increases in raw material costs, which have still stood at much lower levels than those of 2018. Weaker domestic automotive demand and a late start to the construction season signaled some potential for further price concessions but inching up of raw material prices could serve to keep prices stable.

▪ NYLON 6 and 66 prices mostly flat.

Nylon 6 prices rolled over in April, having remained flat through first quarter, according to RTi’s Chesshier, who had projected as much, including a move by suppliers to increase prices in April. Suppliers issued increases of 6¢/lb, attributing the move largely to the temporary climb of benzene prices, but there was strong resistance from buyers. This because benzene prices eased off and there was oversupply. A key reason for the latter is relatively weak demand from the automotive sector, which has not rallied all year. Yet another factor was a nearly 17% increase in nicely priced European imports.

Nylon 66 prices remained largely flat through the first two months of second quarter as they had during the first, following the 2018 increases of 25-40¢/lb that was driven by globally tight supply of nylon 66 intermediaries. RTi’s Kallman characterizes the market as much more balanced; the result of a 10-month global softening in demand in the automotive sector coupled by incremental improvements in the supply chain.

Related Content

Prices Up for PE, ABS, PC, Nylons 6 and 66; Down for PP, PET and Flat for PS and PVC

Second quarter started with price hikes in PE and the four volume engineering resins, but relatively stable pricing was largely expected by the quarter’s end.

Read MorePrices of Volume Resins Generally Flat or Lower

Exceptions in early March were PP and PS, which moved up solely due to feedstock constraints, along with slight upward movement in PVC and PET.

Read MorePrices Up for PE, PP, PS, Flat for PVC, PET

Trajectory is generally flat-to-down for all commodity resins.

Read MorePrices of PP, PET Drop; PE, PS and PVC to Follow

Going into fourth quarter, prices of the five commodity resins were heading downward, barring supply interruptions.

Read MoreRead Next

Prices of PE, PP, PS Up; Flat-to-Down for PVC, PET

Potential for short-lived upward pricing trajectory possible for the polyolefins, PS.

Read MorePrices of Volume Resins to End First Quarter Largely Flat-to-Down; PS & PVC Move Up

Decline in raw materials, slowed demand, record-high inventories and lower-priced imports in some cases impacted most resins.

Read MoreFor PLASTICS' CEO Seaholm, NPE to Shine Light on Sustainability Successes

With advocacy, communication and sustainability as three main pillars, Seaholm leads a trade association to NPE that ‘is more active today than we have ever been.’

Read More