IHS Markit Analyzes U.S.-China Trade Relations & Implications for the Chemical Markets

Escalations in the U.S.-China trade dispute have driven both countries to respond with tariffs that could derail a global economic boom.

Here is an interesting take on the potential implications of the Chinese tariffs on the U.S. and global petrochemical and plastics industries from key IHS Markit experts.

Included are Mark Eramo, v.p., global business development, oil, midstream, downstream and chemicals; Debnil Chowdhury, executive director, natural gas liquids; Joel Morales, senior director, polyolefins Americas; Nick Vafiadis, v.p., plastics, and Hazel Kreuz, executive director, inorganics, discuss the potential implications of the Chinese tariffs on the U.S. and global petrochemical and plastics industries.

The recent global economic boom has greatly benefited the global petrochemical industry, which has enjoyed significant profitability across many sectors, according to new IHS Markit analysis of the recently announced Chinese tariffs. The U.S. industry, in particular, has experienced a renaissance in productivity and profitability due to its abundant supply of advantaged shale gas feedstocks, which has enabled the industry to invest significantly in capacity and new production, much of which is intended for export to feed hungry Asian and Chinese markets.

While the U.S. represents a country with many resources, including available investment capital, low-cost energy and feedstocks, as well as chemical technology, China represents the primary hub for future chemicals demand growth as it seeks to back-integrate within various value-chains to maintain an acceptable level of self-sufficiency in base chemicals.

China requires these basic chemicals, which serve as the building blocks used in the manufacturing of durable and non-durable consumer goods. These consumer goods are manufactured in China and are sold all over the world, and increasingly are consumed domestically, as China’s urbanization levels continue to rise.

Trade between the U.S. and China is a key and essential connection between the two countries. In 2017, the U.S. imported U.S. $505 billion in goods from China, and China imported U.S. $130 billion in goods from the U.S. The U.S.’s trade deficit of $375 billion was one of the key issues raised by the 2016 Trump presidential campaign, and now President Trump has made trade with China a major issue in 2018, with numerous tariffs imposed across many business sectors. The Chinese have responded in kind, with more tariffs on U.S. imports, many of which take aim at the petrochemical and plastics sectors.

The IHS Markit economics team has been very clear in stating that a potential trade war between the U.S. and China—which pits the world’s largest developed country and consumer against the world’s largest developing country and supplier—is one shock that could derail the global economic boom.

On March 22, 2018, based on the United States Trade Representatives’ (USTR) Section 201 investigation into China’s alleged intellectual property rights violations, the U.S. intends to impose a 25 percent tariff on U.S. $60 billion worth of imports from China. China responded within hours of the U.S. announcement with a tariff plan of its own.

China’s outlined tariff plan on U.S. imports is to be carried out in two phases covering 128 products with a total value of approximately $3 billion. On April 4, 2018, China announced additional retaliatory tariffs on U.S. products. The announcement included a proposal to impose up to 25 percent additional tariff on U.S. exports of 106 products worth about U.S. $50 billion per year, including several key petrochemical and plastics products, such as propane, a natural gas liquid and key chemical feedstock, as well as the polyethylene and vinyls (plastics) value chains.

As of April 6, 2018, the IHS Markit Chemical Week team reported President Trump has requested tariffs on an additional $100 billion of Chinese exports, further escalating the trade dispute between the U.S. and China. As noted previously, one of the significant risks to the IHS Markit forecast for an extended upcycle of profitability in the global chemical industry is the threat of an all-out trade war between the U.S. and China that would also envelop key U.S. allies. As of today, it appears that the probability of that threat has again increased.

While the trade of energy and chemicals represent a small portion of the total trade between the two countries, within a given petrochemical value-chain, the impact of a trade war could be significant. Most notably, we expect impacts to be experienced in the value chains of propane, polyethylene (PE)—which is the world’s most used plastic—and vinyls (EDC and PVC).

Propane

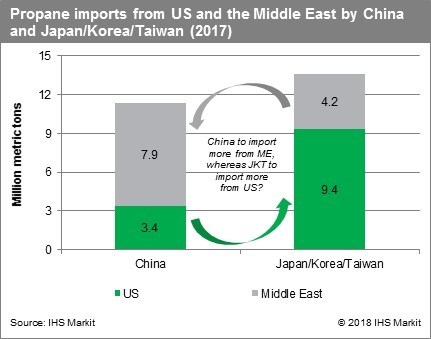

Regardless of any Chinese tariffs in place, U.S. propane production will likely continue to increase, since LPG (liquefied petroleum gas or propane) is produced as a by-product of refining and natural gas processing. In the near-term, Mont Belvieu (Texas) propane prices (the U.S. benchmark) could face downward pressure if China reduces import volumes from the U.S. In 2017, the U.S. exported 3.4 million metric tons to China of propane, according to IHS Markit.

While the additional propane volumes produced in the U.S. could be used as olefins cracker feedstock, this will not be enough to offset the ‘lost’ volumes to China, therefore U.S. LPG volumes will need to be exported to an alternate market location.

Unlike ethane, propane is a much more liquid market and fungible. The expectation is that the China tariff will result in a propane trade rebalancing. For example, Northeast Asia currently takes heavy volumes of LPG from both the U.S. and the Middle East. The market reshuffle is likely to result in Japan and Korea taking more LPG from the U.S., while China will take more LPG from the Middle East, to adapt to the situation.

Of course, there are likely some constraints in the near-term, due to term-contract obligations and other considerations. Further, IHS Markit expects price signals to incentivize such a rebalancing act. For example, the U.S./Asia arbitrage will likely increase for Japan and Korea, whose traders will view U.S. propane as an attractive sourcing option. With that said, the arbitrage is not expected to increase the level of Japanese and Korean demand for U.S. propane that the 25 percent tariff increase would require to offset the lost demand from China.

In summary, the global propane market is efficient enough to find a ‘new norm’ if the proposed tariffs are implemented. There are likely to be short-term inefficiencies before achieving a ‘steady state new norm’ caused by short-term contractual obligations and the allowance of enough time for pricing signals to incentivise the global rebalancing of the market.

Polyethylene

The additional retaliatory tariffs announced by China for U.S. products includes certain grades of polyethylene. There are still many unknowns that make estimating the impacts more challenging—the timing of the implementation of announced tariffs is unclear, and there is uncertainty as to whether or not the list of effected products will be expanded.

According to the trade codes released in the official document, PE products impacted include HS code 39011000, 39014090 and 39019090. Trade code 39011000 covers mainly low-density polyethylene products, and in 2017, China reported 155,000 metric tons of imports from the U.S. under this HS code. Trade code 39014090 refers to metallocene LLDPE (linear low-density polyethylene), a specialty grade of LLDPE. In 2017, China imported slightly more than 20,000 metric tons of products from the U.S. under this code.

Finally, 39019090 refers to polyolefin elastomer and polyolefin plastomer, which are non-commodity grades of polyethylene. Approximately 54,000 metric tons of these products were exported from the U.S. to China in 2017, under the 39019090 code. To summarize, LDPE is the major PE grade impacted by the announcement, LLDPE is limited to non-commodity grades, while high-density polyethylene (HDPE) will not be affected by the current tariffs.

China is a major importer of all three resin types, with HDPE and LLDPE, in particular, being in tight supply, so it is understandable why HDPE and commodity LLDPE may have been excluded from the list. Currently, China is about 60 percent self-sufficient in terms of overall PE consumption.

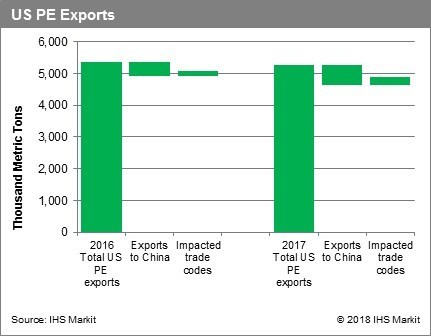

In 2017, total U.S. PE exports to China were just under 1 million tons, with exports to China representing about 17 percent of the total PE exports from the U.S. The majority of PE exports from the U.S. to China have historically been associated with HDPE, while LDPE exports represented about 14 percent of the total U.S. PE export to China.

If the tariffs go through as proposed, we are likely to see some producers optimize their global footprint by exporting more products from the U.S. to Europe, while supplying China from their Middle East or Asia-based facilities. No doubt some shuffling will occur and trade will rebalance.

IHS Markit expects minimal impact on U.S. prices unless this situation lasts into 2019 and beyond, when new LDPE capacity is expected to come online. IHS Markit also expects more than 1 million metric tons of new LDPE capacity to start up by the end of 2019, including projects from Dow, Formosa and Sasol. Most of the production from this new LDPE capacity had been targeted to the export market (China) and some may be redirected to the domestic (U.S.) market. If tariffs are implemented, it could create increased competition for market share in the U.S., thereby impacting LDPE prices and margins.

Vinyls Value Chain

The China tariffs announced include categories that impact U.S. exports to China of ethylene dichloride (1, 2-Dicloroethane), polyvinyl chloride and the production of epichlorohydrin for epoxy resin exports to China. All tariff values are 25 percent and the impact on epichlorohydrin is minimal.

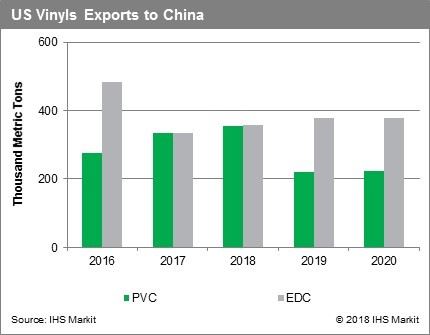

The U.S. exports between 300,000 metric tons and 350,000 metric tons of ethylene dichloride (EDC) to China annually, virtually all of which is consumed for PVC (polyvinyl chloride) and solvents production. Exports to China account for about 2 percent of U.S. EDC production and about 24 percent of U.S. EDC exports. Chinese EDC capacity is insufficient to make up the deficit if imported EDC in that quantity were to cease.

However, current EDC production rates are sufficiently low in the Middle East, that the 25 percent tariff would open an arbitrage window for EDC supply from the Middle East to China, rather than the 25 percent tariff being passed on as higher prices to Chinese buyers, provided that sufficient ethylene is available in the Middle East to increase EDC rates accordingly. A side benefit to Middle East EDC producers would be higher chlor-akali operating rates, which would generate additional caustic soda, a commodity currently enjoying high market prices.

Because U.S. EDC producers have limited alternative destinations for EDC exports displaced from China, IHS Markit projects that U.S. operating rates for EDC would be reduced to avoid excess product in the domestic (U.S.) or contract export markets. Reduced EDC operating rates would necessitate reduction in U.S. chlor-alkali operating rates by 1 to 1.5 percent at plants integrated to EDC exporting facilities. The reduction in chlor-alkali rates would, in turn, reduce caustic soda production. Caustic soda trade flows would shift as Middle East caustic soda production rises concurrent to the decrease in U.S. production, offsetting any expected impact on caustic prices as a result of the EDC tariff.

The U.S. exports approximately 300,000 metric tons of polyvinyl chloride (PVC) to China annually. PVC exports to China account for approximately 4 percent of U.S. PVC production and approximately 11 percent of U.S. PVC exports. In contrast to EDC, Chinese PVC operating rates could be increased to supply an equivalent amount of PVC to the domestic market with no imports from the U.S. However, IHS Markit estimates that the cost to produce the incremental PVC production in China would be approximately 5 to 10 percent higher than U.S. imported PVC prices before the imposition of the 25 percent tariff. Therefore, IHS Markit believes that rates would be increased at acetylene carbide (AC) PVC plants in China to compensate, rather than importing more expensive PVC from the U.S.

A side effect of the increased AC PVC operating rates in China would be an increase of about 200,000 metric tons of caustic soda production in China on an annual basis. Due to the location of AC PVC plants in China, and the relatively small amount of caustic soda co-product production, IHS Markit does not think the additional caustic soda production would materially impact global caustic soda prices. (Note: IHS Markit’s assessment of potential impacts due to tariffs on PVC exports from the U.S. to China is independent of the assessment regarding whether duty drawback provisions exist and would potentially mitigate the impact of PVC tariffs if PVC is being imported into China and used to fabricate end-products that are re-exported.).

The Bottom Line

As the trade rhetoric between the U.S. and China continues to heat up, it is important for U.S. companies that rely heavily on exports to China to begin to identify alternative market scenarios if tariffs are imposed that would make their U.S. products non-competitive. It is also critical to look at U.S.-China trade from a global trade-balance perspective, as the implementation of tariffs will cause a rebalancing over time, as contracts play out and new arbs open and close.

Related Content

Polyethylene Fundamentals – Part 4: Failed HDPE Case Study

Injection molders of small fuel tanks learned the hard way that a very small difference in density — 0.6% — could make a large difference in PE stress-crack resistance.

Read MoreFirst Quarter Looks Mostly Flat for Resin Prices

Temporary upward blips don't indicate any sustained movement in the near term.

Read MoreImproving Twin-Screw Compounding of Reinforced Polyolefins

Compounders face a number of processing challenges when incorporating a high loading of low-bulk-density mineral filler into polyolefins. Here are some possible solutions.

Read MoreFundamentals of Polyethylene – Part 5: Metallocenes

How the development of new catalysts—notably metallocenes—paved the way for the development of material grades never before possible.

Read MoreRead Next

People 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read MoreMaking the Circular Economy a Reality

Driven by brand owner demands and new worldwide legislation, the entire supply chain is working toward the shift to circularity, with some evidence the circular economy has already begun.

Read More

.jpg;width=860)

.jpg;width=860)

.jpg;width=860)