PE Film Market Snapshot 2020: T-Shirt Bags

Coronavirus concerns have made some governments reverse bans on the books, but the T-shirt market is projected to be flat through the next three years.

This is the third in a series of blogs based on 2019-2020 research conducted by market-research firm Mastio & Co., St. Joseph, Mo. on key markets for processors of polyethylene film. There will be 10 articles in all, two a week. The first five will offer Mastio’s analysis—based on interviews with processors conducted direct by the Missouri firm—with film processors representing the five largest PE film markets. The second batch of five will be focused on the five fast-growing PE film markets.

The first of these blogs analyzed the stretch film market. The second focused on consumer/institutional product liners. Here we turn our attention to T-shirt bags.

The T-shirt bag first appeared in Canada during the late 1970s, Mastio reports. The U.S. market began large-scale conversion from Kraft paper grocery bags to plastic in the early 1980s. At first, T-shirt bags in the U.S. were slowly accepted among grocers and consumers. During the 1980s, a common question asked in grocery stores was “paper or plastic?”, and paper was the most common choice. Plastic T-shirt bags were new in the bag market, and many grocery stores and consumers were unaware of the many benefits associated with using them. But that changed in short order as the plastic T-shirt marked started to soar.

Consumer views and ideals have again changed drastically regarding plastic bags. In 2019, eight states, including California, Connecticut, Delaware, Hawaii, Maine, New York, Oregon and Vermont, have passed laws banning single-use plastic bags. However, the law contains an exception that allows stores to sell reusable thicker plastic bags for 10ȼ each. With all the discussions around single-use bag bans, many environmentalists claimed victory, while many businesses claimed government overrun. Ultimately, T-shirt bags and plastic shopping bags made from plastic film remain commonplace in checkout lines.

The Numbers

During 2019, approximately 1.093 billion lb of PE was consumed in the North American production of T-shirt bags, making it the fourth-largest PE film market. With a flat to declining average annual growth rate of 0%, Mastio projects PE resin consumption for T-shirt bags to decrease to 1.092 billion lb by 2022.

The Players

According to Mastio, during 2019, the top three producers of PE T-shirt bags in North America were Novolex; Advance Polybag Inc.; and Superbag Corp. Collectively, these companies processed 794.7 million lb of PE in the production of T-shirt bags for a combined market share of 72.7%.

The Resins

During 2019, T-shirt bags were primarily constructed of HMW-HDPE and UHMW-HDPE resin. However, some film processors of T-shirt bags use LDPE and LLDPE when there is a desire for a strong bag that has improved printing properties, a softer texture, and more surface gloss. The various grades of LLDPE resin utilized included the following: LLDPE-butene, LLDPE-hexene and LLDPE-super hexene. LDPE homopolymer resin was also incorporated in the production of T-shirt bags.

The Processing Trends

This is entirely a blown film market, and nearly 70% of the market is single-layer extrusion. Coex structures are typically three layers.

The Future

Currently, single-use plastic film and bag bans are a major factor affecting many PE film markets. However, environmentalists talk about a so-called loophole that they maintain has undermined the plastic bag ban. Companies are now manufacturing reusable thicker T-shirt style bags in place of single-use T-shirt bags. The new bags, classified as reusable, closely

resemble the single-use bag and are often thrown away after one use. Still, the reusable bags satisfy the law because they can be used 125 times without falling apart. The reusable t-shirt bag was partially intended to stem carbon emissions created by manufacturing the bags, but thicker plastic bags are still made from fossil fuels and have a limited lifespan.

Because of the Coronavirus pandemic, many government have reversed bag bans on the books for fear that the reusable sacks will harbor bacteria. Mastio, though, expects these bans to be put back in place once COVID-19 fears fully subside.

Related Content

How to Select the Right Cooling Stack for Sheet

First, remember there is no universal cooling-roll stack. And be sure to take into account the specific heat of the polymer you are processing.

Read MorePart 2 Medical Tubing: Use Simulation to Troubleshoot, Optimize Processing & Dies

Simulation can determine whether a die has regions of low shear rate and shear stress on the metal surface where the polymer would ultimately degrade, and can help processors design dies better suited for their projects.

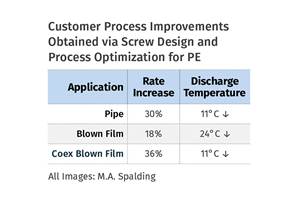

Read MoreHow Screw Design Can Boost Output of Single-Screw Extruders

Optimizing screw design for a lower discharge temperature has been shown to significantly increase output rate.

Read MoreRoll Cooling: Understand the Three Heat-Transfer Processes

Designing cooling rolls is complex, tedious and requires a lot of inputs. Getting it wrong may have a dramatic impact on productivity.

Read MoreRead Next

PE Film Market Analysis: Frozen Foods

Near-term growth looks good but millennials' desire for fresh meal solutions could impact longer-term growth..

Read MorePE Film Market Analysis: Cheese Packaging

Market is projected to grow by 4.4% over the next three years. Coextruded blown film structures dominate.

Read MorePE Film Market Analysis: Geomembrane Liners

Market to average 3.4% growth over the next two years.

Read More