Polyolefin Pricing Update: Moving Towards May

Looks like PE prices remain flat while PP prices are poised for bigger drop than previously thought.

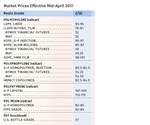

A little before mid-April, as I scrambled to put a finishing touch on our May issue’s resin pricing column, it appeared that PE prices could possibly rise this month once again, though a peak was also being projected, while PP prices had indeed reached their peak and were poised for a drop. Let’s take a look at how things might actually shake out at this stage for each resin:

● Polyethylene: So, suppliers got the first part of their 6¢/lb price hike in March, and were aiming for the other half this month. Mike Burns, v.p. of client services for PE at Resin Technology, Inc. (RTi), noted that the implementation of the April increase was largely dependent on the speed of recovery of supplier inventories, which he thought would take place in May, if not earlier. He also ventured that if not implemented in April, this price hike had little chance for implementation in May.

The latest from PetrochemWire (PCW) is that spot PE prices have been flat-to-lower, with most grades well supplied. This, with the exception of injection-molding grade HDPE, which has been tight as a result of several production disruptions. Moreover, on the contract side of things, PCW reported that some suppliers had send out customer notifications that the 3¢/lb April increase was being postponed to May 1.

● Polypropylene: Having moved up 4¢/lb in March, in step with propylene monomer, it surely appeared that this was the peak for prices, according to all our key industry sources. By the first days of April, spot monomer prices had swiftly dropped by 8¢/lb to 40¢/lb. While the April propylen contracts will follow the new late-settling trend for the monomer, Scott Newell, RTi’s v.p. of PP markets, ventured a drop of at least 2¢/lb, but more likely a 4-6¢ drop, with PP prices following accordingly.

PCW recently reported that spot PP prices continued to slide due to falling monomer prices. Also, that spot prime availability was reportedly limited because suppliers have been throttling back production output to avoid inventory buildup with higher-cost monomer. At the same time, PCW reported that offgrade PP availability appeared to be ample.

Meanwhile, Michael Greenberg, CEO of Plastics Exchange, The reported that as monomer spot prices continue to weaken, April contracts have the potential to drop by 5-8¢/lb. “Now that the monomer bubble has burst, PP processors are expecting a healthy share of producers’ costs savings.” He also noted that while lower prices are nearly always welcomed by processors, a decrease this month (April), could pose problems for some in their efforts to pass prior increases downstream to their customers.

Related Content

-

Polyethylene Fundamentals – Part 4: Failed HDPE Case Study

Injection molders of small fuel tanks learned the hard way that a very small difference in density — 0.6% — could make a large difference in PE stress-crack resistance.

-

Fundamentals of Polyethylene – Part 5: Metallocenes

How the development of new catalysts—notably metallocenes—paved the way for the development of material grades never before possible.

-

First Quarter Looks Mostly Flat for Resin Prices

Temporary upward blips don't indicate any sustained movement in the near term.