Study Examines On-Purpose Propylene Technologies

IHS Markit sees on-purpose production of propylene as critical in meeting future demand for plastics.

A new report and supporting analytics from Houston-based IHS Markit, indicates that the market is hungry for adequate sources of propylene supply and newer technologies for producing on-purpose propylene are critical to meeting the demand for plastics that utilize propylene as a building block—primarily PP (the world’s largest volume plastic; larger than LLDPE but not more than the three PE types combined), ABS, as acrylonitrile is a key derivative of propylene, as well as nylon 66. In the case of the final material, for example, we have reported on Houston-based Ascend Performance Materials, which has become the world’s only completely fully integrated nylon 66 producer that uses the propane dehydrogenation (PDH) method—or, C3-based technology to make the key intermediate (AND) (adiponitrile) compared to the more widely used C4 butadiene-based approach.

The report, Competitive Processes and Cost Tracker (CPCT) On-Purpose Propylene Production, assesses the technical and economic merits and challenges of the various on-purpose technologies. “Our IHS Markit research sought to examine the strength and benefits, from a technical and regional economic perspective, of the six on-purpose propylene production technologies currently gaining traction in the commercial marketplace,” said Don Bari, v.p. of IHS Markit and lead author of the report.

Whereas steam crackers and oil refineries have been the traditional sources of propylene as a derivative or co-product of crude oil processing, they no longer yield the supply of propylene the market requires due to the shift in feedstocks from naphtha (derived from crude oil) to ethane (derived from natural gas) in North America. In the case of the latter, the shift to ethane-based crackers, which produce very low yields of propylene, will continue to accelerate in the shortfall in propylene volumes derived as a co-product from traditional sources for the next five years at least. As such, IHS Markit forecasts the demand for on-purpose propylene production will continue to escalate.

Bari acknowledges that ethane feedstocks are providing significant advantages for producers with U.S. plants. However, the cost advantages are not without tradeoffs for the petrochemical and polymers industries as a whole—such as the ability to maintain an adequate supply of propylene. “Fortunately, the industry is very technologically driven—we’re problem solvers by nature, so companies are willing to invest in new and emerging technologies to find viable solutions,” said Bari.

The six primary propylene on-purpose technologies assessed by the report include propane dehydrogenation (PDH); coat-to-olefins/coal-to-propylene (CTO/CTP); methanol-to-olefins/methanol-to-propylene (MTO/MTP); gas-to-olefins (GTO); metathesis; and high-severity fluidized catalytic cracking (HS-FCC). Each uses a different feedstock and has advantages and challenges that differentiate them.

At this point in time, PDH units dominate, with about 40% of the global on-purpose propylene capacity today, and stakeholders for those facilities expect they will remain competitive due to attractive propane feedstock cost and abundant supply in/from the U.S., explained Bari. “Nevertheless, the challenge is that when companies invest in process technologies, they are making multi-billion dollar investments, which must be sustainable for a 30-year period….During that time, market conditions, feedstock prices and availability will vary, often significantly, so companies really want to be able to interrogate the cost data against a host of variables over time, to minimize investment costs.”

Bari and his fellow researchers, keeping this in mind, used the company’s CPCT analytical model to assess the different on-purpose technologies over a 20-year period, which accounted for a large fluctuation in feedstock prices. What they determined was that the PDH process would have been the most economically competitive in the U.S.

Since the year 2000, they estimated that PDH would have had an average production cost (including depreciation) of $405/metric ton, (with feedstock and co-products taken at market price); but a metathesis-based plant would have had an average $47/m.t. disadvantage over naphtha-cracker-based propylene.

More importantly, a hypothetical CTP-based facility also would have been at an advantage over a naphtha-based technology by $202/m.t. An interesting aspect for the CTP route is the fact that IHS Market estimates for the four-year period of fourth quarter 2010 to third-quarter 2014, CTP-based propylene production was the most competitive on-purpose propylene technology. The process delivered an estimated $215/m.t. production cost advantage over the PDH route.

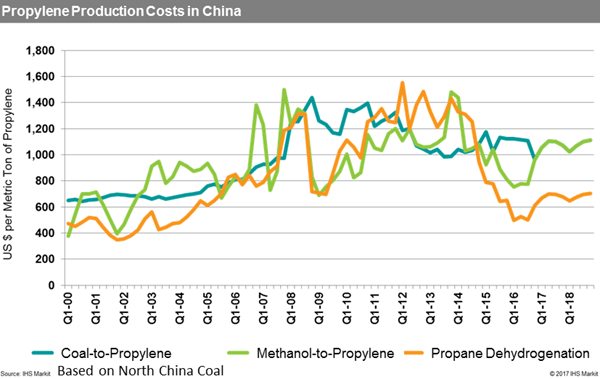

Bari stressed that a time-based analysis proves to be critical in technology selection, and added that this exemplified by the propylene production technology situation in China. “China is in a very deep propylene monomer and derivatives-deficit position. Therefore, during the last decade, China has developed and deployed on-purpose propylene in significant volumes based on technology that takes advantage of its indigenous low-cost coal.”

The IHS Markit analysis determined that during the three-year period of fourth quarter 2005 to third-quarter 2008, and then again in the four-year period of first-quarter 2011 to fourth-quarter 2014, coal-based technology, on average, (based on North China coal prices) has a $100/m.t. production cost advantage over the PDH route.

This advantage is due to the low and relatively stable price of coal as compared to very cyclical (and imported propane), especially during 2011 and 2015, where PDH raw material costs (per ton propylene manufactured) have moved from $420 up to $1060 but most recently, declined rapidly to $309. The CTP route raw that material costs by contrast, have moved in a relatively flat range of $140 to $360 per ton of propylene in the same period.

Summed up Bari:

“Perhaps, once all is considered, particularly giving weighting to the importance of access to inexpensive feedstocks, which is the majority of the cost for on-purpose production, PDH is favored in nearly all regions, with the exception of China…It must also be noted that, even with its fairly rapid commercial success, PDH is still a relatively young technology and has been plagued with operations stability issues. Moreover, new licensors are continuing to introduce ‘improved’ PDH processes, which are discussed in greater detail in our report.”

Related Content

Fundamentals of Polyethylene – Part 3: Field Failures

Polyethylene parts can fail when an inappropriate density is selected. Let’s look at some examples and examine what happened and why.

Read MorePrices for All Volume Resins Head Down at End of 2023

Flat-to-downward trajectory for at least this month.

Read MorePrices of All Five Commodity Plastics On the Way Up

Despite earlier anticipated rollover in prices for most of the volume commodity resins, prices were generally on the way up for all going into the third month of first quarter.

Read MoreFundamentals of Polyethylene – Part 6: PE Performance

Don’t assume you know everything there is to know about PE because it’s been around so long. Here is yet another example of how the performance of PE is influenced by molecular weight and density.

Read MoreRead Next

Making the Circular Economy a Reality

Driven by brand owner demands and new worldwide legislation, the entire supply chain is working toward the shift to circularity, with some evidence the circular economy has already begun.

Read MoreBeyond Prototypes: 8 Ways the Plastics Industry Is Using 3D Printing

Plastics processors are finding applications for 3D printing around the plant and across the supply chain. Here are 8 examples to look for at NPE2024.

Read MoreSee Recyclers Close the Loop on Trade Show Production Scrap at NPE2024

A collaboration between show organizer PLASTICS, recycler CPR and size reduction experts WEIMA and Conair recovered and recycled all production scrap at NPE2024.

Read More