Mixed Outlook for Construction

When the U.S. economy is functioning at its best, a vibrant construction sector generates a lot of jobs and consumes lots of materials.

When the U.S. economy is functioning at its best, a vibrant construction sector generates a lot of jobs and consumes lots of materials. Plastic building materials such as pipe, siding, and profiles quickly come to mind, but a thriving construction sector also uses a voluminous amount of injection molded pails and pallets, extruded films, and blow molded bottles.

When everything is considered, every dollar spent on construction projects generates $6 worth of activity for the economy at large. So to say that a sustainable, long-term economic recovery relies on strong construction activity is an understatement.

For three years after the last recession, the severely damaged construction sector was a drag on the overall economy. This situation started to change in 2012 as the early-stage rebound in the residential segment began. This year, construction of new houses will make a significant contribution to economic growth in the U.S. The two other major categories of construction projects, private non-residential and public (a.k.a. government-funded), will continue to sputter.

Private residential construction spending, which includes money spent on additions, alterations, and repairs as well as new housing starts, is by far the strongest segment so far this year. Through the first three months of 2013, total private residential spending is up more than 17% compared with the same period last year. The recent boom in the multi-family category is winding down, and spending on home improvements will decelerate as a result of the increase in the top income tax rate and the expiration of the payroll tax holiday. So the overall rate of growth will decelerate as this year progresses.

The good news is that the construction of single-family homes is gaining momentum. This will provide welcome relief for processors of siding, profiles, pipe, and barrier films. The total number of new houses started in 2013 is expected to exceed 1 million for the first time since 2007.

In a healthy economy, the number of new houses needed to keep up with new household formations, to replace obsolete stock, and to replace the homes lost to storms, floods, and fires is 1.5 million units. We are not likely to get to this level for another year or two. So there is still a lot of upside to this segment once we straighten out the economic fundamentals.

The private non-residential sector comprises a broad range of categories. So far in 2013 the total amount spent all of these projects is up 3% from 2012. I expect the overall non-residential total to come in flat or modestly higher this year than in 2012. It will be at least another year before this sector starts to contribute significantly to U.S. economic growth.

Now for the bad news. Total public construction spending in the first quarter of this year was down more than 5% compared with Q1 of 2012, and this decline will get worse as we progress through this year due to the federal spending sequester. Government revenues have been essentially flat for the past few years, so any increases in spending have been financed by debt. Government spending on infrastructure projects is a good investment for future economic growth, but even these projects are likely to meet strong resistance until government revenues start to rise as a result of stronger growth in the overall economy.

WHAT THIS MEANS TO YOU

•The trend in housing starts is a leading indicator of future economic activity by consumers. These data are recovering from a very depressed base, but the rate of growth is robust. You should keep track of these numbers.

•Despite sluggish demand from many sectors, the price of building materials remains quite high.

•Plastic products that are cheaper to manufacture, ship, install, and maintain should be well positioned to penetrate further into markets for more traditional building materials.

About the Author

Bill Wood, an economist specializing in he plastics industry, heads up Mountaintop Economics & Research, Inc. in Greenfield, Mass. Contact BillWood@PlasticsEconomics.com.

Related Content

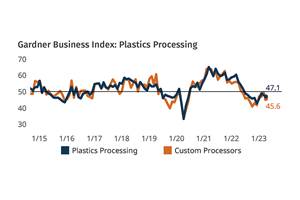

Plastics Processing Activity Near Flat in February

The month proved to not be all dark, cold, and gloomy after all, at least when it comes to processing activity.

Read MorePlastics Index Shows Supply Chain Improvement Despite Production Slowdown

Future expectations reach 2024 high on the heels of the recent election.

Read MorePlastics Processing Continued Contraction in April

Despite some index components accelerating and others leveling off, April spelled contraction for overall plastics processing activity.

Read MoreProcessing Making Slow, Steady Progress

Plastics processing activity didn’t make its way into expansion territory in March, but seems headed in that direction.

Read MoreRead Next

People 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read MoreFor PLASTICS' CEO Seaholm, NPE to Shine Light on Sustainability Successes

With advocacy, communication and sustainability as three main pillars, Seaholm leads a trade association to NPE that ‘is more active today than we have ever been.’

Read MoreBeyond Prototypes: 8 Ways the Plastics Industry Is Using 3D Printing

Plastics processors are finding applications for 3D printing around the plant and across the supply chain. Here are 8 examples to look for at NPE2024.

Read More