Outlook for Consumer Goods: Moderately Improve

Wood on Plastics

Our forecast for total U.S. production of consumer goods calls for a gain of 3% in 2012 following a rise of just over 2% in 2011.

Our forecast for total U.S. production of consumer goods calls for a gain of 3% in 2012 following a rise of just over 2% in 2011. This forecast is based on continuation of the prevailing economic fundamentals that have the greatest effect on consumer spending. These include moderate improvement in the employment data, stability in house prices, a gradual increase in access to credit, and slow but steady gains in household incomes. The risks to this forecast are biased towards the downside at the present time, but we expect 2012 to be moderately better than 2011 for most suppliers of consumer products.

The accompanying chart shows the rate of growth in U.S output of consumer goods. Production of these goods declined by 1% during the recession of 2001, and output plunged by 8% in the Great Recession of 2009. Current production of consumer goods in the U.S. is still not back to its pre-recession level.

One other trend that bears mentioning is that, excluding periods of recession, the long-term annual growth rate for consumer products is only in the range of 1-2%. This is close to the overall rate of growth in the number of households in the U.S. and it is actually a bit higher than the average annual gain in median household income over the past decade. So from a perspective of long-term demographic trends, the consumer products sector tends to chug along at an “average” rate of growth. But that is not the only factor that has significantly affected the gains in this sector in recent years.

Though there are no official statistics to prove it, most people would agree that both the volume and array of consumer products available to American consumers have expanded at a much faster rate than 2% annually in recent years. And a case can certainly be made that the prices of many of these products have actually declined. So except during times of recession, the actual volume of consumer products purchased by Americans tends to grow faster than 2%/yr. For the past two decades, this rising demand has been met by increasing the level of imports of consumer products.

It is no secret that these industries have been buffeted in recent years by imports from countries such as China, and this will continue to be the case for the foreseeable future. But there is mounting evidence to suggest that this trend will also improve gradually in the coming years. There are several reasons for this. Though it is still very early in the process, the Chinese middle class is expanding, and therefore China’s economy is slowly shifting towards producing for its own domestic consumption rather than export.Global energy and materials prices are rising at a rate that will make it increasingly expensive to ship low-margin products from Asia. Global financial forces continue to exert upward pressure on the value of the Chinese currency. And finally, there is a rising consciousness among American consumers that paying a bit more for domestically manufactured products is actually cheaper in the long run.

WHAT THIS MEANS TO YOU

•Consumer products designed to mitigate rising food and energy prices will become increasingly attractive.

•Be aware of demands imposed by big-box retailers such as Wal-Mart that their suppliers furnish products containing recycled content or that are in some way “sustainable.” These demands will trickle down to you.

•It won’t happen overnight, but China will eventually become less of a force in this market.

Related Content

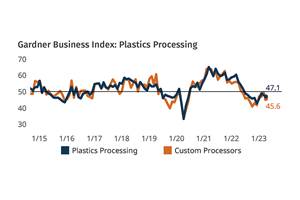

Processing Making Slow, Steady Progress

Plastics processing activity didn’t make its way into expansion territory in March, but seems headed in that direction.

Read MorePlastics Processing Continued Contraction in April

Despite some index components accelerating and others leveling off, April spelled contraction for overall plastics processing activity.

Read MoreProcessing Megatrends Drive New Product Developments at NPE2024

It’s all about sustainability and the circular economy, and it will be on display in Orlando across all the major processes. But there will be plenty to see in automation, AI and machine learning as well.

Read MorePlastics Processing Activity Contracted in July

Plastics processing GBI contracted for the third month in a row.

Read MoreRead Next

Making the Circular Economy a Reality

Driven by brand owner demands and new worldwide legislation, the entire supply chain is working toward the shift to circularity, with some evidence the circular economy has already begun.

Read MoreLead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read MoreFor PLASTICS' CEO Seaholm, NPE to Shine Light on Sustainability Successes

With advocacy, communication and sustainability as three main pillars, Seaholm leads a trade association to NPE that ‘is more active today than we have ever been.’

Read More