Resin Buying Strategies: Softer Prices Ahead

This month, we are launching a new format for our monthly column on resin pricing, which now focuses on “benchmark” grades of the four main “commodity” resins—PE, PP, PS, and PVC.

This month, we are launching a new format for our monthly column on resin pricing, which now focuses on “benchmark” grades of the four main “commodity” resins—PE, PP, PS, and PVC. The content of this article each month will be based on analysis of global feedstock, resin, and economic trends by resin purchasing consultants at Resin Technology, Inc. (RTI), Fort Worth, Texas. A new feature is RTI’s “suggested action strategies” for resin buyers.

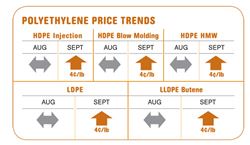

Our new pricing chart, based on data gathered by Plastics Technology, now focuses on the market prices of just the benchmark grades of commodity resins, supplemented by the latest North American short-term futures contracts from the London Metal Exchange (LME) for benchmark grades of LLDPE and PP.

Polyethylene prices moved up 4¢lb in October, representing full implementation of the Sept. 1 hike. Now totaling 17¢/lb for the year, PE price increases have outpaced feedstock costs, affording suppliers some margin enhancement. However, resin exports have been receding since June, domestic demand remains lackluster at best, and feedstock costs have dropped. This is indicated by the secondary market, where there are fresh offers for most PE grades, with the exception of octene LLDPE, which is a little tighter in supply.

Spot ethylene prices in September averaged about 29¢/lb—about 12% lower than their highest level in June. Resin producers’ operating rates averaged in the mid-90s. The low was 80% to 85% for LDPE and the high was nearly 100% for LLDPE. Supplier inventories grew slightly, but they still average only 34 days, one of the lowest levels on record, vs. a normal 42 days. Demand rates for LDPE are at 85% of capacity, though LLDPE is at 90%.

Outlook & Suggested Action Strategies

30-Day: Following implementation of the last PE price increase in early October, prices should be flat, with some reduction possible if exports and feedstock prices subside and suppliers’ inventories grow.

60-90 Day: Watch feedstock prices as a likely indicator for resins.

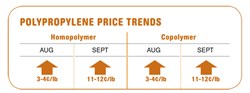

Polypropylene prices moved up 11¢ to 12¢/lb in September as producers implemented Sept. 1 hikes based on sharply higher monomer costs. September propylene contracts rose 12¢ to 57¢/lb. But the picture was changing fast. PP sales through September weakened significantly and suppliers responded with substantial production cutbacks.

This led resin producers into the secondary markets, where wide-spec and off-grade resin was available at well below the September monomer contract price of 57¢/lb. Some brokers even offered prime material at below contract prices. This clearly indicates that the market is not supporting high prices and excess inventory is accumulating.

PP exports have dropped dramatically, as the U.S. has priced itself out of overseas markets. Domestic demand also continues to suffer, with many processors reporting slow sales and reduced production. September’s resin demand was 85% to 90% of capacity.

Meanwhile, resin plant operating rates have been in the 80% to 85% range all year, with even lower rates in September. Producers’ inventory remains low—around 29 to 31 days. Although RTI analysts suspect that there has been some inventory build-up, they don’t expect a big increase because producers have responded quickly to changing demand.

Propylene monomer is still tight. Monomer contract prices for October dropped 10¢/lb to 47¢/lb. They could fall even lower this month.

Outlook & Suggested Action Strategies

30-Day: Buy as needed. Prices are at yearly highs but they should move lower over the next month or two.

60-90 Day: Soft demand and additional monomer supply should help resin buyers. Buy as needed.

Polystyrene prices dropped 5¢/lb in September and were expected to fall another 3¢ to 5¢ in October. After failing to implement two August price hikes totaling 10¢ to 11¢/lb, PS suppliers were considering a 5¢ decrease in contract prices. This would net them 3¢/lb additional margin, based on dropping monomer prices.

From May through August, suppliers issued a total of 22¢ to 23¢ worth of hikes, only 12¢ of which was implemented. That upward trend came to a halt as a result of continued weak demand coupled with the 25% drop in September benzene contract prices. That resulted in an 8¢/lb decrease for styrene monomer, which reduced the production cost of PS by an equal amount. Suppliers are delaying any cut in resin prices. Inventories continue to be squeezed tighter as demand continues to shrink. So far this year, PS demand is off about 16%. PS plant operating rates are at 79% and demand rates are 75% to 77% of capacity.

| Market Prices Effective October | |

| (Source: Plastics Technology) | |

| Resin Grade | ¢/lb |

| POLYETHYLENE (RAILCAR) | |

| LDPE, LINER | 70-72 |

| LLDPE, BUTENE, FILM | 65-67 |

| 40.6 |

| HDPE, G-P INJECTION | 65-67 |

| HDPE, BLOW MOLDING | 64-66 |

| HDPE, HMW FILM | 66-68 |

| POLYPROPYLENE (RAILCAR) | |

| G-P HOMOPOLYMER, INJECTION | 73-75 |

| 40.1 |

| IMPACT COPOLYMER | 75-77 |

| POLYSTYRENE (RAILCAR) | |

| G-P CRYSTAL | 64-66 |

| HIPS | 69-72 |

| PVC RESIN (RAILCAR) | |

| G-P HOMOPOLYMER | 50-51 |

| PIPE GRADE | 47 |

By September, wide-spec PS prices were in the 57¢ to 58¢/lb range for G-P crystal and 61¢ to 63¢ for HIPS. Material is available and prices should continue to soften. Distributor railcar costs were cut by 4¢ to 75¢/lb for G-P crystal and 81¢ for HIPS.

Meanwhile, the benzene market has stabilized after the large drop, settling at $2.60/gal for October contracts, with spot benzene trading slightly higher. Styrene monomer contract prices were expected to drop 6¢ to 8¢ in October. Dow announced the closure of its ethylbenzene and styrene plants in Freeport, Texas, which will reduce North American styrene supply about 7%. Asian styrene markets are extremely oversupplied, and imports are arriving—including the first major shipment from Kuwait.

HIPS prices have been pushed by rubber costs. Butadiene contracts for September rose 5¢ to 65¢/lb. Spot prices are 10¢ higher. Growing imports from Europe and Asia, and domestic plants coming back on line, suggest flatter butadiene in the fourth quarter.

Outlook & Suggested Action Strategies

30-Day: PS prices have peaked. Pursue price reductions with producers, as it now costs them 8¢/lb less to make resin. Buy as needed to take advantage of the falling prices.

60-Day: PS prices will continue to soften in this quarter under the pressure of weak demand and lower benzene costs. Watch the benzene market for indicators of future price movements.

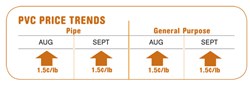

PVC prices moved up 1.5¢/lb in September after a similar increase in August. The 2¢ increase for Sept. 1 was delayed. Domestic demand remains weak, so price increases are driven by feedstock costs and supported by exports and low inventories. Suppliers’ operating rates are around 83% to 85% of capacity and demand rates are in the upper 70s.

Third-quarter price increases in chlorine (due to tight supply) and in ethylene added about 3¢/lb to the cost of producing PVC. In the fourth quarter, that may drop as much as a penny. The cost push is fading as chlorine supply rebalances and ethylene inventories are affected by Middle East capacity additions. North American ethylene exports, which rose 40% in the first half, now have weakened.

Outlook & Suggested Action Strategies

30-Day: The continuation of weak domestic demand, lower exports, and lower feedstock prices, along with lower seasonal demand, will drive prices flat to downward.

60-90 Day: Resin prices are likely to soften for the rest of the year as the construction season ends. But expect higher prices in the second quarter of 2010 as the economic recovery progresses.

Related Content

Prices Up for All Volume Resins

First quarter was ending up with upward pricing, primarily due to higher feedstock costs and not supply/demand fundamentals.

Read MoreFundamentals of Polyethylene – Part 5: Metallocenes

How the development of new catalysts—notably metallocenes—paved the way for the development of material grades never before possible.

Read MorePolyethylene Fundamentals – Part 4: Failed HDPE Case Study

Injection molders of small fuel tanks learned the hard way that a very small difference in density — 0.6% — could make a large difference in PE stress-crack resistance.

Read MorePrices of PE, PP, PS, PVC Drop

Generally, a bottoming-out appears to be the projected pricing trajectory.

Read MoreRead Next

See Recyclers Close the Loop on Trade Show Production Scrap at NPE2024

A collaboration between show organizer PLASTICS, recycler CPR and size reduction experts WEIMA and Conair recovered and recycled all production scrap at NPE2024.

Read MorePeople 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read More