Resin Buying Strategies - November 2010 Resin Prices Mostly Flat or Soft

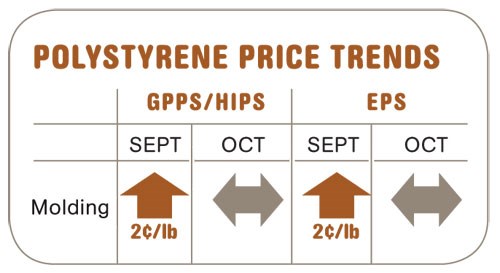

Prices of commodity resins other than PVC moved up in September—and, in the case of polypropylene, rose a bit more in October.

Prices of commodity resins other than PVC moved up in September—and, in the case of polypropylene, rose a bit more in October. New price hikes were issued for both polyethylene and polystyrene, while the announced September increase of 3¢/lb for PVC remained on the table. Other than a PS hike this month, prices of commodity resins are projected to remain flat and perhaps sink a bit through the remainder of this year, according to resin purchasing consultants at Resin Techology. Inc. (RTi) in Fort Worth, Texas. Here’s more of what RTi experts project.

PE PRICES SHOULD HOLD

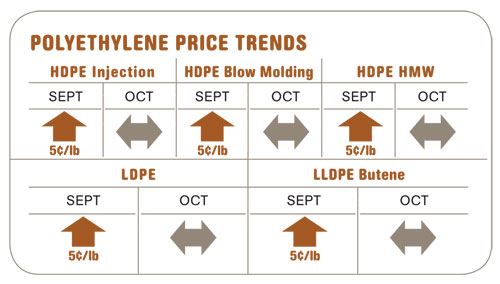

Polyethylene prices rose 5¢/lb in September. A 4¢ increase for Oct. 1 did not appear to take effect by mid-month. But Dow issued a 5¢ hike for Dec. 1. The London Metal Exchange (LME) North American short-term futures contract for butene LLDPE blown film grade in October was 53.3¢/lb, up from September’s 51¢/lb.

Ethylene monomer spot prices moved from 33-35¢/lb up to 38¢/lb last month, owing primarily to higher ethane costs. However, the main driver behind PE resin prices this entire year has been a tight supply/demand balance. Resin suppliers say the market never fully recovered from some unplanned shutdowns in the first half, and that demand has been strong. Suppliers’ inventories shrank by nearly 15 days in the third quarter, falling below the 2009 average.

Average PE operating rates in August and September were around 95%, buoyed mostly by LLDPE running above 100% of capacity. LDPE remained below 90% and HDPE dropped to the low 90s. Suppliers are determined not to allow inventory levels to swell, but they couldn’t prevent some inventory growth last month, due to lower demand. This could nix the chances of that 4¢ increase going through. Overall, 2010 demand appears about equal to 2009 and above 2008, but below 2007.

Outlook & Suggested Action Strategies

30-60 Day: Buy as needed. Exports are expected to subside, which will put more material back into the supply chain. Suppliers will reduce production rates further to prevent a large year-end inventory buildup that would put downward pressure on prices. Do not expect any large PE price concession during the rest of 2010.

PP PRICES COULD SOFTEN

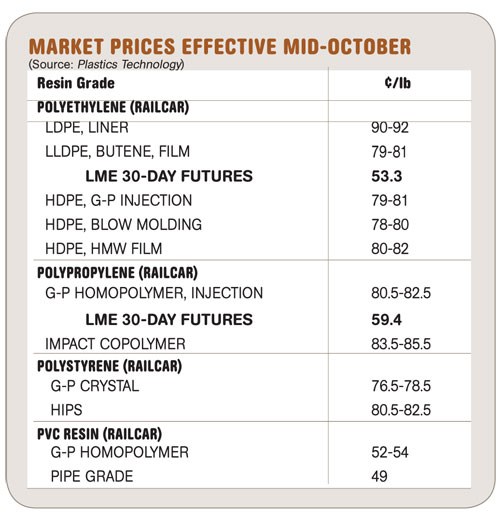

Polypropylene prices moved up 2.5¢/lb in September and 1.5¢ more in October, meaning that suppliers got 80% of their planned September hike. These could be the last price hikes of the year. The October LME short-term futures contract for g-p injection-grade homopolymer was 59.4¢/lb, down from September’s 66.6¢.

Propylene monomer’s contract price rose 2.5¢ in September to 60¢/lb. Monomer supply/demand balance was tight. Demand appears to be heading lower and supplies are expected to improve with the startup of new Petrologistics capacity. RTi expects monomer prices to fall in the coming months.

So far in 2010, there has been some impressive growth in PP demand, especially domestically. Through September, domestic demand was up 11.5%. Suppliers’ inventory levels were down to the 28-29 day level in September. By then, processors were reporting that downstream demand was starting to slip. Many of the forecasted PP orders for September were being canceled, and this material made its way into the secondary markets, where sellers were willing to negotiate on price. This was strong indication that the market had reached its upside limit.

Outlook & Suggested Strategies

30-60 Day: Buy as needed. Prices appear to have peaked and spot prices were starting to weaken. The combination of new monomer supply from Petrologistics and demand falling adds downward potential to prices.

PS PRICES MOVING UP

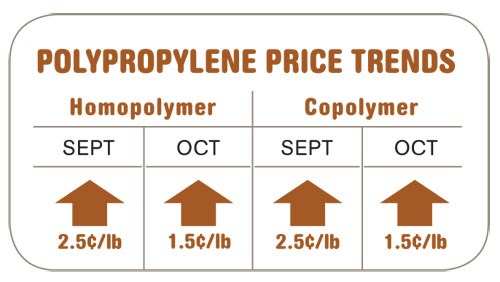

Polystyrene prices moved up 2¢/lb in September, in step with a 1-2¢ rise in feedstock costs. Suppliers have issued a 5¢ increase for Nov. 1. Again, feedstocks are to blame. Higher crude oil prices produced a spike in spot benzene prices—from $3.07/gal to $3.45—by mid-October. October contracts were expected to be around $3.50/gal, up 49¢ from September. Styrene monomer contract prices were also expected to rise as much as 5¢/lb due to higher benzene prices but even more to very strong monomer export demand, particularly to China. That has significantly tightened supplies.

PS profit margins are at an all-time high as prices kept ahead of cost pressures for most of the year. Generic prime and wide-spec prices are moving up and supply is getting tighter.

Competitive activity for HIPS and decreasing butadiene prices have caused the HIPS/GPPS differential to start coming down from 7¢/lb toward the typical 4-5¢. Meanwhile, total demand in 2010 for both PS and EPS looks to be on pace to increase 3% to 5%, which would be the first increase in demand since 2004. Supplier operating rates have been around 76% for PS, and 78% for EPS.

Outlook & Suggested Strategies

30-60 Day: October PS prices were expected to remain flat, although suppliers still had a 2¢ TVA on the table. Expect prices to move up 3¢ to 5¢/lb this month. Resin inventories are snug but ample material should be available. December prices are likely to be stable or lower, barring further feedstock price hikes.

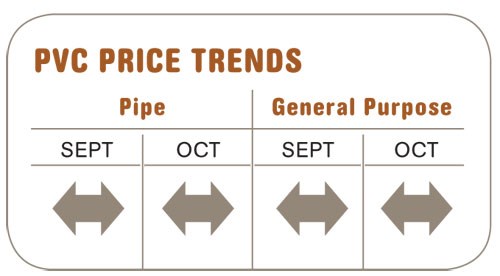

PVC PRICES FLAT FOR NOW

PVC prices were flat last month. However, suppliers have kept their Oct. 1 hike of 3¢/lb on the table and will aim to implement at least part of it. There was some pressure from rising ethylene spot prices, but chlorine prices returned to last year’s levels in September and are expected to remain flat or fall lower this year.

Suppliers report an unexpected uptick in exports in this quarter. Domestic demand, however, dropped by 13% in July and August, after a rising second quarter. Further reduction in seasonal demand is expected.

Suppliers are preparing to dial back operating rates, which rose from 85% to 87% in the third quarter, to prevent domestic oversupply. Start-up of Shintech and Formosa plant expansions over the next five months will add 900 million lb of capacity in North America, with much of that volume initially targeted for export.

Outlook & Suggested Strategies

30-60 Day: This month, processors may leverage reduced demand as they unwind hurricane inventories and the market begins to move into the winter construction hiatus.

Related Content

Fungi Makes Meal of Polypropylene

University of Sydney researchers identify two strains of fungi that can biodegrade hard to recycle plastics like PP.

Read MoreImproving Twin-Screw Compounding of Reinforced Polyolefins

Compounders face a number of processing challenges when incorporating a high loading of low-bulk-density mineral filler into polyolefins. Here are some possible solutions.

Read MoreCommodity Resin Prices Flat to Lower

Major price correction looms for PP, and lower prices are projected for PE, PS, PVC and PET.

Read MoreFlexible-Film Processor Optimizes All-PE Food Packaging

Tobe Packaging’s breakthrough was to create its Ecolefin PE multilayer film that could be applied with a specialized barrier coating.

Read MoreRead Next

Beyond Prototypes: 8 Ways the Plastics Industry Is Using 3D Printing

Plastics processors are finding applications for 3D printing around the plant and across the supply chain. Here are 8 examples to look for at NPE2024.

Read MoreLead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read MorePeople 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read More