Resin Buying Strategies - November 2010 Year-End Tabs Flat or Slightly Higher

Except for PP, prices of commodity resins bumped upward in November.

Except for PP, prices of commodity resins bumped upward in November. At least partial implementation of fourth-quarter price increases for PE, PS, and PVC was under way at press time, with soft domestic demand being offset by higher feedstock costs and increased exports. Little further change was expected this month, according to resin purchasing consultants at Resin Technology, Inc. (RTi) in Fort Worth, Tex. More of their forecasts follow.

Meanwhile, the London Metal Exchange (LME) is ending its six-year effort to develop plastics futures contracts. It will be delisting the contracts, launched in May 2005, at the end of April. LME Chief Executive Martin Abbott stated that the effort to bring price transparency and hedging facilities to plastics failed to attract sufficient volume. Plastics risk management, however, continues to be available through the CME/Nymex commodities exchange with its plastics contracts and new plastics swaps contracts (purely a financial bet, with no physical delivery) based on benchmark prices from industry newsletter PetroChem Wire.

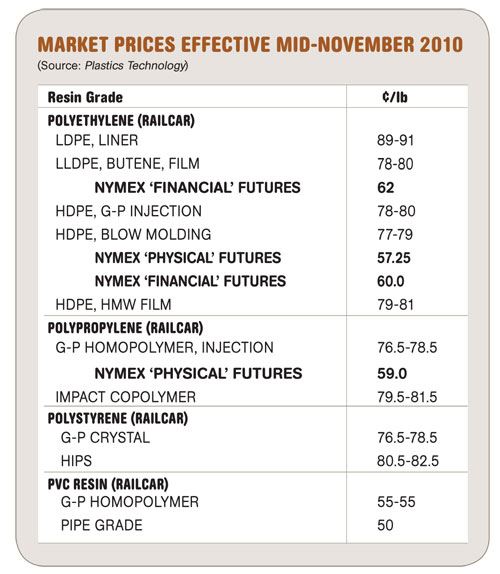

Starting this month, we will replace the LME short-term futures contracts with Nymex Clearport “physical” contract settlements for blow molding grade HDPE and g-p injection grade PP homopolymer, as well as “financial” settlements for blown-film butene LLDPE and blow molding HDPE swap futures.

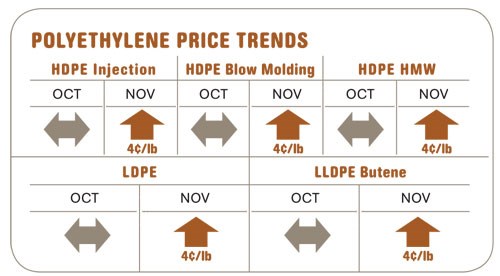

PE PRICES PUSH UPWARD

Polyethylene prices were on the way up by mid-November, with suppliers pushing to fully implement their October 4¢/lb hike. A 5¢ increase, for Dec. 1 was also on the table.

Market dynamics did not support the delayed 4¢ increase, says RTi. Suppliers’ inventories increased modestly, while domestic production decreased more than 10% and total sales dropped over 21%. Average PE operating rates dropped under 93% by October. LLDPE was the exception, running above 100% (but down 4% from late third quarter), while LDPE and HDPE were below 90%. Secondary market prices in October were flat but moved higher last month. LDPE remained very tight.

his hike is feedstock driven. Ethylene spot prices moved to 53¢/lb in mid-November, up from 38¢ in October. September contract prices rose 3¢ and October contracts were expected to go higher too. Tight supply/demand balance is the driver. Three steam crackers were shut down for planned and unplanned maintenance, and at least two will remain down for several weeks. Despite higher ethylene prices, PE suppliers’ margins remain very strong. Exports to Asia appear to be reviving. Chinese buyers entered the U.S. market in November for the first time since March.

Outlook & Suggested Action Strategies

30-60 Day: Feedstocks will influence prices for the remainder of the year. In mid-November, production and supplier inventories were moving up and domestic demand was soft. Expect some price relief when monomer prices correct themselves. But if resin inventories decline due to a pickup in domestic or export demand or a drop in production, and if ethylene supply and demand do not balance, expect continued upward resin pricing pressure.

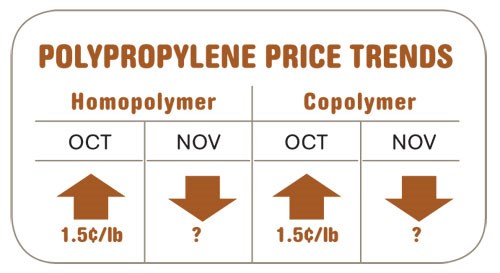

PP PRICES FLAT OR LOWER

Polypropylene prices were flat through last month, and attempts by a couple of suppliers to hike prices by 3¢/lb in October fell by the wayside.

Since October, demand took a big step backwards and suppliers were not able to respond quickly enough to prevent inventory buildup. October demand rates dropped to 83.5% from 92.2% and 98.9% in the two previous months. Through August and into September, domestic demand for PP grew by 11% for the year. However, with exports down by about 45%, overall demand is now up only 3.4%. September domestic demand was 10.6% lower than in August—a loss of 154 million lb. Likewise, supplier inventories showed significant gains—up 133 million lb or 700 railcars of PP—and days of inventory jumped to 34.1 in October from 28.7 days in the two previous months. Operating rates in October held at 90%.

All this moved the PP market from short to long and has pushed much of the excess resin into the secondary market at discounted prices. By the end of October, spot prices were down from 3¢ to 11¢/lb. Meanwhile, propylene monomer contract prices fell 15¢ in October to 58.5¢/lb and November contracts were expected to settle another 3¢ to 5¢ lower.

Outlook & Suggested Action Strategies

30-60 Day: Buy as needed for contract purchases, as monomer prices are expected to drop further. Offers for spot PP are likely to become even more attractive this month. RTi sees no indication that prices will rise in the near term. Softer demand is driving the weakened market, but watch for rebounds.

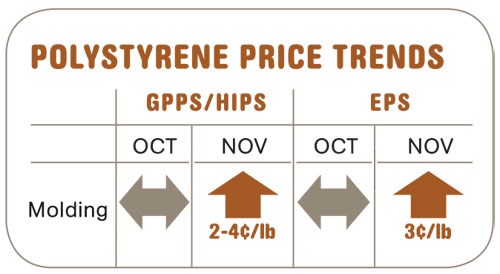

PS PRICES UP

Polystyrene prices were expected to move up 2¢ to 4¢/lb last month in partial implementation of a 5¢ November increase. Key drivers are higher ethylene and styrene monomer prices. September monomer contracts moved up 2¢ to 57¢/lb and October contracts were expected to rise 2¢ to 5¢, driven by rising benzene prices and stronger exports. Spot monomer prices were trading at 56¢/lb for November deliveries, up nearly 12¢/lb in three months.

September PS production was up about 3%, but sales dropped 8% from August.

Outlook & Suggested Action Strategies

30-60 Day: December PS prices are expected to be flat to lower. However, strong export opportunities for both monomer and resin could keep prices up through year’s end.

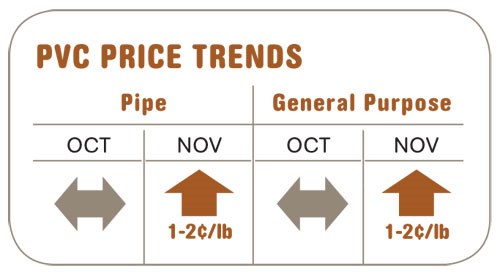

PVC PRICES ON THE WAY UP

PVC prices looked set to move up 1¢ to 2¢/lb in November in partial implementation of the 3¢ October increase. Pressure from higher ethylene spot prices was a key factor. Domestic demand in September was flat, with third-quarter sales volume showing a 22% decline from the second quarter. But the third quarter also saw a 50% jump in exports over the second quarter.

Outlook & Suggested Action Strategies

30-60 Day: Expect suppliers to continue efforts to limit oversupply. Better deals are unlikely to be seen before New Year’s.

Related Content

Prices Up for PE, PP, PS, Flat for PVC, PET

Trajectory is generally flat-to-down for all commodity resins.

Read MorePolyethylene Fundamentals – Part 4: Failed HDPE Case Study

Injection molders of small fuel tanks learned the hard way that a very small difference in density — 0.6% — could make a large difference in PE stress-crack resistance.

Read MoreImproving Twin-Screw Compounding of Reinforced Polyolefins

Compounders face a number of processing challenges when incorporating a high loading of low-bulk-density mineral filler into polyolefins. Here are some possible solutions.

Read MorePrices of PE, PP, PS, PVC Drop

Generally, a bottoming-out appears to be the projected pricing trajectory.

Read MoreRead Next

Lead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read MorePeople 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read MoreBeyond Prototypes: 8 Ways the Plastics Industry Is Using 3D Printing

Plastics processors are finding applications for 3D printing around the plant and across the supply chain. Here are 8 examples to look for at NPE2024.

Read More