Resin Buying Strategies: Resin Prices Soften

Despite further increases in prices of commodity resins in March and April, all indicators point to lower pricing, except perhaps for PVC, according to purchasing consultants at Resin Technology, Inc. (RTi) in Fort Worth, Texas (resinpros.com). Improvements in the supply of ethylene and propylene monomers were a key factor in lower prices.

Despite further increases in prices of commodity resins in March and April, all indicators point to lower pricing, except perhaps for PVC, according to purchasing consultants at Resin Technology, Inc. (RTi) in Fort Worth, Texas. Improvements in the supply of ethylene and propylene monomers were a key factor in lower prices. Here’s more of what RTi experts see ahead.

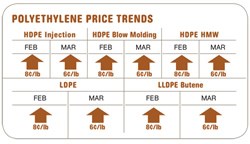

PE PRICES UP, RELIEF IN SIGHT

Polyethylene prices moved up 6¢/lb last month in full implementation of the March increase. This brought PE price hikes to a total of 18¢/lb so far this year. The London Metal Exchange (LME) North American short-term futures contract for butene LLDPE film grade in April dropped 11¢ to 59¢/lb.

The 5¢ increase posted for Apr. 1 was still pending in mid-April, and RTi gave it a 50/50 chance of implementation. If monomer supply keeps improving and its price recedes, PE prices should remain flat.

Domestic PE demand through the first quarter was vibrant, but by mid-April, there were indications of a slowdown—possibly an effect of higher prices. PE exports remained subdued as Asian PE prices continued to drop. There were some reports of exported material coming back into the domestic market.

Spot ethylene monomer first increased to 65¢/lb in April and then reversed direction, dropping to 50¢/lb, and further reductions were expected. Ethylene supply availability was still tight, but some easing was expected with the restart of several crackers. Other downed units were expected to come back on line last month, though Dow and Ineos had plant turnarounds scheduled for mid-April.

Outlook & Suggested Action Strategies

60-90 Day: Additional ethylene supplies are expected to put downward pressure on monomer prices. May will present a good opportunity in the PE market to negotiate price concessions if ethylene tabs retreat as expected. Weak exports are expected to provide added leverage for lower resin prices.

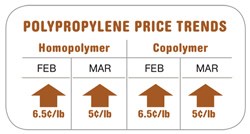

PP PRICES UP—TEMPORARILY

Polypropylene prices moved up 5¢/lb in full implementation of the March increase, which was pegged to an identical rise in propylene monomer prices. Though a few suppliers attempted an additional 2¢/lb hike in March, PP prices just followed monomer tabs penny for penny. PP suppliers issued price hikes of 11¢ to 12¢/lb for Apr. 1, following propylene contract offers with 11¢ increases. The LME April short-term futures contract for g-p injection-grade homopolymer dropped 2¢ to 69¢/lb.

March monomer contracts rose to 68¢/lb, while spot prices were as high as 79¢/lb. Monomer supplies were tight due to cracker outages. Several crackers were restarted in March but there were also some unexpected outages. Overall monomer production rates have improved. Current cracker economics favor a heavier feed slate, which yields more propylene. Still, not much price relief was expected for PP until this month.

Supplier operating rates and market demand rates were both 80% to 81% last month. Resin export opportunities are nil. Domestic PP prices average 20¢ higher than in the Far East and about 10¢ higher than Europe. As a result, there appears to be a lot of interest from domestic buyers in imported material but very few have positioned themselves to be able to act.

Outlook & Suggested Strategies

30-Day: Buying activity ought to have taken place in March. With prices headed up in April, we recommended a buy-as-needed approach, and wait and see how the market sorts itself out.

60-90 Day: Barring any unexpected events that would keep monomer supplies from improving, prices should begin to retreat in this time frame. Double-digit drops would not be a surprise. Timing will be key. Watch for any shifts in demand and monomer spot prices, which will be leading indicators for price movements.

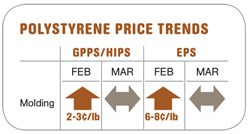

PS PRICES SOFT

Polystyrene prices peaked by early March after the feedstock-driven price hikes of the previous two months. Prices were mostly flat in March, but downward pressure was mounting by mid-April, as spot ethylene feedstock prices retreated toward 50¢/lb and tight ethylene supplies eased significantly.

Styrene monomer prices were softening, too. In February, contract prices moved up to a range of 68¢ to 71.5¢/lb. No increases were announced for March and April. Spot monomer prices softened in March, dropping from 59¢ to 57¢/lb as supplies improved and demand shrank in expectation of lower prices in April. April butadiene contract prices were expected to rise from 76¢/lb in March to around 80¢/lb.

Wide-spec PS railcar prices were in the 65¢ to 70¢/lb range for GPPS and 70¢ to 75¢/lb for HIPS. Wide-spec prices softened as inventories improved, and PS import prices started to drop. Still, imports are not expected to be competitive with domestic prices until later this year.

Outlook & Suggested Strategies

30-60 Day: Demand is increasing, but expect supply to continue to loosen and prices to soften. A conservative inventory strategy and expanding your sourcing options will allow you to enjoy lower pricing ahead of your peers. Continue to buy as needed.

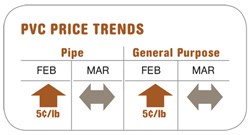

PVC PRICES UP

PVC contract prices appeared likely to move up 3¢/lb in partial implementation of the proposed 5¢ March increase. This would follow a total of 10¢ increases in the two previous months. A 5¢ hike for April was on the table.

Tight supplies of ethylene feedstock increased PVC costs by at least 3¢/lb in March. The overall impact of 18¢ higher ethylene prices since September added 9¢/lb to the cost of making PVC. Chlorine has contributed a cost decrease of 1.5¢/lb in the same period, for a net increase of 7.5¢/lb. First-quarter chlorine prices dropped around 3¢/lb but improved demand is expected in the second quarter. Ethylene spot prices were dropping in March and into April due to easing of tight supplies.

Outlook & Suggested Strategies

30-60 Day: Keep an eye on improvements in ethylene supplies and the level of export demand, which could affect domestic prices. Buy as needed.

Related Content

Fundamentals of Polyethylene – Part 6: PE Performance

Don’t assume you know everything there is to know about PE because it’s been around so long. Here is yet another example of how the performance of PE is influenced by molecular weight and density.

Read MoreFungi Makes Meal of Polypropylene

University of Sydney researchers identify two strains of fungi that can biodegrade hard to recycle plastics like PP.

Read MoreThe Fundamentals of Polyethylene – Part 1: The Basics

You would think we’d know all there is to know about a material that was commercialized 80 years ago. Not so for polyethylene. Let’s start by brushing up on the basics.

Read MorePolyethylene Fundamentals – Part 4: Failed HDPE Case Study

Injection molders of small fuel tanks learned the hard way that a very small difference in density — 0.6% — could make a large difference in PE stress-crack resistance.

Read MoreRead Next

People 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read MoreSee Recyclers Close the Loop on Trade Show Production Scrap at NPE2024

A collaboration between show organizer PLASTICS, recycler CPR and size reduction experts WEIMA and Conair recovered and recycled all production scrap at NPE2024.

Read More