Resin Buying Strategies: Still a Buyer's Market

Resin prices were soft this autumn, and despite some announced hikes for commodity resins, purchasing consultants at Resin Technology, Inc., (RTI) in Fort Worth, Texas, advise that processors continue to look for bargains.

Resin prices were soft this autumn, and despite some announced hikes for commodity resins, purchasing consultants at Resin Technology, Inc., (RTI) in Fort Worth, Texas, advise that processors continue to look for bargains. However, polypropylene shows some potential to buck the trend. Here's more of RTI's analysis.

PE PRICES FLAT FOR NOW

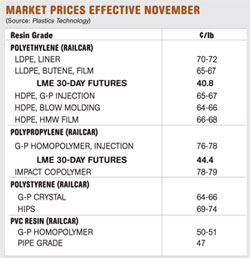

Polyethylene prices were flat through October, following full implementation of a 4¢ hike in September. The 5¢ increase for Oct. 1 was delayed to November and cut to 4¢. Also, most producers issued an additional 3¢ hike for Dec.1. The London Metal Exchange (LME) North American short-term futures contract for butene LLDPE film grade was unchanged from October's level of 40.6¢/lb.

PE prices are up 17¢/lb for the year so far, with 7¢ more pending. Indicators in early October pointed to weakness in the market and suppliers losing leverage for pending price increases. However, the scenario appeared to change when crude oil prices jumped from early October levels of $65 to $75 a barrel to $80/bbl later that month, due to the weakening U.S. dollar. PE exports to Asia revived as prices there spiked due to higher feedstock costs, increased demand, and low inventories. However, domestic demand remains flat as buyers remain uncertain of the direction PE prices will take. Prices in the secondary market moved up about 2¢/lb.

Spot ethylene monomer prices averaged 32¢ to 33¢/lb from late October into November, up from 29¢/lb in September.

Resin producers' inventories are still low, but they grew for the third consecutive month from a low of 34 days to 40-43 days, despite a recent surge in exports. Operating rates averaged about 92% with LLDPE running as high as 98%. Demand rates for LDPE ranged from 80% to 85% of capacity and for LLDPE, 85% to 90%.

60-90 Day: Indicators point to softness in the next few months. Along with weak domestic demand and lower feedstock prices, this could put downward pressure on resin prices.

PP PRICES FLAT TO HIGHER

Polypropylene prices were on the move, up 2.5¢ to 3¢/lb in November after softening in October. These swings are closely tied to propylene monomer prices: November monomer contracts settled 2.5¢ higher at 49¢/lb. The LME contract for g-p injection-grade homopolymer was unchanged from October, at 40.6¢/lb.

Poor demand in late September and early October pushed up producer inventories, resulting in some excellent offers in the secondary market for wide-spec, off-grade, and even prime material.

A big shift took place in late October, when the spike in crude oil prices allowed PP prices to regain strength. Moreover, monomer supplies are tight, which will keep prices high. There was also a bit of an uptick in domestic PP demand during much of October, with processors buying at discounted prices to replenish dwindling inventories. Still, overall demand remains weak.

By late October and into November, producers pushed to implement their increases, and price offers into the secondary market also firmed up. PP exports are still poor, and prices have a long way to fall before U.S. resin becomes cost-competitive.

PP makers' operating rates are in the 75% to 80% range. Producer inventories rose in early October to 33 to 35 days. Demand rates are estimated at between 75% and 80% of capacity.

60-90-Day: Watch energy prices. Monomer has gained some strength, which could lead to further price hikes. Demand for PP will also play an important role, as weak demand could blunt the impact of higher monomer prices.

PS PRICES DOWN

Polystyrene prices dropped by another 2¢ to 3¢/lb in October, following September's 5¢ slide. Suppliers issued a 3¢ hike for Nov. 1, citing feedstock cost pressurs. But by the end of October, prices of styrene monomer and benzene feedstock retreated to earlier levels. Only 1¢ to 2¢ of the November PS hike is likely to survive.

Wide-spec PS railcar prices dropped in October to 55¢ to 57¢/lb for G-P crystal and 50¢ to 61¢/lb for HIPS. Prices continue to soften.

Meanwhile, EPS prices have been sliding due to lower feedstock costs and lower import prices. Domestic tabs slid an average of 5¢/lb in October, though molders had to fight for every penny.

Meanwhile, November benzene contracts settled at $2.85/gal, up from $2.60/gal. This increase follows a drop of nearly $1.05/gal over the previous two months. PS producers had seen a net decrease in production costs of 10¢/lb and now face an increase of about 2¢/lb from the benzene hike. October ethylene contract prices settled 2.75¢ higher at 37.25¢/lb. Spot ethylene was trading at 33.5¢/lb in mid-November.

September butadiene contracts settled 3¢/lb higher at 68¢/lb. Butadiene (used for the rubber portion of HIPS) is up 43¢ since March but is still down 54¢ from November 2008 to the start of last month. Spot prices are currently near 73¢/lb.

Nonetheless, October styrene monomer contracts settled lower at 52.75¢/lb—32¢ below a year ago. Nominations for November contracts are 3¢ to 5¢ higher. Spot prices are holding at around 44¢/lb. Nova said it would temporarily shut down its 1-billion-lb/yr styrene plant in Texas City “until margin levels improve”—which it hoped would come in the first quarter of 2010. Meanwhile, America's Styrenics plans to shutter 170 million/lb of PS capacity by year's end. Based on projected operating rates no higher than the mid-70% range, further resin capacity reduction is likely for 2010.

60-90 Day: Watch the benzene market for indicators of future price moves. If oil prices keep increasing and the dollar continues to soften, resin prices could remain high. Feedstock prices should level off and soften under the pressure of weak demand by year's end and into early first quarter 2010.

PVC PRICES FLAT

PVC prices stayed flat through October, as no action was taken on a 2¢/lb increase that was delayed from September. Domestic demand dropped another 3% from September to October, with domestic demand rates in the mid-70% range. Resin capacity utilization remained steady in the mid-80% range, due to both improved chlorine availability and export demand. Global caustic demand has been improving, and chlorine prices saw a modest decrease in October. Chlorine had moved up about 5¢/lb in the third quarter, adding about 2.5¢/lb to the cost of PVC. PVC export prices rose but remain under 35¢/lb, down 6¢ to 8¢ from where they were in August.

Outlook & Suggested Action Strategies

30-Day: Weak demand and higher PVC inventories due improved chlorine availability will drive resin prices flat to downward 60-90 Day: Expect further downward pressure on PVC prices into first quarter 2010, due to seasonally lower construction demand and lower feedstock cost projections.

Related Content

Prices Up for PE, PP, PS, Flat for PVC, PET

Trajectory is generally flat-to-down for all commodity resins.

Read MoreImproving Twin-Screw Compounding of Reinforced Polyolefins

Compounders face a number of processing challenges when incorporating a high loading of low-bulk-density mineral filler into polyolefins. Here are some possible solutions.

Read MoreCommodity Resin Prices Flat to Lower

Major price correction looms for PP, and lower prices are projected for PE, PS, PVC and PET.

Read MoreFundamentals of Polyethylene – Part 3: Field Failures

Polyethylene parts can fail when an inappropriate density is selected. Let’s look at some examples and examine what happened and why.

Read MoreRead Next

Making the Circular Economy a Reality

Driven by brand owner demands and new worldwide legislation, the entire supply chain is working toward the shift to circularity, with some evidence the circular economy has already begun.

Read MorePeople 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read MoreSee Recyclers Close the Loop on Trade Show Production Scrap at NPE2024

A collaboration between show organizer PLASTICS, recycler CPR and size reduction experts WEIMA and Conair recovered and recycled all production scrap at NPE2024.

Read More