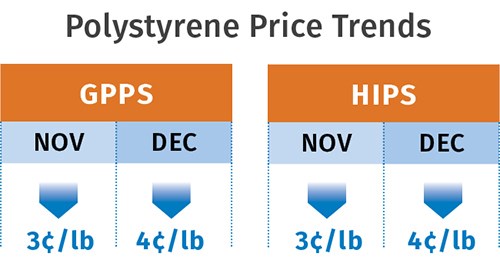

Broad Drop in Resin Prices

With feedstock and energy costs dropping globally, commodity and engineering resin prices are following suit.

As December rolled in, prices of the four commodity resins continued on the downward trajectory and market analysts predicted that this would last into at least the first month of the year. Ditto for the most common engineering resins. These are the views of purchasing consultants at Resin Technology, Inc., Fort Worth, Texas, and CEO Michael Greenberg of The Plastics Exchange, Chicago.

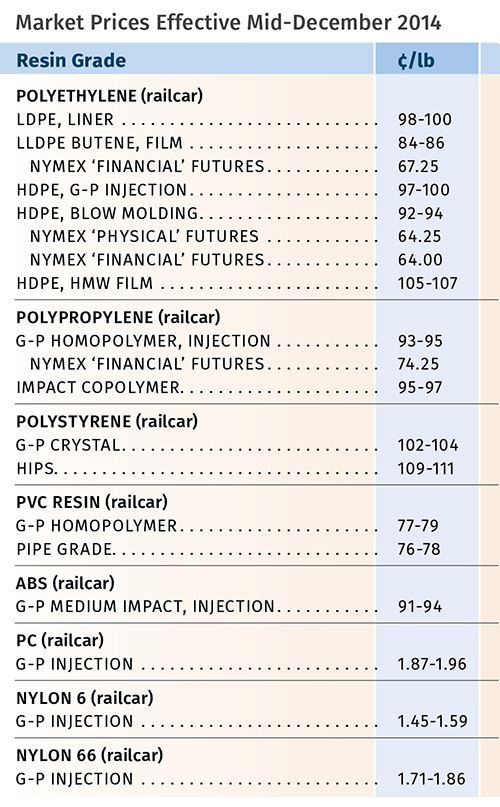

PE PRICES DOWN

PE prices dropped 3¢/lb industrywide by the end of November, and further price relief was anticipated into the new year. "Domestic resin prices will continue to track oil prices—up or down. Oil priced at over $90/barrel is a whole different ballgame from oil at $65/barrel," says Mike Burns, RTi’s v.p. for PE.

In late November, The Plastics Exchange’s Greenberg described the PE spot market as very active, with prices dropping by 3¢/lb and nearly all grades readily available. He also reported that PE export prices plunged as PE suppliers dropped their asking prices to compete with lower global price levels.

"People are now buying as needed, as they expect lower prices, and supplier inventories will grow," says Burns, who thinks domestic PE prices are not likely to bottom out until after the Chinese New Year in mid-February.

Burns expects demand for 2014 to exceed growth of GDP, but cautions that it will be measured by how much domestic suppliers lower prices compared with global pricing levels. PE prices this year could be lower than 2013 and 2014 levels, he says. If not, an escalation in imports of finished goods and a halt to reshoring is feared.

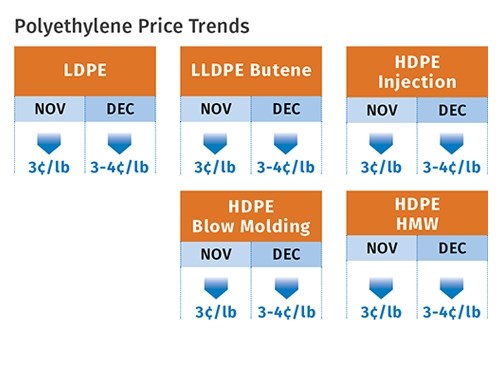

PP PRICES TUMBLE

Polypropylene prices dropped 5¢/lb in November, nixing out October’s 4¢/lb increase, all in step with propylene monomer price movement. PP prices were expected to drop further last month—at least another 5¢ and possibly a whopping 7-9¢/lb, according to Scott Newell, RTi’s director of client services for PP.

As November came to a close, Greenberg reported that spot PP trading was slightly above average, with material availability improved yet still on the tight side. He also noted that demand for spot material was lackluster, as buyers were anticipating PP prices to drop in December. PP suppliers have been managing their production output in line with demand, so the market is fairly tight, according to Newell. He anticipated processors increasing their buying activity last month as prices fell. Neither he nor Greenberg saw much chance of PP prices increasing this month, so further buying activity is likely.

Newell points out that PP suppliers were able to pass on a 2¢/lb margin expansion, over and above the price increases of propylene monomer, to several customers in the early fourth quarter. He expected this to be implemented industrywide by the end of this month, despite the falling prices. He expected 2014 would finish with a slight increase in PP demand, about 1%, and he projects 2015 to be the start of healthier growth. Among the drivers is monomer availability, which will be even better when Dow brings on stream its new "on-purpose" propylene plant in the second half of the year.

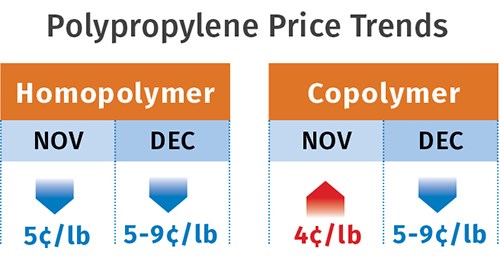

PS PRICES DROP MORE

Polystyrene prices dropped 3¢/lb in November and a couple of suppliers announced decreases of 4¢/lb for last month. Further price decline is likely this month, according to Mark Kallman, RTi’s v.p. of client services for engineering resins, PS, and PVC. Such movement would cancel out the 6¢ increases left over in 2014.

Driving the downward slide is the precipitous decline in November contract prices for benzene, which dropped by 48¢/ gal to $3.37/gal; and of ethylene, which fell another 5¢/lb following a 4¢ drop in October. Spot prices for both were significantly lower than contract prices in December, so further declines were expected for this month.

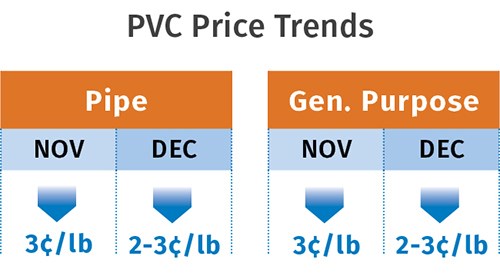

PVC PRICES LOWER

PVC prices dropped 2-3¢/lb in November and were expected to drop another 2-3¢ in December, according to RTi’s Kallman. Last year, PVC prices moved up a total of 11¢/lb.

Kallman ventured that prices would drop even further this month, driven by the declining costs of ethylene and chlorine. Moreover, he noted that higher domestic prices are limiting PVC exports, as PVC prices abroad have dropped even more significantly— similar to the scenario taking place in the domestic PE market.

ABS PRICES DOWN

ABS prices dropped throughout the fourth quarter about 2-4%, driven by the drop in benzene, butadiene, and styrene prices. A further slide was very likely this month, according to Kallman.

Asian ABS prices also dropped quite a bit, and competitive imports continue to be a factor in the domestic market. Modest growth in demand is expected this year, as was the case in 2014, with ABS continuing to face competition from lower-cost resins, particularly PP.

PC PRICES HEADING DOWNWARD

Polycarbonate prices trended flat after spiking last summer due to cost spikes in benzene and propylene, but the reversal in feedstock costs is putting pressure on suppliers. According to Kallman, this month could be the test, when quarterly contracts are typically drawn up.

Domestic supply is trending from ample to balanced with Styron’s exit from the PC commodity market. Low growth is likely for this year (as it was for 2014) for this resin, owing to upticks in the automotive and construction sectors. Globally, there is a glut of PC, and although one Asian PC shutdown has been announced, more are needed to eliminate the glut. Kallman sees downward pricing pressure on domestic PC prices from cheaper imports if the glut continues.

NYLON PRICES DOWN

Nylon 6 prices dropped 2-4% by the end of November, and even lower prices were expected for December and January, driven by the steep benzene price drop. Demand has been pretty flat, with processors looking forward to lower prices. Kallman said some pre-buying demand growth is possible through the first quarter before prices bottom out, followed by relatively more stable pricing.

Nylon 66 prices were flat by year’s end, with strong downward pressure from falling benzene, propylene, and butadiene tabs. Kallman generally expected lower prices this month, depending on quarterly contract agreements and on polymerization route (propylene vs. butadiene based). Domestic demand for 2015 is expected to be better than 2014, with the trend toward lightweighting in automotive moving from small-to-medium-sized cars to larger SUVs and pick-up trucks, Kallman says.

Keep an eye on the Plastics Technology blog at ptonline.com/blog for more updates on resin prices as they unfold.

Related Content

Fundamentals of Polyethylene – Part 6: PE Performance

Don’t assume you know everything there is to know about PE because it’s been around so long. Here is yet another example of how the performance of PE is influenced by molecular weight and density.

Read MoreImproving Twin-Screw Compounding of Reinforced Polyolefins

Compounders face a number of processing challenges when incorporating a high loading of low-bulk-density mineral filler into polyolefins. Here are some possible solutions.

Read MoreFirst Quarter Looks Mostly Flat for Resin Prices

Temporary upward blips don't indicate any sustained movement in the near term.

Read MoreCommodity Resin Prices Flat to Lower

Major price correction looms for PP, and lower prices are projected for PE, PS, PVC and PET.

Read MoreRead Next

Styron To Exit Commodity PC Resin Business

Specialty PC compounds and blends in North America is Styron's new focus.

Read MoreLead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read MoreMaking the Circular Economy a Reality

Driven by brand owner demands and new worldwide legislation, the entire supply chain is working toward the shift to circularity, with some evidence the circular economy has already begun.

Read More