Commodity Prices Fall; More Dips Coming?

Falling prices for the four main commodity thermoplastics was the trend by mid-July.

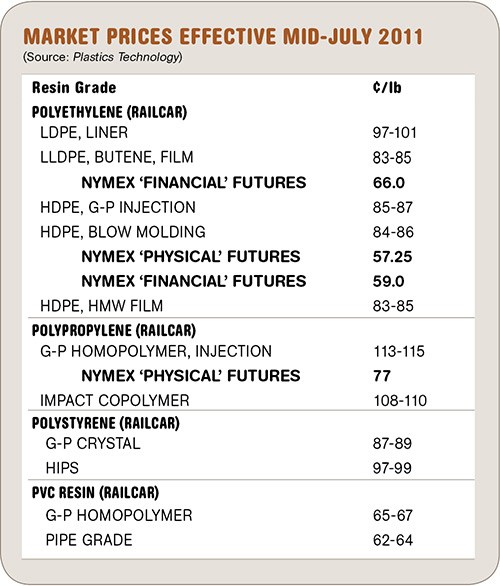

Falling prices for the four main commodity thermoplastics was the trend by mid-July. This was driven by stagnant domestic and export demand, along with rising resin-supplier inventories and falling feedstock prices. Further price relief is in the offing, barring unplanned feedstock or resin plant outages, according to resin purchasing consultants at Resin Technology, Inc. (RTi) in Fort Worth, Texas (resinpros.com). Here’s more on RTi’s outlook.

PE PRICES DOWN

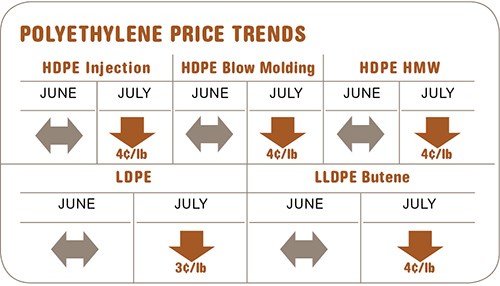

Polyethylene prices dropped in June by 4¢/lb for LLDPE and HDPE and 3¢ for LDPE. Further erosion was expected last month, especially for LLDPE and HDPE. Availability has improved for all resin grades. (Domestic PE production rose 3% in June while sales dropped almost 9%.)

In secondary markets, sellers were seeking out buyers in June and July with offers significantly lower than May prices. Some generic prime grades were offered for as little as 10¢ to 13¢/lb.

Spot ethylene monomer prices dropped 5¢/lb in June, rebounded by 3¢ by July 1 to about 58¢/lb, and then declined slightly in early July. Improved availability and minimal supply disruptions have contributed to flat-to-downward pricing.

Outlook & Suggested Action Strategies

30-60 Days: Continue to buy as needed while pursuing price concessions. Manage your inventory. If exports improve or a hurricane develops, suppliers may attempt a price increase.

PP PRICES PLUMMET

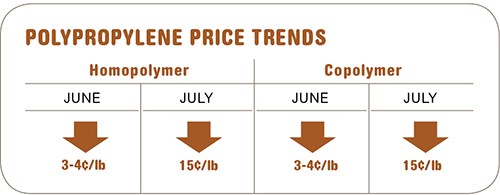

Polypropylene prices dropped a whopping 15¢/lb in June, following the price drop in propylene monomer penny for penny. Suppliers faced with soft demand and rising inventories made no attempt to issue new price hikes for either June or July. Supplier inventories grew to 41.2 days by the end of June, from 33.1 and 32.5 days in April and May, respectively. (Suppliers are expected to throttle back production in order to get inventories back in balance.)

The secondary market was particularly active in June. Prices varied widely but with a definite downward trend. Opportunities for large discounts attracted a lot of interest. By July it appeared that a lot of product had moved and the secondary market was beginning to firm.

Polymer grade propylene monomer dropped to 82¢/lb. It looked last month like July contracts would shave off another 3-5¢/lb. Spot monomer prices were as low as 77.5¢/lb by late June.

Outlook & Suggested Action Strategies

30-60 Days: PP prices may be bottoming out, though modest decreases (3-5¢/lb) are possible in the July/August time frame.

PS PRICES DROP

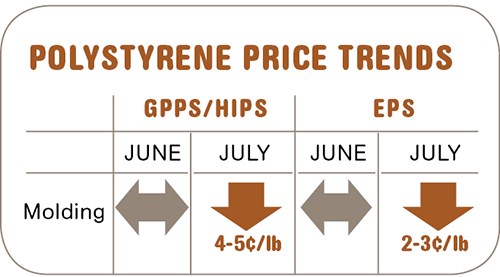

Polystyrene prices rolled over from May into June and then started a downward slide. Spot prices for GPPS dropped 2-3¢/lb while prices for HIPS, which continue to command an 11-12¢ premium, remained flat.

By mid-July prices had dropped 4-5¢ across the board. The June 4¢ hike on EPS saw partial implementation but was losing traction last month due to lower import prices and weakening demand.

Resin prices closely followed the drop in styrene monomer spot prices, which lost 4-5¢ by the end of June, down to 63¢/lb, while June styrene contracts dropped to 69-70¢, after discounts, from May’s 74-75¢/lb. Further softening in monomer contract prices was expected for July and August.

Spot prices of both benzene and ethylene precursors dropped in June, but butadiene continued to skyrocket, with June contracts settling 10-15¢ higher at about $1.50-$1.55/lb. July contracts were looking at a further 10¢ hike. Spot butadiene can run over $2/lb. (For perspective, average butadiene prices were 45¢ in 2009 and 84¢/lb in 2010.)

Meanwhile, PS operating rates in June dropped to 60% from 79% in May, and the downtrend was expected to continue in July/August, following a drop in domestic demand since the end of May.

Outlook & Suggested Action Strategies

30-60 Days: Weakening feedstock prices a

nd growing inventories are expected to result in further price declines this month. But HIPS prices will remain at a premium and reductions will be harder to achieve before the fourth quarter of this year.

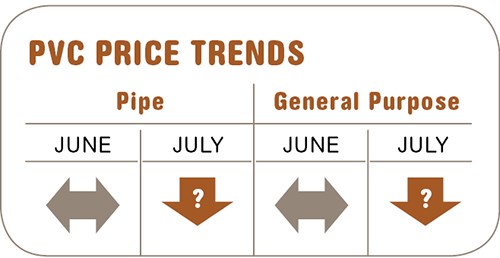

PVC PRICES MOVING DOWNWARD

PVC prices from the end of May and into June/July were flat-to-down as export demand continued to slide and there was only modest improvement in domestic demand.

Pushed to July, the 5¢/lb June price hike did not appear to have any chance of implementation. Spot-market availability at discounted prices was on the rise, despite Georgia Gulf’s force majeure that lasted through the end of June.

Supplies were ample and PVC supplier inventories rose dramatically in June and continued rising last month. Meanwhile, PVC feedstock costs were flat or on the way down.

Outlook & Suggested Action Strategies

30-60 Days: Look for opportunities as prices continue to decline through the third quarter, before the next round of planned domestic planned cracker maintenance outages in the fourth quarter. Ethylene production reliability is key. Buy as needed.

Related Content

Fundamentals of Polyethylene – Part 3: Field Failures

Polyethylene parts can fail when an inappropriate density is selected. Let’s look at some examples and examine what happened and why.

Read MoreDelivering Increased Benefits to Greenhouse Films

Baystar's Borstar technology is helping customers deliver better, more reliable production methods to greenhouse agriculture.

Read MoreFirst Quarter Looks Mostly Flat for Resin Prices

Temporary upward blips don't indicate any sustained movement in the near term.

Read MoreNew Facility Refreshes Post-Consumer PP by Washing Out Additives, Contaminants

PureCycle prepares to scale up its novel solvent recycling approach as new facility nears completion.

Read MoreRead Next

Beyond Prototypes: 8 Ways the Plastics Industry Is Using 3D Printing

Plastics processors are finding applications for 3D printing around the plant and across the supply chain. Here are 8 examples to look for at NPE2024.

Read MorePeople 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read MoreMaking the Circular Economy a Reality

Driven by brand owner demands and new worldwide legislation, the entire supply chain is working toward the shift to circularity, with some evidence the circular economy has already begun.

Read More