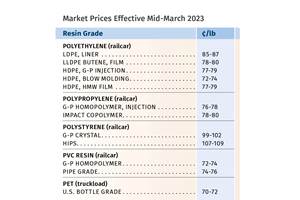

Mixed Bag for Prices of Volume Resins

Prices are up for PP, PET and nylon 66; flat-to-down for most others.

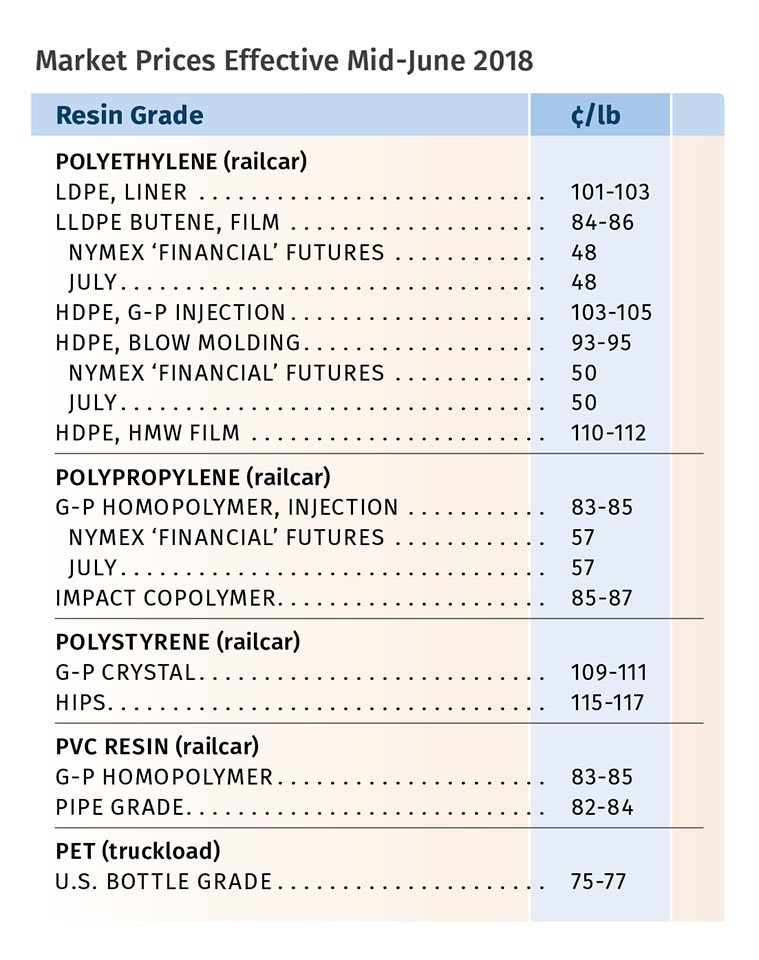

Lower prices of some key feedstocks coupled with improved supply-demand balance resulted in a flat-to-lower pricing trend for PE, PVC, PS, ABS, PC and nylon 6. Tight supplies and higher prices of other feedstocks and their intermediaries resulted in an upward pricing trajectory for PP, PET and nylon 66.

These are the views of purchasing consultants from Resin Technology, Inc. (RTi), Fort Worth, Texas; CEO Michael Greenberg of the Plastics Exchange in Chicago; and Houston-based PetroChemWire (PCW).

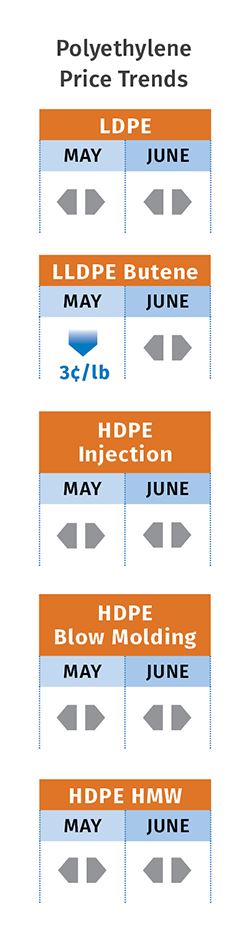

PE PRICES FLAT TO LOWER

Polyethylene prices in May were a mixed bag for the first time in years. Two suppliers offered a decrease of 3¢/lb for LLDPE and no change on other grades. Dow announced a 4¢/lb increase for June, while other suppliers postponed their 3¢/lb price hikes. Mike Burns, RTi’s v.p. of client services for PE, predicted that June prices would be flat, with a good chance of that trend continuing into this month and beyond.

Flattening of PE prices was apparent in secondary markets. PCW reported that spot PE prices were mostly unchanged amid sluggish trading activity by the end of June’s first week. “Export volumes were limited as suppliers waited for a clearer view of domestic demand and inventories.”

The Plastics Exchange’s Greenberg reported that while the market has been awash in butene LLDPE and injection-grade HDPE, film and injection grades of LDPE were more difficult to source, at least at prices agreeable to processors.

PP PRICES UP

Polypropylene prices moved up 5¢/lb in May in step with propylene monomer contracts, while another 2¢/lb was tacked on to reinforce suppliers’ margins. Spot monomer prices were surging by as much as 6-7¢/lb, so industry sources figured another PP price hike was likely for June. “We see June prices going up 5¢/lb or more, in step with propylene contracts,” said RTi’s Scott Newell, v.p. of PP markets . The runup of monomer tabs was driven by higher oil prices, propylene supply tightness at refineries, and reports of production outages at dedicated propylene plants.

Newell ventured that July PP prices could be flat, and perhaps lower, if June proves to be the peak for monomer tightness. “I think there could be a lot of demand destruction for PP if these prices are sustained. Expect to see imports increasing.” He said PP demand was generally good, starting in April, after lagging for six or seven months.

PCW reported spot PP prices as flat to higher as supply remained tight due to strong domestic demand and three production outages. Similarly, Greenberg characterized the spot PP market as challenged by scarce supplies and rising prices: “While some buyers’ initial response might be to wait out this cycle, there are some real supply issues that could help keep PP prices elevated for a while.”

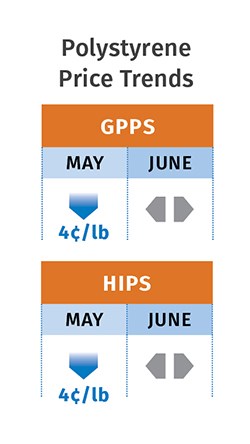

PS PRICES DOWN

Polystyrene prices dropped 4¢/lb in May, and RTi’s Kallman expected flat-to-slightly upward movement in June and July. He cited a bit of cost pressure from benzene, up only 6¢/gal in May, and butadiene, up 7¢/lb. However, ethylene contracts settled lower in April and May and were likely to sink lower in June. At the same time, he foresaw more upward pressure in August, due to stronger demand for PS during its normally strong season, including some pre-buying for hurricane season and some tightness in benzene and styrene monomer. Going into June, PCW reported that spot GPPS and HIPS prices were down 4-5¢/lb after peaking in early April. Feedstock costs were steady, with the implied-styrene-cost formula (based on 70% spot benzene/30% spot ethylene) was flat at 32.6¢/lb.

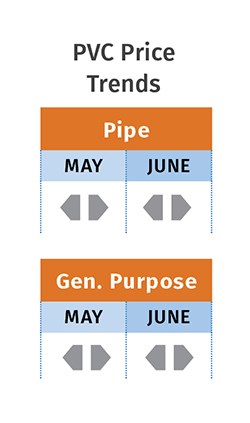

PVC PRICES FLAT

PVC prices were flat in May, driven by very low ethylene contract costs that were likely to fall another 2-3¢/lb, which would reduce the cost of making PVC by 1-1.5¢/lb, according to RTi’s Kallman. However, spot ethylene prices bottomed out at 12¢/lb and were up 3.25¢/lb by the end of May.

PCW reported that late-settling April ethylene contracts settled 1.5¢/lb lower, at 26.75¢/lb, and May contracts dropped 0.75¢/lb to 26¢/lb. “Resin buyers were trying to discern how the settlements will affect their PVC prices, as a drop of 2.25¢/lb in ethylene could imply a reduction of about 1¢/lb in PVC pricing.” However, both PCW and Kallman noted that suppliers’ stance was that low ethylene prices cannot be sustained and that domestic demand picked up nicely in April-May, as did exports, a trend likely to continue into June and the third quarter. Kallman noted that suppliers have been running their plants at very high rates due to very low feedstock costs.

PET PRICES UP

PCW reported increases in domestic bottle-grade PET prices in May by 3-5¢/lb to the mid-70¢/lb range (delivered Midwest), driven by rising oil and PET feedstock prices. Average U.S. PET feedstock costs in May were up 2.4¢/lb from April to 61.28¢/lb, according to one calculation used by large-volume PET suppliers and buyers to invoice May deliveries. PCW predicts that prices of PET (prime, offgrade and rPET) are likely to increase by another 1-3¢/lb in June-July, driven by “skyrocketing” consumption of carbonated soft drinks and bottled water. This projected price increase also assumes that crude oil prices will rise or stay at current elevated levels.

Meanwhile, U.S. PET import prices stood at 72-74¢/lb (delivered duty-paid to the West Coast), up 2-3¢ from April—a rise attributed directly to anti-dumping duties on PET imports from Brazil, Indonesia, South Korea, Pakistan, and Taiwan.

ABS PRICES FLAT

ABS prices remained fairly stable through the second quarter, following the 5¢/lb increases in January. Suppliers’ efforts to push through price hikes of 6-7¢/lb failed as feedstock prices retreated and competition rose from cheaper ABS imports, according to RTi’s Kallman. Noting that the market is now more balanced, he ventured that prices would hold level at least through June, with some upward potential late in the third quarter.

PC PRICES GENERALLY STEADY

Polycarbonate prices were generally flat through the second quarter, following the implementation of January increases of up to 14¢/lb, with independent compounders and secondary suppliers implementing similar increases in February-March, according to RTi’s Kallman. There were some new price-increase attempts announced for May, but implementation was at best mixed, leaving Kallman to characterize overall PC pricing as steady.

Further, he foresaw PC prices remaining mostly flat through the third quarter. “Keep your eyes on prices of benzene, propylene and lower-priced imports,” he noted. He described demand as good on a global level and domestic automotive demand as good but not as strong as in 2017, with a reduction in Asian imports through June.

NYLON 6 FLAT; NYLON 66 UP

Nylon 6 prices remained flat from March through May, as benzene prices bottomed out at $1.90/gal and moved up to only $1.96/gal in May, according to RTi’s Kallman. Potential for some upward pressure is possible this month, as benzene oversupply will be finished and prices could firm up. Nylon 6 plants are operating at high rates as there is increasing industry talk of substituting for nylon 66 due to the latter’s higher prices.

Nylon 66 prices were largely flat through May, after moving up 15-20¢/lb in the first quarter, driven by a global market that became very tight, according to Kallman. “We had seven force majeure actions on intermediates through the first two quarters. Recovery will be long—supply is tight globally. He anticipates upward pricing pressure in the third quarter due to supply tightness and possible price increases for butadiene and propylene monomer.

Related Content

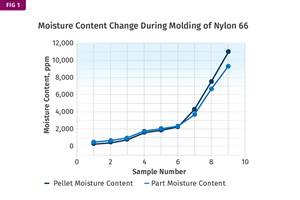

What's the Allowable Moisture Content in Nylons? It Depends: Part 2

Operating within guidelines from material suppliers can produce levels of polymer degradation. Get around it with better control over either the temperature of the melt or the barrel residence time.

Read MorePrices Bottom Out for Volume Resins?

Flat-to-down trajectory underway for fourth quarter for commodity resins.

Read MoreNPE2024 Materials: Spotlight on Sustainability with Performance

Across the show, sustainability ruled in new materials technology, from polyolefins and engineering resins to biobased materials.

Read MorePrices of Volume Resins Generally Flat or Lower

Exceptions in early March were PP and PS, which moved up solely due to feedstock constraints, along with slight upward movement in PVC and PET.

Read MoreRead Next

Lead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read MoreBeyond Prototypes: 8 Ways the Plastics Industry Is Using 3D Printing

Plastics processors are finding applications for 3D printing around the plant and across the supply chain. Here are 8 examples to look for at NPE2024.

Read More