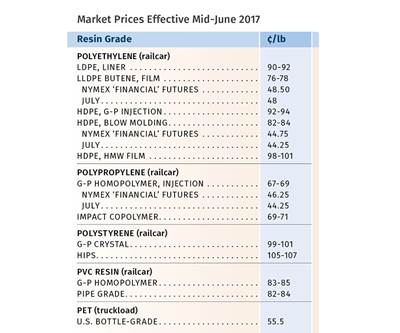

PE Flat, PP Moving Up; PS, PVC, PET Flat-to-Down

Resin and monomer production disruptions halted further price decreases, but there’s still downward potential.

Prices of key feedstocks for the five commodity resins overall continue to be lower in June, but unplanned and planned production outages resulted in prices bottoming out for PE and PP. A reversal in pricing was being attempted for the two polyolefins, though that’s only likely to happen for PP. Meanwhile, prices for PET dropped a bit more, with similar expectations for both PS and PVC in the July/August timeframe.

These are the views of purchasing consultants from Resin Technology, Inc. (RTi), Fort Worth, Texas, CEO Michael Greenberg of Plastics Exchange, The, Chicago, and Houston-based PetroChemWire (PCW).

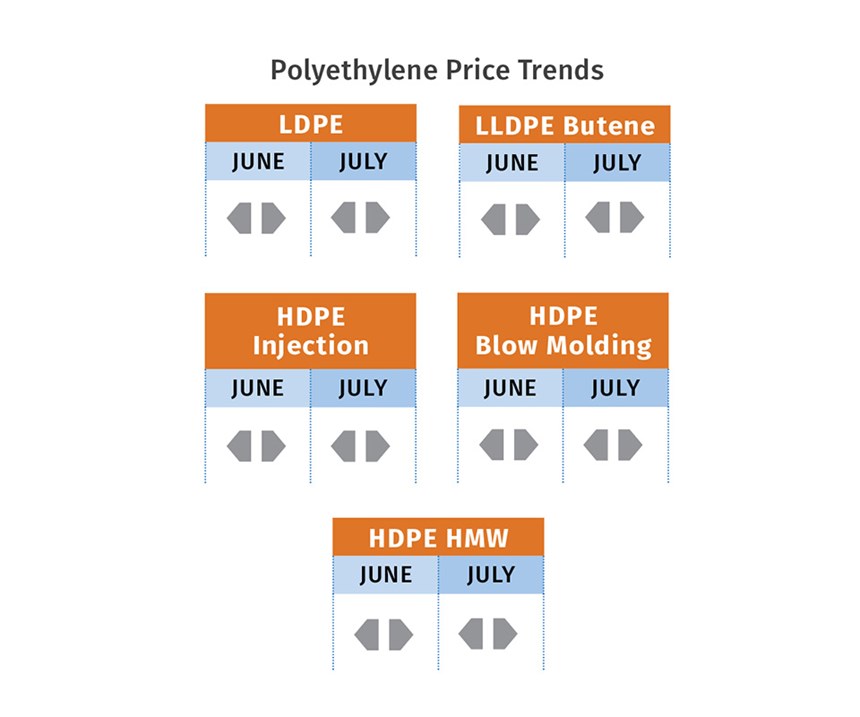

PE PRICES FLAT

Polyethylene prices remained flat through June, following a price reduction of generally 3¢/lb by some suppliers, according to Mike Burns, RTi’s v.p. of client services for PE. Suppliers were out with a 3¢/lb hike for July, but Burns expected all PE prices to remain flat through July and August, noting that a PE price change in the July-August time frame took place just once in a span of 10 years.

An expected earlier scenario of further resin decreases is not materializing, primarily due to several unplanned and planned production disruptions, which tightened the market. Moreover, recovery of suppliers’ inventories did not take place as originally thought, this while domestic demand continues to be rather robust, said Burns. PCW reported that spot supply was relatively balanced because of robust domestic demand and production outages. They noted that HDPE pressure pipe and conduit sales in particular have seen strong growth this year, contribution to the healthy demand overall.

Both Burns and PCW characterized export markets as quiet, partly due to lack of material and slowed demand. Interestingly, PE suppliers have been running plants in the high 80s-to-low-90s%, versus mid-to-high 90s during the last few years.

The Plastic Exchange’s Greenberg described the spot market as ho-hum, noting that processors had a negative outlook on pricing—which had dropped some and then stabilized—and were buying smaller sized orders. Also, he noted that many processors claimed to have been well supplied through July.

Commenting on current domestic prices, Burns noted, “The reality is that pricing is now good—ideal delta with Chinese PE prices is 7-10¢/lb and we are now at 8¢/lb. Meanwhile, Dow expected to start up its now LLDPE production this month and CP Chem is expected to start up its new HDPE and LLDPE production in third quarter.

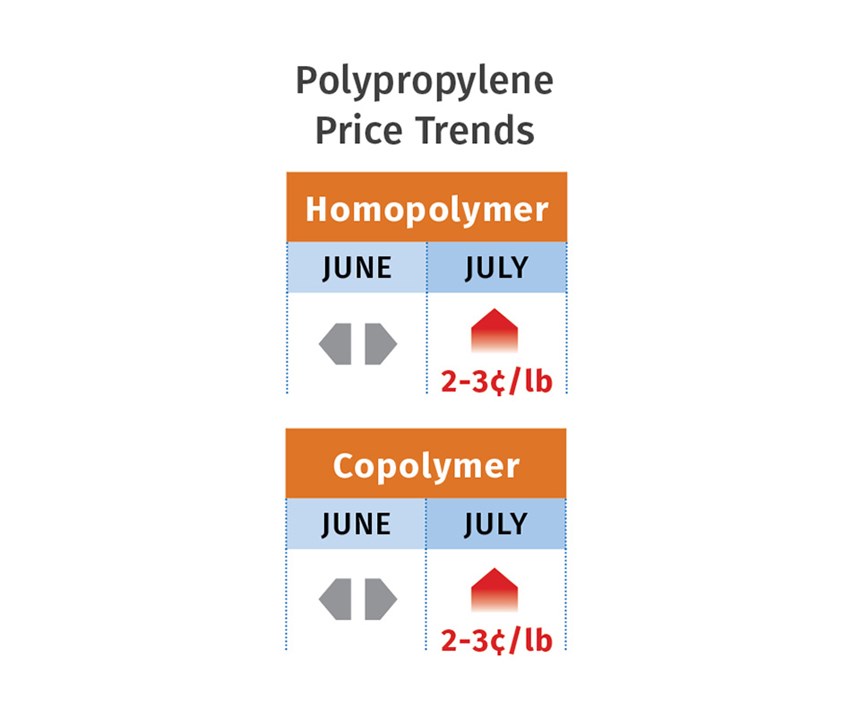

PP PRICE FLAT-TO-UP

Polypropylene prices were flat in June, in step with propylene monomer, which rolled over from May at 38.5¢/lb, However, production disruptions at two PDH on-purpose propylene units resulted in monomer tightness. July monomer contract nominations stood at 2-3¢/lb and PP suppliers were poised to issue similar resin price hikes, according to Scott Newell, RTi’s v.p. of PP markets.

Burns noted that LBI issued a price increase expansion margin of 3¢ on top of the monomer increase, effective this month, but there was no further industry support. The Plastics Exchange’s Greenberg reported, “We believe the market is now settling up for another series of margin expanding increases ahead, though the success would not be an automatic slam dunk.” Factors that could influence this trend is the slow but steady demand in downstream demand with no new resin production complexes on the near horizon—essentially tipping supply/ demand in favor of PP suppliers.

Demand for PP was very good in May and June, following the drop in prices--a total of 13.5¢/lb in April/May time frame, so buyers were stocking up, according to Newell. Unplanned production outages for both PP and PP impact copolymer tightened things up.

PCW described PP spot prices a flat- to-higher due to the tighter supply. Still, Greenberg described PP trading activity as improving, with buyers becoming a bid more aggressive with their orders and spot demand showing signs of strengthening. Spot PP homopolymer remained available, but prices have ticked up a few cents, while PP copolymer had become scarce and commanded a growing premium. PCW also reported on Braskem’s late June announcement that it will construct a 962 million lb/yr plant adjacent to existing PP units in LaPorte, Texas, with an expected startup in first quarter 2020. The

“Delta” line represents Braskem’s seventh production line in the U.S., and will produce homopolymers, random copolymers, impact copolymers and reactor thermoplastic polyolefins.

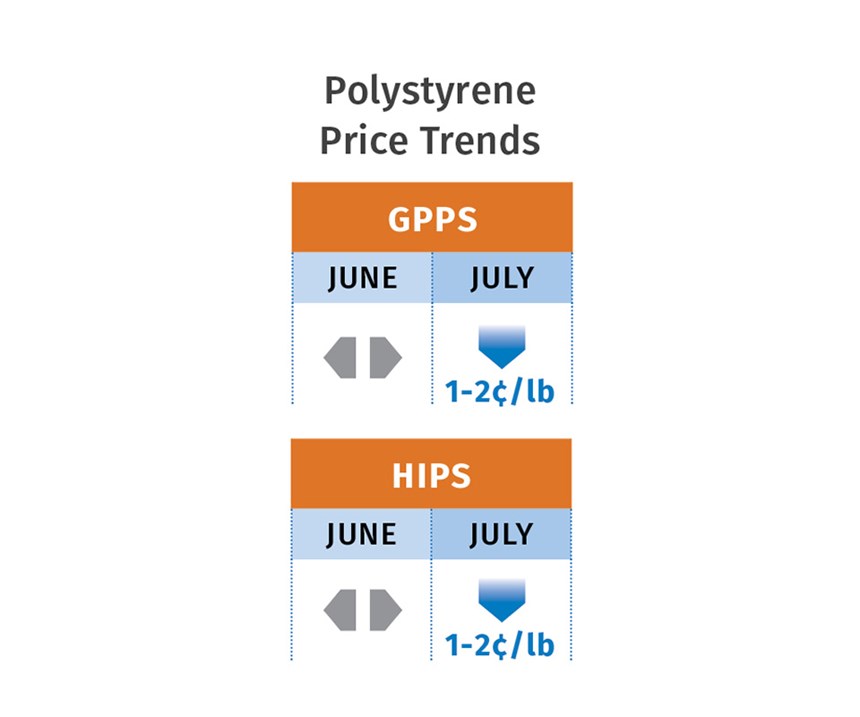

PS PRICES FLAT

Polystyrene prices remained flat in June, following a cumulative 7¢/lb drop in the two previous months, and due to a rollover in benzene contract prices, according to Mark Kallman, RTi’s v.p. of client services for engineering resins, PS, and PVC.PCW reported spot PS prices were flat-to-lower amid seasonally slower demand. Spot styrene monomer at end of June, ended up down by 9%. Spot benzene slid nearly 20 ¢/gal. Kallman ventured that July benzene contract prices would settled down 10-20¢/gal. This could trans- late to a July decrease of 1-2¢/lb for PS resins.

Meanwhile, PCW reported that spot prime general-purpose PS remained flat while generic prime HIPS was down 1¢/ lb as global butadiene prices plunged. Kallman concedes that there is an “unusual” pressure from imports—more specifically, for prime HIPS imports from the Far East and Brazil, which are coming into port at 64¢/lb. Following repackaging and transport, that price moves up by 10¢/lb but is still attractively priced compared to domestic prime HIPS.

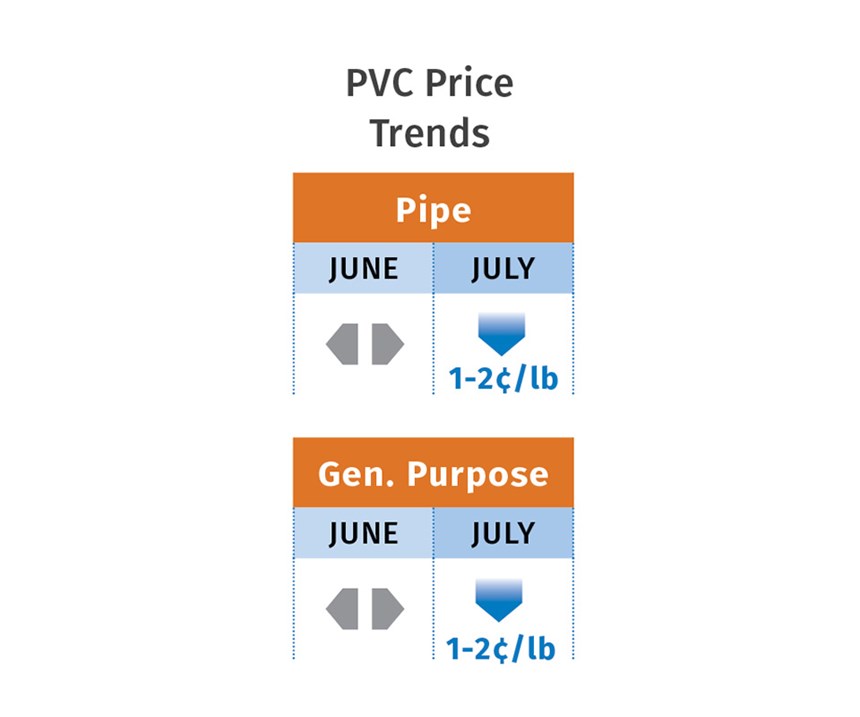

PVC PRICES FLAT-TO-DOWN

PVC prices remained flat in June, but and had good potential for dropping between 1-2¢/lb in the July-August timeframe, according to RTi’s Kallman. This driven primarily by ample supplies of ethylene and lower spot prices through June, which would result in lower July ethylene contract settlements, as well as lower crude oil prices.

Meanwhile, domestic demand for PVC through May, was up 2% year-to-date. PVC production has recovered to January levels, so suppliers’ inventories are in much better shape. For now, exports are flat-to-down.

PET PRICES DOWN

Domestic bottle-grade prime PET prices in June averaged 55.5¢/lb, down 2.2¢/lb from May, based on PCW’s Daily PET Report. That price represents PET business on a delivered Chicago basis. The price on June 30, dropped to 54¢/lb, driven primarily by lower costs of raw materials PTA, MEG and PX.

Meanwhile, prices of imported prime PET, with an IV of 78 ml/gram or higher, also fell in June, averaging 51.4¢/lb, down 2.5¢ from May. This represented PET resin on a delivered duty-paid U.S. port basis. The price for imported PET on June 30, was 53.5¢/lb. PET feedstock costs in June averaged 50.5¢/lb, down 1.31c/lb from May, according to a calculation used to price prime PET for monthly invoicing by resin suppliers and distributors supplying domestic end users.

Related Content

Part 3: The World of Molding Thermosets

Thermosets were the prevalent material in the early history of plastics, but were soon overtaken by thermoplastics in injection molding applications.

Read MorePrices of All Five Commodity Plastics On the Way Up

Despite earlier anticipated rollover in prices for most of the volume commodity resins, prices were generally on the way up for all going into the third month of first quarter.

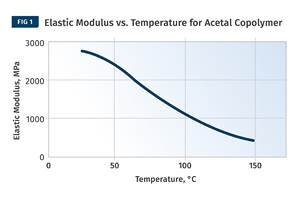

Read MoreThe Effects of Time on Polymers

Last month we briefly discussed the influence of temperature on the mechanical properties of polymers and reviewed some of the structural considerations that govern these effects.

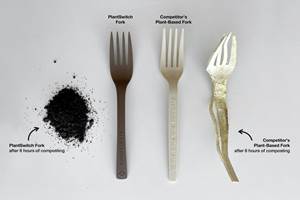

Read MoreAdvanced Biobased Materials Company PlantSwitch Gets Support for Commercialization

With participation from venture investment firm NexPoint Capital, PlantSwitch closes it $8M bridge financing round.

Read MoreRead Next

Most Resin Prices Down or Flat; PC and Nylon 66 Up for Now

Falling feedstock prices are a key driver as we enter the third quarter.

Read MoreFor PLASTICS' CEO Seaholm, NPE to Shine Light on Sustainability Successes

With advocacy, communication and sustainability as three main pillars, Seaholm leads a trade association to NPE that ‘is more active today than we have ever been.’

Read MoreSee Recyclers Close the Loop on Trade Show Production Scrap at NPE2024

A collaboration between show organizer PLASTICS, recycler CPR and size reduction experts WEIMA and Conair recovered and recycled all production scrap at NPE2024.

Read More