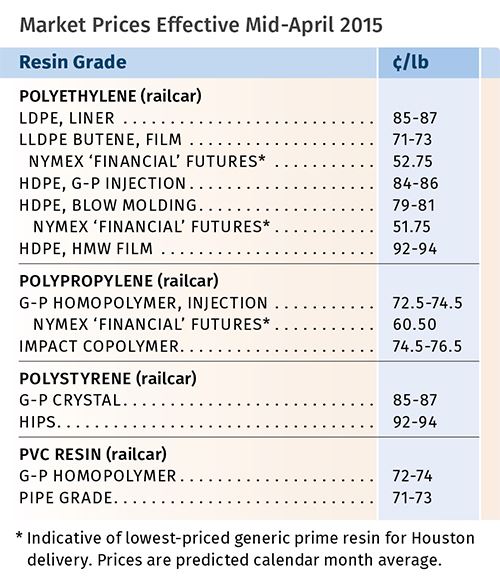

PE, PS, PVC Prices Moving Upwards

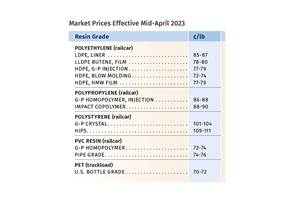

Global and domestic supply constrictions reverse the recent downward trend in prices for commodity resins.

At the end of the first quarter, a mixed bag of contributing factors reversed the trajectory of most commodity resin prices from a downward to upward direction. Prices may have bottomed out for PE for possibly the rest of the year, barring any major global supply disruptions. On the other hand, PP contract prices were moving down because of the direction of propylene monomer, but PP pricing appears to be increasingly decoupled from that of monomer.

PS and PVC prices could soften again as supply constrictions are resolved and feedstock costs resume their decline. These are some of the views of purchasing consultants at Resin Technology, Inc. (RTi), Fort Worth, Texas, and CEO Michael Greenberg of The Plastics Exchange in Chicago.

PE PRICES MOVING UP

Polyethylene prices held steady through March and April, and then suppliers issued price hikes of 5¢/lb for May 1. Full implementation of those hikes is very likely, according to Mike Burns, RTi’s v.p. for PE, due to the resumption of flourishing export demand. The pricing move was initiated by ExxonMobil after the NPE2015 show, where the resin supplier heard many processors enthuse over the strength of business activity. ExxonMobil appears to have become a price leader over the last year, in that all moves up or down have been implemented successfully whenever the firm opted to support them.

Both Burns and The Plastics Exchange’s Greenberg reported that spot prices had firmed up by end of March, signaling that prices had bottomed out, halting the four-month slide of 16¢/lb. “March and April could reflect the lowest PE prices for the year, barring a drop in oil prices below $30 a barrel,” says Burns.

Greenberg noted that processors were still looking for further price relief in April, citing record PE inventories in the recent past, along with low energy and feedstock costs. But suppliers countered that those factors were trumped by stronger demand for exports.

Indeed, ethylene monomer shortages due to several plant turnarounds in Southeast Asia and China, along with rising prices for oil-based naphtha, a dominant ethylene feedstock outside the U.S., have revived export business for domestic suppliers to those regions. Moreover, exports to Latin America, which nearly vanished when global PE prices were so much lower than domestic prices, are now back in the picture. “The outcome of domestic price increases will continue to depend heavily on the price of oil-based PE made from naphtha and the tight material supplies in other regions,” says Burns. He expects that domestic PE prices will remain relatively stable, though there is potential for another price increase in the third quarter.

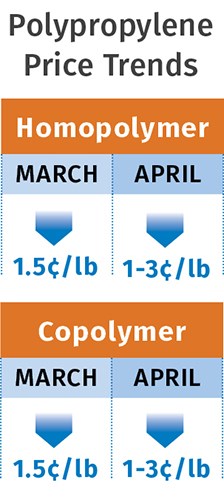

PP PRICES DROP

Polypropylene prices dropped by 1.5¢/lb in March, in step with propylene monomer contract prices. Further monomer price drops were anticipated last month, yet PP prices were not expected to drop by as much. “There is a big push by PP suppliers for another 2¢/lb margin increase,” explained Scott Newell, RTi’s director of client services for PP.

Greenberg reported early last month that based on spot propylene market conditions, April monomer contract prices could drop by 3-4¢/lb. He also said the market foretells further softness for monomer, as prices are currently predicted to slide a total of 15¢/lb by December. Newell ventured that April monomer contracts could drop by as much as 4-5¢/lb, but he said that would most likely translate into a PP price decline of just 2-3¢/lb. Both sources agree that while some resin contracts are still tied to monomer costs, the PP resin market has become less transparent, with a very wide range of PP prices now in place.

Meanwhile, spot PP prices have been exceeding contract prices, due to limited supply brought on by several unplanned production disruptions. Demand was good during the first quarter, but Newell attributes much of it to processors’ restocking. Still, he sees potential for some real growth as the year progresses.

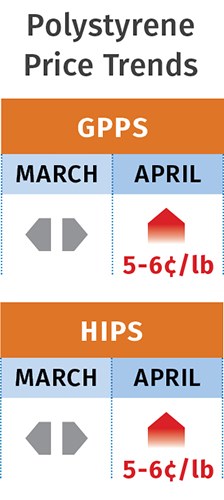

PS PRICES MOVE UPWARDS

Polystyrene prices were flat in March, but suppliers had issued price hikes of 5-6¢/lb for April 1, ending the decline of 13¢/lb so far this year, after another 12¢/lb drop in fourth-quarter 2014. Mark Kallman, RTi’s v.p. of client services for engineering resins, PS, and PVC, predicted last month that at least 5¢/lb of the increases would be mplemented.

All the earlier decreases were driven primarily by sharp price drops in benzene feedstock and lackluster resin demand. However, April benzene contract prices jumped up by 52¢ to $2.58/gal, and PS suppliers had their hands full trying to meet demand, which entered the busy season for construction and recreational products, Kallman explained. While he foresees further increases in benzene prices, he anticipates they will be in much smaller increments.

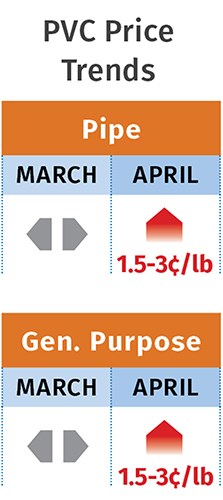

PVC PRICES ON WAY UP

PVC prices were flat in March, but suppliers were pushing hard to get that month’s 3¢/lb increase implemented early in April, with an additional 3¢/lb increase also on the table. “At this point, I don’t see them getting more than a total of 3¢/lb from these combined price increases,” noted RTi’s Kallman.

Constricted supply of PVC has been the major driver behind these price nominations, due to a series of planned maintenance outages over the last few months, along with restricted supply of ethylene east of the Mississippi. April was the month for completing the remaining turnarounds at two PVC plants, according to Kallman. That was just in time for the construction season, which has been delayed by extended winter weather yet is widely expected to be even better than last year. “The end to these plant turnarounds should lead to a balanced to well-supplied market,” says Kallman. He noted that PVC exports, thus far, have been lower than last year, owing to the amount of domestic capacity that was off-line as well as lower oil prices. He anticipates relatively stable domestic PVC prices following the partial implementation of the nominated increases, with that increase coming sometime in the summer months.

Related Content

PP Prices May Plunge, Others Are Mostly Flat

PP prices appear on the verge a major downward trajectory, with some potential of a modest downward path for others.

Read MoreFirst Quarter Looks Mostly Flat for Resin Prices

Temporary upward blips don't indicate any sustained movement in the near term.

Read MoreBaxter to Scale Up PVC Intravenous Bag Recycling Program

Successful pilot program with Northwestern Medicine will expand to additional units and health systems.

Read MoreCommodity Resin Prices Flat to Lower

Major price correction looms for PP, and lower prices are projected for PE, PS, PVC and PET.

Read MoreRead Next

Lead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read MoreBeyond Prototypes: 8 Ways the Plastics Industry Is Using 3D Printing

Plastics processors are finding applications for 3D printing around the plant and across the supply chain. Here are 8 examples to look for at NPE2024.

Read More