PP Prices Spike; Other Prices Up, Too

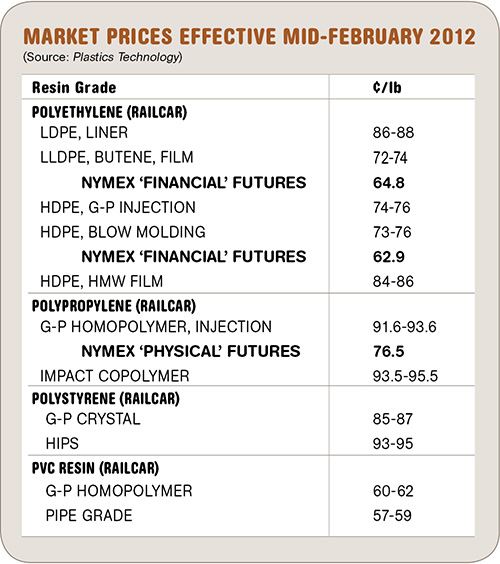

Prices of commodity resins all moved up in the first quarter.

Prices of commodity resins all moved up in the first quarter. Polypropylene was in the lead with a double-digit increase in February. This followed on a 41¢ drop between May and December of last year. Here’s what industry sources make of the current situation. We interviewed resin purchasing consultants from Resin Technology, Inc. (RTi) of Fort Worth, Texas, and Michael Greenberg, CEO of the Plastics Exchange, Chicago.

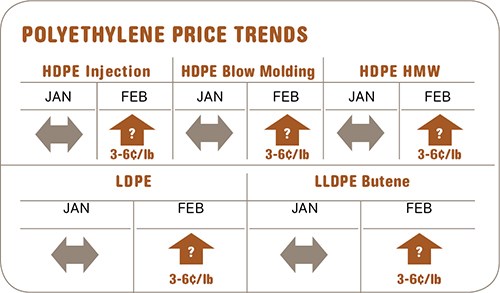

PE HIKES UNCERTAIN

Suppliers attempted, but failed, to raise polyethylene prices by 6¢/lb in January and they were trying again at press time last month. Whether any or all of it would be implemented was still unclear. A new 7¢ price hike was also on the table for Mar. 1. One contributing factor was ethylene monomer, whose spot prices rose 7¢ to 64¢/lb by the end of the first week in February, up 14¢ total since December.

There is still plenty of ethylene supply, despite several planned cracker outages. “This is a short-term spike,” says Mike Burns, RTi’s v.p. of PE, adding that ethylene precursor ethane is at a low of 44¢/gal (about 19¢/lb). Greenberg of the Plastics Exchange notes that there have also been a couple of recent unplanned outages, and he foresees spot ethylene tabs will remain elevated into April.

So far, PE demand appears to be soft following lots of prebuying in December in anticipation of price hikes. According to Greenberg, that prebuying helped processors resist the January price increases. He points out that despite what appears to be an oversupplied market, PE spot prices rose in the last two months because resin suppliers are using the export market to add to the demand base.

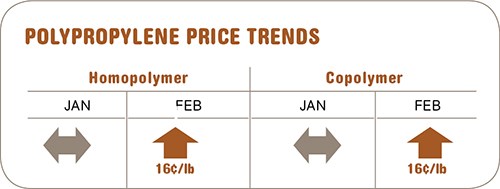

PP PRICES SURGE

For the third time in the last two years, polypropylene prices took a giant leap upward, of 16.5¢/lb, in lock-step with the increase in February propylene monomer contracts. PP suppliers had aimed for an additional 2¢ to rebuild their eroded margins, but they got no more than a penny-for-penny match with the monomer hike.

Driving the monomer market price surge is tighter supply due to scheduled outages at crackers and refineries, as well as higher demand from the gasoline market, according to Scott Newell, director of client services for PP at RTi.

Spot monomer markets appeared to calm down by mid-February. RTi’s Newell notes that monomer and PP prices are unlikely to retreat but they are also unlikely to spike by double-digits again soon. Greenberg says moderate resin price increases are likely if monomer remains tight. He notes that spot monomer prices were already rising 1-2¢ right after the whopping contract price move.

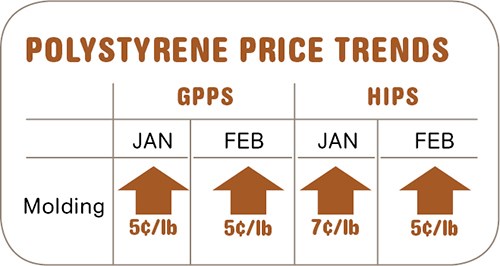

PS PRICES UP

Polystyrene prices moved up in January, by 5-7¢/lb for GPPS and 7-8¢ for HIPS. Price hikes of 5¢ for GPPS and 7¢ for HIPS were announced for Feb. 1 by Total, Styrolution, and Americas Styrenics. Those increases were expected to be mostly implemented, although the full 7¢/lb for HIPS was questionable.

Says Stacy Shelley, RTI’s director of business development for engineering resins, PS, and PVC, “Suppliers have been trying to increase the premium on HIPS by 4¢/lb, but butadiene prices are not justifying such a move.” He thought a 5¢ hike was more likely for both resin types. Since December, feedstock costs for GPPS are up 13¢/lb and 15¢/lb for HIPS.

Styrene monomer producers were losing, on average, nearly 2¢/lb last month on spot transactions. A lack of export opportunities and an overall weak market made it difficult to absorb the feedstock price increases, according to Shelley. He predicted that March monomer prices would be flat or down, barring any world crisis. Benzene spot prices held at $4/gal and February contracts were at $4.20/gal. The contract price increase resulted in a 5¢/lb higher cost to produce styrene monomer.

Imports could add some monomer pricing stability, and forward prices are seen as flat to down. February butadiene contracts settled about 25¢/lb below current spot prices.

No major change in domestic PS demand is expected this year, according to Shelley. Demand was strong in January as companies looked to stock up ahead of the February increases, but no more than a 3% to 5% overall increase is expected for the year.

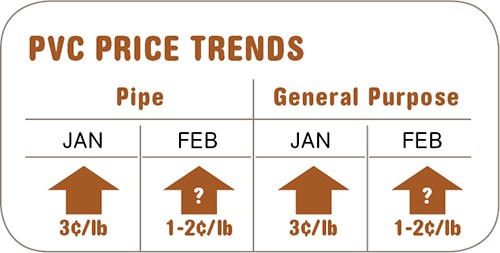

PVC PRICES UP

PVC prices moved up 3¢/lb in January. Suppliers were seeking another 2¢ for February, but discussions were ongoing at press time. Prices could rise another 1-2¢ this month as a result, according to Mark Kallman, RTi’s director of client services for engineering resins and PVC.

The increases are attributed largely to tight resin supply. Kallman notes that exports were quite strong at the end of 2011, but suppliers were unsure what direction the export market would take in the first quarter of 2012.

As a result, they were very cautious about running their plants at higher rates. PVC capacity utilization rates were in the low- to mid-70s (percentage) entering the new year.

Several planned maintenance turnarounds in the first quarter for both PVC resin and key feedstocks such as ethylene further tightened supply. Completion of most of the turnarounds is due by April. Signs of improvement in domestic demand, particularly from the construction sector, were emerging in mid-February, linked to the unusually mild winter.

Kallman says resin plant operating rates can be expected to rise this month, possibly to the low-80s, as a result of the initial improvements in demand and in anticipation of the usual demand spike in the second quarter.

Related Content

Prices of PE, PP, PS, PVC Drop

Generally, a bottoming-out appears to be the projected pricing trajectory.

Read MorePolyethylene Fundamentals – Part 4: Failed HDPE Case Study

Injection molders of small fuel tanks learned the hard way that a very small difference in density — 0.6% — could make a large difference in PE stress-crack resistance.

Read MoreFirst Quarter Looks Mostly Flat for Resin Prices

Temporary upward blips don't indicate any sustained movement in the near term.

Read MorePrices of All Five Commodity Plastics On the Way Up

Despite earlier anticipated rollover in prices for most of the volume commodity resins, prices were generally on the way up for all going into the third month of first quarter.

Read MoreRead Next

Making the Circular Economy a Reality

Driven by brand owner demands and new worldwide legislation, the entire supply chain is working toward the shift to circularity, with some evidence the circular economy has already begun.

Read MoreFor PLASTICS' CEO Seaholm, NPE to Shine Light on Sustainability Successes

With advocacy, communication and sustainability as three main pillars, Seaholm leads a trade association to NPE that ‘is more active today than we have ever been.’

Read More