Price Relief in Commodity Resins

Resin-Buying Strategies

Combination of slowed global demand, build-up in resin suppliers’ inventories, and projected drops in feedstock prices are expected to provide some price relief at least through the second quarter.

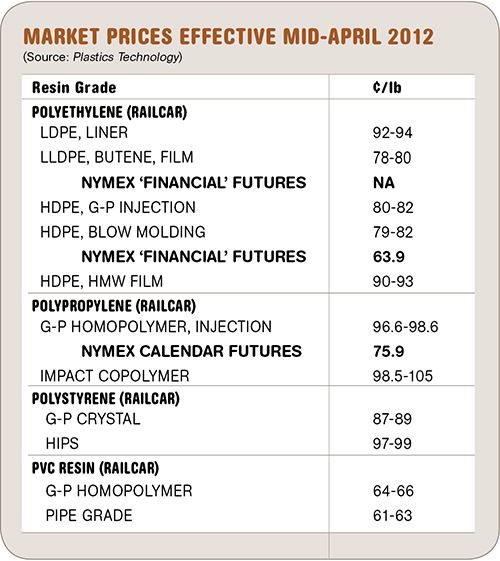

Prices of the four major commodity thermoplastics rose through the first quarter, driven principally by feedstock cost increases andtighter supply/demand due to lengthy planned maintenance outages. For PVC, add a real uptick in domestic demand during an unusually moderate winter season.

While the second quarter is usually a stronger period for demand growth with firmer resin pricing, a combination of slowed global demand, build-up in resin suppliers’ inventories, and projected drops in feedstock prices are expected to provide some price relief at least through the second quarter. These observations and other projections of what’s ahead were gleaned from consultants at Resin Technology Inc. (RTi) of Fort Worth, Texas, and Michael Greenberg, CEO of Chicago-based The Plastics Exchange.

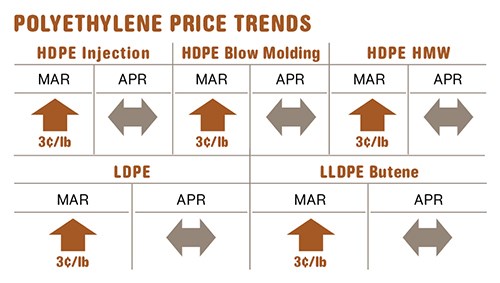

PE PRICES LIKELY TO SOFTEN

Polyethylene prices rose 3¢/lb in March from implementation of the second half of the January increase. Suppliers were still seeking additional increases totaling 7¢/lb, but market fundamentals appeared not to support higher PE prices. Although spot ethylene monomer prices briefly spiked in early April, due to a very short unexpected outage at the Williams cracker in Geismar, La., prices then dropped back to about their starting level of 68¢/lb. According to Greenberg, ethylene prices should ease upon the completion of all the maintenance turnarounds in May. “Third quarter ethylene was only in the high-50¢/lb range, and monomer for delivery in the fourth quarter is steeply discounted.”

Notes Mike Burns, v.p. of PE at RTi, “In the last four years, exports accounted for 25% to 30% of domestic PE production. Export volume has now dropped to 17% or less.” Suppliers have not throttled back on production and Burns says inventories are building. “While the market is still relatively balanced in mid-April, growing inventories could soon make for an oversupplied market,” he notes.

Because of recent PE price volatility, processors have continued wisely to buy only “as needed.” Price fluctuations in 2011, coupled with episodes of pre-buying, made it difficult to be certain about last year’s “real” PE demand, explains Burns. PE demand did grow by 3% to 4% in 2011, and there is potential for similar growth in 2012. Lower feedstock costs and steady demand are expected to cause downward price pressure starting this month.

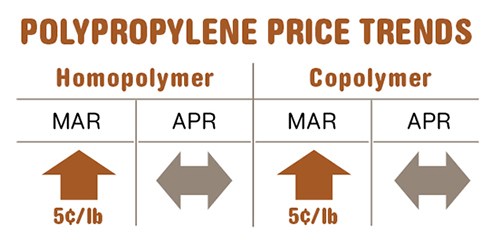

FLAT PP PRICES AHEAD?

Polypropylene prices seem to have peaked after spiking upward more than 21.5¢/lb in the first quarter, moving in step with propylene monomer prices. Despite suppliers’ efforts to raise monomer contract prices by 2¢ to 5¢/lb for April, it was considered likely that monomer and PP prices wouldn’t budge.

Scott Newell, director of client services for PP at RTi, ventures that prices would be close to flat (± 1¢) and could even decline as market demand slows. Greenberg notes that PP contract prices will follow the monomer’s trend, but PP spot prices will be “much more indicative of real supply/demand.” He noted that spot propylene and PP prices were trading at discounts of 3-4¢/lb to estimated contract prices in the first two weeks of April.

PP demand was largely flat in the first quarter, with at most an increase of about 1%, owing to pre-buying in January before the whopping increase. PP suppliers have not throttled back production, and inventories have been building.

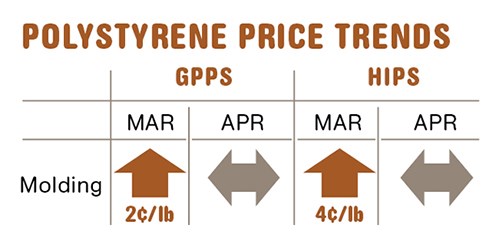

PS PRICES FLAT OR DOWN

Polystyrene prices appeared to have reached their peak by early April, and there were no new price hikes under way. Some previously delayed EPS price hikes were being implemented.

Although the second quarter has historically seen the highest demand for styrenic resins, real demand is not projected to be strong, according to Stacy Shelly, RTi’s director of business development for engineering resins, PS, and PVC. In fact, he anticipates falling PS prices by the end of this quarter.

By mid-April, feedstock costs for GPPS and EPS were down about 1.5¢/lb after rising 13.5¢/lb since Jan. 1. In contrast, costs to produce HIPS remained flat last month, after increasing 17¢ since December, due to higher butadiene prices.

According to Shelly, the HIPS premium over GPPS for export shipments is as low as 9¢/lb, while the domestic spread is now closer to 13¢. (The historical delta of 4-5¢/lb was last seen in 2010.) April butadiene contract prices are up 57¢/lb—close to 60%—for the year to date. Starting this month, BD supply is expected to increase and prices ought to start coming down.

Styrene monomer spot prices were declining last month. “While ABS demand is strong, downstream demand for PS is weak. After the upcoming cracker restarts, ethylene prices should drop, easing some of the upward pressure on styrene prices,” says Shelly.

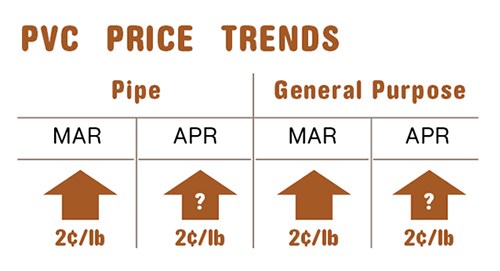

PVC PRICES RISE, BUT COULD FALL

PVC prices moved up 2¢ in March, driven by higher ethylene prices and a tighter supply/demand situation. New PVC hikes of 2¢ and 3¢/lb have been issued for Apr. 1 and May 1 respectively.

Ethylene contract prices, to which PVC resin suppliers are tied, dropped 1.75¢/lb in February and rose by the same amount in March. Domestic PVC demand was up 9% in first quarter, while plant operating rates were throttled back by suppliers to the low-to-mid 70s.

PVC suppliers might be able to implement their 2¢ April hike, after the temporary unplanned supply outage at the Williams ethylene cracker—representing 3-4% of domestic ethylene production—unsettled an already tightly balanced market, according to Mark Kallman, RTi’s director of client services for engineering resins and PVC.

However, most of the planned ethylene cracker outages were ending last month, and ethylene contract prices are very likely to move downwards. So the May 3¢ PVC hike does not appear to have much chance of implementation. On the contrary, lower prices for PVC are supported by significant pre-buying in the first quarter.

Related Content

New Facility Refreshes Post-Consumer PP by Washing Out Additives, Contaminants

PureCycle prepares to scale up its novel solvent recycling approach as new facility nears completion.

Read MoreCommodity Resin Prices Flat to Lower

Major price correction looms for PP, and lower prices are projected for PE, PS, PVC and PET.

Read MorePolyethylene Fundamentals – Part 4: Failed HDPE Case Study

Injection molders of small fuel tanks learned the hard way that a very small difference in density — 0.6% — could make a large difference in PE stress-crack resistance.

Read MoreFirst Quarter Looks Mostly Flat for Resin Prices

Temporary upward blips don't indicate any sustained movement in the near term.

Read MoreRead Next

Beyond Prototypes: 8 Ways the Plastics Industry Is Using 3D Printing

Plastics processors are finding applications for 3D printing around the plant and across the supply chain. Here are 8 examples to look for at NPE2024.

Read MoreMaking the Circular Economy a Reality

Driven by brand owner demands and new worldwide legislation, the entire supply chain is working toward the shift to circularity, with some evidence the circular economy has already begun.

Read More