Prices Drop for Polyolefins, Others Mixed

Prices of PS, PVC, PC & nylon 66 were flat, despite upward push for PET, ABS, nylon 6.

As had been expected by industry pros, 2016 appeared in early December to be ending with prices of PE and PP dropping, while PS, PVC, PC, and nylon 66 were generally flat to slightly lower, and PET, ABS, and nylon 6 were moving upward. Driving the flat-to-downward trajectory of most end-of-year resin prices were falling prices of key feedstocks, a buildup of supplier inventories, and slowing of domestic and/or export demand. Supporting the upward push on some resin prices were rising crude oil and natural gas prices, tight benzene supply, and higher prices of some imports.

These are the views of purchasing consultants from Resin Technology, Inc. (RTi), Fort Worth, Texas, CEO Michael Greenberg of the Plastics Exchange, Chicago, and Houston-based PetroChemWire (PCW).

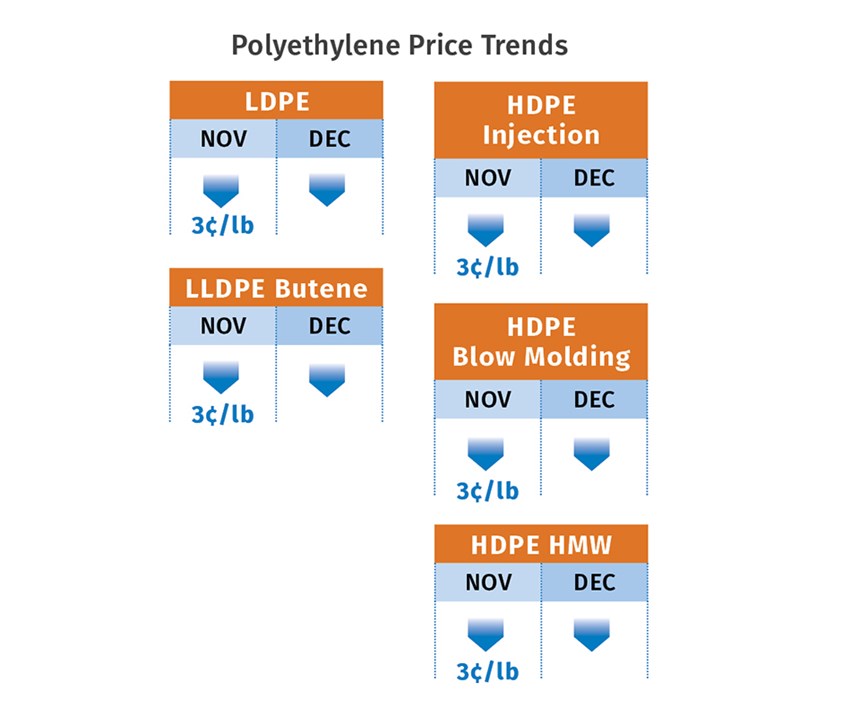

PE PRICES DOWN

Polyethylene prices dropped 3¢/lb in November, with suppliers signaling further drops coming in December, on the order of 2-5¢/lb. A more realistic expectation was a 2-3¢ drop by year’s end, according to Mike Burns, RTi’s v.p. of client services for PE. “It now takes 45¢/lb to make a pellet, and domestic prices are 10¢/lb higher than that cost,” he said. He noted that if crude oil prices move up this month to an expected $50/bbl, that may stop any further PE decreases, but will not result in increases. Only if oil prices rise beyond $55/bbl will shale gas prices also move up, taking PE prices with them.

The Plastic Exchange’s Greenberg reported that the PE spot market was very active, with deeply discounted material. Prices of most HDPE grades were first to fall sharply; and others like LDPE film and LLDPE injection molding grades, which had carried steep premiums, were also seeing price erosion as supplies improved. PCW reported that export volume had picked up by the end of November, but demand in Latin America was said to be sluggish, and Far East markets, including China, were slowing down.

An oversupply situation for PE is likely to loom for the next couple of years, barring any major disruption. Overall demand last year was better than in 2015, as domestic PE became very price-competitive, noted Burns.

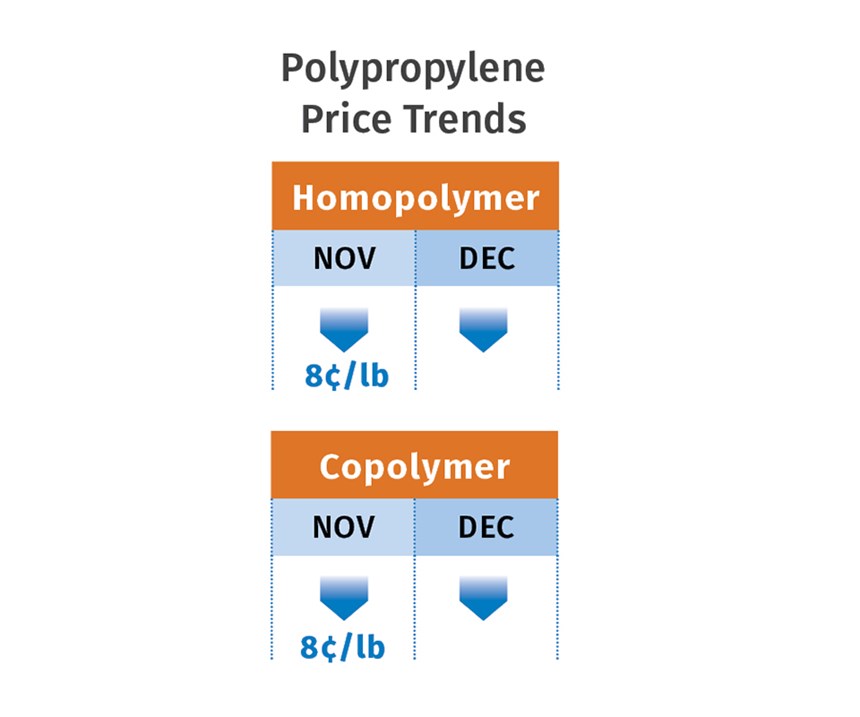

PP PRICES DROP

Polypropylene prices dropped 6¢/lb in step with the monomer in November, but suppliers added a further 2¢ discount, cutting into their margins. In addition to the 8¢ drop in November, PP prices are expected to slump another 3-4¢/lb by the end of December, based on the trend in monomer prices, accompanied by a 2-2.5¢ margin erosion, according to Scott Newell, RTi’s v.p. of PP markets.

PP supplier margins are still about 7¢/ lb going into January, but Newell ventured that 2.5¢/lb of that would come off resin prices this month. Both The Plastics Exchange and PCW reported slower spot PP trading by November’s end, with high availability of all grades. PCW also reported that PP export activity had picked up at the start of December, but then appeared to dwindle, noting that fourth- quarter export volumes appeared lower than in the previous quarter.

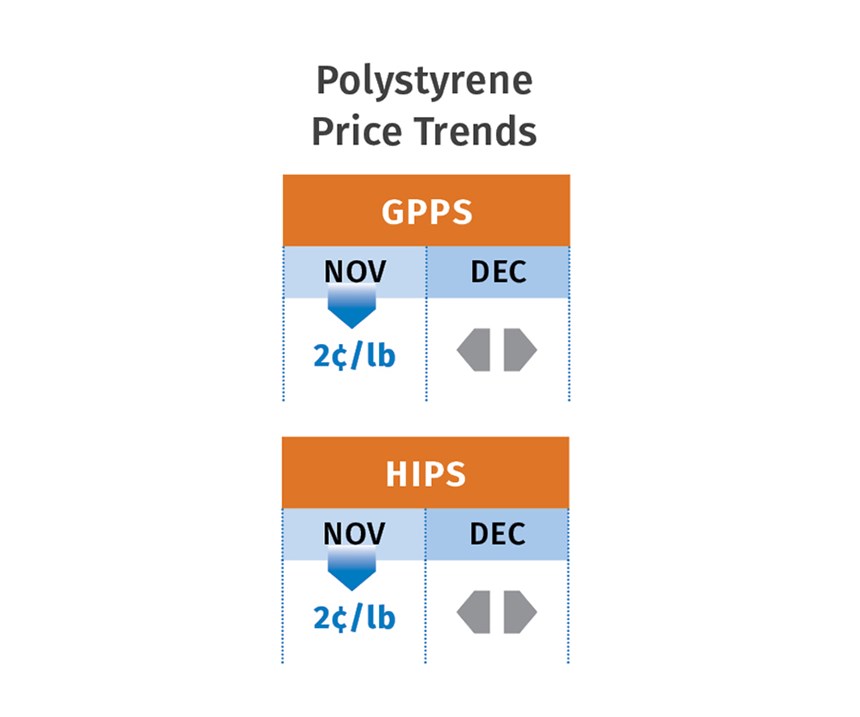

PS PRICES SOFT

Polystyrene prices dropped 2¢/lb in November, in step with that month’s benzene contract settlement at $2.21/gal. December benzene contracts settled 13¢/gal higher at $2.34, driven by tightening supply as imports dwindled, according to Mark Kallman, RTi’s v.p. of client services for engineering resins, PS, and PVC.

An attempt to increase PS prices in December by 2¢/lb did not appear to have any legs. Still, Kallman noted that this month, depending on pressure from crude oil prices and tight benzene supply, there is potential for benzene prices to move up by another 10¢/gal, with a resulting modest increase in PS prices. PCW reported that despite the drop in November prime market prices, no change was observed for spot prime or wide-spec prices. Preliminary industry data in November, according to PCW, indicated that PS demand, including exports, was down 7% from 2015.

PVC PRICES UP AND DOWN

PVC prices, after remaining flat for seven months through September, moved up 2¢/lb in October, only to drop by the same amount in November. The blip occurred after suppliers aimed to make up for the September ethylene contract-price increase, which was due to tight supplies. But, as RTI’s Kallman had predicted, a buildup in ethylene supplies was soon underway, sending monomer spot and contract prices on the way down through the fourth quarter.

PVC supplier inventories did see a bit of shrinkage in October due to planned maintenance at some resin plants, as well as an extended construction season due to warm weather. However, a return to slower seasonal demand was underway last month.

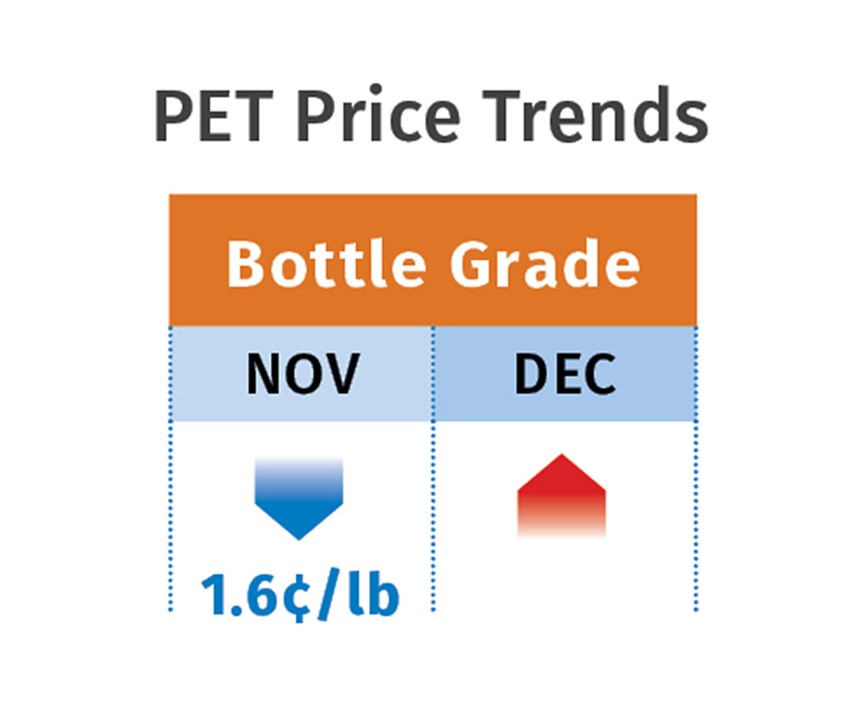

PET PRICES TURN UP

Domestic bottle-grade PET prime resin prices in November averaged 54.44¢/lb, down 0.16¢/lb from October, based on PCW’s Daily PET Report. That price represents PET business on a delivered Chicago basis. On Dec. 5, however, the price moved up to 55.25¢/lb, and prices were expected to be higher through the month. Driving this reverse trajectory were rising costs for PET feedstocks—PTA, MEG, and PX—themselves tied to rallying crude oil and natural gas prices, according to Xavier Cronin, senior editor for the PCW report.

Imported PET averaged 50.5¢/lb in November, up 8¢/lb from October. This represented PET resin on a delivered duty-paid U.S. port basis. (In some cases, it included inland delivery in super sacks.) Prices of PET from Brazil, representing about 11% of all imports, were rising for a second consecutive month, one reason average import prices were up.

Meanwhile, M&G Chemicals expects its new PET plant in Corpus Christi, Texas—for which the latest capacity estimate is 2.4 billion/lb/yr—to be brought on line by the end of the first quarter.

ABS PRICES RISE

ABS prices held generally flat through October, but a trajectory change was underway in November, according to RTI’s Kallman. He expected ABS prices to range from flat to 3¢/lb higher before the year concluded. Among the key drivers were higher prices of sty- rene monomer, acrylonitrile, and butadiene.

Moreover, strong ABS demand in Asia resulted in higher prices of imported ABS, giving domestic suppliers more leverage to increase their prices. Domestic demand for ABS has continued to be steady, thanks to automotive and construction/appliance sectors.

PC PRICES LARGELY FLAT

PC prices were generally flat through the fourth quarter, with little pressure for an increase at the start of the new year, said RTI’s Kallman. Additional capacity now on stream in Asia has slowed domestic exports, resulting in a buildup of supplier inventories. In addition, benzene and propylene feedstock costs dropped significantly.

NYLON 6 UP, NYLON 66 FLAT

Nylon 6 pricing was a bit “messy” as 2016 was coming to a close, according to RTI’s Kallman. Despite good supply and falling ben-zene and caprolactam prices during the fourth quarter, suppliers were trying to raise prices by 5-8¢/lb in the last two months of the year. Suppliers attributed their actions to a developing tight domestic supply situation for caprolactam following some plant closures. Kallman expected a partial implementation of the price hike before year’s end. “It all depends on processors’ price point, volume, and type of material,” he said. (At press time, BASF sought to hike both caprolactam and nylon 6 by 8¢ on Jan. 1.)

Nylon 66 prices were ending the year flat due to decreases in feed- stock cost for material produced via both the benzene/propylene and butadiene routes. Moreover, there was competition for market share during 2017 contract negotiations, so flat pricing was expected to continue, according to Kallman. Demand in 2016 continued to be good, owing largely to automotive, but on pace with 2015.

Related Content

Commodity Resin Prices Flat to Lower

Major price correction looms for PP, and lower prices are projected for PE, PS, PVC and PET.

Read MoreHow to Optimize Injection Molding of PHA and PHA/PLA Blends

Here are processing guidelines aimed at both getting the PHA resin into the process without degrading it, and reducing residence time at melt temperatures.

Read MorePrices Up for PE, PP, PS, Flat for PVC, PET

Trajectory is generally flat-to-down for all commodity resins.

Read MoreFirst Quarter Looks Mostly Flat for Resin Prices

Temporary upward blips don't indicate any sustained movement in the near term.

Read MoreRead Next

Lead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read MoreSee Recyclers Close the Loop on Trade Show Production Scrap at NPE2024

A collaboration between show organizer PLASTICS, recycler CPR and size reduction experts WEIMA and Conair recovered and recycled all production scrap at NPE2024.

Read More