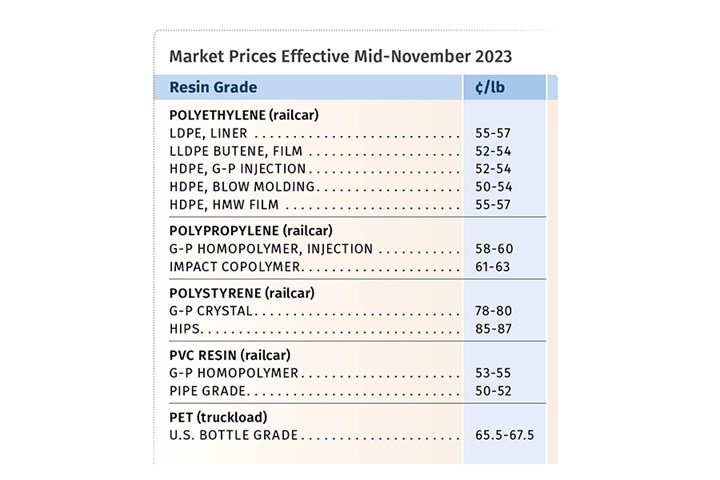

Prices Flat for PE, PVC, Up for PP and PS, Down for PET

A mixed bag, though prices likely to be down if not flat for all this month.

Once again, prices of the five commodity resins going into the last two months of the year appeared to be on a different trajectory. Prices of PE and PVC were flat with potential for decline in the case of both. Prices for PP and PS were driven up by higher prices and tightness of key feedstocks; yet, while prices for the former may stay flat, prices for PS were forecast for a relatively significant decline. Meanwhile, the reverse in feedstock prices led to a reduction in PET prices.

Overall contributing factors have included lackluster demand, unplanned production issues with feedstocks such as propylene monomer and benzene, some unplanned production issues in the polyolefins arena, and a throttling back of operating rates for all commodity resins by year’s end.

These are the views of purchasing consultants from Resin Technology Inc. (RTi), senior analysts from Houston-based PetroChemWire (PCW), CEO Michael Greenberg of The Plastics Exchange, and Scott Newell, executive v.p. polyolefins at distributor/compounder Spartan Polymers.

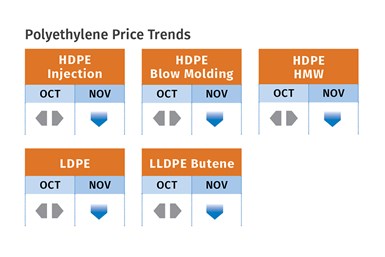

PE Prices Flat-to-Down?

Polyethylene prices appeared to be a rollover in October, following the 3¢/lb September increase and despite some suppliers who were out with increases of 3¢/lb and another 3¢/lb for November. This according to David Barry, PCW’s associate director for PE, PP and PS; Robin Chesshier, RTi’s v.p. of PE, PS and nylon 6 markets; and The Plastic Exchange’s CEO Michael Greenberg.

Both PCW’s Barry and RTi’s Chesshier project PE prices decreasing in the November-December time frame, noting they would not be surprised to see the 6¢/lb gained by suppliers since July coming off by year’s end. They attribute this to slowed domestic and exports demand, and lowered supplier production rates. It was apparent that suppliers had reduced plant operating rates from the high 80s percentile earlier this year to the low-to-mid 80s, and were destocking at year’s end.

Barry characterized spot PE prices by October’s end as flat to lower amid softer domestic and international demand. Greenberg cited preliminary supply/demand data for September released by the American Chemistry Council (ACC), revealing that after two months of growth, PE production was reduced back to its lowest level since February 2023. “PE exports, while off a tad, remained robust. It was the fifth straight month above two billion pounds. Domestic PE demand was average, actually 99% of the trailing 12-month average.

Altogether, this generated a nearly 2% reduction in PE producers’ collective resin inventories, pulling back to their lowest level since February 2023. Producers have well managed supply/demand these past several months, leaning on massive exports facilitated by elevated crude oil prices to regain pricing power,” he reported.

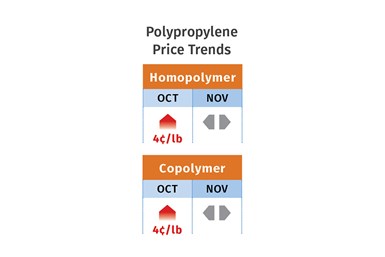

PP Prices Up for Now

Polypropylene prices were set to move up 4-5¢/lb, in step with propylene monomer in October, and as spot monomer prices were elevated by that month’s end due to tight supply, another increase was possible for November, according to PCW’s Barry, Spartan Polymers’ Newell and The Plastic Exchange’s Greenberg. Two non-monomer price increase initiatives for October and November, each for 3¢/lb, were unlikely to take hold.

PCW’s Barry notes that some typical contract buyers opted to cut back on order volumes due to weak finished goods order books. “Moreover, spot availability was much tighter as suppliers had reduced operating rates. Incremental export volumes were very limited. Import volumes were expected to pick up this quarter as Asia prices looked increasingly favorable.”

Spartan Polymers’ Newell notes that PP suppliers have done a good job of bringing the supply/demand balance to a better position than earlier this year. “With plant operating rates down to 72-73%, the market is very competitive.” As such, he ventured PP prices could be a rollover for December.

By October’s last week, The Plastic Exchange’s Greenberg reported their spot prime PP prices has moved up another 2¢/lb, which brought current levels to 8¢/lb above the July low. “We maintain our bullish stance that we have held since the summer; producers’ collective PP inventories entered October at the lowest point of 2023 and we believe that downstream inventories have been drawn down significantly, leaving the market susceptible to supply-chain disruptions, like the current PGP situation.”

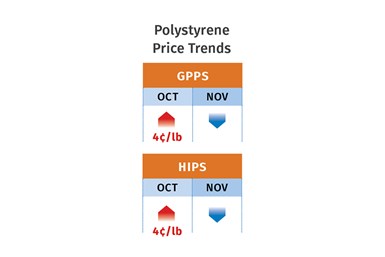

PS Prices Up, Then Down

Polystyrene prices moved up between 3¢/lb to 8¢/lb in October, following increases of 6¢/lb in the two previous months, according to PCW’s Barry and RTi’s Chesshier. The former indicated that industry reports were that 4¢ out of the 8¢/lb sought by suppliers was largely implemented in most cases. Both sources saw prices dropping in the November-December time frame. Contributing factors include a downward trend in key feedstocks, particularly benzene.

Chesshier ventures that market fundamentals, including lackluster demand and plant operating rates below 60%, could result in as much as a double-digit increase by year’s end. Barry characterized the market as balanced-to-long, with consistently slow demand seen this year. By October’s end he reported the implied styrene cost based on a 30% ethylene/70% benzene spot formula was down 7.4¢/lb compared with four weeks earlier. “If you want it, they have it,” was how one buyer described PS availability this month,” he reported.

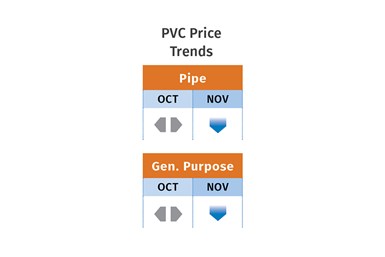

PVC Prices Flat, Then Down

PVC prices were flat in October, but some decline before year’s end was expected, according to Paul Pavlov, RTi’s v.p. of PP and PVC and PCW’s senior editor Donna Todd. Pavlov ventures that a drop of at least 2¢/lb is possible, owing to slowed demand despite a more balanced supply situation following suppliers’ reduced plant operating rates.

Todd noted that one industry pundit is forecasting a 1¢/lb in November, and flat in December. She reports that there is concern among some market participants that PVC prices will drop further and faster. This was prompted by Formosa Taiwan dropping its export prices for November by $100/mt (which equates to 4.5¢/lb reduction). “While market watchers noted that changes to Asian export prices do not necessarily have a direct effect on U.S. domestic prices, they were aware that export prices have a larger influence on the domestic market than they have in previous years. As such, they were anxious that a market pundit would feel that domestic prices would need to slide by a corresponding amount.”

PET Prices Down

PET prices dropped 4¢/lb in October, based on raw material formulation contracts after rolling over in September, and nixing the August 3¢/lb increase, according to Mark Kallman RTi’s v.p. of PVC, PET and engineering resins. He ventures that prices in November-December would be flat to fractionally lower. He noted that the market continues to be well supplied, even with suppliers reducing plant operating rates and better priced spot imports are readily available. Also, he points out that fourth quarter is traditionally slower in demand; this following the bottle season’s underwhelming demand this year in second and into third quarters.

Related Content

Prices of PE, PP, PS, PVC Drop

Generally, a bottoming-out appears to be the projected pricing trajectory.

Read MorePrices Up for PE, PP, PS, Flat for PVC, PET

Trajectory is generally flat-to-down for all commodity resins.

Read MorePrices of All Five Commodity Plastics On the Way Up

Despite earlier anticipated rollover in prices for most of the volume commodity resins, prices were generally on the way up for all going into the third month of first quarter.

Read MorePrices Up for All Volume Resins

First quarter was ending up with upward pricing, primarily due to higher feedstock costs and not supply/demand fundamentals.

Read MoreRead Next

People 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read MoreFor PLASTICS' CEO Seaholm, NPE to Shine Light on Sustainability Successes

With advocacy, communication and sustainability as three main pillars, Seaholm leads a trade association to NPE that ‘is more active today than we have ever been.’

Read More