Prices Trending Upward for Commodity & Engineering Resins

Entering this year’s second quarter, prices of four commodity thermoplastics were largely flat but poised to move upward, driven by higher feedstock costs.

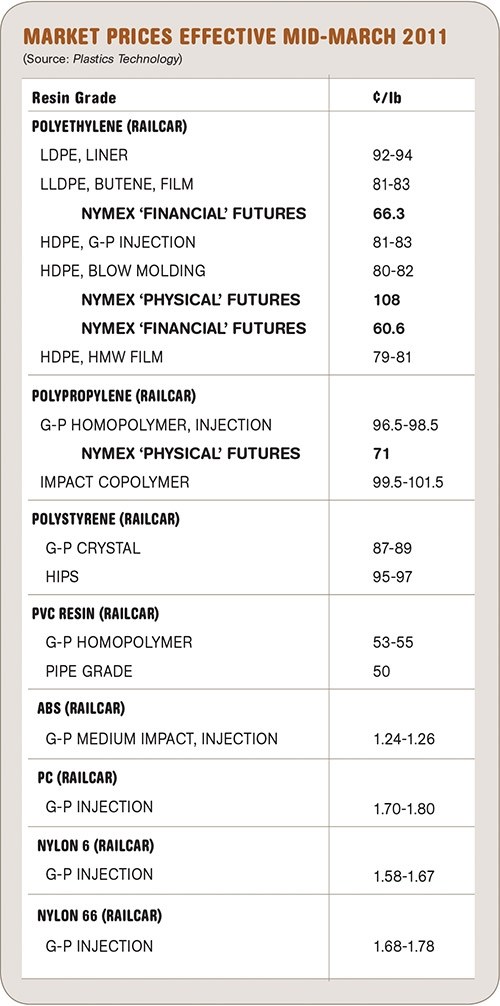

Entering this year’s second quarter, prices of four commodity thermoplastics were largely flat but poised to move upward, driven by higher feedstock costs. The latter reflect tight supplies after planned and unplanned plant outages in the previous quarter and also the volatility of oil prices shaken by Middle East unrest. A similar situation applies to four major “commodity” engineering thermoplastics—ABS, polycarbonate (PC), and nylon 6 and 66—whose prices will be reviewed quarterly, starting this month.

Also in the picture are a strong return of export markets as well as the potential for further improvement in domestic demand. These are among the key factors at play, according to resin purchasing consultants at Resin Technology, Inc. (RTi) in Fort Worth, Texas. More of their analysis follows.

PE PRICES FLAT, BUT NOT FOR LONG

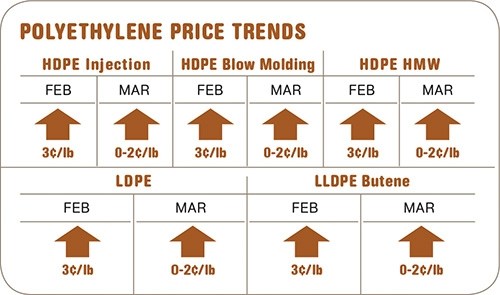

Polyethylene prices moved up 3¢/lb in February as suppliers implemented half of their announced 5¢ hike. Projections for March prices were anywhere from flat to a 2¢/lb increase. A new 5¢ hike for Apr. 1 emerged by mid-March. Resin suppliers placed part of the blame on rising oil prices, though those prices had not yet seriously impacted feedstocks. Although PE prices in the secondary market were relatively stable, some brokers were “planting the seed for higher prices,” as RTi sources put it.

Meanwhile, spot ethylene monomer prices did rise 3¢ to 56¢/lb (from an average of 49¢ since January), although this was attributed to production problems.

The PE export market also began to heat up. At the same time, ExxonMobil put HDPE on allocation due to unspecified “operational issues” at its Mont Belvieu facility, which were expected to last into April. LyondellBasell declared “order control” on all its PE production, which was also expected to last into this month.

Outlook & Suggested Action Strategies

30 to 60 Day: RTi advised buying ahead to cover your April needs. Key drivers that will dictate PE price direction are domestic and export demand and supplier inventory levels.

PP PRICES DOWN FOR NOW

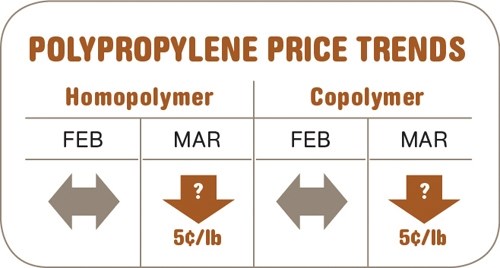

After the dramatic 17¢ surge in January, polypropylene contract prices were flat in February, as propylene monomer contracts stayed flat. PP spot prices dropped by as much as 10¢ between February and March, in concert with the retreat in spot monomer prices. March monomer contracts settled at 72.5¢/lb, down 5¢, and while it appeared at press time in mid-March that PP contract prices would follow, it was too close to call, since there were proposals for April monomer contracts to bounce higher again by about 5¢.

Slow domestic demand through most of the first quarter caused suppliers to offer much of their excess inventory to the secondary markets at steep discounts—as much as 15¢/lb. Domestic demand dropped 11.1% from 2010 averages, equal to about 150 million lb/month. But a rebound appeared to be on the way last month, as evidenced by the strong secondary market activity. PP plant utilization rates were steady at 83.8% since December, while suppliers’ inventories grew to 38.6 days, the highest since late 2008.

Outlook & Suggested ActionStrategies

30-60 Day: PTi expected prices to bottom out by the end of last month. The degree of pickup in demand will be a key factor in prices. Also, monomer supplies could tighten again.

PS PRICES FLAT

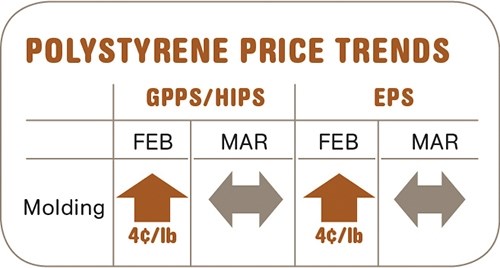

Polystyrene price increases of 3¢/lb for Mar. 1 emerged late for GPPS and HIPS, following total price gains of 8¢ in January and February. These increases were totally feedstock driven. Similar increases were also implemented for EPS, and new hikes of 2¢ to 4¢/lb were being pushed strongly for Mar. 1.

Demand for PS rose in the first quarter for the first time in six years, although the gain was less than 1%. PS operating rates are in the low 70% range, with little export activity. PS packaging faces continued substitution pressure due to rising global prices.

Benzene contract prices in March rose by 4¢ to $4.39/gal. In total, contract benzene prices increased $1.11/gal, or 34%, through the first quarter. Spot prices were falling back to $3.94/gal in March, and April prices were trading even lower as imports arrived. Styrene monomer contracts in February settled at 69¢ to 70¢/lb, while March contracts were projected to increase to 72¢ due to strong demand and producers’ aims to recover lost margins. Spot prices were over 70¢.

March contract prices for butadiene (used in the rubber portion of HIPS) settled near $1.04/lb, up 6¢. Spot prices were trading above $1.10/lb, suggesting an additional increase for April.

Outlook & Suggested Action Strategies

30-60 Day: RTi projected prices would peak last month and urged buyers to stock up to cover needs through this month. Competition continues to be your best defense against price hikes.

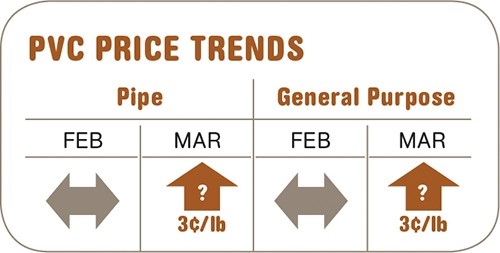

PVC PRICES MAY RISE

PVC prices remained flat through most of the first quarter, though suppliers issued 3¢ hikes for Mar. 1. A strong rebound of exports to Asia could support an upward price move. Some modest improvement in domestic demand also was evident. But PVC operating rates decreased 3%, due to scheduled plant outages.

Dow is closing 2 billion lb of vinyl chloride monomer capacity in Louisiana and Texas, representing 10% of domestic capacity. This move pushed industry operating rates to near 90% utilization, but Dow’s shuttered capacity is expected to be more or less replaced by a Shintech expansion later this year. Ethylene feedstock spot prices were pushed up by supply disruptions.

Outlook & Suggested Action Strategies

30-60 Day: Asian export demand, along with ethylene monomer production issues, are likely to drive prices higher soon, though the prospect of more reliable ethylene supplies could provide some relief in the latter part of this quarter. Buy as needed.

ABS PRICES UP

ABS prices continued their upward trend, rising an average of 11¢/lb in the first quarter. SABIC issued a 13¢ hike for Apr. 4; Ineos called for a 5¢ increase on Apr. 1; and BASF was also expected to issue an increase. Prices for ABS are on the rise worldwide due to rapidly growing feedstock costs and improved demand.

Supplies have tightened as ABS operating rates dropped to the mid-60% range, and there has been an increase in prebuying ahead of price hikes. Ineos was reported to have cut off orders for the month of March while accepting orders for shipment in April.

In feedstocks, acrylonitrile monomer prices broke the $1.10/lb mark in February, following unprecedented hikes for propylene monomer. Rising propylene prices are likely to keep acrylonitrile tabs at all-time highs through this quarter. Butadiene prices moved up 6¢/lb, but spot prices exceeded the March contract price level, suggesting even higher April contract prices. Styrene monomer contracts for March were expected to move up to 72¢/lb but could soften as benzene prices drop (see PS section above).

Outlook & Suggested Action Strategies

30-Day: Buy as needed. Supply is catching up with demand. Feedstock costs are also crucial.

PC PRICES RISING?

Polycarbonate prices appeared to be on the way up again, with two of the three domestic suppliers posting an increase of 14¢/lb for Mar. 1, a move that was in line with the February spike in feedstock costs. Supply tightened following Bayer’s declaration of force majeure in February, attributed to cold-weather power disruptions at its Texas facility. Return to full operation was delayed by problems in a phenol pipeline last month. Bayer’s PC allocations were reported to be as low as 50%.

Suppliers have focused on maximizing margins before significant new capacity hits the market. Completed maintenance turnarounds, along with planned capacity expansions in Asia and the Middle East, are expected to improve the supply/demand balance in the latter part of this quarter.

Meanwhile, phenol has been in tight supply due to unusually strong global demand and scheduled plant outages. Overall, feedstock costs for PC were up 13¢/lb in the first quarter. Those costs were expected to drop 2¢ to 3¢ last month, and could fall more this month if oil prices and/or demand decrease. This gradual downslide of feedstock costs could be reversed if Middle East unrest persists.

Demand for PC this year is projected to grow, based on a forecasted 10% to 20% increase in global automotive sales, plus continued weight-reduction efforts and some incremental added use in automotive glazing.

Outlook & Suggested Action Strategies

30-60 Day: PC supply last quarter moved from well balanced to tight and is likely to remain that way into this quarter. RTi expects Asian participation in the U.S. market to strengthen. The price trend through this quarter will be highly dependent on the recovery of Bayer’s capacity, supplemental volume from other suppliers, and the impact of oil prices on feedstocks.

NYLON PRICES STILL RISING

By March, nylon 6 suppliers implemented 10¢ to 15¢/lb of the 20-30¢ total increases posted for January and February. Caprolactam monomer remains very tight and high-priced, fueled by production outages here and in Europe and strong global demand for synthetic fibers.

Nylon 6 feedstock costs increased a total of 12¢ to 13¢/lb in the first two months of the year because of escalating benzene and ammonia costs.

December/January price increases for nylon 66 were implemented in February for direct buyers in the range of 5¢ to 10¢/lb for uncompounded materials, with higher amounts for flame-retardant and impact-modified compounds. February and March price increases of 10¢ to 12¢/lb were announced by multiple suppliers, with even higher increases for specialty grades.

These hikes were based on volatility in feedstocks due to unrest in Libya, as well as strong demand from the automotive market, which is rebounding more than 10% globally, with closer to 20% gains expected for China. Suppliers focused on not losing any margin gains since the recession.

Cold weather in the South pushed Invista to declare force majeure on intermediates and nylon 66, but production was restarted last month, and additional capacity was restarted for the first time since 2008.

Outlook & Suggested Action Strategies

30-60 Day: RTi sees demand continuing to recover for nylon 66 in automotive and nylon 6 in textiles. Nylon suppliers are currently optimistic and highly profitable. High oil prices muddy the outlook for feedstock costs. Buy as needed.

Related Content

Prices Up for PE, PP, PS, Flat for PVC, PET

Trajectory is generally flat-to-down for all commodity resins.

Read MoreNew Facility Refreshes Post-Consumer PP by Washing Out Additives, Contaminants

PureCycle prepares to scale up its novel solvent recycling approach as new facility nears completion.

Read MoreFirst Quarter Looks Mostly Flat for Resin Prices

Temporary upward blips don't indicate any sustained movement in the near term.

Read MoreThe Fundamentals of Polyethylene – Part 2: Density and Molecular Weight

PE properties can be adjusted either by changing the molecular weight or by altering the density. While this increases the possible combinations of properties, it also requires that the specification for the material be precise.

Read MoreRead Next

See Recyclers Close the Loop on Trade Show Production Scrap at NPE2024

A collaboration between show organizer PLASTICS, recycler CPR and size reduction experts WEIMA and Conair recovered and recycled all production scrap at NPE2024.

Read MorePeople 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read More