Resin Prices May Have Bottomed Out

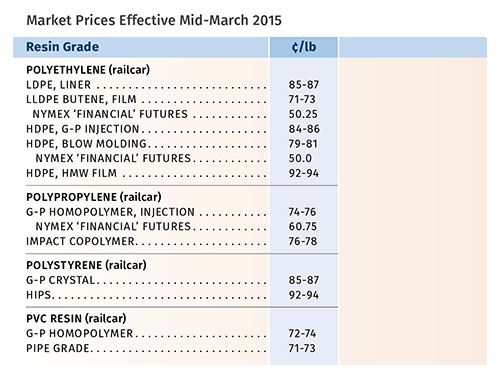

With continued declines in feedstock and energy costs through much of the first quarter, commodity and engineering resin prices fell too.

As March rolled in, prices of the four commodity resins and those of the most common engineering resins had dropped further since their decline in the fourth quarter of 2014, but they may have bottomed out in most cases. Exceptions are PP, PVC, and ABS, which are projected to be flat to modestly higher. Those are the views of purchasing consultants at Resin Technology, Inc. (RTi), Fort Worth, Texas and CEO Michael Greenberg of The Plastics Exchange, Chicago.

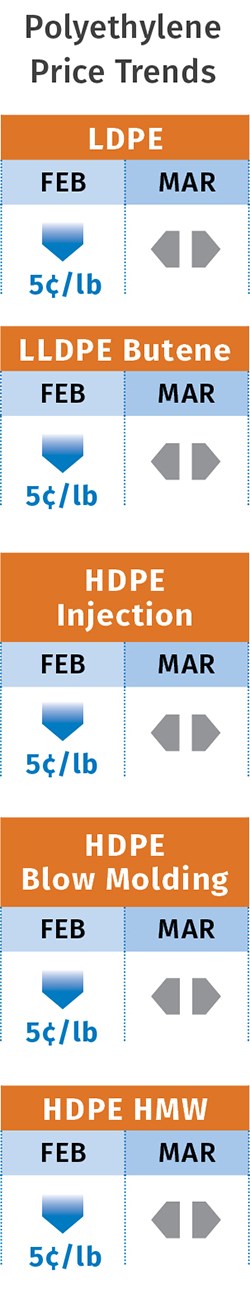

PE PRICES BOTTOMED OUT?

Polyethylene prices dropped 5¢/lb in February, bringing the total decline in prices within a five-month period to 16¢/lb. The downward movement has been linked to crude oil prices, a key driver of PE pricing for the last four years, says Mike Burns, v.p. for PE at RTi. “The delta between global and domestic PE prices has shrunk. For example, China’s PE prices dropped by 20¢/lb within a two-month period last year and domestic prices took longer to follow but are now close enough.” In general, he sees PE resin prices as having bottomed out, noting that global prices have started to rebound a bit and domestic secondary markets are showing the same trend.

At the end of February, The Plastics Exhange’s Greenberg noted that spot PE prices had strengthened a bit. “Houston export prices have firmed, along with the international market, so the huge gap that existed between export and domestic PE prices has closed significantly.” He noted that while nominations from two PE suppliers to increase prices by 4-5¢/lb in mid-March and April lend some support to market prices, they are “not yet ready to bounce back.”

Burns projected that domestic PE prices would firm up by this month, but with very little chance of upward movement. He ventures that PE exports will start to pick up in the second and third quarters, and that 2015 has the potential to emulate 2014’s second and third quarters in terms of demand and pricing stability.

He points out that last year, demand appeared to be up during the first quarter primarily due to prebuying in anticipation of price increases and to production capacity issues that affected nearly every PE resin grade. In contrast, processors have been buying “as needed” this year in anticipation of further price relief. In addition, supplier inventory

levels are at their highest in the last six years.

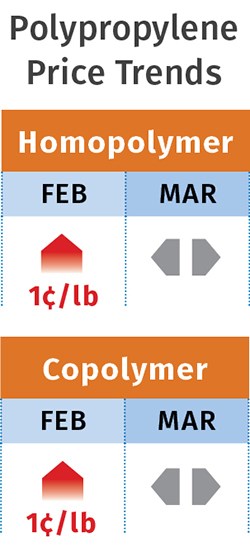

PP PRICES VARY CONSIDERABLY

PP prices generally moved up 1¢/lb in February in step with propylene monomer contracts. While there was an early March bid for a monomer price increase of 1.5¢/lb, monomer contracts were considered more likely to go in the opposite direction, with PP prices following.

Scott Newell, RTi’s director of client services for PP, projected flat-to-lower pricing with potential declines of 1-2¢ or even 3-4¢ by the time contracts settled, given the 4-5¢/lb decline in spot monomer prices. Greenberg noted that spot market conditions were not likely to support an increase, with little trading taking place and prices down to 47¢/lb. He said the forward market shows slightly lower prices offered each month until December.

Meanwhile, market observers say the “real story” is that from fourth-quarter 2014 through January, PP suppliers succeeded in implementing at least 2-3¢/lb margin-expansion increases beyond the cost of monomer. Explains Newell, “The PP market is no longer moving in unison. There is a splintering in prices—not everyone gets the same amount or at the same time, as suppliers have been approaching different markets and customers with different price structures.” He says a much wider range of pricing now exists for PP, so that the market is less transparent. He points out that the spot market is also reflecting this, with a large premium over contract prices.

Tight supplies, driven by unplanned production disruptions, have been one driving force, along with rising demand. The latter is being met to a small degree by imported PP, available at competitive prices, according Greenberg. Newell concedes that there are more PP resin imports coming in, but at a very slow pace, and noted that “this is a market driver to watch for over the next two years.” He characterizes the increase in demand this past January as more indicative of processors restocking low inventories and taking advantage of lower prices. However, he sees potential for some “real growth” as the year progresses.

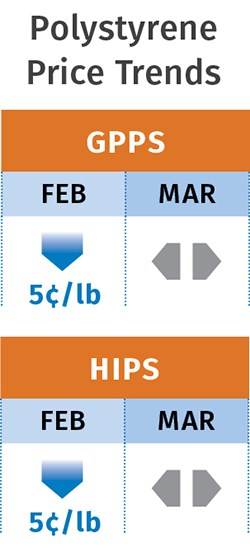

PS PRICES DOWN

Polystyrene prices dropped another 2-4¢/lb in February, following January’s decreases of 9-11¢/lb, bringing the net decrease for this year to 13¢/lb. These decreases followed a 12¢/lb decline in fourth-quarter 2014, all driven primarily by sharp decreases in benzene contract prices along with lower ethylene contract prices.

But PS prices may have bottomed out, according to Mark Kallman, RTi’s v.p. of client services for engineering resins, PS, and PVC. He predicted that PS prices would be flat in March, followed by a modest increase of 1-3¢/lb this month. Driving factors include

the return of upward pricing pressure on benzene, though not likely to the high levels seen over the last two years. The combined decrease of January and February benzene

contract prices was $1.36/gal, while March contracts dropped by 3-7¢/gal. April benzene contract price nominations were for an increase on the order of 20¢/lb as the market tightens. Reasons include on-purpose benzene production becoming less economical and slowing down of Asian benzene imports.

Meanwhile, an improvement in domestic PS demand is typical for the second quarter as

construction and recreation markets pick up. Domestic styrene monomer prices are already being driven higher by global monomer plant maintenance issues and an uptick in crude oil prices.

PVC PRICES FLAT BUT COULD MOVE UP

PVC prices remained flat in February, despite suppliers aiming to implement a price hike of 3¢/lb. In fact, prices may have bottomed out after a total decline of 7¢/lb between November and January, according to RTi’s Kallman. Meanwhile, some suppliers moved their February increase to March, others to April, and one called for a 2¢/lb increase in May.

Driving factors include resin tightness, with two planned outages completed in February and two others taking place last month. Domestic demand, meanwhile, was at a normal level for the first quarter, but second-quarter expectations were for higher demand than last year due to an improved construction market.

There were also some export opportunities developing as global crude oil prices moved up a bit. But Kallman notes that PVC contract price negotiations could be “iffy” for suppliers, as ethylene spot prices have dropped to a four-year low, with February contract prices at 34.75¢/lb.

ABS PRICES DROP BUT MAY REVERSE

ABS prices dropped further in the first two months of the year, bringing the cumulative decline to about 10% since fourth-quarter 2014. Driving the decline were price drops in benzene, styrene monomer, butadiene, and acrylonitrile, as well as competitive Asian ABS imports due to overcapacity abroad.

But ABS prices were likely to have bottomed out in March, with modest increases expected in the second quarter, driven by an uptick in feedstock costs, says Kallman. Domestic demand for ABS is good. Continued strong growth in automotive and a

healthier construction season are expected to result in some modest growth in ABS demand this year.

PC PRICES DROP

Polycarbonate prices dropped in the first quarter on the order of 2-8%, depending on the grade, market, and volume. The decrease was anticipated since the fourth quarter due to the sharp decline in benzene and propylene prices, says Kallman.

Prices in the second quarter are likely to be flat to lower, depending on cheaper global imports if global overcapacity is not curtailed further. Although feedstock prices are expected to increase due to supply constraints, they will still be significantly lower than a year ago, ventures Kallman. Meanwhile, domestic supply and demand are pretty balanced. Suppliers are operating at high rates due to the recent departure of Trinseo (formerly Styron) from the PC commodity market, in order to take advantage of lower feedstock costs, and continued but modest growth in automotive and construction market sectors.

NYLON PRICES LOWER

Nylon 6 prices dropped further in first quarter for a cumulative decline of 5-10% since third-quarter 2014, according to Kallman. The price decline was tied primarily to the sharp drop in benzene prices and ample capacity. Second-quarter pricing is likely to be

flat to higher, driven by feedstock cost increases and some improvement in demand.

Nylon 66 prices dropped by a “few percent” in the first quarter, according to Kallman, who says the market is a bit more balanced and not as competitive as nylon 6, which is more of a “commodity” resin. Demand is fairly good, particularly in automotive, and is

expected to improve over last year. Kallman sees pricing trending flat to lower, as suppliers have continued to expand margins due to lower feedstock costs.

Related Content

Fundamentals of Polyethylene – Part 3: Field Failures

Polyethylene parts can fail when an inappropriate density is selected. Let’s look at some examples and examine what happened and why.

Read MorePrices of PE, PP, PS, PVC Drop

Generally, a bottoming-out appears to be the projected pricing trajectory.

Read MorePrices of All Five Commodity Plastics On the Way Up

Despite earlier anticipated rollover in prices for most of the volume commodity resins, prices were generally on the way up for all going into the third month of first quarter.

Read MoreFirst Quarter Looks Mostly Flat for Resin Prices

Temporary upward blips don't indicate any sustained movement in the near term.

Read MoreRead Next

Lead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read MoreFor PLASTICS' CEO Seaholm, NPE to Shine Light on Sustainability Successes

With advocacy, communication and sustainability as three main pillars, Seaholm leads a trade association to NPE that ‘is more active today than we have ever been.’

Read MorePeople 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read More