Resin Prices Mostly Higher, But Some Will Fall Back

A flat-to-down trajectory projected by year’s end.

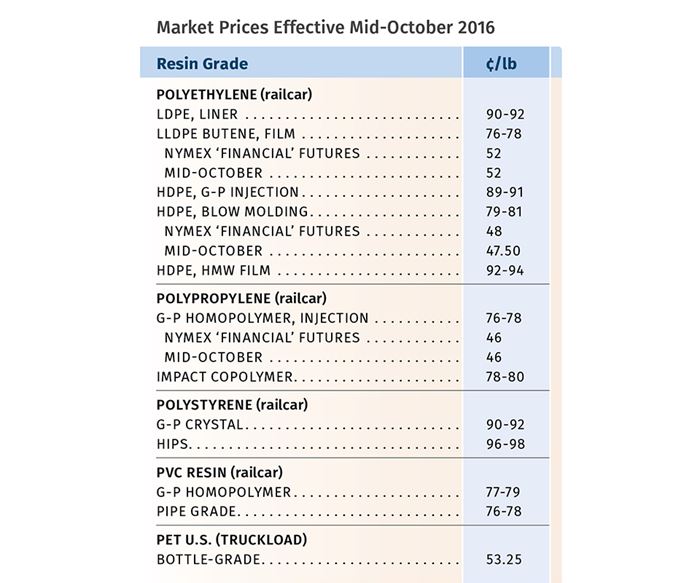

With the exception of PET, the start of the fourth quarter saw prices of large-volume commodity resins spike upward, driven by increased feedstock costs resulting from significant planned and unplanned production disruptions and, in some cases, tight resin supplies. Following those recent increases, PE and PVC prices could remain flat through December, while PP and PS are more likely to subside to prior levels. As for PET, the pricing trajectory is decidedly downward.

Those are the views of purchasing consultants from Resin Technology, Inc. (RTi), Fort Worth, Texas, CEO Michael Greenberg of The Plastics Exchange in Chicago, and Houston-based PetroChemWire.

PE PRICES UP

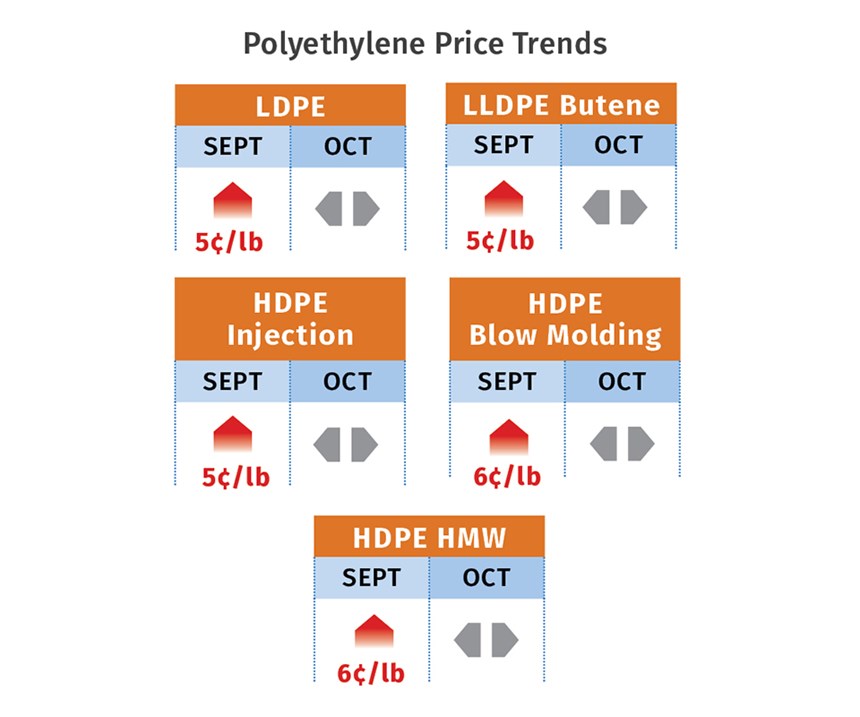

Polyethylene prices were on the way up in September as suppliers aimed to implement a 5¢/lb price hike. A 4¢/lb increase for Oct. 1 did not appear to have legs, with only three suppliers supporting it, according to Mike Burns, RTi’s v.p. of client services for PE.

Key to the expected full implementation of the 5¢ September increase was a significant drawdown of suppliers’ inventories due to heavy prebuying in anticipation of higher prices. “Because we are coming to the end of the year, suppliers will look to maintain their margins,” says Burns, noting that the 5¢ increase would hold, possibly through December. He also noted that increased competition from imports of finished PE goods like trash bags was likely, as domestic commodity PE film processors had announced September price hikes of 6%. Burns said that unless crude oil prices rise to $55/bbl, the current delta between U.S. PE prices and the global prices is too wide. He noted that the September PE price was the highest since January 2015, when crude oil first dropped to $45 from $90/bbl. Burns also expected suppliers’ inventories to return to healthier levels by year’s end.

As September ended, The Plastics Exchange’s Greenberg wrote, “We expect both PE supplies and demand to continue to improve in October and the variable timing of each should create good spot opportunities. Spot ethylene [monomer] levels have quickly dropped about 8¢/lb, while contract PE prices added a nickel for healthy margin expansion. With neither a need nor concerted effort by PE producers to raise contracts further, spot PE prices, which have softened a little, could ease back a bit more in the coming weeks.”

PetroChemWire (PCW) reported at the end of October’s first week that PE spot prices were mostly lower, with downward pressure focused on HDPE grades. PCW added that both domestic and export buyers “appeared to be taking a cautious approach amid sentiment that PE prices will trend downward through fourth quarter”. Industry sources anticipate that the year will close with domestic demand up about 4-5%.

PP PRICES SURGE, THEN SLUMP

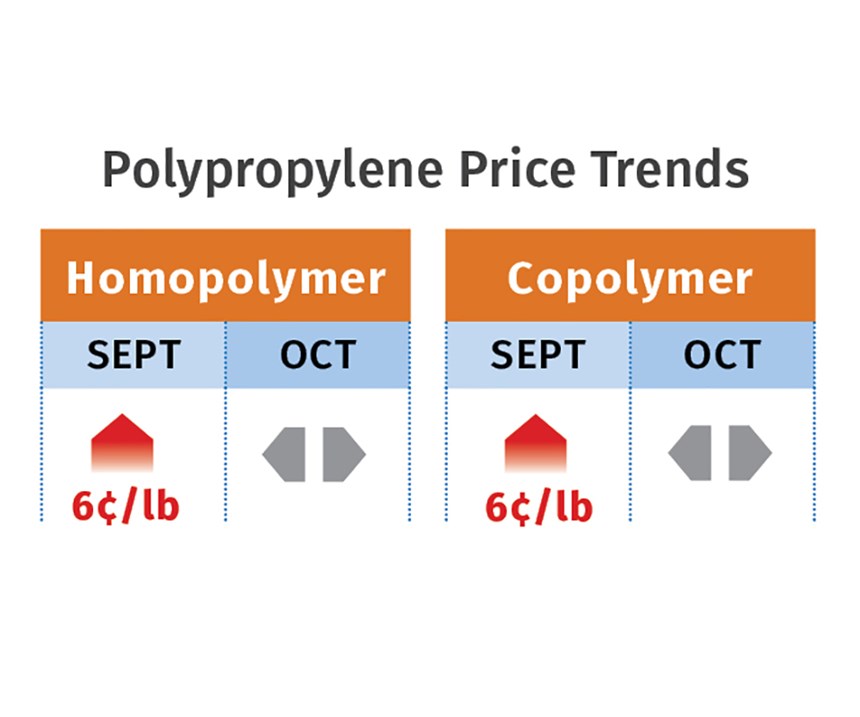

Polypropylene prices spiked 6¢/lb in September, following the 3.5¢/lb August increase, both moves in lockstep with pro- pylene monomer contracts, which settled sharply higher at 43¢/lb in September, up from 37¢/lb. “It was a little bit of a mixed bag, with those buyers whose contracts were tied to propylene monomer prices or to industry indices (e.g., IHS, PCW) getting the full increase; while those not tied to either negotiated lower prices, mostly in commodity markets like film or fiber,” said Scott Newell, RTi’s v.p. of PP markets.

Greenberg reported at September’s end that despite cost pres- sures, PP production remained robust and supplies were plentiful, resulting in softer spot prices. However, he ventured that spot availability would tighten and prices would firm up. After the first week of October, PCW reported on an oversupply of wide-spec material, and noted that buyers were working off inventories as lower monomer prices were anticipated in the fourth quarter. Both PCW and Newell noted that at least some PP suppliers were throttling back production in September and October.

Newell summed up things this way: “Suppliers’ margins peaked in the second quarter, and where we are today (early October) is where they stay.” Newell projected October PP prices to end flat or slightly lower, noting that the industry was not totally out of the woods in terms of monomer supply issues. “Propylene now is tightly balanced, but things appear to be improving, with spot monomer prices now dropping.” He went further to predict that by the end of the year, PP prices could return to August levels or even lower by as much as 5-6¢/lb.

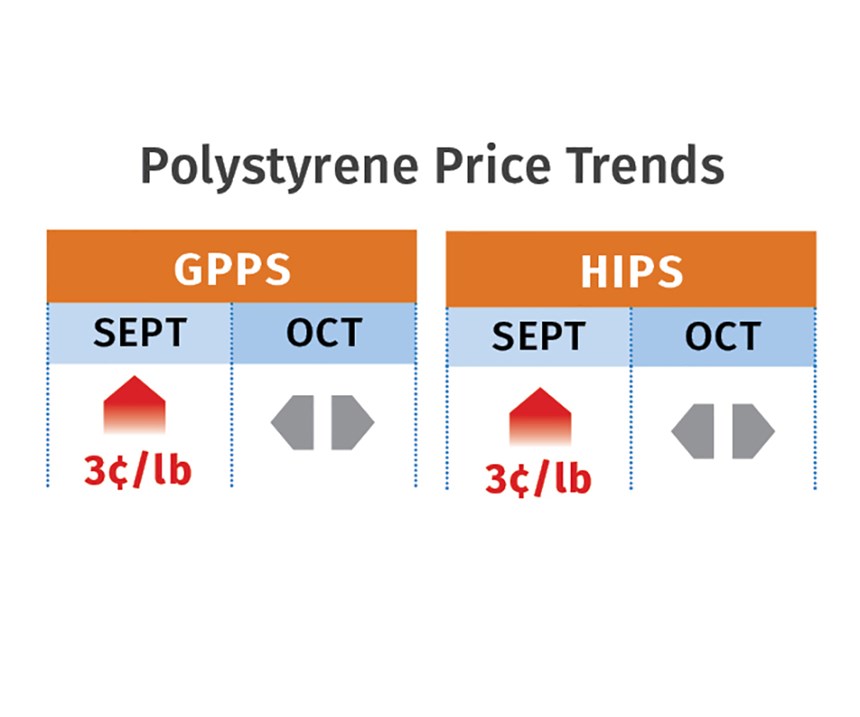

PS PRICES UP, BUT NOT FOR LONG

Polystyrene prices generally moved up 3¢/ lb in September, though one supplier had an Oct. 1 effective date; this followed the 2¢/lb hike in August. Once again, benzene and ethylene prices drove the increases. PCW reported that September benzene contracts settled upward at $2.45-2.51/gal. But October contract negotiations were rumored to be around $2.31/gal and spot benzene prices were coming down, according to both PCW and Mark Kallman, RTi’s v.p. of client services for engineering resins, PS, and PVC.

And, while late-settling September ethylene contracts moved up 2-3¢/lb, October contracts were expected to drop by at least 1-2¢/lb. Kallman attributes that reversal to the end of extended plant outages and falling spot prices. For this month, Kallman predicted further erosion in ethylene prices and flat to lower benzene prices. Thus, he sees a likelihood of PS prices returning to August or July levels by year’s end.

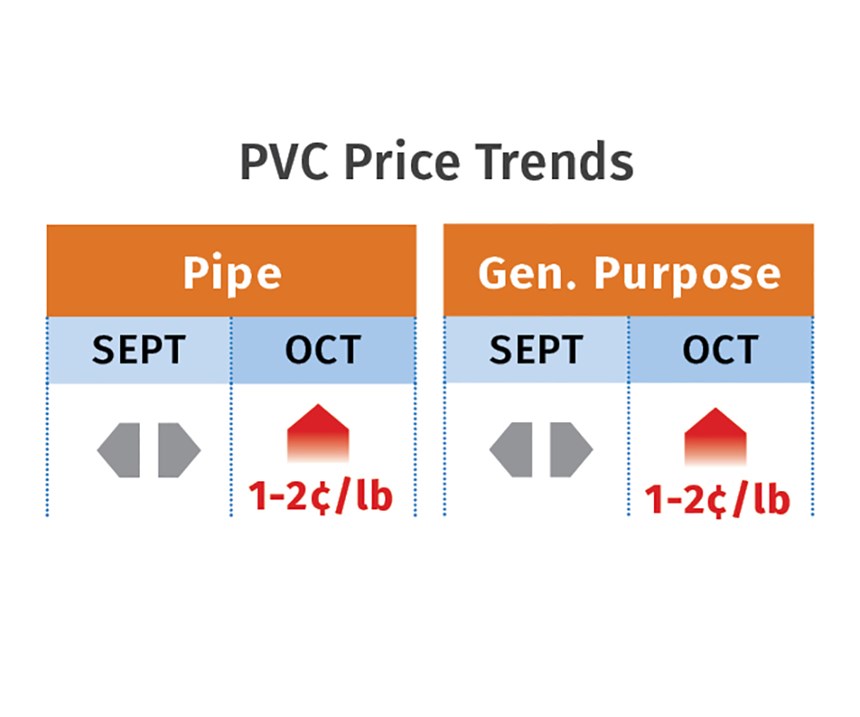

PVC PRICES FLAT TO A BIT HIGHER

PVC prices stayed flat in September for the seventh consecutive month. PVC suppliers sought to implement an October 4¢/lb hike, but RTI’s Kallman thought they were more likely to get 2¢ at most. Kallman attributed his prediction to ethylene costs dropping, the start of a buildup in supplier inventories, and seasonal decline in demand. “PVC producers are fighting some significant headwinds with demand and costs dropping,” he said. He noted that improved demand for exports to China could be the wild card. U.S. PVC export prices have been lower than domestic prices.

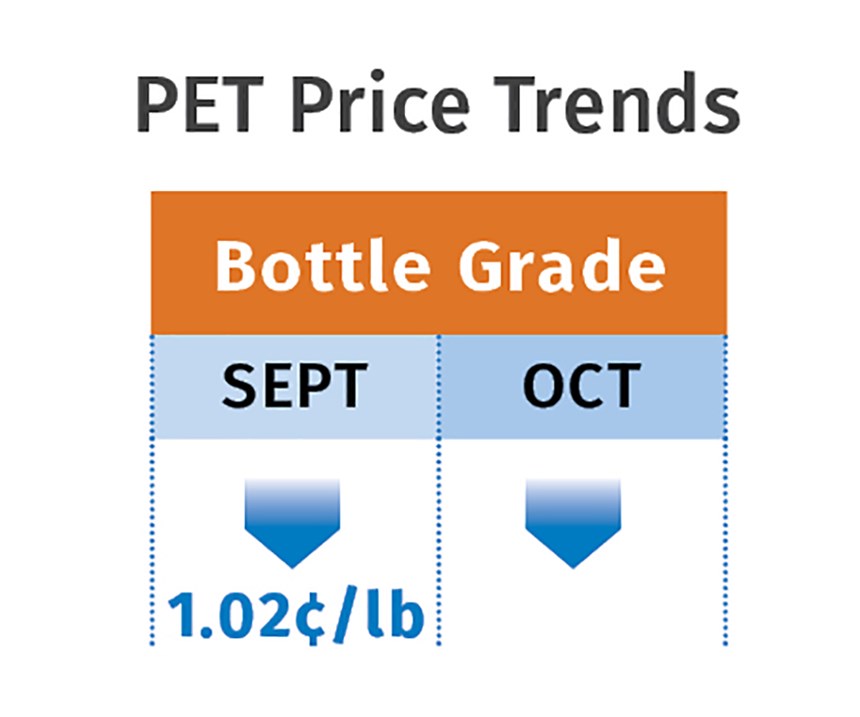

PET PRICES DROP

Domestic bottle-grade PET prime resin prices in September averaged 56.6¢/lb, down 1.02¢/lb from August (delivered to Chicago), based on PCW’s Daily PET Report. On Oct. 5, the price was 53.25¢/lb. Meanwhile, U.S. imported PET (packaging grade) averaged 48.6¢/lb in September, down 0.87¢/lb from August (delivered duty-paid to U.S. ports or, in some cases, inland delivery in super sacks), according to Xavier Cronin, senior editor for the PCW report.

U.S. imported PET poundage rose 11% through July. Import prices have been 4.5¢/lb lower than domestic prices for most of this year. The import price on Oct. 5 was 48.5¢/lb, with some PET imported from Brazil 1-2¢/lb lower. One of 23 countries that have exported PET to the U.S. this year, Brazil accounted for 11% of U.S. imported PET in the first seven months of 2016.

Oversupply remains the major driver for lower PET prices. M&G Chemicals’ new 2.4 billion lb PET complex is due for startup by year’s end. Add to this the steady flow of lower-priced imports, as well as a robust supply of domestic and imported recycled PET pellets and flake, and it’s clear why long-term PET prices are heading down, noted Cronin.

Related Content

The Fundamentals of Polyethylene – Part 1: The Basics

You would think we’d know all there is to know about a material that was commercialized 80 years ago. Not so for polyethylene. Let’s start by brushing up on the basics.

Read MoreCommodity Resin Prices Flat to Lower

Major price correction looms for PP, and lower prices are projected for PE, PS, PVC and PET.

Read MorePrices Flat-to-Down for All Volume Resins

This month’s resin pricing report includes PT’s quarterly check-in on select engineering resins, including nylon 6 and 66.

Read MoreFungi Makes Meal of Polypropylene

University of Sydney researchers identify two strains of fungi that can biodegrade hard to recycle plastics like PP.

Read MoreRead Next

Resin Prices Mostly Higher

Third quarter ends with upward movement for most resin prices, even for high-volume engineering grades, except for PET.

Read MorePeople 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read MoreSee Recyclers Close the Loop on Trade Show Production Scrap at NPE2024

A collaboration between show organizer PLASTICS, recycler CPR and size reduction experts WEIMA and Conair recovered and recycled all production scrap at NPE2024.

Read More