Upward Pricing for PS, PVC and More

Higher global oil prices and derivative feedstocks are among the factors driving resin price increases in PS, PVC, PET and nylons.

Higher global oil prices and derivative feedstocks are among the factors driving resin price increases in PS, PVC, PET and nylons.

Here we are into the shortest month of the year and already the industry is seeing price increases either being implemented or about to be. Just last week, I tried to tackle what is taking place and how things might turn out, at least going into second quarter, in the typically volatile polyolefins pricing arena.

Meanwhile, in addition to supply/demand fundamentals, which vary depending on the resin, the combination of higher global prices of crude oil and key resin feedstocks, along with planned and unplanned production outages, are major factors driving price initiatives for other resins as well. Polystyrene and PVC are among them, and Mark Kallman, v.p. of client services for engineering resins, PS, and PVC at Resin Technology, Inc., recently offered an update.

• PS: Driven by January benzene contracts that moved up by nearly 60ȼ/gal, PS prices moved up 5ȼ/lb last month. Moreover, PS suppliers are out with an 8ȼ/lb price hike for this month, and Kallman says, they are likely to get at least 6ȼ/lb of this increase. Global supply constrictions in benzene, styrene monomer and butadiene (which affects HIPS) are behind the upwards movement. A clear indication of this widespread situation is that there have been no low-priced PS imports coming in. Still, Kallman ventures that some softening in PS prices is likely as early as April.

• PVC: Interesting, but PVC prices which were flat in January, as they were for eight months of 2016, are expected to move up 3-4ȼ/lb this month, according to Kallman. This would reflect suppliers’ February 4ȼ/lb hike. In addition, PVC suppliers are now out with a 3ȼ/lb price increase for March.

Driving this upward movement are the typically late-settling monthly ethylene contracts, expected to settle up by 2ȼ/lb for January, following a 2ȼ/lb hike in December. Due to both planned and unplanned outages, a third such ethylene contract increase is likely for this month, according to Kallman.

Still, if PVC suppliers get their 4ȼ/lb increase in place, the ‘new’ March 3ȼ/lb hike might be pushed off. Although PVC suppliers ended last year with strong inventories, some supply constrictions were likely due to some domestic PVC plant maintenance turnarounds during the first quarter. This would occur nearly mid-way into this quarter, as PVC processors are looking to stock up for the startup of construction season in second quarter.

At this juncture, it appears that there are adequate supplies for domestic consumption but little for exports, according to Kallman. He ventures there’s potential for some easing on PVC prices once ethylene and PVC outages are completed or resolved.

At the same time, however, there are some industry projections that this year’s construction season will be a strong one. If this pans out, the PVC price hikes now expected to go through, will be maintained for a while.

Meanwhile, other resin price increases underway include PET and a broad range of nylons, driven primarily by spiking feedstock costs.

• PET: January’s average cost of feedstocks (including PTA, MEG, and paraxylene), according to PetroChemWire (PCW) was 55.8ȼ/lb, up 3ȼ/lb from December. Prices of domestic bottle-grade PET in January averaged 56.3, and by February 3, PET prices has moved up to 58ȼ/lb (delivered Chicago basis), according to Xavier Cronin, senior editor of PCW’s Daily PET Report. He confirmed that DAK Americas, for one, successfully increased its PET resins by 5ȼ/lb last month.

• Nylons: In this arena, several key suppliers have issued hefty, across-the-board price increases—generally on the order of 12-13ȼ/lb--for nylon resins and compounds, ranging from nylon 6 and 66 to high-temperature and specialty nylons like nylon 12 and beyond, effective this month or as contracts allow. Generally, the increases are on the 12-13ȼ/lb range. Included are: Ascend Performance Polymers; BASF; Solvay; DuPont Performance Polymers, and a Evonik.

Related Content

Prices for PE, PS, PVC, PET Trending Flat; PP to Drop

Despite price increase nominations going into second quarter, it appeared there was potential for generally flat pricing with the exception of a major downward correction for PP.

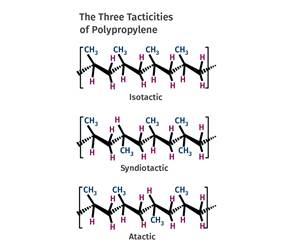

Read MoreFundamentals of Polyethylene – Part 5: Metallocenes

How the development of new catalysts—notably metallocenes—paved the way for the development of material grades never before possible.

Read MoreCommodity Resin Prices Flat to Lower

Major price correction looms for PP, and lower prices are projected for PE, PS, PVC and PET.

Read MoreFundamentals of Polyethylene – Part 3: Field Failures

Polyethylene parts can fail when an inappropriate density is selected. Let’s look at some examples and examine what happened and why.

Read MoreRead Next

People 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read MoreFor PLASTICS' CEO Seaholm, NPE to Shine Light on Sustainability Successes

With advocacy, communication and sustainability as three main pillars, Seaholm leads a trade association to NPE that ‘is more active today than we have ever been.’

Read More