Will Your Future Shipments of PE Come From North Dakota?

Do North Dakota’s plans to build a $3 billion cracking facility with annual capacity for 1.5 million metric tons of polyethylene (3.3 billion pounds) reflect a tipping point in the shale oil/gas revolution?

On October 13, the state which trailed only Texas in oil production in 2013 with a record output of 313 million barrels, announced its plans to work with Badlands NGL LLC and build an estimated $4 billion processing facility that will convert ethane gas into PE.

The next day, speaking at the Great Plains & Empower ND Energy Conference, North Dakota’s Governor Jack Dalrymple (pictured below with microphone), explained his rational.

We are making great advances in our energy industry by adding value to our resources right here in North Dakota. North Dakota is a national powerhouse in energy production and we have taken important steps to convert our energy resources into products of greater value. Still there is much more opportunity ahead for us to take value-added energy to a whole new level.

North Dakota, as well as other states participating in the fracking revolution, have struggled at times to find an outlet for the so-called “associated gas” that comes up through the shale formation fissures whose primary target is oil. Some fields have turned to flaring, burning off natural gas liquids (NGLs) like ethane, propane and methane. This has been particularly true of North Dakota, according to this LA Times article, which reported that the amount of gas flared in the Bakken oil field has almost tripled since 2011, “sending gas worth more than $1 billion a year into the sky.”

NGLs that aren’t flared and remain in the crude oil extracted from the Bakken pose more of a threat than wasting a fossil fuel, however, with several high-profile explosions of crude-hauling rail cars leading to calls for regulation. Illustrating the growing size of the threat, the number of tank carloads of Bakken crude has risen from less than 10,000 in 2009 to more than 400,000 in 2013, according to NPR.

In a statement released by Governor Dalrymple announcing the huge, new project, the issue of flaring was addressed:

This project is fully aligned with our goals to reduce flaring, add value to our energy resources right here in North Dakota and create diverse job opportunities across the state. By advancing the responsible development of our energy resources and by adding value to all of our resources, the opportunities in North Dakota are boundless.

Given that the plant will have the capacity to produce enough PE for every citizen of North Dakota to take home more than 4500 pounds annually, Dalrymple acknowledged that Badlands will have to target customers beyond the state’s borders, and perhaps look even further abroad:

Badlands intends to market the majority of the polyethylene products domestically, but product will also find its way to markets in Asia, South America and Europe.

Badlands is working with Spanish contractor Tecnicas Reunidas and Texas based petrochemical development consultant Vinmar Projects on the proposed plant, with a preliminary engineering analysis to be completed this year, including technology evaluations, engineering and planning, and final site selection.

This project joins four proposed shale-gas-fueled crackers in Ohio, Pennsylvania, and West Virginia, involving Braskem, Shell, Appalachian Resins, and a Thai/Japanese partnership of PTT and Marubeni.

Such projects involve big price tags and bigger lead times, but even if only half come to fruition, the impact on global plastics production and trade balances can’t be understated. Similarly, if a similar tact is taken in other shale-oil producing states regarding flaring and associated gas, the potential for a massive new supply of plastics and petrochemical feedstocks is massive.

Related Content

Prices Up for PE, PP, PS, Flat for PVC, PET

Trajectory is generally flat-to-down for all commodity resins.

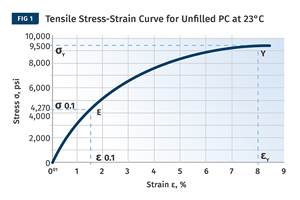

Read MoreThe Effects of Stress on Polymers

Previously we have discussed the effects of temperature and time on the long-term behavior of polymers. Now let's take a look at stress.

Read MorePrices of All Five Commodity Plastics On the Way Up

Despite earlier anticipated rollover in prices for most of the volume commodity resins, prices were generally on the way up for all going into the third month of first quarter.

Read MoreHow to Optimize Injection Molding of PHA and PHA/PLA Blends

Here are processing guidelines aimed at both getting the PHA resin into the process without degrading it, and reducing residence time at melt temperatures.

Read MoreRead Next

Shale gas pushes petrochemical projects forward

Over a five-day period last week, two massive North America polyolefin projects made possible by shale gas marked significant milestones.

Read MoreThe Shale Gas Game Changer

Processors and resin suppliers alike believe the availability of low-cost feedstock will present huge opportunities in the North American plastics market.

Read MoreSee Recyclers Close the Loop on Trade Show Production Scrap at NPE2024

A collaboration between show organizer PLASTICS, recycler CPR and size reduction experts WEIMA and Conair recovered and recycled all production scrap at NPE2024.

Read More