Appliance Market Continues Upward Trend

Market drivers support continued expansion.

Industrial production of household appliances increased over the second quarter of 2017 from the prior quarter. The index for Q2 came in at 120.2, only slightly below the post-Great Recession high of 120.3, recorded during the fourth quarter of 2016. (The index is based on a value of 100 for production in 2012, seasonally adjusted.) The gains come at a time when the drivers for appliances all indicate support for the market. These drivers include U.S. Treasury bond interest rates, which directly impact mortgage rates, and housing-market strength, as measured by permits and starts. Let’s dig a little deeper:

Appliance Production: Industrial production data for household appliances through the second quarter of 2017 maintained the steady upward trend that started in early 2013. Production of small electrical appliances, which advanced faster than major appliances in 2014 and 2015, has increased minimally over the last 18 months. Nearly 20 years of industrial production data for appliances suggests that there could be more room for this sector to grow. During the years 2000 through 2002, average industrial production for all appliances exceeded 135.3, but soon after the Great Recession, production fell to a low of 92.6 in 2011.

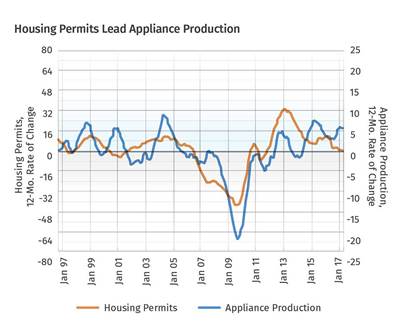

Housing Permits: Since the Great Recession, nationwide housing permits have increased at a steady pace. The average number of monthly new housing permits in 2017 through August was 106,500; up from a monthly average of 100,600 in 2016. Gardner Intelligence tracks housing permits to approximate the near-term demand for new appliances resulting from the completion of newly built homes.

Interest Rates: The 10-yr Treasury bond rate is the most commonly used tool by the banking industry for setting home mortgage rates. As mortgage rates decrease, the cost of borrowing to own a home, versus renting, becomes more appealing and thus can bolster housing starts. Lower mortgage rates can also spur housing price appreciation, which makes home ownership a powerful path to wealth creation.

Since the start of 2017, the 10-yr Treasury rate has fallen by 12 basis points to 2.20%. (A basis-point is 1/100th of a percentage point, or 0.01%.) Gardner Intelligence believes that the probability of significant rate decreases of 50 to 75 basis points or more is unlikely, given already low interest rates combined with a strong national employment picture—which give the Federal Reserve less reason to lower rates in the future.

Looking ahead, both the “five-year, five-year forward inflation expectation rate” (a financial industry measurement of expected average inflation over five years, starting five years from now) and consumer survey expectations of inflation over the next few years project inflation of around 2%. Should these forecasts be accurate, and barring any shock-event, mortgage rates may remain in their current range for the next several years.

ABOUT THE AUTHOR: Michael Guckes is the chief economist for Gardner Business Intelligence, a division of Gardner Business Media (Cincinnati, OH). He has performed economic analysis, modeling and forecasting work for nearly 20 years among a wide range of industries. Michael received his BA in political science and economics from Kenyon College and his MBA from The Ohio State University. mguckes@gardnerweb.com

Related Content

Medical Molder, Moldmaker Embraces Continuous Improvement

True to the adjective in its name, Dynamic Group has been characterized by constant change, activity and progress over its nearly five decades as a medical molder and moldmaker.

Read MoreConsistent Shots for Consistent Shots

An integral supplier in the effort to fast-track COVID-19 vaccine deployment, Retractable Technologies turned to Arburg and its PressurePilot technology to help deliver more than 500 million syringes during the pandemic.

Read MoreMultilayer Solutions to Challenges in Blow Molding with PCR

For extrusion blow molders, challenges of price and availability of postconsumer recycled resins can be addressed with a variety of multilayer technologies, which also offer solutions to issues with color, processability, mechanical properties and chemical migration in PCR materials.

Read MoreImpacts of Auto’s Switch to Sustainability

Of all the trends you can see at NPE2024, this one is BIG. Not only is the auto industry transitioning to electrification but there are concerted efforts to modify the materials used, especially polymers, for interior applications.

Read MoreRead Next

Appliance Growth Slowing

Current growth rate in production is strong, but the dip in housing permits could change things.

Read MoreBeyond Prototypes: 8 Ways the Plastics Industry Is Using 3D Printing

Plastics processors are finding applications for 3D printing around the plant and across the supply chain. Here are 8 examples to look for at NPE2024.

Read MoreSee Recyclers Close the Loop on Trade Show Production Scrap at NPE2024

A collaboration between show organizer PLASTICS, recycler CPR and size reduction experts WEIMA and Conair recovered and recycled all production scrap at NPE2024.

Read More

.jpg;width=70;height=70;mode=crop)